Table Of Contents

What is Hot Hand?

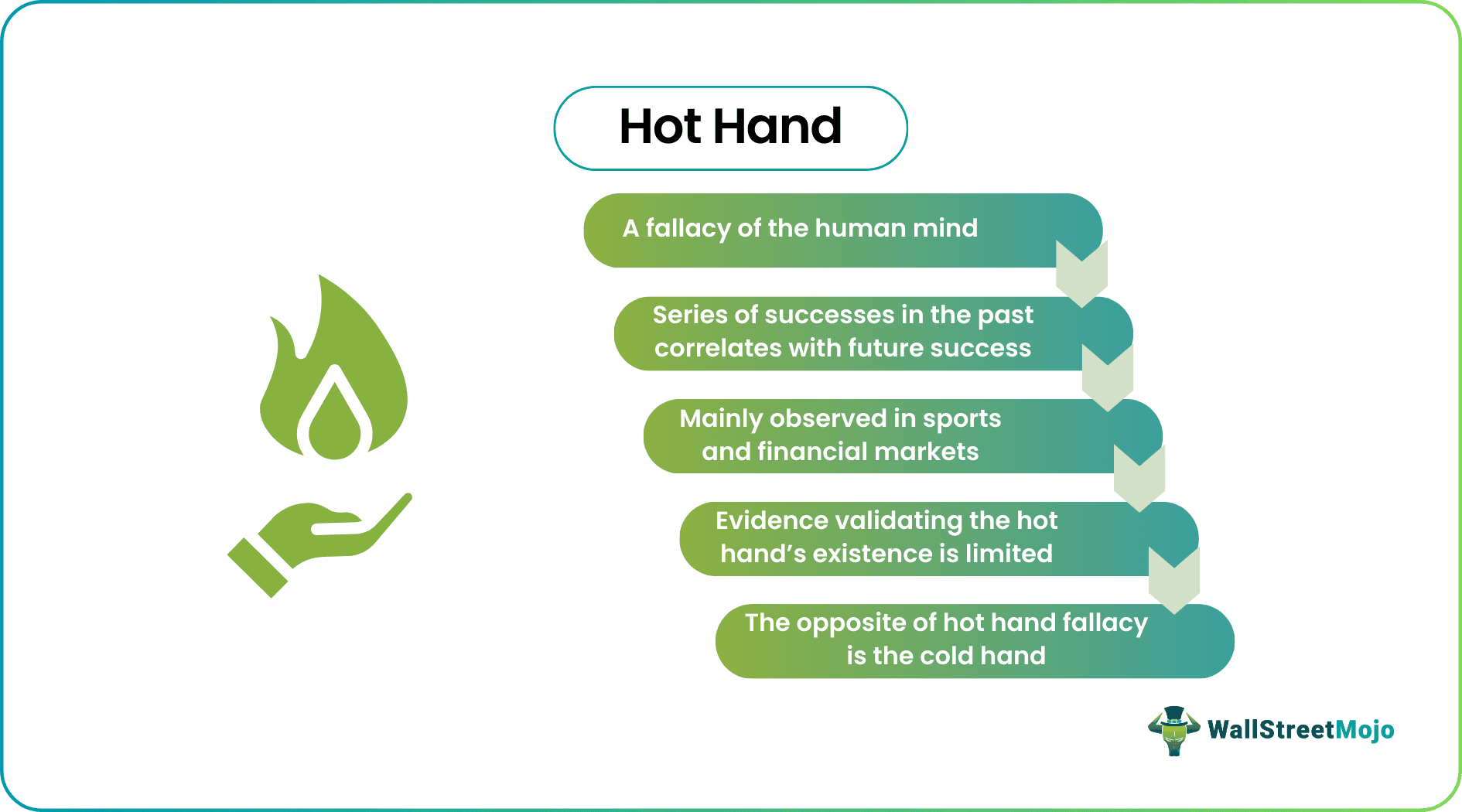

Hot hand refers to the belief that a continuous series of a positive results will continue to thrive. For example, people often believe that if a company or its share has performed well in the past, it will continue the same trend in the future.

The concept advocates the subsistence of positive outcomes, whereas the phrase cold hand coined the continuity of negative results. Both ideas reflect the impression of past trends to be continued in the future. This interesting psychological phenomenon is mainly observed in sports and financial markets.

Table of contents

- What is Hot Hand?

- Hot hand fallacy in psychology is a notion and belief that a series of successful outcomes in the past of any entity, individual, or investment will continue likewise in the future.

- Academics defines it as a behavioral bias.

- The opposite concept is the cold hand, where the horrible history or loss endured by an entity is predicted to continue.

- Apart from sports and gambling, this phenomenon plays a prominent role in investment decisions. Investors buy stocks that have shown good returns and healthy past performance

Hot Hand Fallacy Explained

The hot hand fallacy was first explained in the cognitive psychology article "The Hot Hand in Basketball: On the Misperception of Random Sequences" by Thomas Gilovich, Robert Vallone, and Amos Tversky. The article focused on the origin and validity of the hot hand and streak shooting in basketball. People believe that a player's chance of hitting a shot is greater if the previous shot is a hit. However, empirical evidence shows no positive correlation between the results of successive shots.

Researchers match this concept with behavioral biases like extrapolation or recency bias. People predict the random outcomes of an event by studying their past performance, which may or may not come out as true. If it comes out true, they will continue to believe in the concept. Continuous experience plays an important role in programming their brain to use the same concept whenever a similar situation arises.

It is increasingly investigated in disciplines including psychology and behavioral economics in conjunction with another opposing concept known as the Gambler's Fallacy, sometimes known as the Monte Carlo Fallacy. It illustrates how a sequence of something will be followed by the occurrence of its inverse, that is, exhibiting negative recency. Both notions represent the process by which the human brain seeks to make sense of the occurrence of random sequential events.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Example

Let us consider the example of Amplify Energy Corp., signifying one of the classic hot hand fallacy examples.

The company’s stock price declined almost 50%, reporting a significant oil spill off the Orange County Coast on October 2, 2021. Approximately 12600 gallons of spill occurred between Newport Beach and Huntington Beach spreading over 6 miles. Its impact is drastically reflected on the Amplify Energy stock price.

The stock price was making a bullish run, specifically from the last week of September 2021, signifying the influence of the hot-hand effect on investors. Many investors believe in the sustainability of upward trends refraining from rationality. But the oil spill news came at a very inopportune time. It has tremendously affected its stock price, it plunged to 2.8800 on October 4 from the previous level of 5.3700, and it never rebounded to the previous highest level. Hence confirming a fallacy about stock price movement.

Role of Hot Hand in Investing

The future performance of investments is highly uncertain. This uncertainty prompts many investors to follow heuristics and biases, giving less importance to rational thinking to derive easy solutions to complex problems. All these point to the fact that the human brain is programmed to recognize patterns based on stock price movements. Ultimately investors fall for a fallacy.

The fallacy is still very much present in investing. Even professional investors believe in this phenomenon. For example, investors affected by Gambler’s Fallacy sell their stocks when the prices are at their peak, and if affected by the hot-hand effect, they buy stocks when prices are rising. Investors following the fund managers with good past performance is another event signifying the irrational choices.

People derive benefits and disadvantages from hoping the series of wins will sustain the two sides of the same coin. It is evident if we analyze the case of people jumping into the cryptocurrency bandwagon. Some traders use market timing strategies to get off the bandwagon after making substantial gains, and other sections of traders are affected by the highly volatile nature of cryptocurrencies.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It refers to the individual's belief that a series of successful results will generate further success. For example, if a company's stock price has been continuously moving upward for the past 20 days, it is easy for an investor to believe that it will continue to rise in the next few days.

There is no convincing empirical evidence to back up its existence. It is classified as a behavioral bias, similar to extrapolation or recency bias, which causes people to make inaccurate forecasts. People make guesses about the randomized events based on their prior performance, which may or may not be correct. They will continue to believe in the notion if it turns out to be true.

The academics Thomas Gilovich, Robert Vallone, and Amos Tversky investigated the validity of hot hands in basketball. The result was explained in the cognitive psychology article "The Hot Hand in Basketball: On the Misperception of Random Sequences." The article inclined with the absence of a positive correlation between the results of successive shots.