Table Of Contents

What is A Capitalization Table?

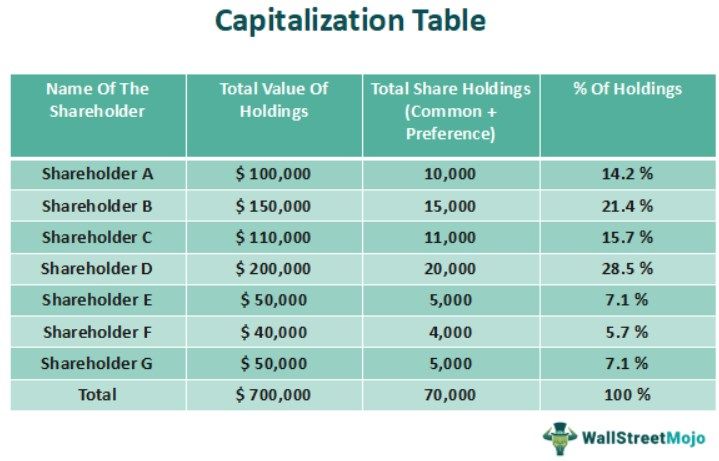

The capitalization table is a record of all the shareholders of the company as well as the records of all the securities issued by the company with pricing, i.e., preferred shares, equity shares, share warrants, convertible debts, etc., and their holdings which help to keep track of equity ownership of the company and the percentage holdings of stakeholders.

Capitalization table management plays a vital role in making financial decisions relating to market value, market capitalization, and equity ownership. For private companies, it acts as a key metric to evaluate their market value. Additionally, it also plays a pivotal role in avenues such as capital issuance marketing and shareholder reporting.

Key Takeaways

- The capitalization table is a comprehensive record of the company's shareholders and the securities they hold, including preferred shares, equity shares, share warrants, and convertible debts.

- It tracks the company's equity ownership and stakeholders' percentage holdings.

- A cap table is a spreadsheet that tracks a company's securities and shareholdings, including percentages for stakeholders. It is updated as changes occur, such as new capital issuances or altered shareholdings.

- Private companies find it easier to manage a capitalization table than public companies because they have more shareholders and frequent share transactions, often requiring complex software or outsourcing.

Capitalization Table Explained

A Capitalization Table, which is often termed a 'Cap Table,' is a table maintained in a spreadsheet that may have different annexures recording the securities and shareholdings of a company from different perspectives. The table consists of the stakeholders' data and their securities then. The table also mentions the percentage of holdings of the shareholders and the promoters. This table updates from time to time or whenever there is a requirement of updating the table, for example, in case of an issue of capital or change in shareholding.

The capitalization table maintains the list of stakeholders and the percentage of holdings they possess at a particular time. For the new companies, doing so is simple, but the cap table becomes more complicated for the growing public companies. In the case of private companies, the shareholder’s list is limited, and the transfer of shares is also limited, so making and maintaining the capitalization table becomes less complicated. But in the case of public companies, on the issue of new public securities, the number of shareholders becomes large and regular transactions in shares also make it difficult to track the records of the holding stakeholders. In this case, a company either uses heavy software or outsources handling such matters.

The listing of this table can be in different forms of depending on the target audience for the disclosure of the document. For instance, it can be listed in the form of mentioning the promotor's holding first, followed by employees and executives, investors, VC firms, and so on. Some tables of this nature also can list in descending order of the holdings of its shareholders. Therefore, there is no specific capitalization table template which is rigorously followed. It completely depends on the effectiveness of portraying information to the target audience.

Capitalization vs Expensing Video

How to Make?

The capitalization table template is prepared during the company's acquisition with the percentage of shareholdings maintained by the promoters. It can be created by maintaining a sheet in an Excel file. A spreadsheet is used to record the name of the shareholders and the securities held by them with the value and the valuation of a percentage of shareholdings they hold then. Within the same spreadsheet, we can maintain the records of securities issued at an earlier stage and the recording of every fresh securities issue at every stage of the issue done by the company and mention the percentage of distribution.

Firstly, on the company's acquisition, the holdings of Promoters or Founders are recorded. After that, upon the issue of securities to the Public or persons, the name of the shareholders and the number of securities held by them are recorded with the value of the securities. The same sheet is updated every time on the transfer of securities or the issue of new securities.

Examples

Let us understand the concept of capitalization table management with the help of a couple of examples. These examples will not only give us a clear idea on how to prepare them but also an insight from the world of angel investing and finance as well.

Example #1

We need to prepare a Capitalization Table. Let's suppose a company on foundation/acquisition has issued common equity to its promoters worth $1500000 with shares of $4 each, making the number of shares 375000. Further, the company released preference shares of 1125000 shares of the value of $4 each, which was subscribed by nine persons with shares bought as 300000, 90000, 75000, 115000, 100000, 50000, 250000, 45000, 100000 shares.

Solution

Refer to the excel sheet given above for detailed calculation.

Example #2

Angel investing is one of the riskiest forms of investing in a company. The risk of investments amounting for almost nothing is usually pretty high. Therefore, it becomes an important facet to understand scrutinize, and formulate the fundamentals and technical of a company.

One of the easiest ways to understand the structure and flow of a company, cap tables can be an excellent indicator of the same. It also gives the investor an idea of the returns they can make if the company is sold in the future based on the divide in the stakes of the company.

How to Use?

A capitalization table template is used to record the shareholding composition and pattern within a company, which can be done by updating the table based on a change or transfer or new fresh equities.

When the management decides to raise funds for the company, the reference to the cap table helps the company measure the effect of raising funds through other securities and analyze the effect on the company's Debt Equity Ratio of the company. For securities, while finalizing the subscription company also refer to the capitalization table to ensure that the decision-making power of the

In the cap table, the date of issuance of securities can also be mentioned, which can help the organization look into the convertible securities and the impact it will bring on the structure of security distribution. In the case of issuing employee stock options, capitalization also details how many stocks have been subscribed, how much has been rejected, and how many remain at a particular time.

Importance

Let us understand the importance of capitalization table management through the discussion below.

- Capitalization Table helps in making Notes to Accounts of the Balance sheet of the company, where it is required to disclose the list of the stakeholders who hold a significant holding proportion of the securities of the company.

- The table helps determine and analyze the segregation in decision-making power within the company by ensuring that the decision-making power within an organization does not fall within a single group.

- It also helps the board of directors to decide how to raise funds for the company and ensure compliance with the laws. I.e., whether a company should issue more common shares or raise funds by the issue of new debentures so that the company's Debt-Equity ratio should be in check, it also helps the board decide whether to issue Employee stock options to match the organization's interest with the employees and provide them with the incentives to motivate them toward the mission and vision of the company.