How Financial Analysis Enhances Customer Support in FinTech Companies

Table of Contents

Introduction

Considering the growing competition in the fintech space, it is becoming increasingly important for companies to enhance customer support. In fact, how well an organization can resolve issues and improve the overall experience through specific offerings determines whether it can build brand loyalty and improve its market reputation.

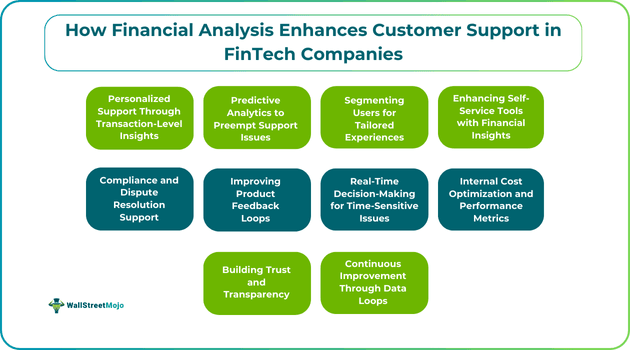

Precisely, customer support is now a key differentiating factor for fintech companies, with expectations rising for more efficient, personalized, and fast services. To fulfill such expectations and meet the predetermined goals, companies are leveraging financial analysis. This process can help spot and resolve issues faced by customers via insights backed by data. Moreover, it can help provide tailored services that can enhance customers’ overall experience.

If you are looking to understand the role of financial analysis in fintech customer support in detail, you are in the right place. In the following sections of the article, we will discuss its significance to help you develop a comprehensive understanding.

The Intersection of Financial Analysis and Customer Support

Financial analysis involves working with the financials of an organization to get a clear idea of its potential, performance, and health. The data accumulated by analyzing financial reports and statements can help in predicting customers’ future creditworthiness and behavior.

Moreover, the insights can help detect potential fraud. These benefits enable companies to make better decisions and improve the fintech customer experience. For instance, organizations can provide personalized loan offers, optimized investment strategies, and fraud prevention measures.

Companies can even use financial analysis to determine whether there is scope to introduce cost-saving methods, for example, automation in customer support, to improve the fintech customer experience. Also, the analysis helps understand the impact of the current customer support strategy on growth and revenue retention. Based on the financial insights for customer service, the company can decide whether adjustments to the strategy are necessary.

Personalized Support Through Transaction-Level Insights

Personalized support via these insights can offer customers tailored recommendations and advice on the basis of their distinct goals and habits. Considering that modern customers have to deal with substantial financial data, the demand for fintech solutions that can transform vast information into actionable insights is rising. Such solutions involve analyzing investment behaviors, savings habits, and spending patterns to provide recommendations that are in line with the customers’ financial goals.

Let us look at the benefits of incorporating transaction-level insights into Data-Driven Support Strategies to get a better idea:

- Facilitates proactive management of finances

- Reduction of financial stress

- Personalization of investment and saving strategies

- Enhancement in financial literacy

Predictive Analytics to Preempt Support Issues

With predictive analytics, financial institutions, including banks, can obtain valuable insights into customer behavior, market dynamics, and future trends to make informed, strategic, and proactive business decisions. This type of analytics helps spot data patterns and identify possible opportunities and risks.

Fintech companies can also detect fraud using artificial intelligence or AI and machine learning. Through the continuous analysis of customer behavior and transactional data, companies are able to flag transactions that are suspicious and help prevent financial fraud. Thus, predictive analytics can prevent support issues, protecting the organization’s reputation and the customer’s assets.

Segmenting Users for Tailored Experiences

Financial analysis in fintech customer support also plays a key role in categorizing users for personalized experiences. Note that the segmentation is based on shared characteristics, which are essential for formulating data-driven support strategies. The different types of segmentations are as follows:

- Behavioral Segmentation: This means categorizing based on transactions, actions, and interactions with the fintech organization.

- Psychographic Segmentation: It involves segmenting based on psychological traits like beliefs, attitudes, and other psychological traits.

- Requirement-Based Segmentation: This involves categorization on the basis of challenges, desires, problems, and goals.

- Value-Based Segmentation: It refers to segmenting customers based on the actual or perceived value to the organization.

- Demographic Segmentation: This involves segregating on the basis of basic attributes like gender, income, location, and age.

Enhancing Self-Service Tools with Financial Insights

Self-service tools are proving to be a complete game-changer in the financial sector. With the help of such tools, customers can pay bills, carry out transactions, check balances, etc. In short, they are helping to manage financial accounts and transactions independently. This, in turn, improves customer satisfaction.

If customers face any issues when using such self-service tools, they can contact the company. In that regard, it might be helpful for the organization to opt for fintech call center outsourcing as it can help resolve queries quickly. For longer-term scalability, partnering with a fintech recruiter can help build high-performing support teams and reduce time-to-hire for specialized roles.

Compliance and Dispute Resolution Support

Fintech companies use financial analysis to execute a robust system that can help manage customer complaints effectively. This helps resolve the issues or disputes quickly. Also, one must note that these companies need to comply with various rules and regulations. For example, they must adhere to rules associated with Know Your Customer or KYC, data privacy, etc.

Financial analysis can comply with the regulations via the identification of regulatory breaches, fraud, etc., which, in turn, helps in intervening early and avoiding customer complaints.

Improving Product Feedback Loops

In the case of fintech companies, enhancing feedback loops concerning products or services involves accumulating and analyzing feedback from customers and then taking the necessary measures to make improvements to the offerings so that they can positively impact key financial metrics like customer lifetime value. Financial analysts can also check certain data, like a decrease in transaction volume or higher support costs, to identify areas requiring enhancement. Based on their analysis, they can make changes per their prioritization.

Real-Time Decision-Making for Time-Sensitive Issues

Financial analysis can provide key insights in real-time. Based on such insights, they can offer personalized recommendations that can help customers improve their decision-making and quickly put an end to problems that may arise. Real-time insights can also help spot unusual transaction-related patterns that can help the company prevent serious customer issues. Also, note that real-time insights can help settle disputes instantly and ensure optimal customer experience.

Internal Cost Optimization and Performance Metrics

Financial analysis in fintech customer support can also assist in the optimization of internal costs and performance metrics. This type of analysis allows companies to spot inefficiencies in the support process that have a negative effect on customer experience. It also allows companies to allocate resources optimally to integrate support tools that can enhance customer support while minimizing the business’s operational costs.

Building Trust and Transparency

Financial analysis allows companies to provide a detailed explanation of the products’ pricing structures to customers. This fosters transparency and helps in building trust. Moreover, when companies use key financial data to justify their policies related to different charges, like interest rates, customers may find the business to be trustworthy. As a result, the company’s customer retention rate can improve. Moreover, sharing financial details regularly with customers can make a company appear to be responsible and accountable.

Continuous Improvement Through Data Loops

Continuous improvement involves looking for ways that improve the efficiency, effectiveness, and quality of the different processes, like customer support via data loops. The process involves different steps like accumulating customer data, carrying out analysis of the data to understand patterns and inefficiencies, and executing improvements.

Financial analysis links customer support revenue and costs with customer feedback. The Analysts can track the financial metrics and evaluate to figure out whether enhancements are effective. Moreover, based on the assessments, the company can determine what improvements are necessary and what steps it must take for the same.

Conclusion

As customer expectations keep evolving, the importance of financial analysis in fintech customer support will continue to increase. Companies need to leverage key financial insights and create intuitive, engaging, and seamless experiences to exceed such expectations. Also, they must incorporate strategies that can improve engagement, foster loyalty, and strengthen their reputation.

A seamless experience for customers in the fintech space can ensure that they effortlessly navigate a company’s platform, access the offerings they require easily, and feel supported by the company throughout the journey.