Table Of Contents

Meaning of Foreign Tax Credit

Foreign Tax Credits are tax reductions that taxpayers and businesses can claim on income taxes paid for an investment or income source in a foreign country. Taken as a deduction or used as a credit, foreign tax credits reduce the U.S. taxable income if one has income sources in another country which are subjected to taxes.

An entity cannot claim both a deduction and credit. The foreign tax credits are non-refundable credits that add to an entity’s total tax liability before all other credits are calculated. One can carry back unused tax credits for a year and forward them to the next ten years.

Key Takeaways

- Foreign tax credits serve to avoid double taxation for individuals.

- They serve to reduce the net tax bill and are applied directly to the taxable amount of the total bill (on whatever income one claims as taxable).

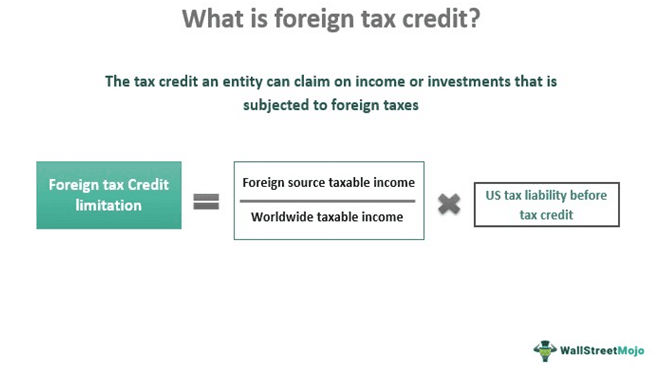

- The foreign tax credit limit does not exceed the proportion of income from foreign sources to the worldwide taxable income multiplied by the total liability before credits.

- A taxpayer is only eligible for foreign tax credit if the tax was imposed on them, they paid or accrued the foreign tax, and the tax is a legal liability based on income.

How Does Foreign Tax Credit Work?

Foreign tax credits work to reduce the tax liability of a person who has gained taxable income in a foreign country.

The U.S. foreign tax credit forms are as follows. Individuals, estates, and trusts that paid tax to a different country will have to use Form 1116 to claim the US foreign tax credit. Corporations of the same eligibility should file Form 1118, Foreign Tax Credit—Corporations,

A US foreign tax credit reduces the overall taxable income. Each finance year, one takes the amount of any accepted foreign taxes accrued during the year as a foreign tax credit or deduction. They can also change the choice for each year’s taxes, i.e., one year, they can take a tax credit and the next year a deduction.

The tax credit aims to relieve taxpayers of double taxation from two different countries. Benefits of a tax credit over a tax reduction are:

- The credit reduces the total amount of a person’s income tax (the actual amount of taxes paid), whereas the deduction reduces only the income subject to tax. In other words, it directly reduces one’s tax bill.

- The credit is available to the person even if they do not itemize deductions. This means that they can take the standard tax deduction each year in addition to the credit.

- Tax credits have carryover, whereas deductions do not.

Example

First, let’s understand the difference between tax credits and tax deductions.

Credits directly reduce the overall tax income a person owes from the beginning. It can reduce the overall tax liability, thus minimizing the whole.

For ex.

Assuming a 10% tax rate,

The taxable income is $10,000 while the tax owed is $1,000

If the tax credit is $1,000,

Total tax bill = $0

Deductions reduce a person’s already determined taxable income subject to tax. Here, you have the whole liability that slowly begins to reduce itself bit by bit. This, in essence, lowers the tax bill.

For example,

$10,000 taxable income – $1,000 deduction = $9,000 taxable income

Assuming a 10% tax rate,

Tax bill = $900

Foreign Tax Credit

$10,000 taxable income and $1,000 tax owed in the U.S.

$500 paid in foreign tax on taxable income in that country= $500 tax owed in the U.S.

Foreign Tax Deduction

$10,000 taxable income in the U.S.- $500 foreign tax deductible= $9500 taxable income in the U.S.

At 10% tax rate, tax owed in the US= $950

It usually benefits the taxpayer to use these tax credits over tax deductions to reduce their overall tax bill. If the amount of the foreign tax paid was large, say $200,000, it could reduce a person’s tax bracket (and thus overall percentage owed), and hence it might be worth choosing the deduction.

Foreign Tax Credit Limitation

Foreign Tax Credit Carryover

If the foreign taxes exceed the figure calculated on form 1116, a person can have carryover for up to 10 years. Let’s say a person lives in a highly taxed country abroad. The chances are that they will have a significant amount of carryover credits. However, should they move back to the United States, one cannot apply these carryover credits to domestic income – they can only be applied to foreign income. While one can apply them to the previous tax year and for one year forward, the taxpayer loses it if they do not use it within ten years.

Things to Remember

All countries have their own rules regarding taxes, and certain tax treaties have more restrictions than others. To know what applies to them, one can refer to Tax Treaties in Publication 514 and Publication 901 U.S. Tax Treaties.

Not all income types are eligible for this type of tax credit. The general conditions are as follows. The taxpayer must have the tax imposed on them. They should have paid the foreign tax, the tax must be a legal liability, and it must be based on an income of some kind.