Table Of Contents

What Is Effective Tax Rate?

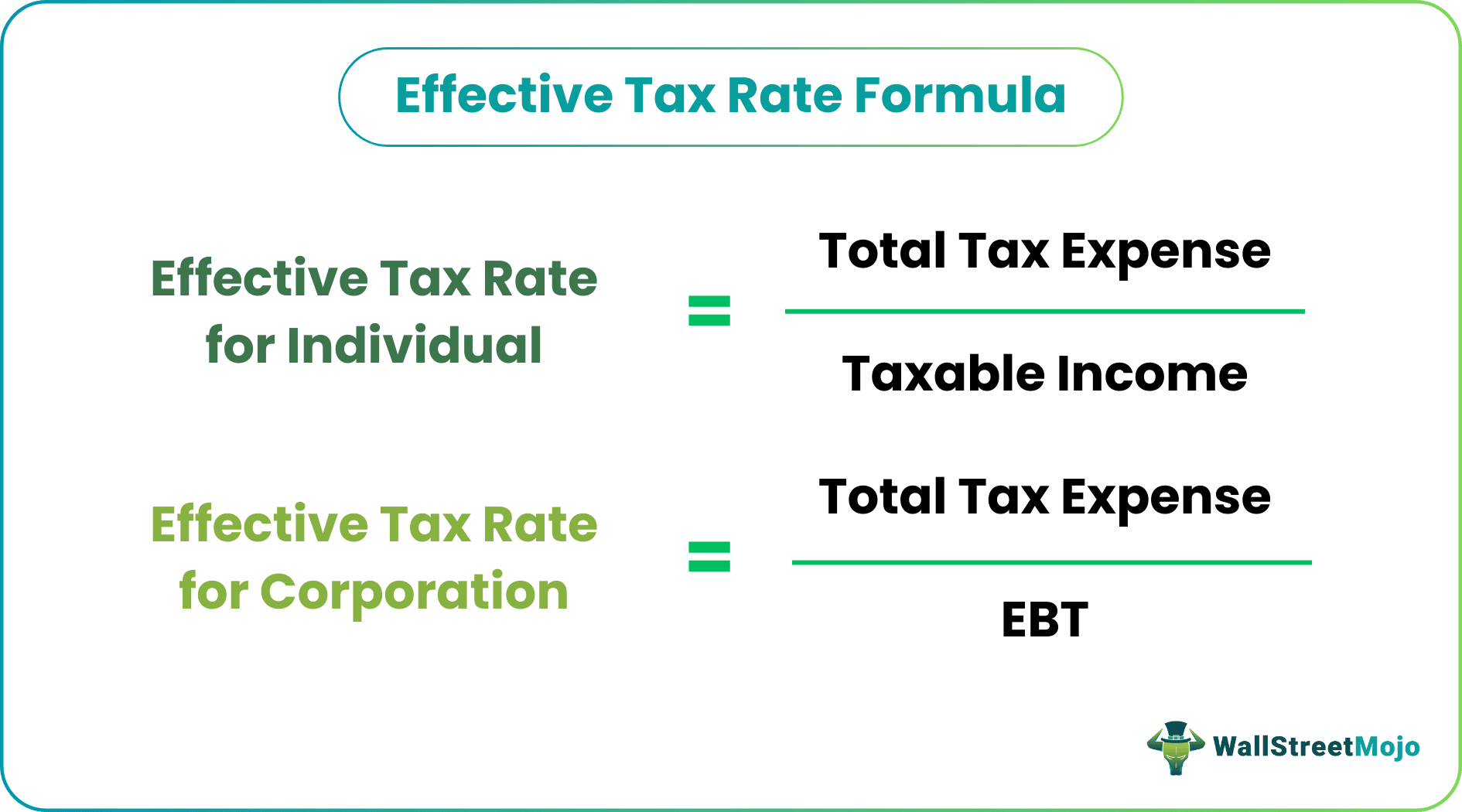

Effective Tax Rate refers to the average taxation rate for an individual or a corporation wherein for an individual, it is calculated by dividing total tax expense by the total taxable income during the period. For the corporation, it is calculated by dividing total tax expense by the total earning before tax during the period.

It is an individual or a company’s tax amount divided by their taxable income. Functions such as budget planning, cash flow, and tax-avoidance strategies are closely tied to the effective tax rate brackets. Investors look at this rate to understand the strategies of a company in terms of their financial planning.

Effective Tax Rate Explained

Effective tax rate is a taxpayer’s total tax liability divided by their taxable income. In the United States, it is said that effective tax rate brackets are more conducive for 95% of individuals as it accounts for the taxpayers’ last dollar of income.

On the contrary, marginal tax rate might be more feasible for individuals with high tax brackets.

It is very important to understand the concept of an effective tax rate because it is one metric that investors can use as a profitability indicator of a company. However, the rate may fluctuate dramatically yearly due to the taxable income falling into different tax slabs in a progressive tax regime. Otherwise, it is difficult to assess straightaway the reason behind a sudden jump or drop in the tax rate.

For example, the change in the tax rate may be due to asset accounting manipulation by the company intended to reduce the tax burden. Nevertheless, the tax rate is a good indicator of the tax burden imposed by the government.

Formula

The formula to calculate to understand the tax liability and make an effective tax rate corporation or an individual is as discussed below.

For Individuals

Effective Tax Rate Formula Individual = Total Tax expense / Taxable Income

For Corporations

Effective Tax Rate Formula Corporation = Total Tax Expense / EBT

Since EBT is effectively net income plus total tax expense and as such, the above formula can be modified as,

Effective Tax rate Corporation = Total tax expense / (Net income + Total tax expense)

How To Calculate?

Let us understand how individuals and effective tax rate corporations calculate their yearly tax liability which indicates their cash flow and tax planning through the step-by-step explanation below.

Firstly, determine the total expense of the individual from the income tax filing submitted.

Next, determine the taxable income of the individual. It can be computed by subtracting total exemptions and total deductions from the individual's total gross income. i.e., Taxable income = Gross total income – Total exemptions – Total deductions

- Finally, calculate the individual's effective tax rate by dividing the total tax expense by the taxable income, as shown above.

The formula for a corporation can be derived by using the following steps:

- Step 1: Firstly, determine the total expense of the corporation, which will be easily available as a line item just above the net income in its income statement.

- Step 2: Next, determine the net income of the corporation, which will also be available as a line item in the income statement. The EBT can be calculated by adding the total tax expense to the net income. i.e EBT = Net income + Total tax expense

- Step 3: Finally, the corporation's effective tax rate is calculated by dividing the total tax expense by its EBT, as shown above.

Tax rate Corporation = Total tax expense / (Net income + Total tax expense)

Examples

Let us understand how effective tac rate corporations plan their cash flow, budget, and taxes with the help of a few examples. This will help us grasp the intricate details of the concept.

Example #1

Let us determine the tax rate for an individual with a taxable income of $600,000 under the following hypothetical progressive tax regime.

As per above table,

- Total tax expense = $100,000 * 10% + $200,000 * 15% + $200,000 * 25% + $100,000 * 35%

- = $125,000

Therefore, the calculation of this formula will be as follows

- Effective Tax Rate = Total tax expense / Taxable income

- = $125,000 / $600,000

- Tax Rate = 20.83%

Example #2

Let us take the example of John to understand the calculation for the effective tax rate. John joined a bank recently where he earns a gross salary of $200,000 annually. While filing for his income tax returns, his accountant informed him that he is eligible for tax exemption worth $20,000 and deductions worth $25,000. Calculate the tax rate if his total income tax payable as per IT filing is $45,000.

Use the following data for the calculation –

Taxable income

- Taxable income = Gross salary – Deductions – Tax exemp

- = $200,000 - $25,000 - $20,000

- = $155,000

Therefore, the calculation of the tax rate is as follows,

- Tax Rate = $45,000 / $155,000

The Tax Rate will be -

- Tax Rate = 29.03%

Therefore, the tax rate for John is 29.03%.

Example #3

Let us take the real-life example of Apple Inc.'s annual report on September 24, 2016, September 30, 2017, and September 29, 2018. The following information is available.

For the calculation, we will first calculate the EBT as follows –

EBT for Sep 24, 2016

- EBT = Net income + Total tax expense

- =$45,687 + $15,685

- =$61,372

Similarly, we will calculate the EBT for 2017 and 2018.

After calculating EBT, we will do the calculation as follows –

The calculation for September 24, 2016, will be as follows –

The tax rate for September 24, 2016, will be –

- = $15,685 Mn / $61,372 Mn

- = 25.56%

Similarly, we will calculate the Tax Rate for 2017 and 2018.