Table Of Contents

What Is Efficient Market Hypothesis?

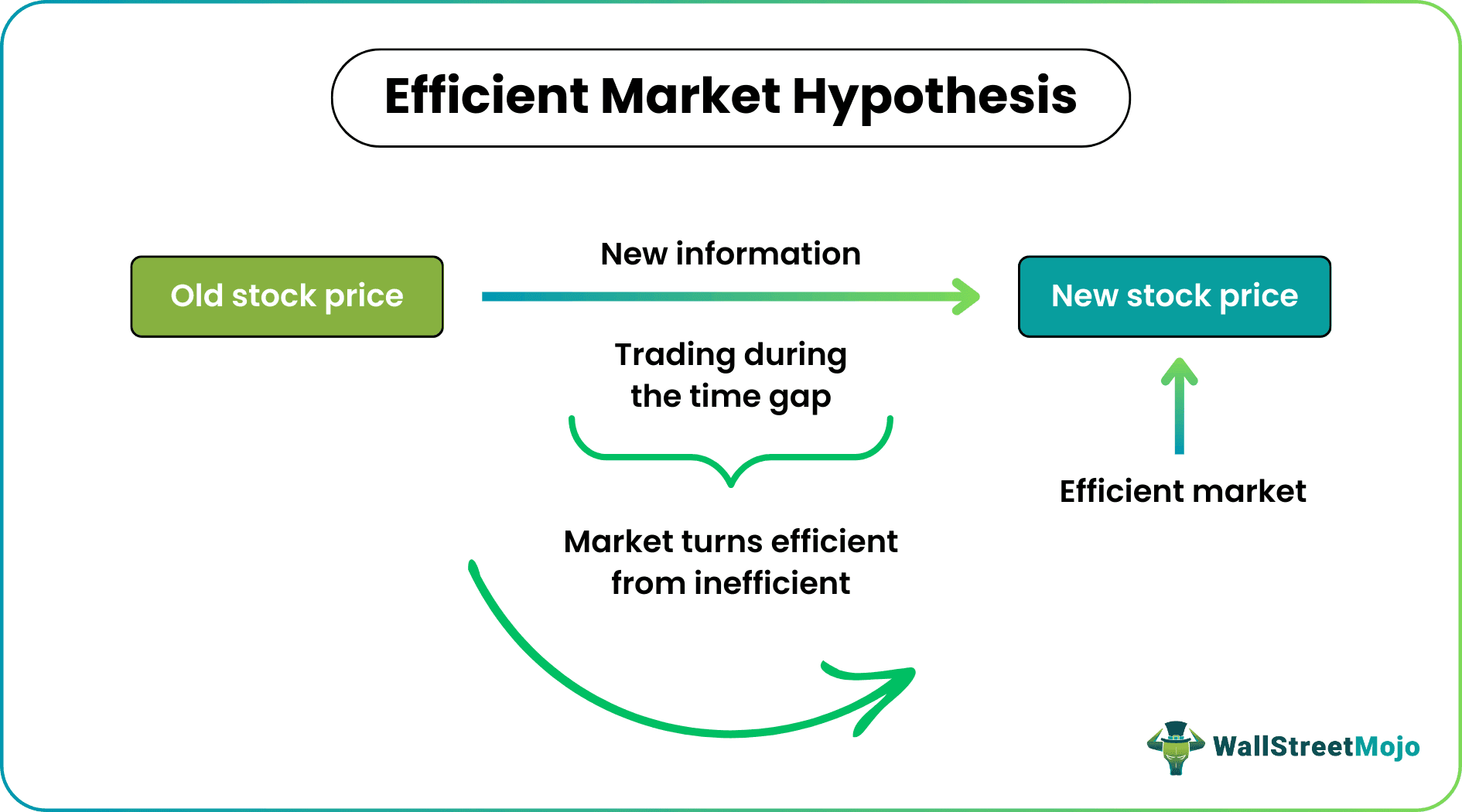

The Efficient Market Hypothesis (EMH) states that the stock asset prices indicate all relevant information very quickly and rationally. Such information is shared universally, making it impossible for investors to earn above-average returns consistently. The assumptions of this theory are criticized highly by behavioral economists or others who believe in the inherent inefficiencies of the market.

According to this hypothesis, the efficient market will not provide any profitable opportunity for trading. Thus, attaining a superior return consistently in such a condition is impossible. Time is an essential factor within which the market spreads information. This time gap provides traders the opportunity to exploit the inefficiency. Economist Eugene Fama gave the efficient market hypothesis in the 1960s.

Key Takeaways

- The Efficient Market Hypothesis (EMH) states that the stock prices show all pertinent details. This information is shared globally, making it impossible for investors to gain above-average returns constantly. Behavioral economists or others who believe in the market's inherent inefficiencies criticize the theory assumptions highly.

- In the 1960s, economist Eugene Fama provided the efficient market hypothesis.

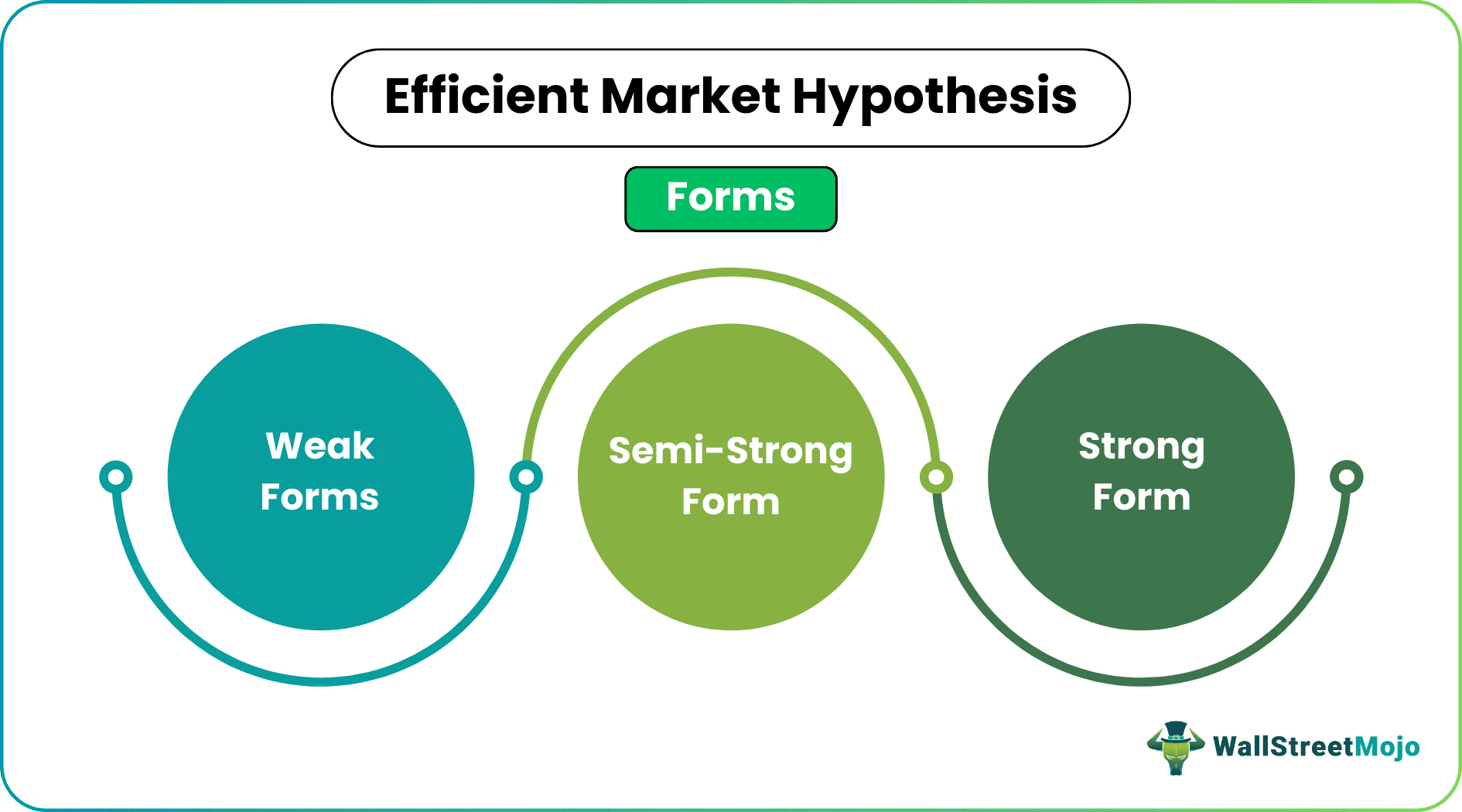

- The Efficient Market Hypothesis (EMH) forms are weak, semi-strong, and strong.

- This theory is criticized because it has market bubbles and consistently wins against the market.

Efficient Market Hypothesis Explained

Efficient market hypothesis theory is a situation in which all assets are priced to show any new or recent information. This does not give any window to capture excess returns. However, traders who can exploit this time gap within which the market is inefficient, can earn extra returns.

It can be said that trading is the way in which the new information is incorporated in the asset prices. The speed with which information is adjusted is actually the time taken foe the trade to get executed. This time frame may also be less than one minute.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Assumptions Of EMH

Let us look at some assumptions of the efficient market hypothesis theory.

- Investors in the market may act rationally or normally. If there is unusual information, the investor will react unusually, which is normal behavior, or doing what everyone else is doing is also considered normal behavior.

- The stock price indicates all the relevant information shared universally among the investors.

- It also states that the investors cannot exploit the market since they need to act as per the market information and make decisions accordingly.

Forms

Let us look at the different forms of the concept of efficient market hypothesis.

The strength of the Efficient Market Hypothesis (EMH) theory's assumptions depends upon the forms of EMH. The following are the forms of EMH: -

- Weak Form: This form states that the stock prices indicate the public market information, and the past performance has nothing to do with future costs.

- Semi-Strong Form: This form states that the stock prices reflect both the market and non-market public information.

- Strong Form: This form says that public and private information instantly characterizes stock prices.

Example

The below given example will help in understanding the concept of efficient market hypothesis.

Suppose a person named Johnson holds 900 shares of an automobile company, and the current price of these shares trades at $156.50. Johnson had some relations with an insider of the same company who informed Johnson that the company had failed in their new project and the price of a share would decline in the next few days.

Johnson had no faith in the insider and held all his shares. Then, after a few days, the company announces the project’s failure, dropping the share price to $106.00.

The market modifies the newly available information. To realize the gross gain, Johnson sold his shares at $106.00 and a gross gain of $95,500. If Johnson had sold his 900 shares at $156.50 earlier by taking the insider's advice, he would have earned $140,850. So, his loss for the sale of 900 shares is $140,850-$95,500 i.e., $45,350.

Importance

Given below are the importance of efficient market hypothesis.

- This theory takes into account the fact that there are always some special cases or outliers who are able to use the time gap between the old pices and change in price due to new information to earn extra return.

- The importance of efficient market hypothesis also lies in the fact that it is useful in the asset pricing models.

- There is no need of government intervention since stock prices adjust automatically.

Criticism

- Existence of Market Bubbles: One of the biggest reasons behind the criticism of the efficient market hypothesis is market bubbles. So, if such assumptions were correct, there was no possibility of bubbles and crashing incidents such as stock market crash and housing bubbles in 2008 or the tech bubble of the 1990s. Such companies were trading at high values before hitting. Thus, this criticism is an important argument for efficient market hypothesis testing.

- Wins against the Market: Some investors, such as Warren Buffett, won against the market consistently. He had consistently earned above-average profit from the market for over 50 years through his value investing strategy. On the other hand, some behavioral economists also highly criticize the efficient market hypothesis theory because they believe that past performances help predict future prices.

Implication

The efficient market hypothesis implies that the market is unbeatable because the stock price already contains all the relevant information. It created a conflict in the minds of the investors. They started believing they could not beat the market as it is not predictable, and future prices depend upon today’s news, not the trends or the company’s past performances. However, many economists criticized this theory. theory for the purpose of efficient market hypothesis testing.

Efficient Market Hypothesis Vs Behavioral Finance

Efficient market hypothesis states that markets are efficient since information quickly spreads whereas behavioral finance states that investors tend to be irrational in their judgement. Let us look at their differences.

| Efficient Market Hypothesis | Behavioral Finance |

|---|---|

| It states that market is in equilibrium since information spreads quickly. | It states that due to behavioral differences, market may not be in equilibrium. |

| Investors are always unbiased. | It states that investors may be use their bias while investing. |

| It makes market unpredictable. | Irrationality tend to make investors try and predict the market. |

| No planned approach is possible. | Investors try to make a planned approach. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The author analyzes recent research on behavioral finance, momentum investing, and popular fundamental ratios that aims to differ from the theory and concludes that it is optional in the long run. Thus, the Efficient Market Hypothesis remains true.

The weak form Efficient Market Hypothesis, also known as the random walk theory, denotes that future securities' prices are unexpected and not affected by past events. The advocates of weak form efficiency state that all existing information is shown in stock prices. In addition, the past data has no relationship with current market prices.

The Efficient Market Hypothesis is essential because it has political implications by adhering to liberal economic thought. It suggests that no governmental intervention is required because stock prices are always traded at a 'fair' market value.

Violation of these markets suggests that markets could be more efficient. Hence, here are a few scenarios that could potentially challenge the assumptions of EMH, market anomalies, insider trading, market manipulation, behavioral biases, information asymmetry, and inefficiencies in the market microstructure