Table Of Contents

Zero-Sum Game Meaning

A zero-sum game refers to a competitive situation wherein the profit of one equals the loss of another and vice-versa, thereby nullifying the net change in wealth for participants involved. The number of participants can be anything but one. It is a type of game theory and often applies in economic and political situations.

The idea is not only applicable for games, but it is also suitable in other affairs, such as trade, war, love, and life. It is more common in trading in financial markets, where one party wins a contract at the loss of the other. While futures and options trading is excellent for a situation like this, stock market investors may not always expect the same due to other factors impacting the trade.

Table of contents

- Zero-Sum Game Meaning

- The zero-sum game definition describes a situation where the profit made by one party is equal to the loss incurred by another party.

- Also referred to as a strictly competitive game, it is an idea derived from the game theory formulated by famous mathematician John von Neumann.

- Though Neumann tried finding an optimal strategy for a zero-sum game, other complicated scenarios could occur in a game other than the one in which the outcome sum is zero.

- Traders in the stock market trade stocks depending on price movement and speculation, so the net change in gains or losses is not always zero.

How Does Zero-Sum Game Work?

Game theory describes three situations that are likely to arise in a game or a financial affair. They are a win-win situation, zero-sum situation, and lose-lose situation.

When profits made or losses incurred by participants involved in an affair are added up and subtracted, the resultant is zero. It is called a zero-sum situation. For example, two friends A and B, bet on a football game. If A wins, B loses, and if B wins, A loses. It thus nullifies the net change in the point.

The idea arose from the fact that only one's loss could lead to another's profit and vice-versa. However, it would keep the financial system in balance by maintaining the equilibrium.

As the understanding of economics enhanced, it became clear that one participant does not need to be at a loss for another to gain. There are affairs where all parties involved can reap profit, indicating a win-win situation. Likewise, all parties involved could also incur a loss, signifying a lose-lose situation.

When it is a zero-sum situation, the environment or surrounding elements should favor or oppose all the participants equally. It means parties involved cannot increase or decrease the available resources as per their requirements. As a result, the profits earned equal to the losses incurred represent a fair game or situation.

Futures and options trading is often considered a zero-sum game. It involves a seller who sells contracts and receives the money and a buyer who buys those contracts and spends the money. In short, the net change in wealth for either party is zero. But that is not the case with stock market trading. Since it involves a buyer, who purchases the stock, and a seller, who sells it based on future price changes, the net difference in gain or loss is not necessarily zero.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Zero-Sum Game Examples

Let us consider the following zero-sum game examples to understand the concept even better.

Example #1

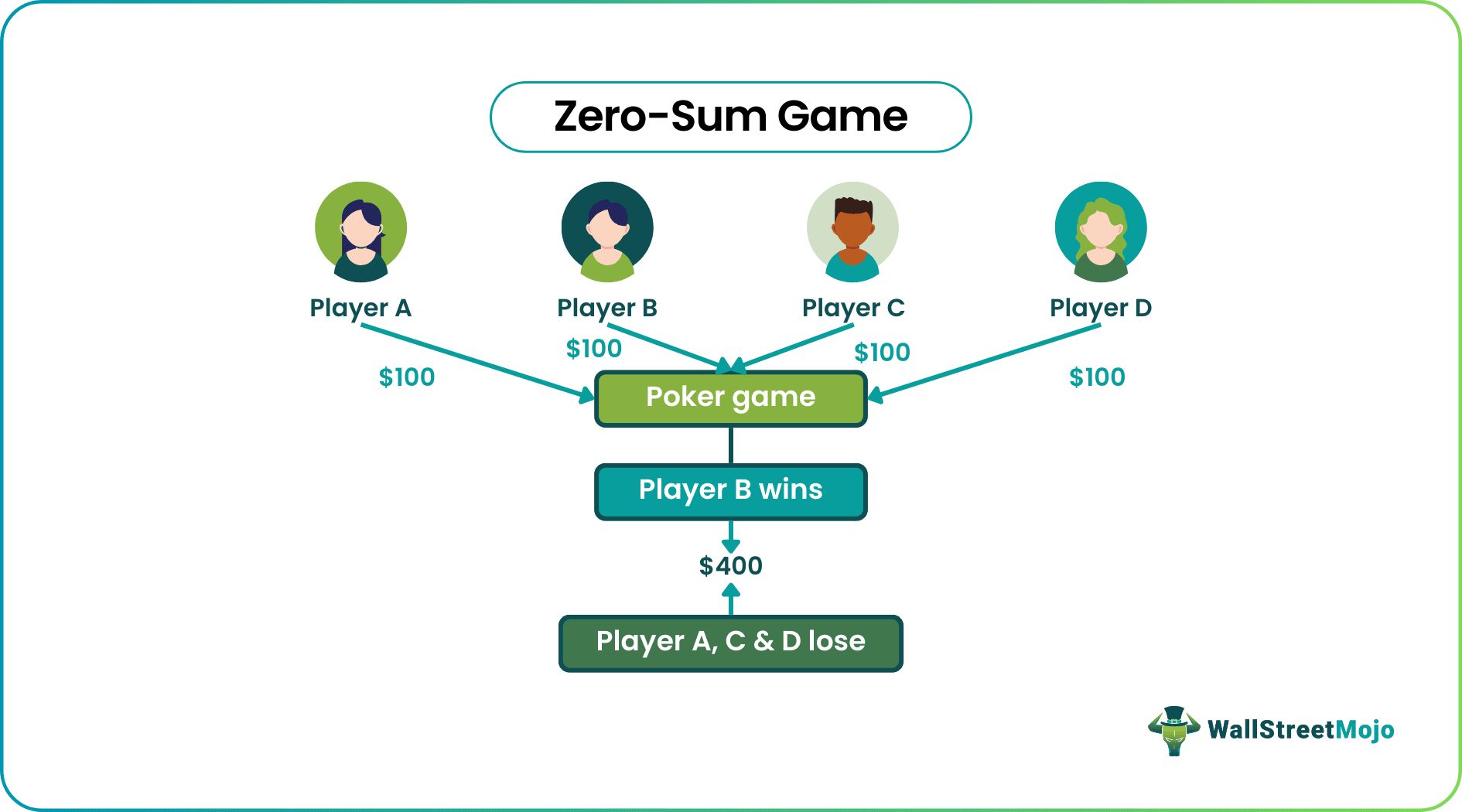

Poker is a perfect example of a zero-sum situation. Here, the total amount won by a player is equivalent to the money lost by opponent players. Since the card game is very competitive, the sum of the game outcome remains zero every time.

If four players place a bet of $100 each, it will accumulate to $400 in the pot. So, for a player to win the table, the remaining three players must lose their bets. There will be no wealth generation at the end of the game. Thus, the net change for each player will stay zero.

Example #2

The adoption of digital currencies by central banks might appear to be a threat to the cash-based or paper money-driven economy. Recently, Wall Street banks have started giving some thoughts to the concept of digital dollars as the next disruptive force, including Digital Money 2.0.

It might seem to be a zero-sum situation. Some fear that central bank digital currencies could threaten the traditional monetary system. But others believe that it will only add to the list of instruments used to pay for goods and services.

Therefore, the growth of one would not mean the extinction of the other. Hence, Citigroup stated, “it does not have to be a zero-sum game," as there is enough space for the digital form of monetary resources to grow.

Zero Sum Game vs Game Theory

A zero-sum game theory represents a competitive situation in the game theory where one’s loss seems necessary for another’s profit. Thus it becomes a strictly competitive game in its true sense.

The game theory is widely applicable in economics, where two or more participants engage in a transaction. Different types of formulas and equations aid the participants in the decision-making process. In doing so, it factors into many variables like profit, loss, individual behavior, etc.

John von Neumann, the man behind the game theory, wanted it to be constructed in a way that fits well to politics, war, love, business, etc. He co-authored the book “Theory of Games and Economic Behavior” with economist Oskar Morgenstern in 1944. It revealed that any economic situation could be the outcome of a game involving more than one participant.

The game, as the book advocated, had three elements – participants, tactics, and rewards. These strategies, however, depend on the moves of the opponents in the game. This strategic interdependence became one of the most significant aspects of the game theory.

Neumann tried developing an optimal strategy for one particular type of game, i.e., zero-sum. However, many other complicated scenarios could also exist in a game other than the one in which the outcome sum is zero.

Zero Sum Game And Stock Markets

In financial markets, trading futures and options are considered the zero-sum game, as for every dollar spent, there is a dollar gained and vice versa.

The speculators bet on the future prices of the assets or commodities. If they are doubtful about the fall in the price of a futures contract, they start buying it. When the price increases as per their prediction, they sell the commodity at the booked price before the contract expires. It results in a gain for them while a loss for someone who is paying more for the same product at the same time. Thus, the net change in the profit or loss is zero, which signifies the zero-sum situation.

Now the question is whether it is always a zero-sum situation in stock market trading. Let us find out.

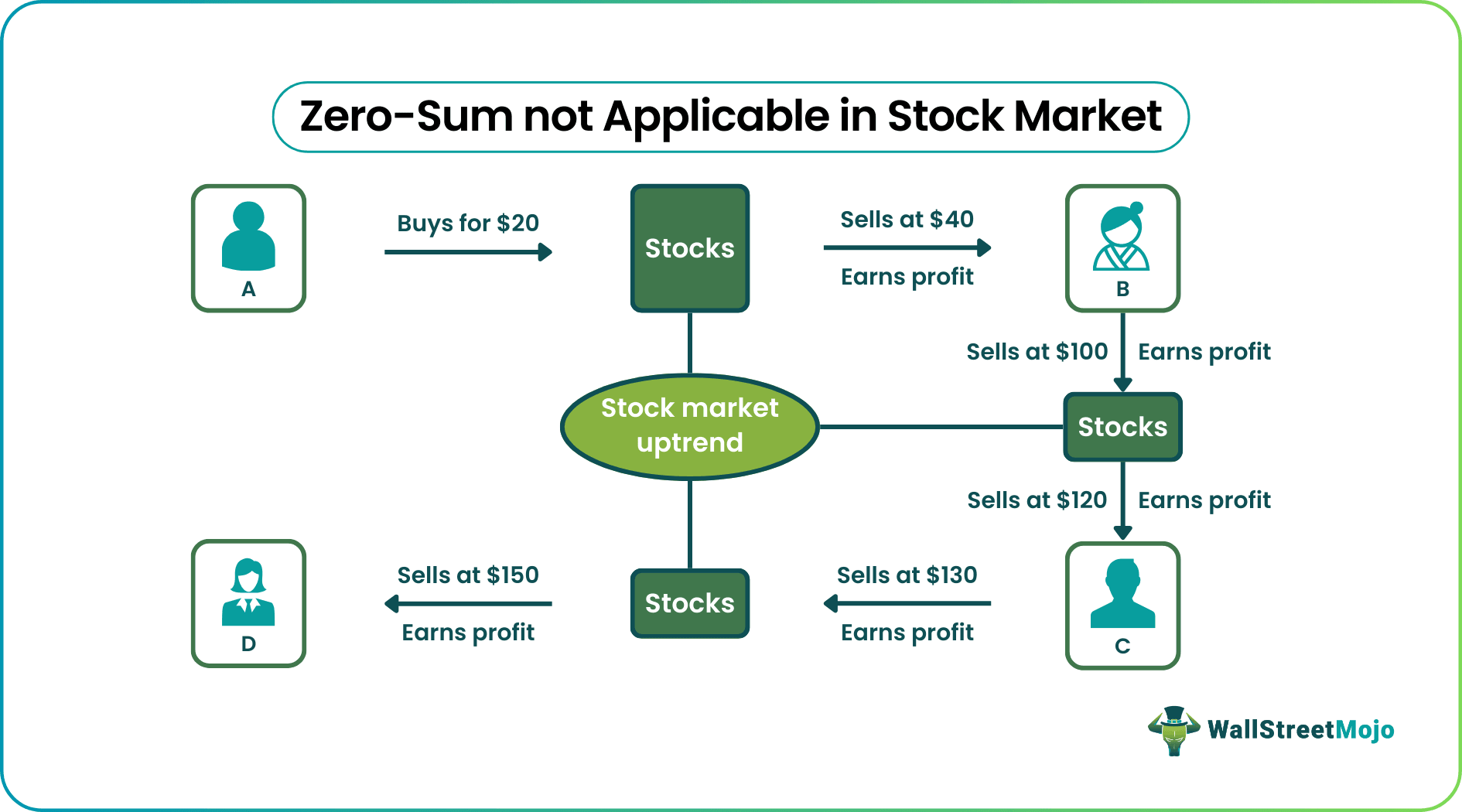

Imagine a situation where stock prices are rising continuously. Trader A buys shares and pays $20. The share price goes up in a few weeks, and A sells it to B at $40. After a month, B sells it to C at $100.

Does it sound like a zero-sum situation? NO. Instead, it is a profit for all and a loss for none. It is a complete win-win situation.

Similarly, if the performance of a stock is not up to the mark and the prices fall continuously, every trader sells securities at a lower price, and it thus becomes a lose-lose situation for all.

Hence, it is not necessary that trading in the stock market is always a zero-sum situation. The market performance depends on the performance of stocks.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A zero-sum game is when the loss of the one leads to the gain of the other in a situation or financial affair and vice versa. When this happens, there is zero net change in the wealth of the participants involved. It is quite the opposite of a win-win situation and a lose-lose situation.

When the total profits and total losses incurred in a game or financial transaction are added up or subtracted, and the outcome is zero, it is called a zero-sum situation. A situation like this does not affect the game or the financial market.

The zero-sum situation tends to be applicable in almost every area, including financial transactions, trading (futures and options contracts), politics, war, life, love, business, etc.

Recommended Articles

This has been a guide to the zero-sum game and its meaning. Here we discuss how does zero-sum game work along with examples and its situation in the stock market. You may learn more about financing from the following articles -