Table Of Contents

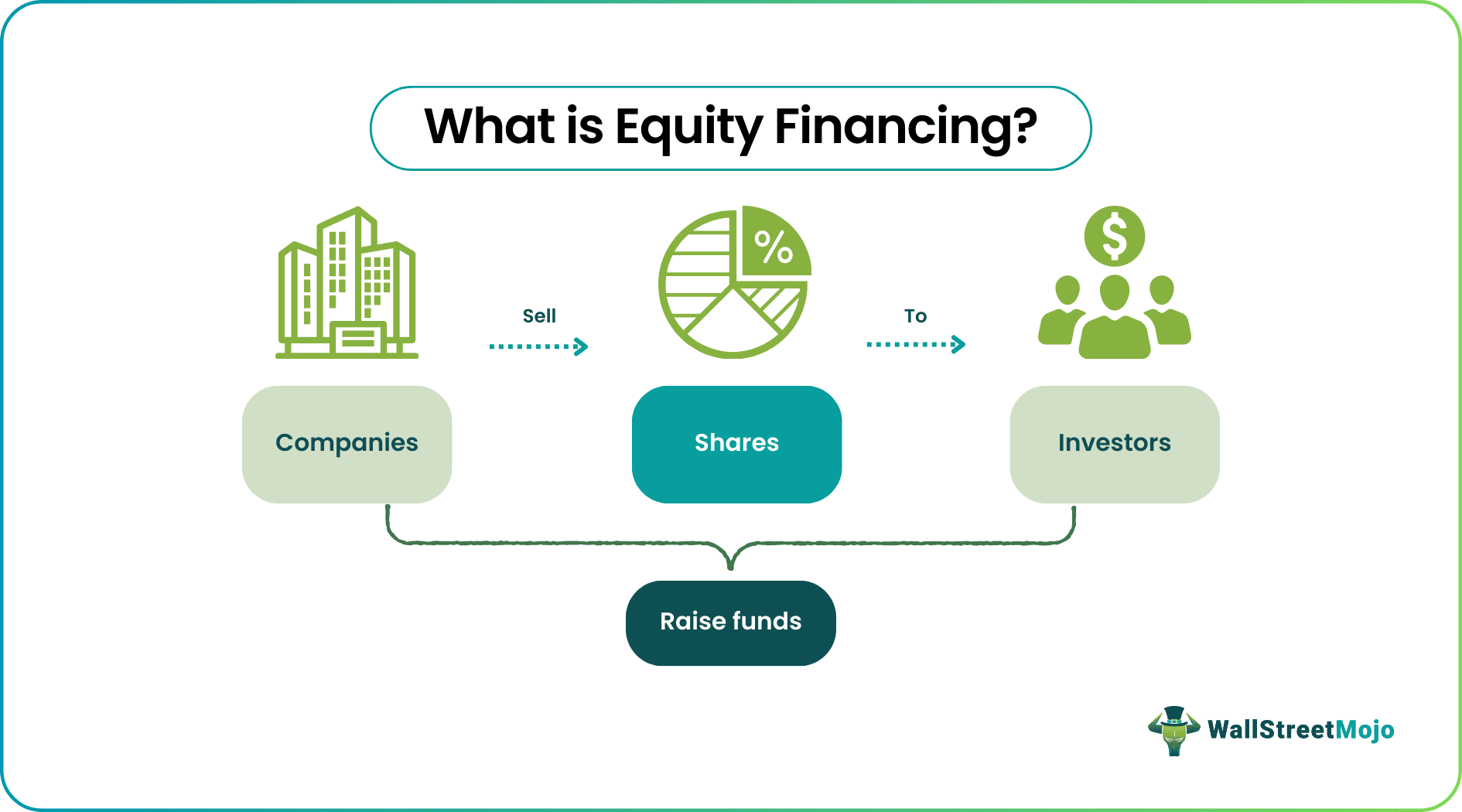

What is Equity Financing?

Equity financing is the process of the sale of an ownership interest to various investors to raise funds for business objectives. One of the advantages of this type of financing is that the money that has been raised from the market does not have to be repaid, unlike debt financing, which has a definite repayment schedule.

The scale and scope of equity financing cover a wide spectrum of activities, from raising a few hundred dollars from friends and relatives to Initial Public Offerings (IPOs), which run into billions of dollars raised by giant corporations and subscribed by a large number of investors.

Key Takeaways

- Equity financing refers to the sale of an ownership interest process to various investors for raising funds for business goals. It saves a lot on interest expenses than debt financing.

- The advantage is that the money raised from the market does not have to be repaid, unlike debt financing, which has a definite repayment schedule.

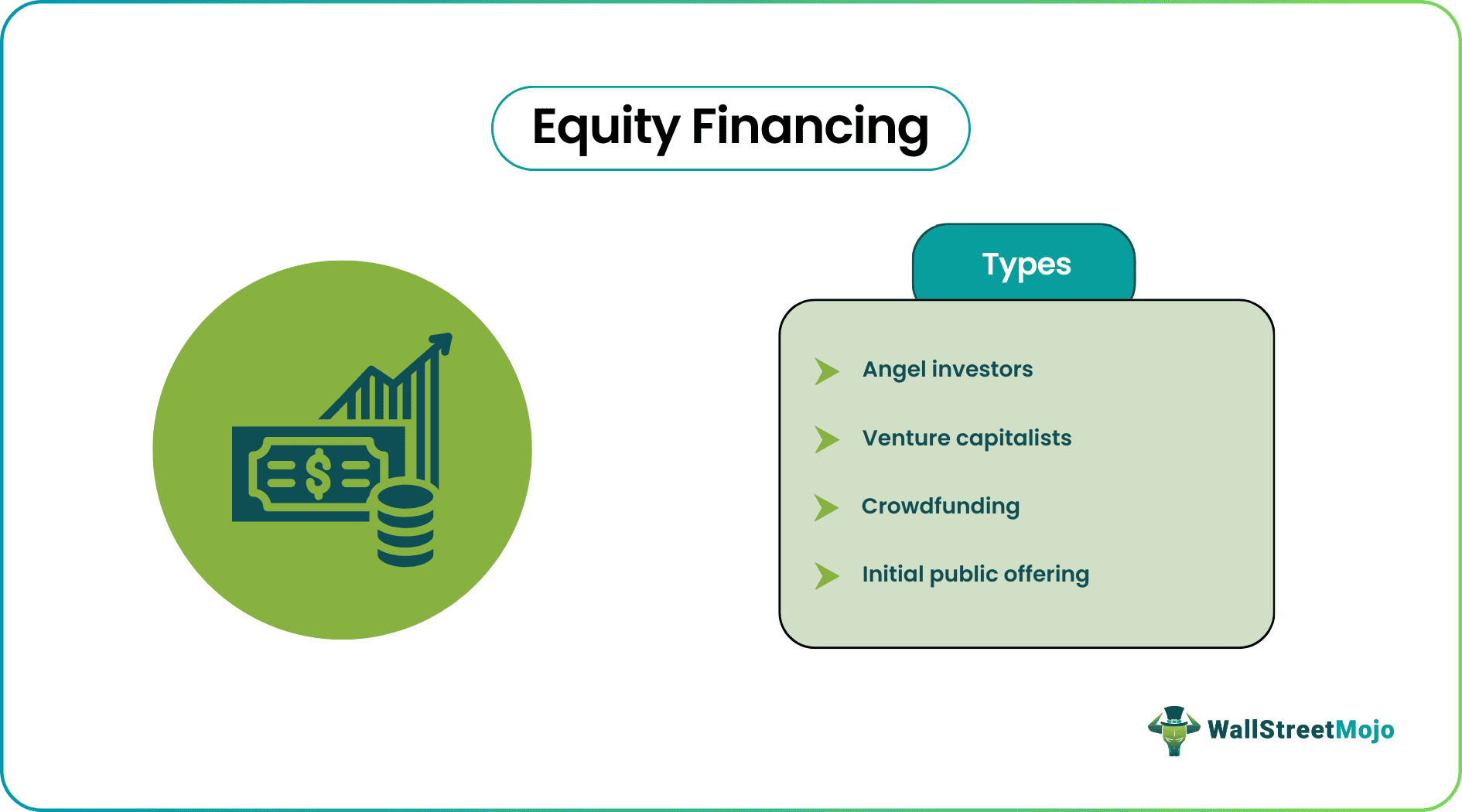

- The equity financing sources include Angel Investors, Venture Capitalists, Crowdfunding, and Initial Public Offerings.

- The scale and scope of this type of financing cover a broad spectrum of activities, from raising a few hundred dollars from friends and relatives to Initial Public Offerings (IPOs).

How Does Equity Financing Work?

Equity financing can come from any source, be it a friend or an entity. There are investors who are ready to spend on budding firms in the form of investments. However, to qualify for this financing, one must ensure meeting the expectations of the interested investors. If a business unit proves its worth, it is likely to receive positive responses from investors.

In the process, the companies make available their shares to people who are interested in investing in the companies. The IPOs become the best way to invite investments from individuals and entities. They buy shares of the companies that appear fruitful to them. As the company grows and progresses, and performs well, making profits, the investors are open to receiving returns in proportion to the investment they made in the company.

Types

The types of equity financing are derived from the sources these financings are obtained from. Exploring these sources makes the equity financing meaning even clearer:

#1 - Angel Investors

This type of equity financing includes investors, usually family members or close friends of the business owners. Even wealthy individuals or groups who extend financial funding for businesses are also known as angel investors.

- The amount invested by such investors is usually less than $0.5 million.

- An angel investor will not get involved in the day-to-day management of the business.

#2 - Venture Capitalists

This type of financing includes professional and seasoned investors and extends funding to handpicked businesses. Such investors analyze the concerned industry based on strict benchmarks. Consequently, they are very selective about investing only in well-managed companies with a strong competitive advantage in their particular industry.

- Venture capitalists believe in actively managing the companies they stay invested in. It helps them maintain a strong watch on the business's day-to-day activities and implement measures to maximize the return on their investment.

- A venture capitalist typically invests an amount above $1 million.

- Venture capitalists usually invest in a business at its nascent stage and eventually exit the investment by converting the firm into a public company by placing the shares on sale at a securities exchange through Initial Public Offering (IPO). As a result, a venture capitalist can yield huge profits from IPOs.

#3 - Crowdfunding

It comprises large angel investors who extend funding to smaller businesses. A crowdfunding investment can be as small as $1,000 for each investor. One can initiate this type of fundraising by starting an online crowdfunding "campaign" through one of the crowdfunding sites.

- Crowdfunder and AngelList in the U.S. and Kickstarter and Indiegogo in Canada are a few examples of such crowdfunding websites.

- However, it is to be noted that equity funding through crowdfunding is legal only in some jurisdictions and under certain circumstances.

#4 - Initial Public Offering

A well-matured company can raise funds through an IPO. In this type of fundraising, a company can source funds by selling the company shares to the public.

- Usually, institutional investors with huge corpus funds invest in such fundraising activities.

- Typically, a company uses this equity financing only after having already raised funds through other equity financings. That is because an IPO process can be a very expensive and time-consuming source of this financing.

Example

Let us consider one of the equity financing examples of an entrepreneur, Mr. X, an example of an entrepreneur who invested seed capital of $1,000,000 in starting his company. Since the entire investment is his own, he initially owns all the shares in the business.

The owner may seek additional funding from interested angel investors or venture capitalists as the business grows. Let us assume that the outside investor bids to pay $500,000, while the original investment is $1,000,000, then the company’s total capital will add up to $1,500,000 (= $1,000,000 + $500,000).

Finally, when the outside investor has purchased the company's shares, the entrepreneur does not own 100% of the business now but 66.67% (investment of $1,000,000 in a total investment of $1,500,000). On the other hand, the investor owns 33.33%, i.e., the company's remaining shares.

Relevance & Uses

One of the company's most popular funding methods is the fund raised through global equity financing. The business, however, can generate the fund internally or be raised externally through IPO, venture capitalists, angel investors, etc.

- A few advantages of such financing are that it saves a lot on interest expenses compared to debt financing. In addition, the fund raised through equity financing does not have to be repaid if the company fails, unlike debt.

- Consequently, if this financing is planned carefully, an entrepreneur can guarantee the growth of their business without diluting much of their stake. The organizations with higher growth potential are likely to continue to obtain equity finance more easily, given the value seen by interested equity source financers.

- A small company does not have good turnover, cash flow, or physical assets to provide collateral during its early stages. In such a scenario, the company can attract equity financing from early-stage investors willing to take risks.

- A small company that matures into a large successful company will likely have several rounds of equity financing during growth. Therefore, this option is equally important for small and large companies at different stages of their development.