Table Of Contents

What Are Derivatives Contracts?

Derivative Contracts are formal contracts that are entered into between two parties, namely one Buyer and other Seller acting as Counterparties for each other, which involves either physical transaction of an underlying asset in the future or pay off financially by one party to the other.

It is based on specific events in the future of the underlying asset. In other words, these contacts derive their value from the underlying asset based on which the contract has been entered. Companies and individuals commonly use them for managing risk or obtaining the opportunity to invest in various instruments in the financial market.

Key Takeaways

- Derivative contracts are financial instruments whose value is derived from an underlying asset, like stocks, bonds, commodities, or currencies. They enable investors to participate in the underlying asset's price movements without directly owning it.

- Derivative contracts serve various purposes, including hedging against price fluctuations to mitigate risk, speculating on future price movements for potential profits, and accessing different markets or assets without direct ownership.

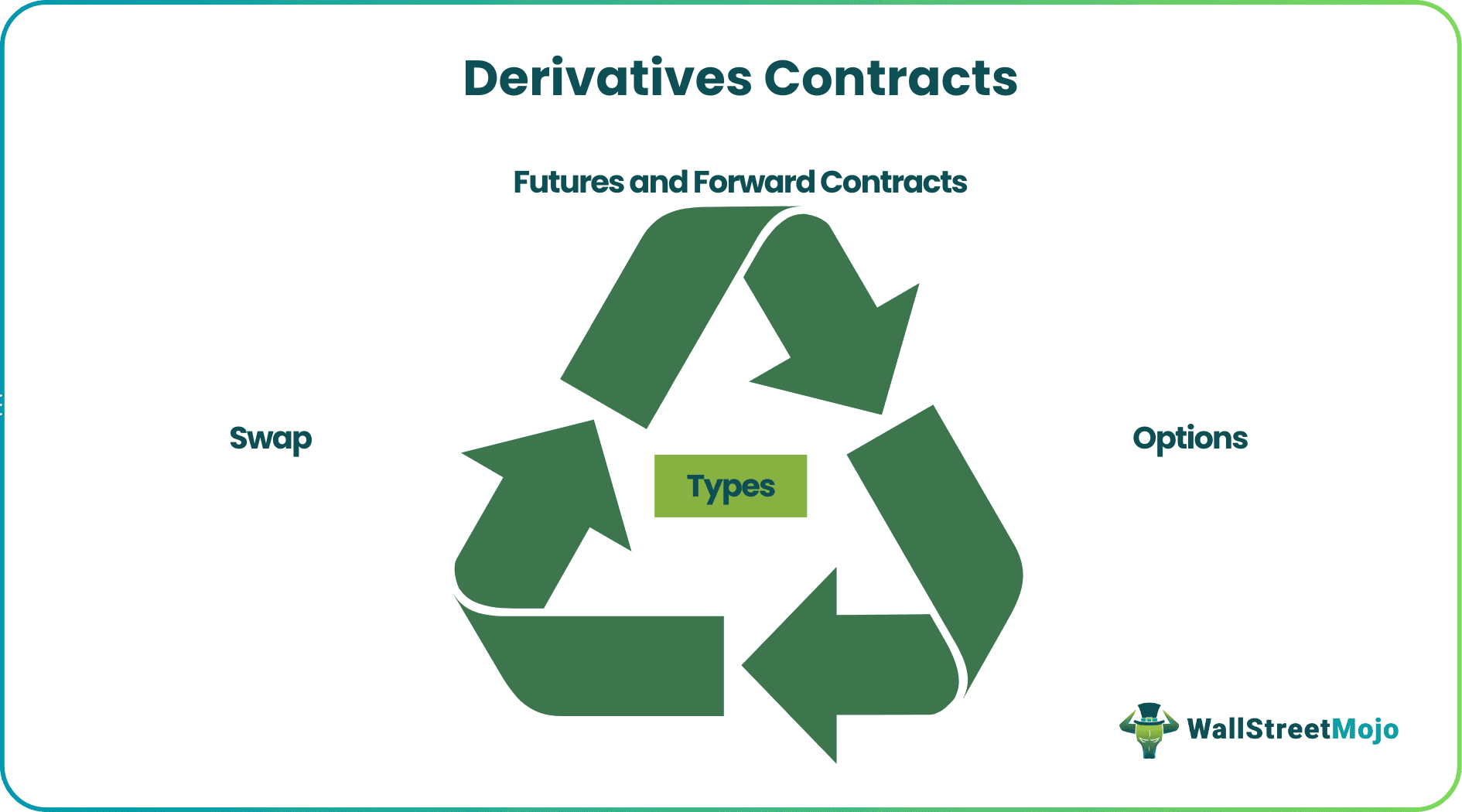

- Common types of derivative contracts include futures contracts, options contracts, swaps, and forward contracts. Each type has distinct characteristics and serves specific investment or risk management needs.

Derivatives Contracts Explained

Derivative contracts are a type of financial instruments that get their value from the underlying asset. Many individuals and entities use them to manage risk exposure, anticipate the price movements or get the opportunity to invest in various types of assets.

There are various types of them. Some involve agreements made to purchase or sell an asset at some future date at a predetermined price but have a standard method. They can be traded in exchanges and so they are exchange-traded derivatives contracts. Some others are more customised according to the needs and expectation of the investor and can be traded in exchange or over the counter.

Smart derivatives contracts are useful financial Instruments which are frequently used by various types of Business and Individuals with different motives and are an essential part of Modern-day finance. The main aim of such contracts is hedging and speculation.

Characteristic

Basic Characteristic of smart derivatives contracts involves:

- Initially, there is no profit or loss for both the Counterparties in a Derivative Contract

- Fair Value of the Derivative Contract changes with changes in the underlying asset over time.

- It requires either no initial Investment or requires a small initial investment compared to the actual outright buying/selling of the underlying asset.

- These are always traded with future maturity and settled in the future.

Types

Here are some important types of such contacts that are used by investors in the financial market.

#1 - Futures and Forward Contracts

Futures are the most common Derivative Contract, which is standardized and traded on an Exchange platform and thus referred to as exchange-traded derivatives contracts, whereas a Forward Contract is an Over-the-Counter Traded Contract, which is customized as per the requirements of the two counterparties.

#2 - Swap

Swaps are large customized derivative contracts dominated by Financial Institutions and intermediaries, mainly Banks, etc., and can take different forms such as an Interest Rate Swap, Commodity Swap, Equity Swap,, Volatility Swap, etc.

The purpose of Swap can be to convert a fixed-rate liability into a floating rate liability, such as the case of an Interest rate Swap and so on. Similarly, Currency swaps can be used by a business that has a relative advantage in borrowing in their capital market as opposed to the capital market of the currency in which they want to borrow.

#3 - Options

Options are Derivative contracts having Non-linear payoff and entered into by two counterparties that provide once counterparty known as Option Buyer to gain the right but not an obligation to buy or sell a specified security at a pre-fixed Strike Price on or before the maturity on payment of a premium amount to the Options Seller. The maximum risk for Option buyers in an Option Derivative Contract is the loss of premium, and for Option Seller, it is Unlimited.

Examples

Let’s understand the concept with the help of a simple example:

Example #1

Raven intends to derive the Forward Exchange rate of a currency forward contract involving a currency pair of INR/USD. The Current Spot Rate of INR/USD is 0.014286 $, which effectively means that one rupee of Indian currency is equivalent to 0.014286 dollars.

The current risk-free rate is 4% in the United States and 8% in India.

Based on the above information, we can derive the 180 day Forward Exchange Rate to derive the Currency Forward Contract rate:

(Excel sheet attached)

Example #2

Let’s take one more example focused on one of the widely used Derivative Instrument Options.

Rak Bank is trying to value certain options (both Call and Put), which it intends to sell to its clients on one of the Manufacturing company stocks Kradle Inc which are currently trading at $80. The Bank has decided to value the option on the Kradle Stock using the hugely popular option pricing model, namely the Black Scholes Merton Model.

A few of the assumptions undertaken to value the options are as follows:

- Spot Price: $80

- Strike Price: $85

- Risk Free Rate: 6%

- Time to Expiry: 3 Months

- Implied Volatility: 25%

Based on the above factors, Rak Bank valued the Derivative Option contracts as follows:

(Excel sheet attached)

Thus the Derived Option Prices for Call and Put with Strike Price of 85 having three months to expiry at the Implied Volatility of 25% comes out to $2.48 and $ 6.22, respectively.

These are an excellent tool that can be used to take positions on underlying assets, converting fixed liabilities to Floating, hedging of Interest Rate Risk, and many more.

Advantages

Like every financial process has advantages and disadvantages, this process has them too. Let us analyze the benefits of managing derivatives contracts first.

- These are used to hedge any unforeseen risk and are used by both Corporates and Banks. Banks actively use Derivative Contracts to hedge their risk, which can arise on account of long term assets in the form of loans and long term liabilities in the form of deposits.

- These are essential for market-making purposes as well.

- These are an ideal tool for taking high leverage trades without actually taking a position in those assets as the amount of investment in Derivative Contract is very minimal compared to the actual underlying asset.

- These are used for undertaking arbitrage trades under which price differentials are exploited by buying in one market and selling in another market and making risk free profit.

Disadvantages

Some disadvantages of the concept are given below:

- Its entered into by the Bank attracts provisioning of Capital, which has a cost. Further, Derivatives contracts are marked to market daily, and any adverse change in the price of the underlying assets can lead to a loss on Derivative Contracts.

- It gives rise to not only credit risk but also counterparty Risk as well, which needs to be analyzed and managed separately and adds to the cost of holding Derivative Contracts.

- Another disadvantage of managing derivatives contracts is they lead to excessive speculation in the market, and at times the complicated nature of such derivative Instruments can lead to losses beyond the capacity of the Business, leading to bankruptcy, etc.