Table Of Contents

What Is Profit And Loss Statement?

A profit and loss (P&L) statement, sometimes called as an income statement, is a financial report that provides investors and outsiders with a financial overview of a company. It reflects the revenues and expenses of a firm for a fiscal year.

A company compares its actual P&L figures to predictions or industry benchmarks and accordingly makes adjustments in future strategies. The P&L outcome plotted on a trendline assists investors in understanding the organization's performance over time. However, the results of P&L vary as per the accounting technique employed - cash basis or accrual accounting basis.

Table of contents

- A profit-and-loss statement is a company's financial record documenting costs incurred and revenues collected to determine the company's profit for a specific accounting period.

- Two approaches to calculating P&L statements are: cash accounting and accrual accounting are both viable approaches.

- Publicly-traded companies must prepare financial statements like P&L statements and file the same with the U.S. Securities and Exchange Commission (SEC)

- The P&L statement follows a sequence: recording revenue, assessing COGS and gross profit, adding overhead expenses, netting operating income, and adjusting income receipts plus expenditures to the firm's net profit.

Profit and Loss Statement Explained

The P&L statement is a financial report containing a company's costs, profits, and revenue. The report helps investors determine a company's profitability. It also demonstrates the company's ability to increase sales and profits by controlling its debts and costs. Publicly-traded companies must prepare financial statements like P&L statements and file the same with the United States Securities and Exchange Commission (SEC). The profit and loss statement self-employed individuals are prepared similarly to the P&L statement for corporations.

The basic profit-and-loss statement's first line highlights the company's annual gross income from sales and external sources. The company's expenses, such as marketing costs and salaries, come after the revenue. Therefore, profit and loss statement template helps investors derive a firm's net profit, which is determined by subtracting its gross costs from its sales. One can calculate the company's overall profit by utilizing its sales and deducting its expenses.

Further, a P&L statement is created using two distinct accounting methods:

#1 - Cash Accounting Basis

To calculate the cash-basis P&L statement, subtract the total costs incurred by the firm from the total cash revenues generated from its products and services sales during the accounting period. It is also considered a simple profit and loss statement.

#2 - Accrual Accounting Method

In this method, all revenue receipts and expense vouchers are continually documented in the ledger against the matching money paid out or received by the business. This strategy is often referred to as the matching principle. It mandates that a corporation must match all of its income collections for a specific time to its spending for that period.

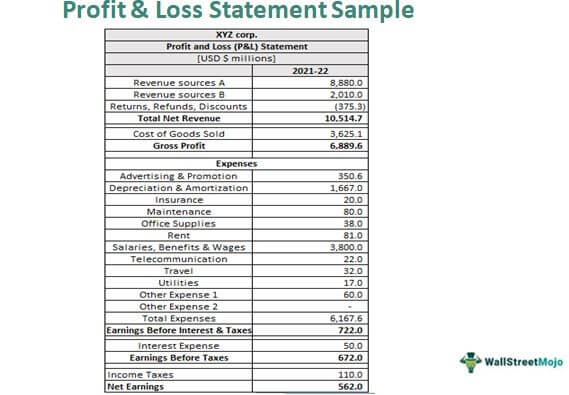

Sample

A profit and loss statement template is shown below to help understand its components better:

How To Prepare?

Let us now learn the different steps that will be used to create the statement for the knowledge of management and investors.

- Prepare journals and ledgers – The first step for preparation of any financial statement is to record the transactions in journal and then transfer them to the ledger. This has to be done regularly and consistently so that all transactions are recorded in a systematic way so as to reflect the correct values of closing balances in the financial statements.

- Prepare trial balance – This will show the summary of all the ledger accounts in the form of closing balances which will be transfers to the profit and loss account.

- Record the income and revenue- This part of the profit and loss statement sheet will include all revenue generated from normal operations as well as the revenue from other income sources like interest and dividend from investment.

- Cost of sales – This is also called the cost of goods sold (COGS), which includes all direct cost of production like direct cost of raw materials and labor, related to the production or purchase process. In some business, the income tax will be a part of the cost of sales.

- Gross profit – Then comes the calculation of gross profit in which the cost of sales is deducted form the total revenue.

- Operating expense – Then come the calculation of operating profit where all the indirect cost related to manufacting of products of the business like the administrative expense, and other cost like depreciation and employee cost, marketing and advertising cost as well as research and development expenses are considered.

- Computation of operating profit – Next comes the calculation of the operating profit, where the operating expenses are deducted from the gross profit. This is an important data that helps stakeholders understand the profit earning capacity of the business.

- Other income and expenses – They are the ones not directly related to the business or manufacturing process. Income can be dividends, and expenses may be interest of borrowings or any other charges.

- Net profit – Finally, the other incomes and expenses, and also tax and interest are deducted from the operating profit to arrive at the net profit of the company. This is the income that is given out to shareholder who invest in the business and expects return from it. This may also be retained within the business for future investment, growth and expansion.

Thus, the above are some typical steps for preparation of profit and loss statement sheet.

Example

We can analyse the concept of profit and loss statement for small business as well as big corporations through an example. Let us look into the profit and loss statement example using the case of Walmart. In the United States, Walmart Inc. is a retail company running a supermarket chain, discount department stores, and hypermarkets worldwide. The income statement of WalMart is linked here for your reference. One can compare it across five years to see how P&L reflects a company's financial standing.

How To Read?

The P&L statement is the entryway to an in-depth financial analysis of a firm since it enables investors to study the sources of income and the areas of expenditures. In common parlance, the P&L statement is analogous to a soccer scorecard in that it aids in assessing a company's strengths and shortcomings to devise plans for reaping profits and sustaining development.

Income, taxes, and costs are examined to comprehend the P&L statement. In addition, the following elements can be used to analyse expenditures and revenues:

- Sales or Revenue: - It depicts the detailed income from numerous sources to assist in evaluating a firm's revenue sources and analysis.

- Cost of Goods Sold or Cost of Sales (COGS):- COGS refers to the cost of producing a product, such as a cost to a firm that manufactures automobiles.

- Expenses – Operational:- These are the administrative costs incurred by a business, including salaries, benefits, utilities, and office space rental.

- Advertising and Marketing:- These are the funds a firm spends on promotional initiatives to acquire new consumers and grow its business.

- Selling, General & Administrative (SG&A): - These expenses are recorded in the expense header of the income statement, which summarises all costs associated with advertising, selling, and delivering goods and services and managing everyday operations. SG&A demonstrates a company's control over overhead costs and ability to reduce costs to sustain rising earnings.

- Expense – Interest:- As a non-operating item on the income statement, they are the charges connected with the company's capital borrowing in the form of interest expenses.

- Taxes - It is the amount of taxes a business or individual owes to the government after multiplying their taxable income by the applicable tax rate.

- Profit or Net Income:- Profit or net income is determined by deducting total costs from the P&L statement.

Importance

Here are some points that specify the impotance of this statement in the industry. Let us study them in details:

- It helps business and management understand the efficiency level and how much profitable the process is.

- Profit and loss statement analysis points out the various expenses and income sources which also helps the management clarify whether the costs are reasonable and if there are some ways and means to reduce the expenses to raise profitability.

- The shareholders can expect a return on their investment based on the profits earned. They can make further investment decisions based on the same.

- It is a way to meet the regulatory requirement of the company.

- The statement has to be audited every financial year. This helps the stakeholders get clear, transparent and fair view of the financial health of the business.

- It acts as a guide to compare the performance of the company with that of its peers to analyse where the business stands in terms of profits and operational costs.

- The data from the profit and loss statement analysis is used for forecasting the future and take financial decision regarding investment, projects, expansion plans. The management can even eliminate functions and processes if they are not found to generate enough revenue of leading to rise in cost.

Profit And Loss Statement Vs Balance Sheet

Both the profit and loss statement and the balance sheet are important components of the financial statements that are prepared by a company for the purpose of stakeholders’ information. However, there are some differences between them, as follows:

- The former is used to report the income and expenses of the business whereas the latter is used to report the asset and liability position of the business.

- The former is prepared related to a particular financial year or time period but the latter it related to a particular day or point of time.

- The profit and loss statement for small business as well as big corporations shows how much income and expenses the business has incurred during the financial year and the latter shows the how much effectively the resources of the business are being utilized. The investors and other stakeholders of the business uses and analyses the former to evaluate the profitability levels and the latter to understand the risk, solvency levels and capacity to meet current and long-term financial obligations.

- The former helps the management to assess whether it is possible to reduce cost and increase sales, revenue and profits further, but the latter helps in assessing whether the existing capital structure requires any changes, whether the business is able to handle its debts properly, the collection and payment is being made on time and the overall financial health of the company.

- The former answers some specific questions like cost, expense, revenue, etc. But the latter gives a long term view about the investments and debts of the company.

Thus, the above are some noteworthy differences of the two components of financial statement.

Frequently Asked Questions (FAQs)

A fundamental requirement to create a P&L statement is to have complete information on revenues, costs, and a tax summary to create a P&L statement in Excel. Begin with computing the revenues in an Excel sheet using the SUM function in the revenues column. Next, calculate total expenses using the SUM method over the costs column. Now, locate the cell that contains the formula net income = gross income minus taxes. If the outcome is positive, there is a profit; if it is negative, there is a loss.

Self-employed or sole-proprietorship businesses are required by the U.S. Internal Revenue Service to report their profit and loss under Section C on Form 1040. Therefore, self-employed individuals will generate their P&L statements using the same structure as firms.

Audited P&L is the process of evaluating the accuracy of the data recorded in the P&L statement concerning the firm's invoices, vouchers, and transaction records. The legislation mandates a yearly audit of P&L statements per national and international accounting practices.

Recommended Articles

This has been a guide to what is Profit and Loss Statement. We explain its sample, example, how to prepare, vs balance sheet, how to read, importance. You may learn more from the following articles –