Table Of Contents

What Is Escrow Payment?

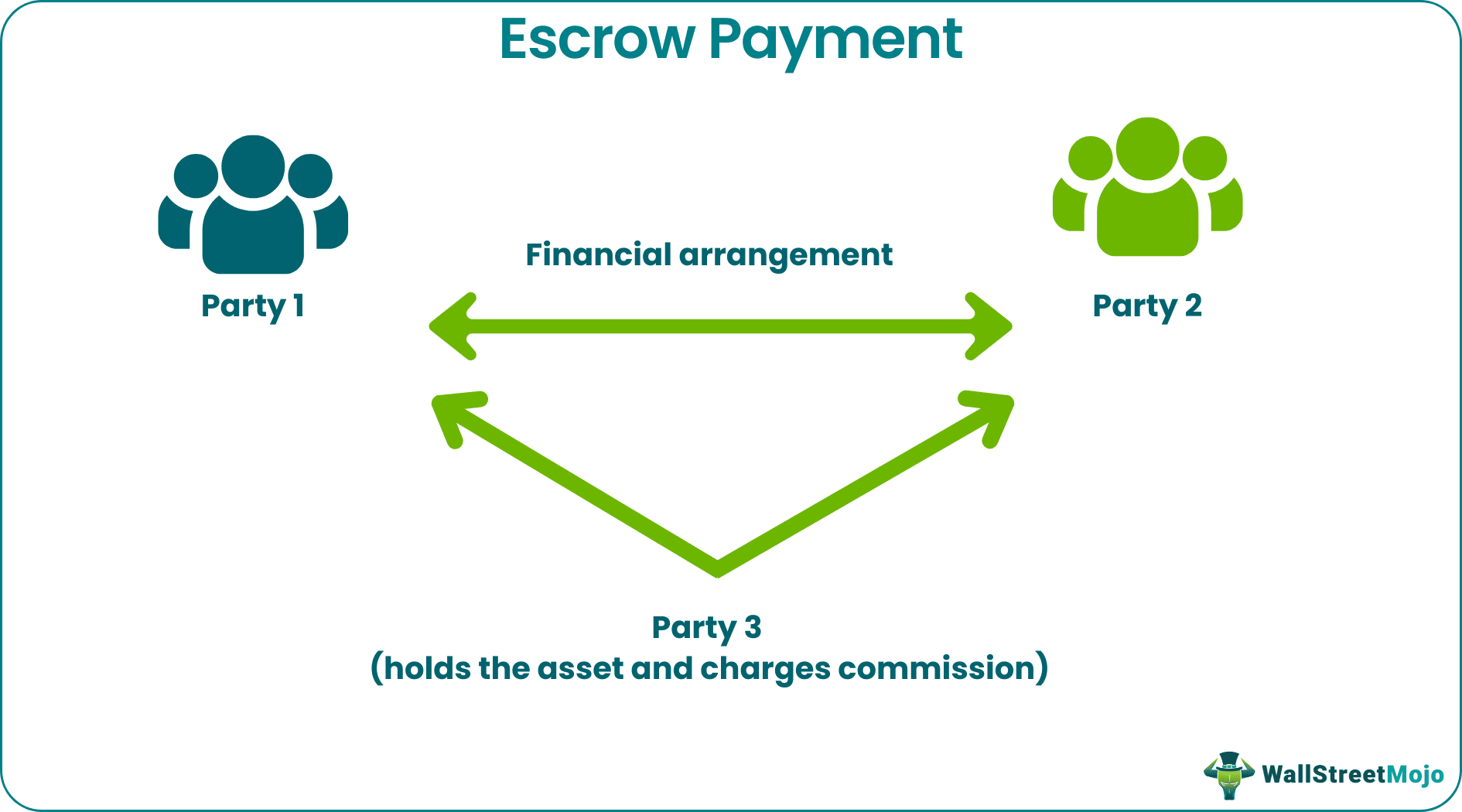

Escrow payment is a legal concept involving a financial arrangement between three parties whereby a third party agrees to hold an asset or money on behalf of the other two involved in a particular transaction at a given time.

For this arrangement, an escrow charges a certain sum of money as commission or fees and keeps the transaction secure by managing and fulfilling predetermined contractual obligations. The escrow or the third party is a neutral one who may hold not only money but any other form of asset too, like securities or any fund.

How Does Escrow Payment Work?

Escrow payment is a financial and legal arrangement whereby there are two parties who wish to enter into a transaction process and the asset that they want to exchange is held by a third party. The asset in an escrow payment method may be security, cash, etc. In this arrangement, the third party can only release the asset if the other two parties fulfil the contract and all their obligations in every way.

This arrangement is widely used in the real estate market but can also be used in other cases like banking, merger and acquisition or transfer if intellectual property. Very often, in the current markets, online transactions related to assets that are very valuable in nature, like jewellery or piece of art, involve an escrow.

International transactions typically involve an escrow, where a neutral third party guarantees that the seller receives payment on time and the buyer receives the goods in proper condition before the funds are released. This entire process is typically managed through a trusted escrow platform, which securely handles the transaction and ensures that all agreed-upon terms are fulfilled by both parties.

While studying about this system of monthly escrow payment, we may often come across the term escrow disbursement. This term simply refers to the payment that is made or yet to be made from the account. However, this arrangement is often considered to be very useful since it protects the interest of both buyer and seller. Especially, in real estate, the seller often appoints an escrow who will ensure that the home insurance and property tax is paid on time.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

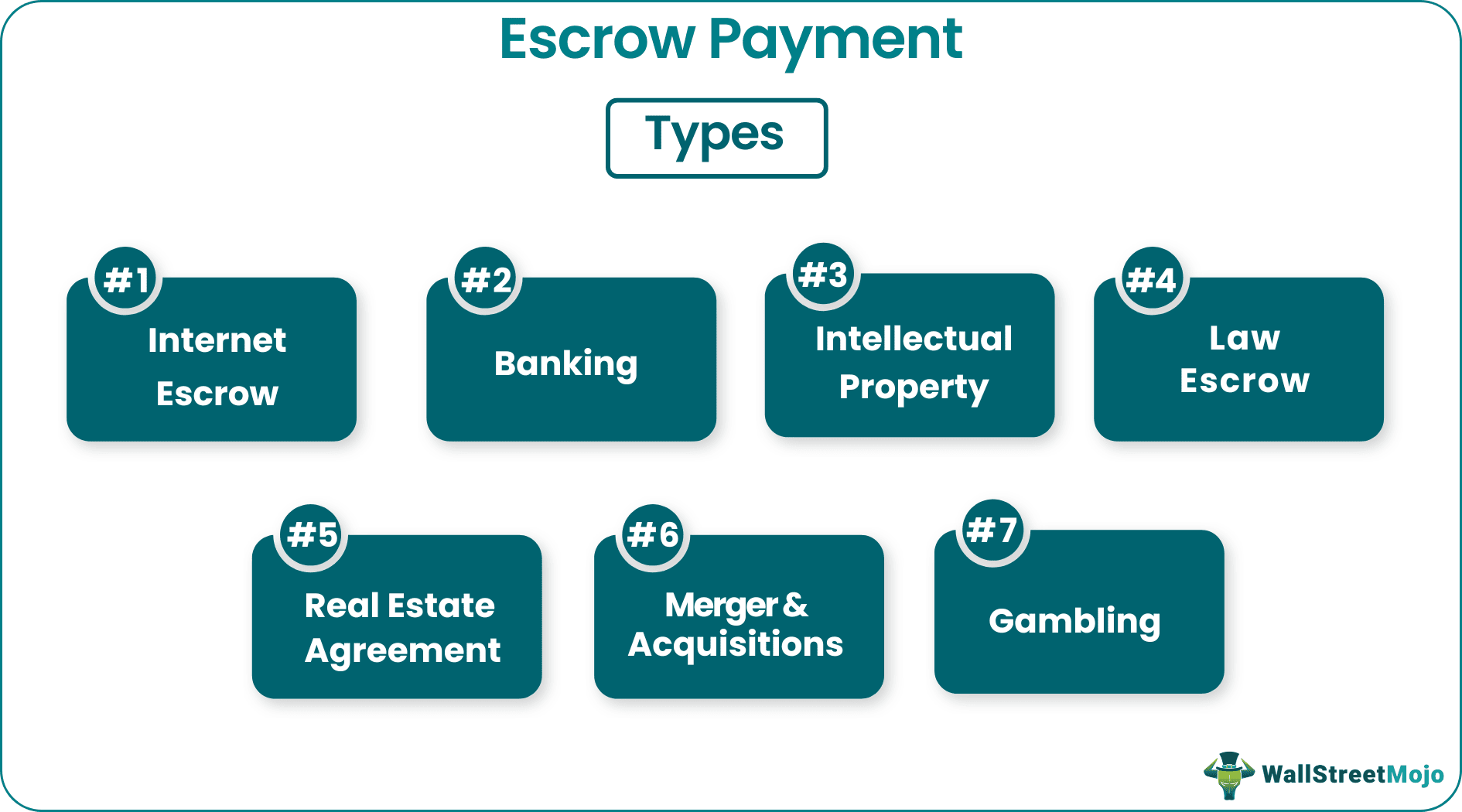

There are seven types in an escrow payment method, which are as follows.

- Internet Escrow - Under this arrangement, a licensed independent third party agrees to keep the money to safeguard the interest of both buyer and seller.

- Banking - Under this arrangement, a machine is used which holds money—for example, ATMs and vending machines, etc.

- Intellectual Property - Under this escrow arrangement, the third party holds the source code for safeguarding the interest of both customers and suppliers.

- Law Escrow - This arrangement is used to distribute funds from an announced cash settlement in an environmental enforcement action or class action suit.

- Real Estate Agreement - This escrow payment arrangement is used to pay for real estate properties and hazard insurance.

- Merger & Acquisitions - Under this escrow payment arrangement, warranties and indemnities are offered by selling parties, usually used when the seller's credit risk is not of good quality.

- Gambling - Under this type of escrow arrangement, parties who have gambled on a particular event hand money to a neutral third party who makes payment after the event as per the fixed terms and conditions.

- Stock Market – We can also find the use of this arrangement related to holding of stocks. During such an arrangement, in some cases the shareholder will not have the right to sell off the stocks that the hold as and when they wish to. When the stocks are issued as bonus or a part of the executive compensation, such employees need to hold the shares in their escrow account for a certain period of time before they can be disposed. This is a policy followed by many companies in order to retain good executives.

- Online sale – A third party acts as an escrow in this case to ensure that the products and services sold online reach the buyer in good condition and the seller gets the payment on time. The escrow payment services ensure money is released form the escrow account only when the transaction is complete in a satisfactory manner.

Thus, the above are some important cases where this system is frequently used.

Examples

Here we can see some examples related to escrow payment services.

Example #1

Imagine a person owes $3000 per year in property tax and $1800 for insurance premiums. To get the monthly escrow payment amount, we need to add this tax and premium expense and divide the result by 12.

Monthly Escrow Payment = ($3000 +$1800) / 12 = $400

Example #2

Imagine a two-person entering into an arrangement with a third-person involving gambling escrow payment whereby the first two-person bets on winning two different out of ten horses running in a horse race. If either of both the horse wins the race, the escrow agent, i.e., the third person who has been handed over possession of money, will make payment to one of the people whose horse wins the race; otherwise, the money will be returned as it is after the deduction of escrow commission.

Therefore, as per the above terms and conditions, the third person will hand over the money to the owner , else will return it after completing a horse race. The escrow agent will earn a commission in either of the cases.

Advantages

Some of the advantages are as follows:

- Under an escrow payment arrangement, both buyers and sellers ensure hassle-free transactions.

- The escrow agent independently verifies the article or service provided before the occurrence of a transaction.

- Two parties involved in the transaction get rid of paperwork and have to just make the deal without wasting their time.

- The cost of arranging escrow payment is low, as the fees charged by the escrow agent are very nominal.

- With the help of an escrow account, taxes and insurance premiums can be paid in monthly installments instead of onetime processing payment.

- It is also useful from a credit rating point of view, which further helps get loans at lower interest rates from banks

Disadvantages

Some of the disadvantages are as follows:

- This type of arrangement requires the maintenance of significant monthly funds.

- Organizations with fluctuating incomes may face a problem when they are short of funds.

- Money deposited in the escrow account gets locked, i.e., one does not have control over the money anymore.

- The money deposited in the escrow account cannot be withdrawn even when there is an emergency.

- This arrangement of escrow payment in mortgage leads to a loss of interest on money kept invested in it. Although some escrow arrangements do provide interest, it is very minimal.

Important Points

- With the changing technology, specific changes are taking place in escrow payment arrangements. One of the most critical changes in internet escrow under which a third party (the escrow agent) keeps the money to ensure the safeguarding of interest of both buyer and seller.

- Another recent change in escrow payment transactions is the involvement of interest factors. Earlier, escrow agents didn't provide interest on funds in possession, but now the concept is changing. Escrow agents have started providing interest on finds in their possession.

- Innovations in types of escrow arrangements: As mentioned and explained above, now there are multiple types of escrow payments being arranged, and hence one may use them as per their requirements.

- With the increasing use of this arrangement, law and regulatory authorities are also focussing on developing rules and regulations for escrow payments to ensure the smoothness of transactions.

Escrow Payment Vs Principal Payment

Even though both the terms mentioned above are related to payments to be made to complete a transaction, there are significant differences between them. Let us study them in details.

- In case of the monthly escrow payment, when we make a payment to the escrow account, the fund is to be kept aside to make payment for future taxes, interests or insurance policy. But in case of the latter, the money being paid is used to reduce the principal amount or the original amount of loan taken for any purpose.

- In case of the former the escrow is a third party, or a neutral party, who ensures that the transaction is completed in a satisfactory manner and it is time to release the payment. But in case of the latter, there is no third party. The borrower will may the principal payment directly to reduce the loan amount.

- The escrow payment in mortgage makes the payment system more easy to handle since a small amount of money is transferred to the escrow at regular intervals. But in case of the latter, since the borrower is making payment of the original loan amount, it is obvious that the amount will be much higher.

- The buyer will often find this arrangement lucrative since, as per the previous point, the cash outflow of the buyer is much less and easily manageable, whereas the latter leads to an outflow of a large amount from the buyer at regular intervals.

- The former is widely used for payments mainly related to property tax, insurance, fees, online purchases and so on. But the latter is strictly related to the loans taken for any purpose, mainly real estate.

- The former is useful in the sense that the payer will have more money left in their hands to save and use for their purpose. But the latter is useful in the sense that loan is reduced and if the borrower pays more amount, it will lead to repayment faster and the borrower will be free from the mortgage obligation.

Therefore the above points are to be kept in mind before going for either the escrow arrangement or the principal repayment because both have their own pros and cons within the system.

It is a contractual arrangement between three parties whereby the third party agrees to keep money on behalf of the other two and make payments per the contractual terms and conditions. Additional escrow payments like real estate, internet, law, intellectual, merger and acquisition, gambling, etc.

Escrow payment transactions help ensure the security of transactions occurring as per terms and conditions. The cost of an escrow arrangement may not be feasible at times. With the changing business models, specific changes are occurring in escrow payments. Due to increased volume and ensuring monitoring of transactions, there are legal rules and regulations in the course of development.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.