Table Of Contents

Derivative Examples

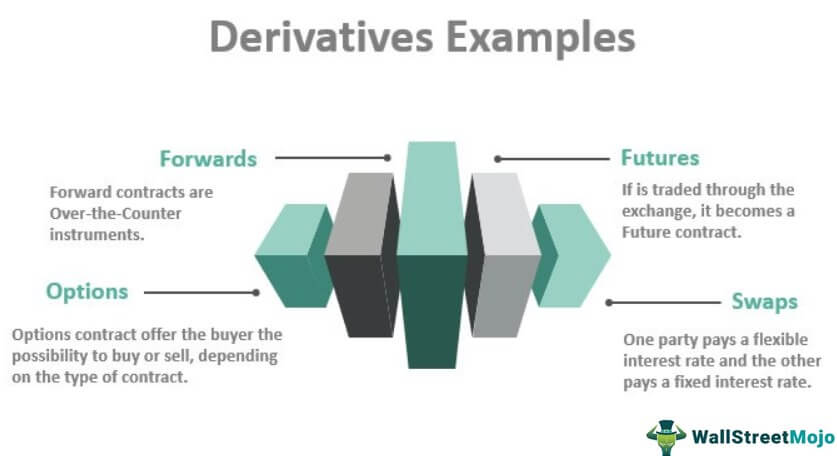

Derivatives are financial instruments like equity and bonds, in the form of a contract that derives its value from the performance and price movement of the underlying entity. This underlying entity could be anything like an asset, index, commodities, currency, or interest rate—each example of the derivative states the topic, the relevant reasons, and additional comments as needed.

The following are the most common example -

- Forwards

- Futures

- Options

- Swaps

Table of contents

- Derivatives are financial instruments that derive their value from an underlying asset, index, or reference rate.

- Examples of derivatives include futures contracts, options contracts, swaps, and forward contracts.

- Derivatives can be used for various purposes, such as hedging against price fluctuations, speculating on future price movements, gaining exposure to different markets or assets, or managing risk.

- Derivatives offer leverage, allowing investors to gain exposure to a larger position than what would be possible with direct investment in the underlying asset.

Most Common Examples of Derivatives

Example #1 - Forwards

Let us assume that corn flakes are manufactured by ABC Inc for which the company needs to purchase corn at a price of $10 per quintal from the supplier of corn named Bruce Corns. By making a purchase at $10, ABC Inc is making the required margin. However, there is a possibility of heavy rainfall, which may destroy the crops planted by Bruce Corns and, in turn, increase the prices of corn in the market, which will affect the profit margins of ABC. However, Bruce Corns have made all the possible provisions to save the crops and have this year used better farming equipment for the corn, therefore, expects higher than the normal growth of the corn, without any damage by the rains.

Therefore, the two parties came to an agreement for six months to fix the price of corn per quintal at $10. Even if the rainfall destroys the crops and the prices increase, ABC would be paying only $10 per quintal, and Bruce Corns is also obligated to follow the same terms.

However, if the price of the corn falls in the market – in the case where the rainfall was not as heavy as expected, and the demand has risen, ABC Inc would still be paying $10/ quintal, which may be exorbitant during the time. ABC Inc might have its margins affected too. Bruce Corns would be making clear profits from this forward contract.

Example #2 - Futures

Futures are similar to forwards. The major difference remains as Forward contracts are Over-the-Counter instruments. They can, therefore, be customized. The same contract is traded through the exchange, it becomes a Future contract and is, therefore, an exchange-traded instrument where supervision of an exchange regulator exists.

- The above example can be a Future contract too. Corn Futures are trading in the market, and with news of heavy rainfall, corn futures with an expiry date of past six months can be purchased by ABC Inc at its current price, which is $40 per contract. ABC buys 10000 such future contracts. If it really rains, the futures contracts for corn become expensive and are trading at $60 per contract. ABC clearly makes a gain of $20000. However, if the rainfall prediction is wrong and the market is the same, with the improved production of corn, there is a huge demand among the customers. The prices gradually tend to decline. The future contract available now is worth $20. ABC Inc, in this case, would then decide to purchase more such contracts to square off any losses arising out of these contracts.

- The most practical example globally for future contracts is for commodity oil, which is scarce and has a huge demand. They are investing in oil price contracts and, ultimately, gasoline.

Example #3 - Options

Out of the Money / In the money

When you are buying a call option – the strike price of the option will be based on the current stock price of the stock in the market. For example, if the share price of a given stock is at $1,500, the strike price above this would be termed as “out of the money,” and the vice-versa would be called “ in-the-money.”

In the case of put options, the opposite holds true for out of the money and in the money options.

Purchasing Put or Call Option

When you are purchasing a “ Put option,” you are actually foreseeing conditions where the market or the underlying stock will go down, i.e., you are bearish over the stock. For example, if you are purchasing a put option for Microsoft Corp with its current market price of $126 per share, you are ultimately being bearish on the stock and expect it to fall up to $120 per share over a period of time, by looking at the current market scenario. So, since you make a purchase of MSFT.O stock at $126, and you see it declining, you can actually sell the option at the same price.

Example #4 - Swaps

Let us consider a vanilla swap where there are two parties involved – where one party pays a flexible interest rate, and the other pays a fixed interest rate.

The party with the flexible interest rate believes that the interest rates may go up and take advantage of that situation if it occurs by earning higher interest payments, while the party with the fixed interest rate assumes that the rates may increase and does not want to take any chances for which the rates are fixed.

So, for example, there are two parties, let’s say Sara & Co and Winrar & Co- involved, who want to enter a one-year interest rate swap with a value of $10 million. Let’s assume the current rate of LIBOR is 3%. Sara & Co offers Winra &Co a fixed annual rate of 4% in exchange for LIBOR’s rate plus 1%. If the LIBOR Rate remains 3% at the end of the year, Sara & Co will pay $400,000, which is 4% of $10 mn.

In case LIBOR is 3.5% at the end of the year, Winrar & Co will have to make a payment of $450,000 (as agreed à 3.5%+1%=4.5% of $10 mn) to Sara & Co.

The value of the swap transaction, in this case, would be $50,000 – which is basically the difference between what is received and what is paid in terms of the interest payments. This is an Interest rate swap and is one of the most widely used derivatives globally.

Conclusion

Derivatives are instruments that help you to hedge or arbitrage. However, there can be few risks attached to them, and hence, the user should be careful while creating any strategy. It is based on one or more underlying; however, sometimes, it is impossible to know the real value of these underlying. Their complexity in accounting and handling make them difficult to price. Also, there is a very high potential of financial scams by the use of derivatives, for example, the Ponzi scheme of Bernie Madoff.

Therefore, the basic method of using Derivatives, which is leverage, should be wisely used as derivatives still continue to remain an exciting yet hideous form of financial instrument for investment.

Frequently Asked Questions (FAQs)

Cash or physical assets, such as money, stocks, bonds, or commodities, cannot be considered derivatives themselves. Derivatives derive their value from these underlying assets, but they are separate financial instruments that are based on contracts and not the assets themselves.

An investor purchasing call options on a stock expecting its price to increase is an example of speculative trading using derivatives. By purchasing call options, the investor can potentially profit from the anticipated price rise without directly owning the underlying stock.

Trading derivatives carries various risks, including market volatility, counterparty risk, liquidity risk, and the risk of misjudging market movements. Additionally, leverage used in derivatives trading amplifies both potential gains and losses. Lack of understanding, improper risk management, and unforeseen events can further increase the risks associated with trading derivatives. It is important for investors to thoroughly understand these risks and consider them before engaging in derivatives trading.

Recommended Articles

This has been a guide to Derivatives Examples. Here we discuss the most common examples of derivatives, including futures, forwards, options, and swaps, along with an explanation. You may learn more about derivatives from the following articles –