Table Of Contents

What Is Classical Conditioning?

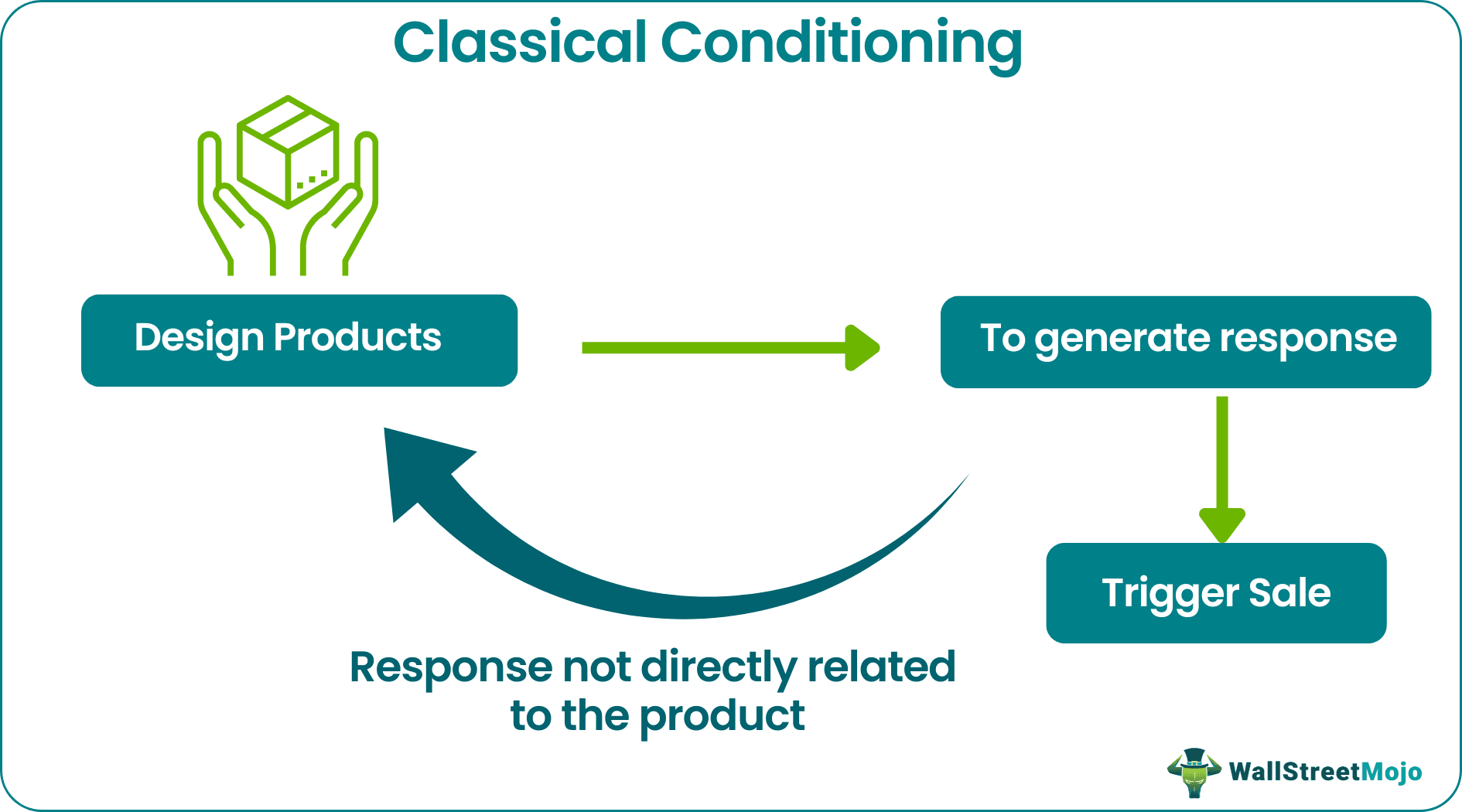

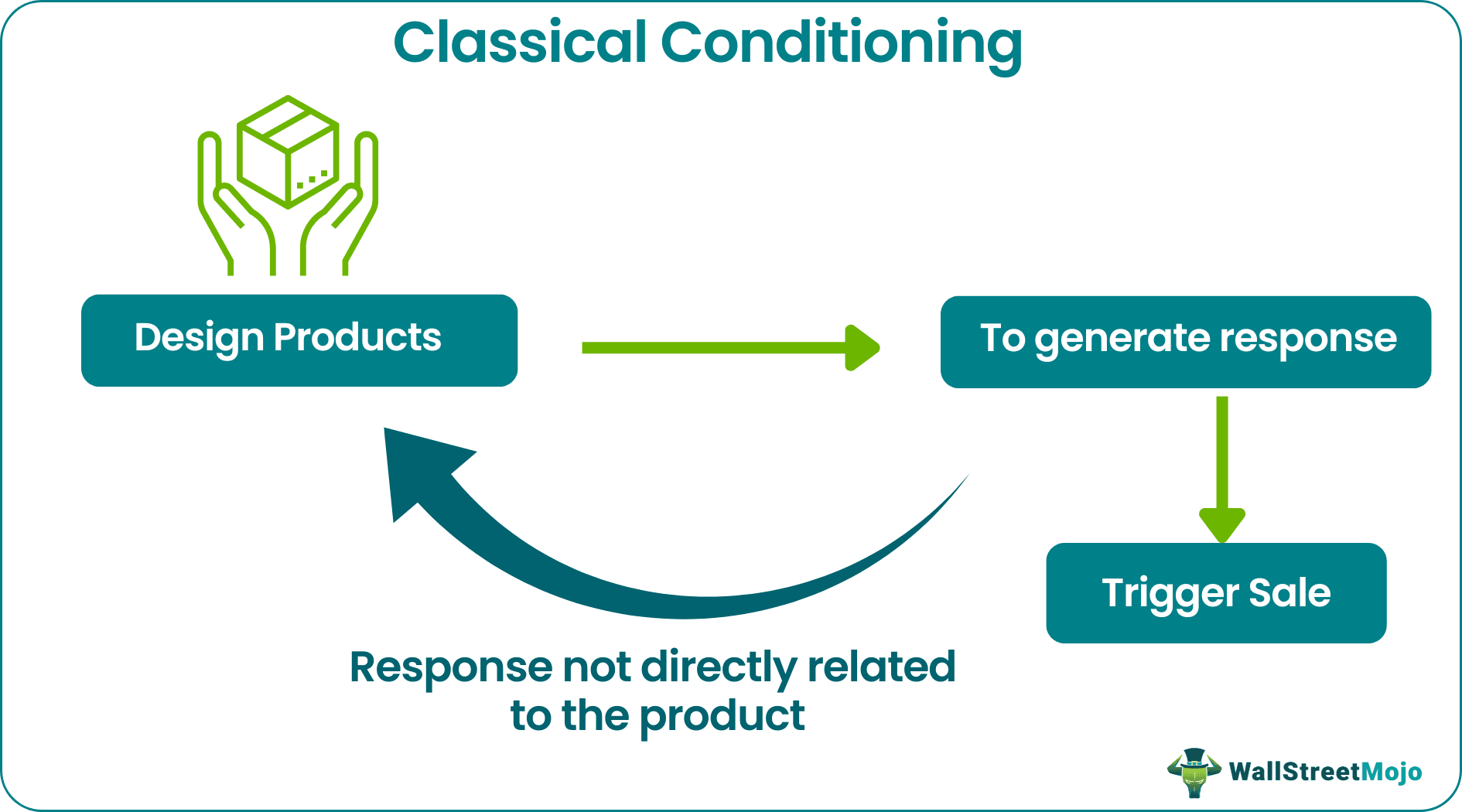

Classical conditioning in business refers to generating responses favorable to the product even though there might not be a direct relationship between the concerned product and the desired response. It has two main aspects that affect human behavior – the interest it generates and the behavior it reinforces in the brain.

It is a fundamental concept in psychology and is extensively used in behavior therapy, marketing, advertisement, evaluation of emotional response, etc. It clearly explains the process in which any kind of stimuli from the environment can affect the behavior of individuals.

Key Takeaways

- Classical conditioning in business refers to creating favorable responses towards a product or brand, even when there is no direct connection between the product and the desired response.

- It involves two important factors influencing human behavior: generating interest in the product and reinforcing specific behaviors in the brain.

- Classical conditioning can be observed in various business and everyday life scenarios, such as shaping consumer behavior through advertising, conditioning employee responses, influencing stock market behavior, and even in the field of insurance.

Classical Conditioning Explained

Classical conditioning theory is the process in which the conditioned stimulus and the unconditioned stimulus is pair with each other and an association is formed between them. Over a certain period of time, the conditioned stimulus can bring out a response from the unconditioned one.

It is an essential concept in the field of psychology and is used in advertising, therapy to influence behavior, etc. It was first introduced by Ivan Pavlov, a Russian physiologist in the early 20th century. There are various components to the process and different principles are followed which are elaborated below.

Over the years, classical conditioning psychology has become very famous and gained a lot of importance and influenced the field of psychology because it follows the concept that environment has a huge influence on the behavior a lot of learning occurs through interaction with the environment.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Components

The various components of the classical conditioning theory are as follows:

- Unconditioned Stimulus – In this case, a response gets triggered immediately and naturally without any prior experience or learning.

- Unconditioned response – This is a reflexive and automatic response that takes place in response to the unconditioned stimulus.

- Conditioned Stimulus – Initially, this is neutral in nature and does not give any desired response. but after repeatedly pairing it with the unconditional stimulus, the conditioned one becomes associated with the unconditioned one, and finally responds to the situation.

- Conditioned Response – It is a learned response that is brought out by the conditioned stimulus. It is very close to the unconditioned response.

Thus, the above are various components of the process.

Principles

There are different kinds of phenomena that can be associated with classical conditioning. Let us closely understand the key classical conditioning principles.

- Acquisition – It refers to the initial stage of learning in which the conditioned stimulus(CS) are paired together repeatedly. At this stage, the relation between the CS and the US become strong and the CR finally starts to come out.

- Extinction – This occurs when the CS is repeatedly presented without the US. Over a period of time, if the CS is no longer presented with the US, then the CR starts to become weak and slowly diminishes. This principle basically states that any learning association can also be forgotten if the proper source of reinforcement is absent.

- Spontaneous recovery – Sometimes it has been noticed that a learned response can again come out even after remaining in extinction fro a long time.

- Generalization – it occurs when a response, that was learned to a particular CS also occurs with response to other stimuli that are close to the original CS.

- Discrimination – The classical conditioning psychology is the ability to differentiate between similar type of stimulus but respond to only one. Through proper training it is possible to respond to one particular stimulus which is not yet paired with any US.

The different classical conditioning principles are elaborately explained above for detailed understanding.

Examples

Let us try to understand the concept with some examples.

Example #1

Stock markets have been the biggest example of classical conditioning over a long period. The place is often thought of as a platform where intellectuals make money while speculators consistently lose it has again proved that reactions are often knee jerks and in the heat of the moment. A simple rule of finance states that when the economy is booming, the equity should give you better returns. However, safe assets like sovereign bonds and gold should be preferred when the economy is going through a rough phase. But what happens when a large firm in booming market posts unexpected results.

The unexpected result might differ from the expectations in terms of top-line numbers. But still, an analysis is required to understand what lies beneath. One must decode the layers of these implicit details to understand how the firm has performed in the last quarter. But what do market participants do? They only look at the initial numbers; if they are unexpected, they start selling the firm's stock.

The simplest reason being they have been conditioned to react in such a way over the years. Just because everyone is doing it, one should do the same. But unfortunately, it leads to a knee-jerk reaction, often an overreaction by the market and its participants. That is why we sometimes face situations where stocks of even blue-chip stock firms are down by 5% -10% even when they have posted decent results. However, an investor with basic knowledge of finance but who can calm his anxiety and avoid blind sheep behavior can weather these storms and use these situations to generate better market returns. It is a classic case of behavioral finance and its effect on investors.

Example #2

Firms across the globe are as much dependent on advertising, if not more, as they rely on the quality of their products. To generate consistent profits, retain a positive image, and customer retention, they need to reinforce the brand value among the consumers. The advertising firms use classical conditioning to support these values and acquire more customers. Take the example of cold drinks and their advertising mechanisms.

They have repeatedly positioned their market strategy to position these products with heat, thirst, refreshment, and adventure. In the classical conditioning scenario, these activities act like unconditioned stimuli to attract customers. Such has been the effect that customers feel thirsty when they come across any poster leading to an impulse buy. The brain gets conditioned with time, and the response becomes even more vital.

One can apply the same classical conditioning experiments to the sponsorship these firms target. For example, they often try to associate themselves with major sporting events worldwide and sign in as the biggest sports celebrity. For example, an association of the Indian great batsman Sachin Tendulkar with major soft drink brand Pepsi has been so successful that it has become a case study for marketing strategists and enthusiasts. Another example is the keyword SALE and its effects on the consumers. It is common in the retail industry to increase footfalls as the consumers have been conditioned to enter the store as soon as they see a boarding or a poster marked SALE.

This keyword acts as an unconditional stimulus and generates a favorable response from our brain leading to an impulsive urge to feel like shopping. Online commerce portals use a similar strategy to attract customers. They also utilize the concept of FOMO – fear of missing out, which further reinforces the urge to shop. Surprising is the fact that the SALE is around the year, but still, the customers have a fear of missing out.

Example #3

Time and again, corporations across various lines of business have used classical conditioning to improve employee outputs. For example, rewarding the agent with a variable bonus better than the expectations reinforces the positive behavior. It motivates them not only to perform better but also to motivate their peers. It acts on two grounds – first, it encourages the employees to positive behavior and reinforces that behavior to generate expected results. Similarly, one can use the same to improve the safety of the employees in manufacturing firms and eliminate accidents on the shop floor.

Example #4

Often, one suggests insurance to counter any unusual activity or a life-changing event. The most important is term insurance, where the victim can safeguard the interest of their dependents in case of his death. The concept is mainly to ensure that the loss of an earning family member may be countered by a lump sum payment to his immediate family. However, the insurance companies have designed new products like ULIPS, which have conditioned the consumers to generate some returns even on these insurance premiums.

The fear of losing the money to generate returns attracts customers to these products. Since everyone else is taking it, it reinforces the consumer's behavior, and eventually, he purchases it. Even for this basic product, the insurance firms have influenced consumer behavior through advertising and reinforcing behavior through classical conditioning experiments.

Classical Conditioning Vs Operant Conditioning

Let us try to differentiate between the two types of conditioning given above.

- The former focusses on the relation between two types of stimulus whereas the latter focusses on the relation between behavior and the end result of it.

- The former deals with reflexive and involuntary response that is beyond the control, whereas the latter deals with voluntary responses.

- In case of the former , the process is established through pairing of neutral and unconditioned stimulus whereas in case of the latter, the learning occurs through punishment or reinforcement.

- For classical conditioning, there is no role of the end result in the learning process whereas in case of operant conditioning, consequence or result plays a big role in shaping the behavior.

Thus, the above are some fundamental differences between the two types of conditioning.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Classical conditioning was first described by Ivan Pavlov, a Russian physiologist, in the late 19th century. Pavlov conducted experiments with dogs, discovering the principles and mechanisms of classical conditioning.

Extinction in classical conditioning refers to the weakening or disappearance of a conditioned response (CR) when the conditioned stimulus (CS) is presented repeatedly without being followed by the unconditioned stimulus (US). In other words, when the association between the CS and the US is no longer reinforced, the conditioned response diminishes or ceases to occur.

Classical conditioning, discovered by Ivan Pavlov, is a valuable concept in understanding behaviors. However, it has limitations. Biological constraints and cognitive factors can influence the ease of learning associations. Context dependency may limit generalization to different situations. Overemphasizing Pavlovian paradigms narrows our understanding of classical conditioning's broader applications. Ethical considerations arise when distressing stimuli are used, or behavior is manipulated without consent.