Table Of Contents

What is Financial Literacy?

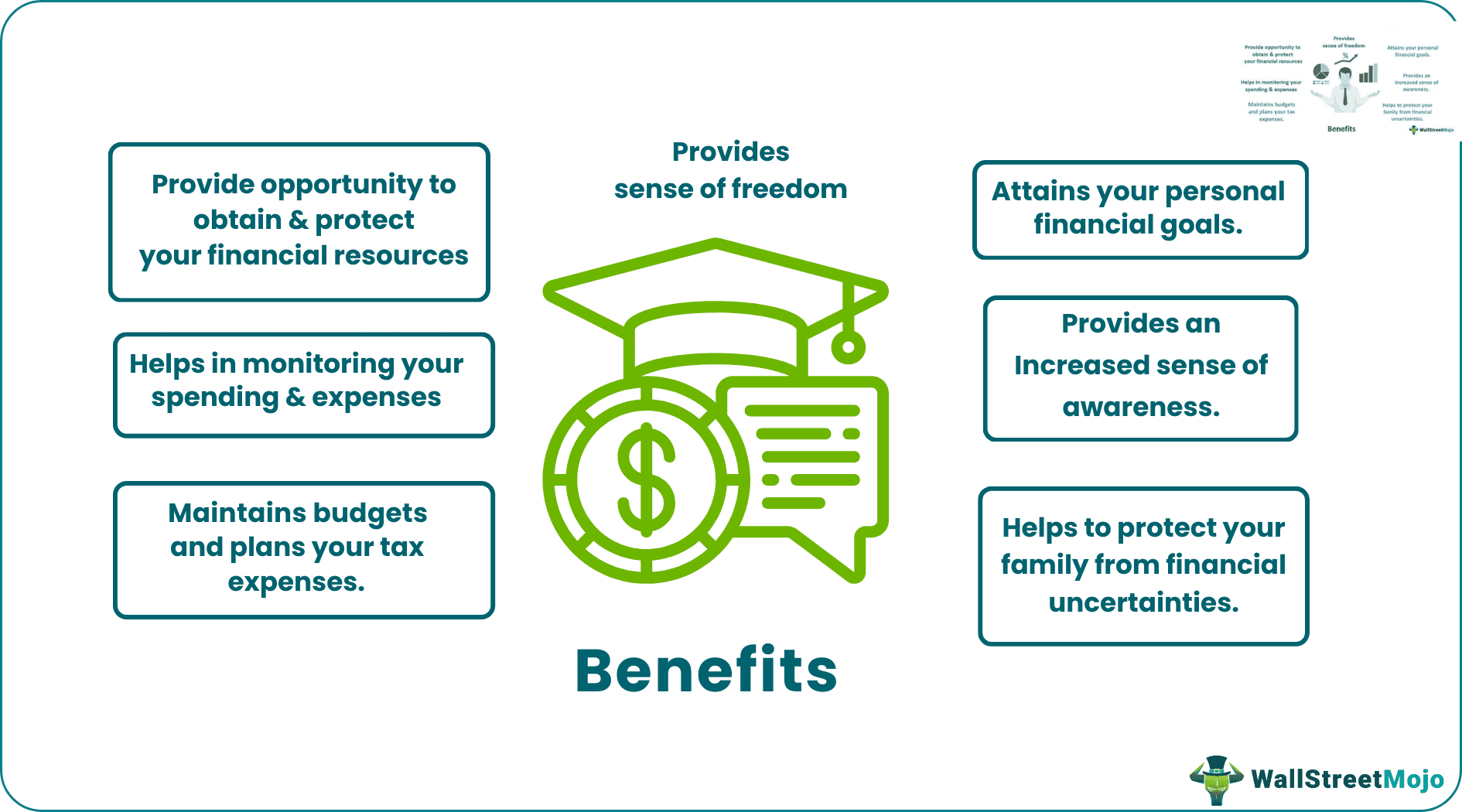

Financial literacy refers to the knowledge and understanding of various financial products. It helps individuals manage their money, personal finances, investment, and tax planning. Its primary purpose is safeguarding individuals from financial frauds and scams.

It is crucial for the realization of long-term goals—a child's higher education, buying a house, or establishing a business. It highlights emergency funds, retirement funds, insurance, and estate planning. Educating one individual creates a chain reaction—creating awareness among friends, family, colleagues, neighbors, clients, etc.

Key Takeaways

- Financial literacy refers to basic personal finance skills—to competently earn, spend, invest, save, budget, and borrow money.

- It includes personal financial management, succession planning, investment decision-making, and tax planning.

- Individuals can acquire financial knowledge from short-term courses on investing, financial management, and budgeting.

- In addition, one can read books, and blogs, intern at a financial firm, and consult financial advisors.

Understanding Financial Literacy

Financial literacy can safeguard individuals from dubious schemes. Financial decisions are an indispensable part of everyday life; one might as well learn about them. Everyone needs basic finance know-how—to differentiate between needs and wants. With awareness comes planning; once individuals narrow down on a financial goal, they can start saving.

At the onset of one’s career, a person can take more risks. Different investment options cater to a variety of needs, but the investor should be aware of them. Warren Buffet once said, “If you buy things you do not need, soon you will have to sell things you need.”

Financial literacy opens the doors to passive income, budget creation, reduced spending strategies, diligent investments, and credit risk minimization. Financially literate individuals avoid monetary losses and attain financial objectives that would otherwise be impossible. Preconceived notions of an individual are the biggest challenge—they stifle learning. People are resistant to new ideas and opportunities, this hinders financial education.

Financial Literacy Programs

Financial literacy programs cover personal finance, banking, budgeting, basics of investment, tax-filing, financial security, credit, interest, retirement savings, credit rating, and account management.

Beginners and students can acquire finance knowledge from the following sources:

- Finance subjects—university degree courses

- Short term courses on investing

- Seminars on financial planning

- Research papers on basic investing

- Books on personal financial planning

- Finance Internships

- Finance blogs

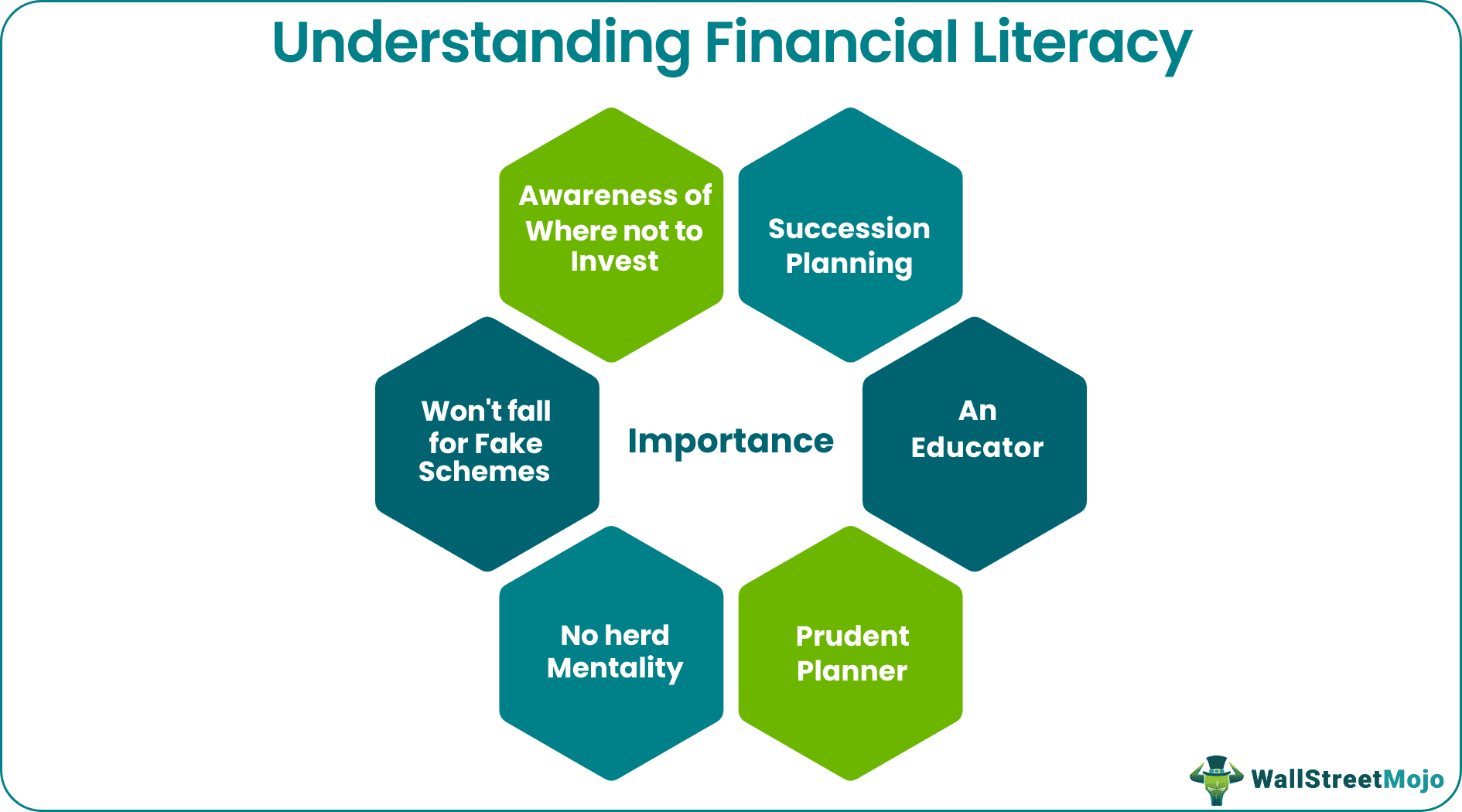

Importance

Learning financial literacy has the following benefits:

#1 – Personal Financial Planning and Management

Individuals who gain financial knowledge develop various sources of income. They prepare a monthly budget and borrow carefully. Financial knowledge ensures diligent financial management—enough savings for a rainy day.

#2 – Identify Fake Schemes

Contemporarily, financial fraud is on the rise—chit funds, pyramid schemes, Ponzi schemes, carding, etc. A financially literate person will evade shady schemes. It is the perfect antidote to get-rich-quick schemes.

#3 – Spread Investment Awareness

Financial education does not occur in a vacuum. It is not an isolated incident. Educating one individual creates a chain reaction. Such an individual would make efforts to educate family, friends, students, colleagues, etc. A financially literate individual may conduct seminars, teach in colleges, write articles and books, mentor students, etc.

Everyone is interested in finance; everyone is a stakeholder. Therefore, financial literacy is a movement; "FIRE” is a good example.

#4 – Succession Planning

It is often said that the poor plan for Saturday night whereas the rich plan for three generations. By being financially prudent, individuals impart valuable knowledge to their children. Moreover, they plan their succession and leave sufficient money for their successors.

#5 – Refrains from Herd Mentality

The financially literate don't follow random public opinion. They get to the bottom of every financial trend. They are more immune to incorrect market speculation. They make cautious investors, but in the long run, the profits add up.

#6 – Financial Planning and Decision Making

It is very important to set up an emergency fund and a retirement plan—the earlier, the better.

Financial Literacy Example

Let us assume that both Jacob and Esau earn $6000 every month. Jacob is financially literate and, therefore, allocates his salary as follows:

- Spending = $3700

- Investing in Mutual Funds = $1000

- Emergency Fund = $500

- Savings Account = $800

At the end of the year, Jacob invests $12,000 in mutual funds and $9,600 into his savings account. On average, the total appreciation of the money in mutual funds was 13%, i.e., $1,560, and the savings account yielded an interest of $360.

Esau, on the other hand, doesn't have any financial knowledge and thus spends impulsively—without any planning. He leaves the remainder in his salary account—it returns very low interest. Consequentially, Esau spent money on unnecessary items and ran out of cash in no time.

Frequently Asked Questions (FAQs)

The term denotes an individual's proficiency in managing personal finance. It involves earning, budgeting, spending, borrowing, saving, and investing money competently.

Financial decisions are an indispensable part of everyday life; one might as well learn about them. In addition, it helps people identify financial frauds and doesn't get trapped in such scams. Individuals who have financial knowledge plan for their future—strategically realize future financial goals.

To improve financial knowledge, one must follow the following steps:

- Going through the financial magazines and newspapers.

- Undertaking short-term online courses in finance.

- Reading finance blogs.

- Consulting professional for financial advice.