Table Of Contents

What Is A Mergers and Acquisitions?

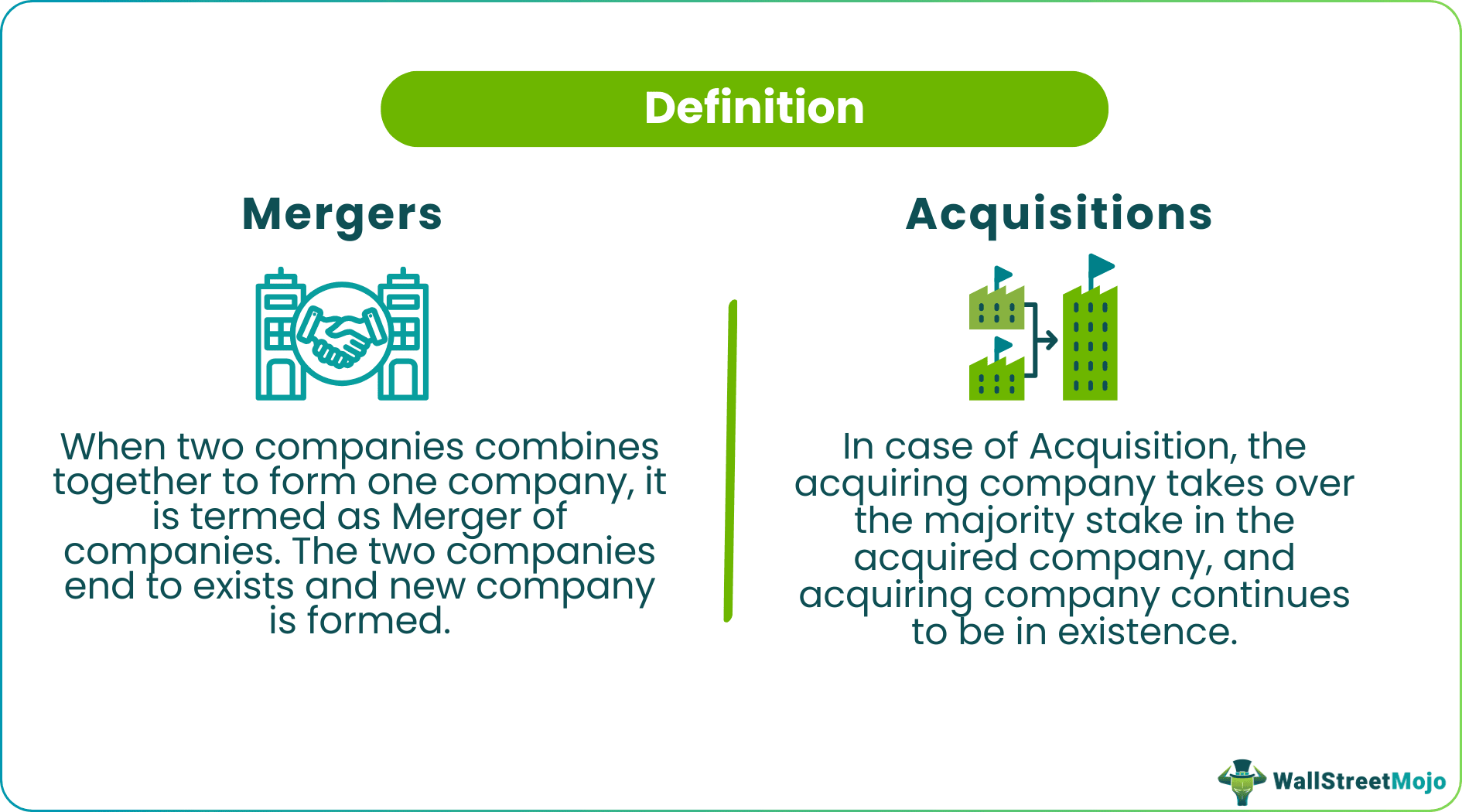

Mergers and acquisitions (M&A) are collaborations between two or more firms. In a merger, two or more companies functioning at the same level combine to create a new business entity. In an acquisition, a larger organization buys a smaller business entity for expansion. The collaboration between merger and acquisition companies is to eliminate competition, improve operations, or gain a larger market share.

A company that aims to take over another business is called the acquirer. The firm that is being purchased by the acquirer is called the target. Valuation is a crucial aspect of M&As—it dictates negotiation and selling price. The dealings take place either through a stock purchase or asset buyouts.

Key Takeaways

- Mergers and acquisitions (M&A) are the two forms of strategic collaboration between two or more firms—one large business entity is formed.

- M&As improve the quality of companies' performance by reducing redundant operations, accelerating growth, and acquiring new skills and technology.

- Growing industries reach a point of excess capacity—new entrants increase—supply rises, and prices fall. Thus, companies merge or acquire to get rid of the excess supply. This way price gets rectified.

Mergers and Acquisitions Explained

Mergers and acquisitions (M&A) are strategic alliances between two or more companies. In mergers, companies join hands to create a new firm by pooling their assets and resources. In acquisitions, however, one organization buys more than 51% shares of the other business entity.

They are carried out for various reasons that are allowed under the mergers and acquisitions law. Its other benefits include elimination of excess workforce, growth acceleration, technology, and the procurement of new talent. By merging or acquiring firms, companies overcome competition, attain economies of scale, acquire a monopoly, and multiply profits.

The disadvantages cannot be overlooked either. It involves a significant level of risk—acquisitions are expensive. Such changes in ownership can adversely impact a firms' stock prices. Cultural difference is a huge hurdle—newly formed teams always take time to work smoothly. The overvaluation of a target firm can result in huge losses. In M&As, many employees lose their jobs—due to the duplicity of roles.

Video Explanation of Mergers and Acquisitions

Types

Let us understand the different types of mergers and acquisition companies through the discussion below. This discussion will help us understand all possible combinations of transactions that can be processed in this domain.

- Vertical: Such a merger occurs between companies operating at different supply chain stages.

- Horizontal: It is a merger between firms operating in the same industry.

- Conglomerate: When a company functioning in one industry collaborates with a firm operating in another sector, it is called a conglomerate merger. This is done for diversification.

- Congeneric: Companies catering to the needs of the same consumer base often come together to form a new congeneric firm.

The various forms of acquisition are as follows:

- Friendly: When the acquirer and the target mutually agree on the acquisition, the transition is friendly.

- Hostile: If the acquirer forcefully takes over the target without the latter's consent, it becomes a hostile takeover.

- Buyout: Alternatively, the acquirer purchases 51% or more stocks, i.e., a controlling share in the target.

Examples

Let us understand the mergers and acquisitions law with the help of a couple of examples.

Example #1

XYZ Ltd. is a market leader in manufacturing stationary. Their revenue for the previous assessment year crossed $250 million, which was only a marginal 3% increase from the year before.

After research and analysis, it was found that a new company, A1 Ltd which entered the market only three years ago, was posing a serious threat to their sales by producing innovative products at a reasonable process. A1’s net worth was $25 million.

Therefore, the top management of XYZ decided to acquire A1 under friendly conditions and eliminate their future threat and competition.

After negotiations and considerations, the deal was finalized at $50 million. XYZ’s sales increased by a staggering 35% due to the addition of innovative products in its product portfolio and its existing essential products.

Example #2

On February 28, 2022, Zip Co (ASX: Z1P) signed a merger agreement with its US competitor Sezzle. In this collaboration, Sezzle shareholders will receive 0.98 Zip shares for every share of Sezzle common stock. Also, Zip shareholders will get 78% stocks of the new entity.

Also, on February 28, 2022, Toronto-Dominion Bank Group (TD.TO) took over the First Horizon Corp (FHN.N) by paying $13.4 billion in cash. Toronto-Dominion Bank holds the second-highest market value in Canada. The group aims to expand into south-eastern parts of the US—outside the domestic boundaries of Canada.

Process

Let us understand the process that is to be followed according to the mergers and acquisition law through the step-by-step explanation below.

- Self-assessment: In this phase, the acquiring company reviews the need for mergers and acquisitions. It analyzes strengths, weaknesses, opportunities, and threats. A specific M&A strategy is strategized.

- Search and Screen: The acquirer identifies potential target businesses that can be purchased at low prices.

- Investigate and Evaluate: Then, the acquirer conducts a detailed analysis and valuation of the identified business—due diligence.

- Negotiate and Acquire: A representative of the acquirer negotiates with the target firm to finalize the deal.

- Post-merger Integration: If the merger or acquisition succeeds, both companies make a formal announcement.

Valuation

Let us understand how two companies deciding to collaborate for business decide the value of their companies. The valuation of mergers and acquisition companies play a vital role in the agreement and the terms as nobody would like to pay extra for a company that is not worth the costs incurred and vice versa.

- Discounted Cash Flow: DCF is computed by deducting the capital expenditure and change in working capital from the sum of net income and depreciation. It thus interprets the firm's current value using future cash flows.

- Enterprise Value to Sales Ratio: EV/Sales ratio evaluates the enterprise value as a multiple of the revenue generated by the company.

- Price to Earnings Ratio: The P/E ratio determines the price an acquirer plans to offer. It is represented as a multiple of the target firm's earnings.

- Replacement Cost: The acquirer determines the replacement cost of a target firm by identifying a competing target available at the same price.

Having knowledge of these valuation techniques and key financial planning and analysis concepts is vital to ensure the key insights are available to make informed M&A decisions. If you want to understand the relevance of FP&A in mergers and acquisitions, you can take this Financial Planning & Analysis Course.

Benefits

Let us understand the benefits of mergers and acquisition companies collaborating with one another in detail through the explanation below.

- When two companies join hands, their size of operation increases and they have better chances of acquiring raw materials at a lower cost since the quantity of purchase is likely to rise.

- Since both companies can combine their workforce, the overall cost of their labor might go down significantly.

- With databases of two companies, it becomes easier to expand sales geographically as well as each of their connections would help them introduce their partnership to a larger audience.

- The biggest advantage of such collaboration is that these companies can grow to an extent with a larger market share in their domain.

Limitations

Despite the benefits mentioned above, there are certain factors from the mergers and acquisition law and other management-related factors that prove to be a limitation for all parties involved. Let us understand them through the points below.

- Firstly, carrying out a merger procedure according to the laws can significantly increase legal costs for both companies.

- There is a great chance of mismanagement of resources as M&A can be time-consuming and a tedious process. Generally, corporations appoint one executive to overlook the procedures and processes on their behalf to ensure daily routine is not affected. However, it often turns out otherwise.

- The coordination and understanding between the management of two companies can clash due to varying ideologies.

Tips For Mergers And Acquisitions

Some useful tips one can follow to ensure the M&A process is smooth are as follows:

#1 - Negotiate Crucial Details

One must remember that the terms of such business deals are typically negotiable. Hence, individuals need to review all relevant information carefully in order to ensure they make decisions that are best for their organization. Some of the main points influencing business deals are as follows:

- Actual or projected growth

- Latest fair market valuation

- Financial performance

- Price payable for the company’s shares

- Potential business, legal, or financial risks

- The sector in which the company operates

#2 - Seek Help From Experts

Considering that individuals require legal, regulatory, or financial assistance, getting in touch with an expert can help steer them clear of pitfalls. Indeed, experienced consultants can provide the necessary regulatory or legal assistance to help ensure that the process is carried out without any hassle.

#3 - Maintain Communication

Ensuring proper communication across all levels of the organizations participating in a takeover or merger is essential. When people can freely share information, everyone involved in the process can have clear knowledge of timelines and what to expect.

#4 - Do Not Lose Patience

One should keep in mind that the completion of most legal transactions generally takes time. Among such transactions, M&As are slower. While some deals might take up to 6 months to complete, some transactions can even take years. Hence, it is vital to be patient when participating in such transactions. A key factor influencing the time taken is the size of the organizations involved.

Merger Vs. Acquisition

While both these terms are used interchangeably, there are noticeable differences. Let us understand the differences between mergers and acquisition companies through the comparison below.

| Basis | Merger | Acquisition |

|---|---|---|

| Meaning | Two or more firms combine their assets and resources to form a single business unit. | One giant company takes over a small business entity by purchasing its stocks or assets. |

| Firm Size | Both merging companies have similar size and scale of operation | The acquirer is larger than the target—in size and scale of operation |

| Type of Decision | Mutual | Friendly or hostile |

| Formation of New Firm | Yes | No |

| Power | Equal power to the involved parties | Acquirer holds the power |

| Legal Procedure | Lengthy | Comparatively quick |