Table Of Contents

Get in Touch with our Experts!

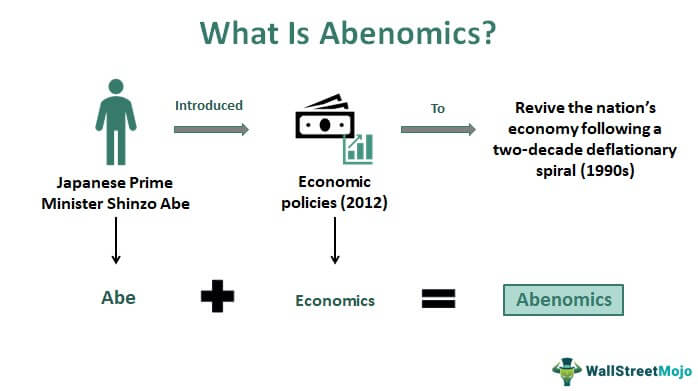

What Is Abenomics?

Abenomics refers to a range of economic and social policies devised and implemented by former Japanese Prime Minister Shinzo Abe to revive the nation’s economy. Thus, the term combines the phrases ‘Abe’ and ‘Economics.’ He proposed these reforms soon after holding office for the second time in 2012.

Abe's Keynesian economic policies aimed to get the country out of a two-decade deflationary spiral. The three-arrow principle encompassed monetary, fiscal, and growth measures. Other objectives included expanding the money supply, increasing government spending, raising inflation, and implementing regulatory reforms.

- Abenomics meaning describes a set of economic and social policies created and implemented by former Japanese Prime Minister Shinzo Abe in 2012 to revitalize the country's economy.

- The three arrow principle considered monetary, fiscal, and growth factors to increase the money supply, government expenditure, and inflation and execute regulatory reforms.

- Abenomics goal was more than economic growth, as it also included societal reforms, such as digitization, women employment, and Society 5.0.

- Many experts lauded Abe's efforts and attributed the improved Japanese economy to him. However, global economic conditions, Japan's financial woes, and the country's aging population hampered the expected growth.

How Does Abenomics Work?

Abenomics in Japan was an effective economic strategy introduced by former Japanese Prime Minister Shinzo Abe in 2012. However, Japan was still recuperating from the global financial crisis of 2008 at that time. As a result, the nation's GDP was negative, at -4.3%, and Japan's exports were also dropping, negatively impacting the country's economy. Therefore, he aimed to raise inflation to 2% and minimize deflation to recover the national economy from a long period of low growth.

Given the limited spending habits of the Japanese people, Abe needed to find a way to balance the loopholes with efficient economic initiatives. When a populace does not spend responsibly, businesses and sectors slow down, impacting the overall financial health of the economy.

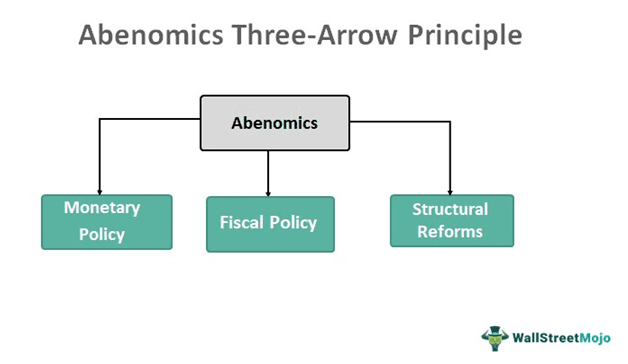

Abenomics meaning is about more than just economic development. It also encompasses digitization and social reforms that must be instilled in society. To revive the nation’s economy, Abe formed a three-arrow economic strategy, which included:

- Adaptive fiscal policy (increased government expenditure)

- Consistent Monetary policy (quantitative easing from the Bank of Japan)

- Economic growth strategy (structural reforms)

These reforms were proven to be beneficial to the country's economic growth, which resulted in:

- Increased exports

- More job opportunities

- Higher pay

- Enhanced competitiveness in the global market

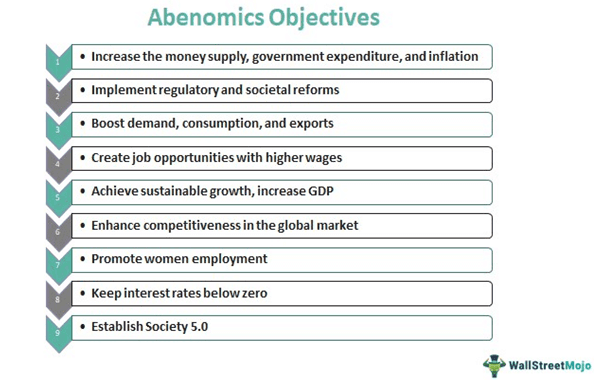

Goals Of Abenomics

The motives of Abe behind framing Abenomics were:

- Achieving sustainable growth rate

- Accelerating an economic cycle

- Boosting the GDP

- Bringing the inflation to up to 2%

- Increasing the demand

- Making the nation globally more competitive

- Expanding country exports

- Raising the national employment rate

- Promoting women employment

- Correcting yen's overvaluation

- Keeping interest rates below zero

- Revising the Bank of Japan Act

- Establishing Society 5.0 – a data-driven, human-centric social arrangement for future generations

Three Arrows Of Abenomics

#1 - Fiscal Policy

The Japanese government spent trillions of yen on infrastructures, such as flyovers, buildings, and highways, due to this Abenomics policy. Consequently, spending on infrastructure development doubled the consumption tax and created a slew of new jobs. Furthermore, an increase in the employment rate let people earn more money and spend more on products and services. As a result, trade and commerce improved, helping enterprises and industries, propelling the economy ahead.

Other highlights of the policy include:

- Encourage public investment and spending

- Stimulate demand for and consumption of goods and services

- Accelerate short-term economic growth

- Achieve long term budget surplus

- Increase the GDP

- Reduce corporate tax rates

- Liberalize agriculture and healthcare industries

#2 - Monetary Policy

It included a series of quantitative easing initiatives to boost liquidity in the Japanese economy. However, due to real estate and asset price bubble bursts, Japan experienced economic stagnation in the 1990s. Furthermore, national banks lent money without confirming the borrowers' credentials. As a result of their inability to repay, the majority of the borrowers became defaulters, causing banking problems.

Given their past experiences, banks and financial institutions began to apply stricter standards. As a result, it made it more difficult for Japanese people to borrow money. Furthermore, because the interest rates were excessively high, no one was willing to take out loans. Also, Japan's inhabitants rarely contemplated borrowing money due to their limited spending habits.

Abe proposed decreasing interest rates to a negative figure to maintain societal balance in terms of monetary resources. Despite fears of the financial system collapsing, the Bank of Japan kept rates negative at minus 0.1% in January 2018 to attract lending and investment.

As a result, the government began printing additional money to keep the loan and spending cycle going. In addition, it increased spending on goods and services, resulting in price increases for those items. All this brought the inflation rate closer to Abe's target. It also boosted exports and inflation in Japan.

#3 - Structural Reforms

Aside from reduced spending and borrowing difficulties, another factor influencing the economy was a labor shortage. Moreover, Japan's birth rate has dropped dramatically over the last few years. As a result, Japan is expected to undergo a protracted era of population decrease, according to the National Institute of Population and Social Security Research's medium-fertility estimate, with a population of 116.62 million in 2030, 99.13 million in 2048, and 86.74 million in 2060.

Abe implemented social reforms to address the labor shortage issue based on projected population projections in Japan. He also introduced Abenomics 2.0 to boost the birth rate while improving pensions and social security for the elderly. In addition, Abe recommended incentive and reward systems to entice people to start families. He invested in child care services and educational reforms to meet the goal. Under his womenomics plan, he pushed more women to enter the workforce and eliminated the spousal tax exemption.

Some other efforts included:

- Encouraging private investment

- Introducing business reforms

- Supporting domestic and international businesses

- Modernizing and liberalizing healthcare and agricultural industries

- Participating in the Trans-Pacific Partnership (TPP)

- Increasing competition in regional and global markets

Did Abenomics Fail?

Abenomics resulted in a significant increase in job opportunities, lowering the unemployment rate to below 3%. The policies worked and strengthened Japan's economy. In addition, the GDP, tax revenues, and inflation all increased. Though the rate of acceleration was not as fast as Abe had hoped, it was enough to get the economy back on track.

The measures successfully eased the Bank of Japan's stricter large-scale monetary criteria. The monetary policy resulted in large asset purchases and yield curve control, setting precedents for other central banks. The equity market benefited from the convenience of monetary transactions. Furthermore, Japanese enterprises were more reliant on exports for profit, improving economic growth.

Abe retired as Prime Minister in September 2020, and his replacement, Yoshihide Suga, carried on the legacy and continued Abenomics. Many analysts praised Abe's efforts and credited him with the improved Japanese economy. In addition, they claimed that his policies helped the country cope with the economic instability brought on by the coronavirus outbreak.

On the other hand, global economic factors, Japan's economic troubles, and the aging population have hindered the predicted growth.