How To Become A Leading Financial Analyst In The Hospitality Industry?

Table of Contents

Introduction

Financial analysts are influential decision-makers in today’s hospitality sector. As hotels evolve into complex, data-driven businesses, demand for specialists who can interpret performance metrics, forecast demand, assess investment feasibility, and optimize profitability has never been greater.

Irrespective of whether you're already working in the hospitality space or transitioning from a more traditional finance background, becoming a leading financial analyst in this field requires certain knowledge and skills. Precisely, it requires a blend of analytical precision, operational understanding, and real-world experience.

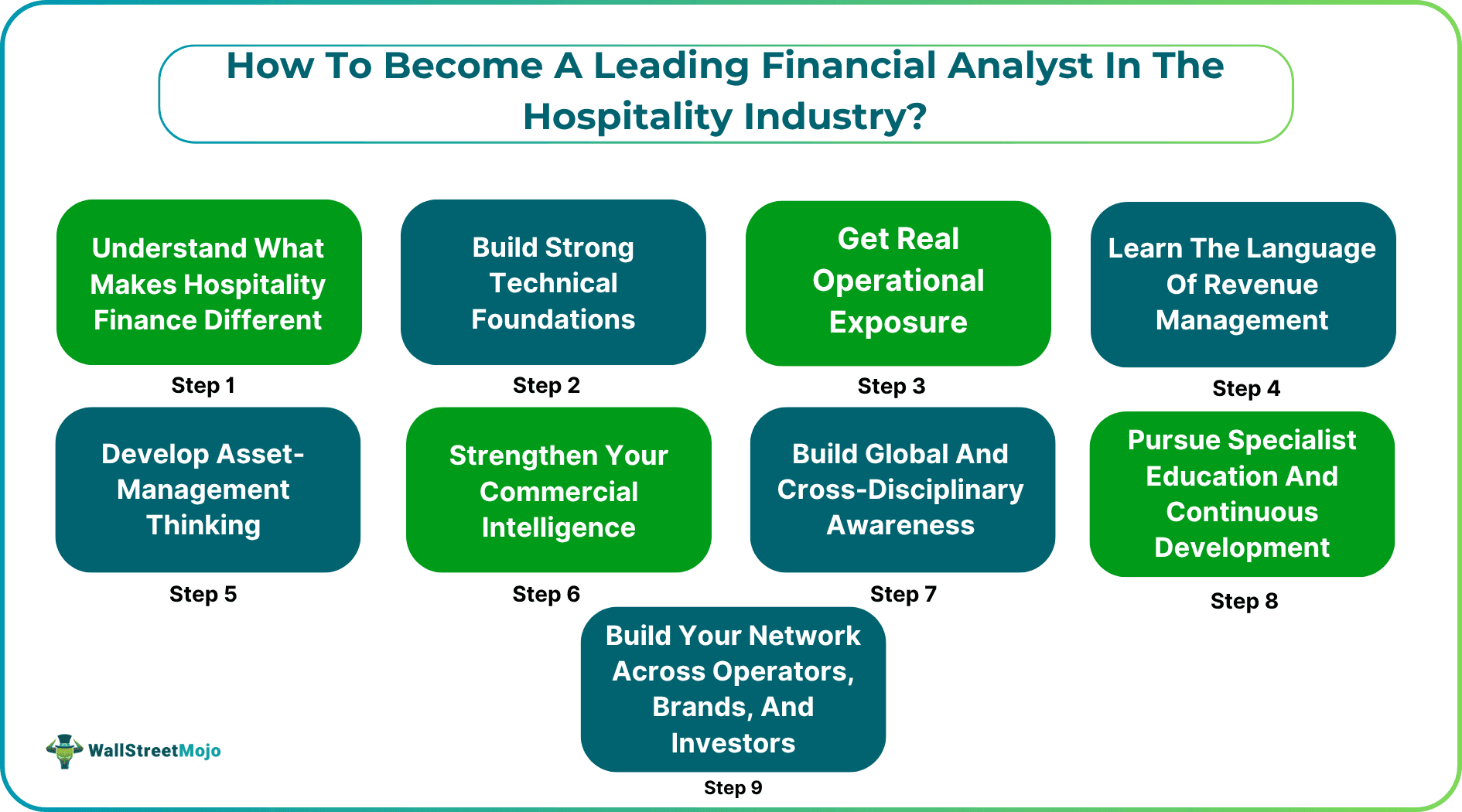

If you are unsure about the steps you need to follow to become a financial analyst in the hospitality industry, you are in the right place. Here, we will provide a step-by-step roadmap to help you achieve your objective.

#1 - Understand What Makes Hospitality Finance Different

Hospitality finance is unlike corporate finance, banking, or general FP&A. Hotels are living, breathing assets: part real estate, part operating business, part brand experience. This means the financial analyst’s role touches everything from daily revenue mix to long-term asset strategy.

To lead in the field, you must have knowledge of key metrics and elements across various areas, which include the following:

Revenue Performance

Some noteworthy metrics indicating revenue performance are as follows:

- ADR (Average Daily Rate)

- Occupancy

- RevPAR

- TRevPAR

- GOPPAR

- Channel mix and distribution costs

Operations

Let us look at a few important metrics that serve as indicators of operational efficiency and performance.

- Labor ratios

- Cost per available room

- F&B cost percentages

- Energy and maintenance forecasting

Real Estate Economics

Let us look at the important elements and metrics associated with real estate economics in the hospitality industry.

- Capex planning

- Asset valuations

- Yield expectations

- Management vs. franchise models

- Investment underwriting

Market Dynamics

The following are some key aspects that financial analysts in the hospitality industry must understand.

- Supply pipelines

- Event-driven demand volatility

- Domestic vs international travel trends

So, from the above points, one can comprehend that it is this intersection of operations, real estate, and demand forecasting that defines hospitality finance.

#2 - Build Strong Technical Foundations

To reach senior levels, one must have specific practical skills required by top financial analysts in the hospitality industry. Some of these skills for hospitality analysts are as follows:

- Advanced Excel modelling

- Financial statements and P&L interpretation

- Forecasting and budgeting

- Sensitivity and scenario analysis

Additionally, one should know how to use the following tools and platforms:

- Business intelligence (BI) platforms

- Data visualization tools (Power BI, Tableau, etc.)

- Market benchmarking tools (STR, HotStats, etc.)

Hospitality is a high-frequency business. Rooms are sold every day, with prices changing hour by hour. Your ability to deal with the dynamic environment and model volatility, pace and pickup will set you apart from other analysts.

#3 - Get Real Operational Exposure

The most respected financial analysts in the hospitality industry have one thing in common: they understand hotel operations from the inside.

Analyzing a P&L statement becomes far easier when you’ve stood at a front desk during peak check-in, watched a housekeeping team turn over a building, or seen a chef manage costs during a banquet rush.

This is where internships or early-career placements are critical. Hospitality schools such as Glion integrate international operational internships into their programs, giving future analysts first-hand insights into how hotels run, where money is made or lost, and how guest experience connects to financial performance.

Real experience turns numbers into meaning and meaning into better analysis.

Example Career Paths In Hospitality Finance (With Typical Salaries)

Hospitality finance offers a wide spectrum of roles, each requiring a mix of analytical, commercial and operational expertise.

Let us look at the most common career paths and what you can expect to earn in the UK market.

#1 - Junior Financial Analyst (Hotel or Corporate Office)

Key Responsibilities:

- Producing daily and weekly financial reports

- Analyzing P&L statements

- Supporting budgeting and forecasting cycles

- Tracking performance against benchmarks (STR, HotStats, etc.)

- Assisting with variance analysis

Average Annual Salary: £30,000–£35,000

Entry-level roles like this one build the technical foundation for future analytical or commercial paths.

#2 - Revenue Analyst/Revenue Executive

Key Responsibilities:

- Analyzing demand patterns

- Adjusting pricing and inventory

- Managing Online Travel Agency or OTA channel mix

Forecasting occupancy and ADR - Supporting the revenue manager with a strategy

Average Annual Salary: £35,000–£45,000

This hospitality industry finance job is one of the fastest paths to senior commercial positions because of its direct impact on topline performance.

#3 - Operations/Business Analyst (Hotel Group)

Key Responsibilities:

- Tracking labor productivity

- Analyzing food and beverage or F&B profitability

- Building efficiency and cost-control models

- Evaluating energy and maintenance costs

- Working closely with property general managers or GMs and department heads

Average Annual Salary: £40,000–£50,000

This hybrid role strengthens your understanding of hotel financial analysis and what truly drives profit on a day-to-day basis.

#4 - Financial Planning & Analysis (FP&A) Analyst

Key Responsibilities:

- Leading budgeting cycles

- Building long-term forecasts

- Supporting regional and corporate strategy

- Consolidating financial performance across multiple hotels

- Preparing performance insights for senior leadership

Average Annual Salary: £30,000–£40,000

This hospitality finance career path gives analysts high-level visibility and direct exposure to decision-making.

#5 - Investment Analyst/Development Analyst

Key Responsibilities:

- Conducting feasibility studies

- Modeling return on investment or ROI for new developments or renovations

- Analyzing demand drivers for new sites

- Supporting deal underwriting

- Providing market intelligence to brand or owner groups

Average Annual Salary: £45,000–£70,000

This is one of the most strategic entry points into hotel real estate and private equity.

#6 - Asset Management Analyst

Key Responsibilities:

- Tracking operator performance

- Recommending capex to improve net operating income or NOI

- Conducting hold/sell analyses

- Reviewing contracts, management fees and KPIs

- Ensuring hotels meet owner investment expectations

Average Annual Salary: £45,000–£80,000

#7 - Senior Financial Analyst/Finance Manager

Key Responsibilities:

- Overseeing multi-property financial performance

- Leading analytical teams

- Driving financial improvement projects

- Presenting performance insights to regional leadership

- Supporting strategic planning and investor reporting

Average Annual Salary: £50,000–£80,000

This is where analysts transition from reporting to shaping strategy.

#8 - Director of Finance (Property or Cluster)

Responsibilities:

- Holding full P&L accountability

- Leading departmental budgets

- Overseeing cash flow, controls, and compliance

- Managing owner relations

- Guiding capital planning and risk management

Average Annual Salary: £90,000–£120,000 + significant bonus potential

Directors of Finance sit at the helm of operational and financial leadership.

#9 - Real Estate Investment Manager/VP Asset Management

Key Responsibilities:

- Developing long-term investment strategies

- Leading acquisitions and disposals

- Structuring debt and financing

- Managing investor relations

- Optimizing total portfolio value

Average Annual Salary: £80,000–£150,000 in major markets

This is widely regarded as the pinnacle of the hospitality-finance pathway.

#4 - Learn The Language Of Revenue Management

Today’s financial analysts in the hospitality sector must work hand-in-hand with commercial and revenue teams to understand the following aspects:

- Pricing strategies

- Demand forecasting

- Segmentation

- Channel profitability

OTA dynamics - Group vs transient mix

- Upselling and ancillary revenue

Hotel revenue engines are now highly automated and algorithmic. Financial analysts in the hospitality sector who can interpret outputs and challenge them quickly become invaluable to senior leadership.

#5 - Develop Asset-Management Thinking

The highest-paid analysts in the industry don’t just crunch numbers; they shape investment decisions.

Note that asset-management skills include the following:

- Reviewing hotel performance compared to market benchmarks

- Recommending capex projects to boost notice of intimation or NOI

- Evaluating operator performance

- Optimizing management or franchise agreements

- Running hold/sell analyses

- Forecasting long-term asset value

This is where hospitality finance overlaps with private equity in real estate. Analysts who master this space often progress into director-level roles, investment management, or consulting with major brands and asset managers.

#6 - Strengthen Your Commercial Intelligence

A leading analyst does not simply report what happened; they explain why it happened and what the leadership should do next.

Develop your ability to translate metrics into strategy. For that, you should learn to figure out the answers to such questions:

- Why are Average Daily Rates or ADRs stagnating in certain segments?

- Why is the Gross Operating Profit or GOP down despite higher revenue?

- What is the impact of rising labor or energy costs?

- Which business lines need restructuring?

- How does the upcoming supply impact local pricing power?

- What’s the ROI on refurbishing a floor or adding wellness amenities?

Commercial storytelling builds influence, and influence is what moves you from an analyst to a leader.

#7 - Build Global And Cross-Disciplinary Awareness

Hospitality is a global industry. Analysts who understand macro-tourism trends, exchange rates, visa policy, airline capacity, and event calendars offer far more strategic value.

Similarly, having knowledge in adjacent domains, like sustainability, marketing, digital distribution, or construction costs, positions you as a well-rounded advisor to owners and operators.

#8 - Pursue Specialist Education And Continuous Development

Because hospitality finance spans multiple disciplines, structured training can accelerate your progression dramatically.

Look for courses or degrees that cover the following areas:

- Hotel real estate finance

- Revenue strategy

- Operational analytics

- Investment appraisal

- Leadership and managerial economics

This technical learning, combined with internships and operational exposure (as offered through institutions like Glion), creates the balanced profile top employers look for.

#9 - Build Your Network Across Operators, Brands, And Investors

To excel, you need to maintain relationships with:

- Hotel GMs

- Revenue managers

- Operators and brand reps

- Asset managers

- Owners and developers

- Consultants and valuers

Many of the best opportunities, from analyst roles to VP-level investment positions, come through industry networking rather than job ads.

Attending the following events may help you get exposure to great opportunities:

- Hospitality investment conferences

- STR and HotStats workshops

- HVS or JLL market briefings

- Leadership forums

- Alumni events

A strong network constantly provides you with insights and opportunities.

#10 - Position Yourself As A Strategic Thinker, Not Just A Number-Cruncher

The hospitality financial analysts who rise quickest do the following:

- Challenge assumptions with data

- Identify revenue opportunities others miss

- Provide clarity during uncertainty

- Align financial decisions with guest experience

- Communicate complex ideas simply

- Present risk and opportunity with equal honesty

Operators, owners, and investors trust analysts who can combine financial rigor with industry intuition.

Final Word

Hospitality is one of the most dynamic, fast-moving and globally connected sectors in the world. Becoming a leading financial analyst here demands more than spreadsheets; it requires operational empathy, sharp commercial instincts, and a deep understanding of how hotels create value across both the P&L and the property.

With hands-on exposure, specialist training, and the right analytical mindset, you can build an illustrious career as a top financial analyst in the hospitality industry. This will allow you to be at the center of investment decisions, operational strategy, and set the future direction of some of the world’s most innovative hotel brands.