Table Of Contents

What Is A Privately Held Company?

A privately held company refers to a separate legal entity that is privately owned by its founders or investors or other stakeholders. The ownership of such companies might belong to a unit as small as an individual or family to as large as hundreds of investors together. Hence, there is no limitation to the number of ownerships in a private company.

A privately held company stock is not listed on exchanges for the public, and hence these ventures are different from publicly owned enterprises, which make their shares available to the public through an initial public offering (IPO).

Key Takeaways

- A privately held company is a separate entity registered with the Securities and Exchange Commission (SEC) and is privately owned by an individual or a group.

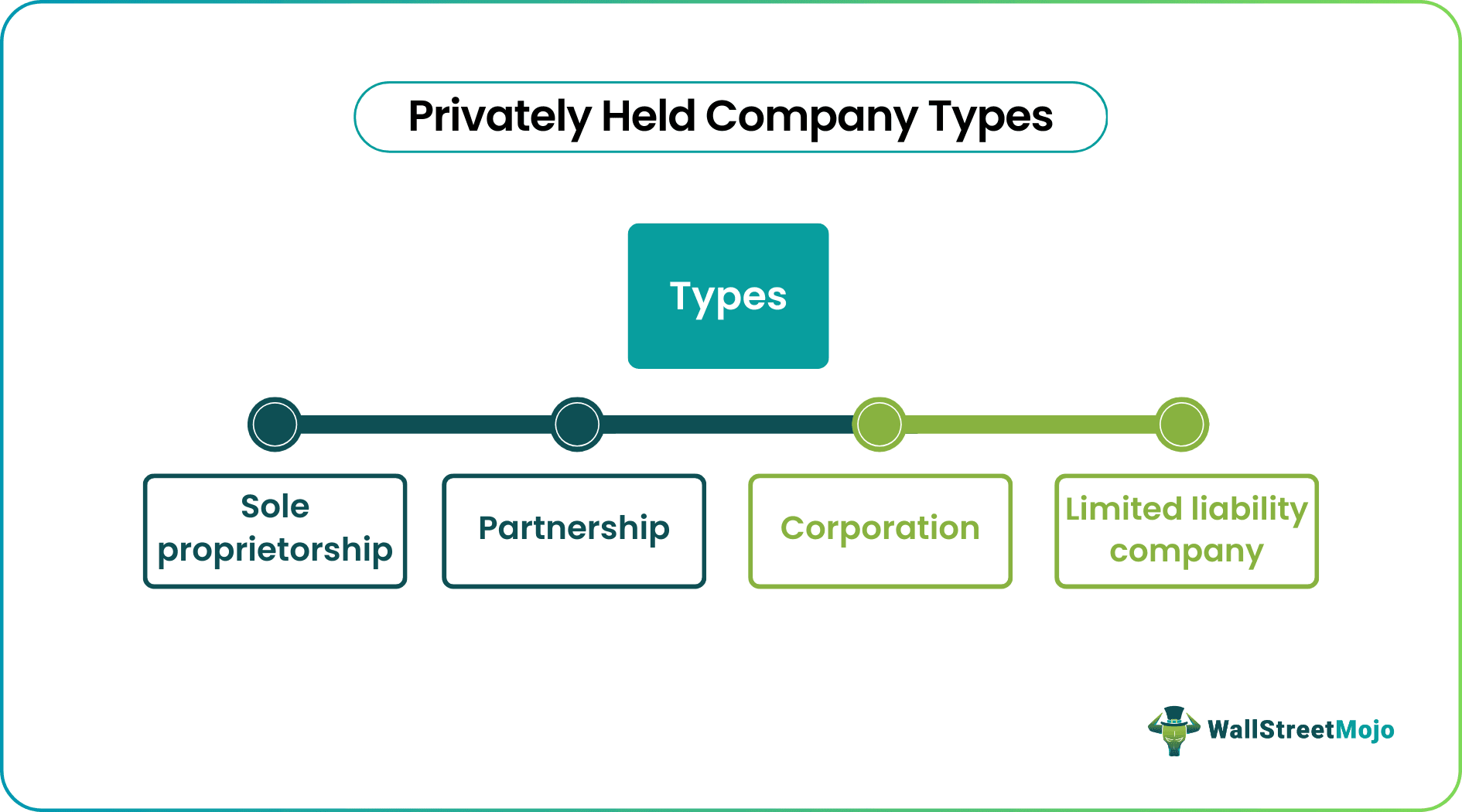

- A privately held company is of four types: Sole proprietorship, partnerships, corporations, and limited liability company (LLC).

- Such a company comes with perks such as the autonomy of the owner, non-disclosure rights, privately controlled taxation, and maintaining confidentiality.

- Privately held companies like Dell haven’t released their IPOs due to the possibility of misaligned objectives.

How Does A Privately Held Company Work?

A privately held company is a closely-held company with private ownership. There is no direct involvement of the public in purchasing or selling shares as they are not publicly listed on exchanges. Being a privately held firm, it doesn’t need to adhere to any regulation specified by the Sarbanes-Oxley Act (SOX) or Securities and Exchange Commission (SEC).

Since preparing documents for SOX and SEC is pretty expensive, being a privately held company helps the owners save a lot of money. If a privately held firm owner wants to sell off shares in the private market, they need to wait months to sell off.

As private shares are highly illiquid, it’s tougher to sell them. However, being a private company does give its owners a lot of autonomy and freedom. Since adhering to regulations is an afterthought, they can always think about the company’s long-term future rather than worrying about the next quarter’s profit figure.

Types

These companies are available in four different forms – sole proprietorship, partnership, corporation, and Limited Liability Company (LLC).

- Sole Proprietorship: A sole proprietorship company doesn’t have a separate entity. It’s the same as the entity of the person. As a result, the company owner gets unlimited freedom to make their own decisions. But at the same time, the risk is huge, and raising money becomes way too difficult.

- Partnership: A partnership is an extension of a sole proprietorship with the number of owners being more than one (or at least two). The owners have the same unlimited liability and at the same unlimited autonomy to make decisions.

- Corporations: A corporation is free from personal liabilities. This means the risks are handled by the corporation as an entity and not passed on to the owners as an individual. These entities can be of two types C-corps and S-corps. While C-corps are liable for double taxation both at the corporate level as well as individual level, S-corporations are not liable to pay any corporate income tax.

- Limited Liabilities Companies (LLC): This is yet another private company type. LLCs have multiple owners who share the responsibilities. Such entities provide the benefits of both partnerships and corporations. The two advantages of being an LLC are – these entities can have pass-through income taxation, and they have limited liability.

Examples

Let us consider the following privately held company examples to understand its working better:

Example 1

Company A managed to become one of the best privately held companies in town. However, it refrained from turning into a publicly-traded company despite knowing its worth. This is because the company knew how expensive it is to conduct an IPO. Hence, it decided not to invest in going public and using the profits for something productive to build the brand image. As a privately owned venture, the owner had the liberty to make decisions without consulting anyone further.

Example 2

Agribusiness ace Cargill has been declared as the largest privately held company second time in a row in 2022 in terms of the revenue earned. The global food corporation was established in 1865 and reported a revenue worth $165 billion in 2022.

Advantages

Owning a privately held company has its advantages. Here are the topmost advantages that a privately held company has –

- Control & Autonomy: The first and the most significant aspect of owning a privately held company is having complete autonomy over operational decisions. Since one doesn’t need to worry about the regulations, one can think of long-term benefits and concentrate on the things that would be good for the company in the future rather than worrying about the next year’s profits.

- Non-disclosure rights: One of the most crucial factors is non-disclosure rights. As an owner of a privately held company, one has to focus on better things. In addition, the company must not incur a huge cost of preparing the documents for SEC Regulation.

- Taxation structure: In privately held companies, the owners can decide how to structure the company. They can structure the company as a limited liability company or any structure that best serves the company’s interest. As a result, they can escape paying double taxes and pay the lowest taxes possible (as per the statute).

- Confidentiality: Public companies can’t keep their secrets. They need to disclose everything to the public because the SEC regulation binds them to do so. But privately held companies can maintain confidentiality as they don’t need to disclose any confidential information to the public.

- No litigation: Public companies disclose all. As a result, they’re more vulnerable to lawsuits. On the other hand, privately-held companies don’t need to convey their legal matters or any sensitive information to anyone. Hence, they can avoid litigation issues by all means.

Disadvantages

There are not many disadvantages to private companies. But it has a couple of demerits. Let us have a look at them:

- Limited Capital: It's not easy to source share capital for a privately held company. If one has a sole proprietorship company or a limited liability partnership company, the chances of sourcing capital depend on finding some private backers. Once they have the latter onboard, they can source capital via private placements.

- Unlimited responsibility/liability: There’s no separate entity for a sole proprietorship business and the sole proprietor. That’s why as a privately held business owner, one has to shoulder all the responsibility/liability. If there are any lawsuits and verdicts against them, the court may seize their assets beyond the company assets.