Table Of Contents

Full Form of PAN - Permanent Account Number

The full form of PAN is the Permanent Account Number. It is a computer-based electronic system that assigns a unique 10-digit alphanumeric number issued by the income tax department, India's government, to various entities to identify several taxpayers in India. PAN consists of both alphabetic and numeric digits that help identify, record, and maintain details of taxpayers.

PAN card comes in a tangible form that the unique PAN number is allotted, including the entity's name, DOB, and photographs, which can even be submitted as proof of identity and many other regulatory requirements. The Income Tax department conducts the permanent account number verification to ensure a taxpayer’s authenticity.

PAN Card Explained

A Permanent Account Number (PAN) is a unique 10-character alphanumeric code issued by the Income Tax Department in many countries, including India, for the purpose of tracking financial transactions and ensuring tax compliance. PAN serves as a universal identifier for individuals, businesses, and other entities engaging in financial activities.

PAN number assists the concerned department, particularly the income tax department, in identifying all the transactions made by the PAN holder. This transaction varies from income tax payments, credit for TDS, return on income, etc.

PAN number enables the authority to extract the PAN number holder's information and match the transactions like investments, borrowing, and other business-related transactions.

It is primarily used for filing income tax returns, paying taxes, and claiming tax refunds. It helps authorities monitor an individual or entity's financial transactions and income. It is mandatory for various financial transactions such as opening bank accounts, investing in securities, buying or selling immovable properties, and conducting high-value cash transactions.

Permanent account number details serves as a valid proof of identity, often required for official and financial documentation, including passport applications, loan applications, and property registrations. By linking financial transactions to individuals or entities, PAN helps prevent tax evasion and money laundering, promoting transparency and accountability.

In essence, PAN is a vital tool in ensuring transparency and accountability in financial transactions and taxation. It plays a pivotal role in India's financial landscape and is a fundamental requirement for individuals and businesses to fulfill their tax and financial obligations.

Format

The PAN card format contains information related to the applicant, like name, and DOB, as commensurate with the KYC guidelines.

#1 - Card Format

PAN card has the following details:

- Name: Name of the applicant.

- Father’s Name: Name of the applicant’s father.

- DOB: Date of Birth of the applicant, in case of other than individuals, the date of registration with the appropriate authority.

- PAN Number: Out of the 10 digit number first 5 characters are alphabetic series, out of which the first 3 characters stand from AAA to ZZZ.

#2 - Pan Card Number Format

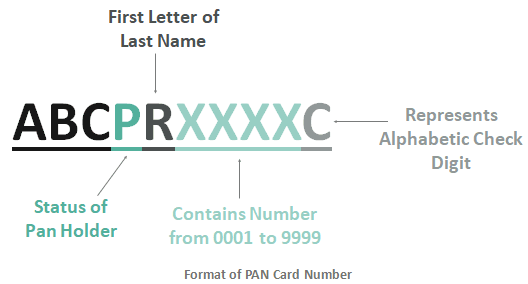

For example, "ABCPRXXXXC"

4th Character

Out of the 10-digit number of PAN, the fourth character indicates the PAN number holder's status.

- ‘P’ represents an Individual

- ‘C’ represents Company

- ‘H’ represents the Hindu Undivided Family (HUF)

- ‘A’ represents the Association of Persons (AOP)

- ‘B’ represent Body of Individuals (BOI)

- ‘G’ represents the Government Agency

- ‘J’ represents Artificial Judicial person

- ‘L’ represents Local Authority

- ‘F’ represents Limited Liability Partnership or Firm

- ‘T’ represents Trusts

5th Character

ABCPRXXXXC

The 5th character of the PAN 10-digit number refers to the first character of the surname or last name of the individual. The non-individual 5th character represents the first character of the PAN cardholder name.

6th to 9th Character

ABCPRXXXXC

The above highlighted 4 characters are numbers from 0001 to 9999.

10th Character

ABCPRXXXXC

The 10th character represents the alphabetic check digit.

Eligibility

Let us understand the eligibility criteria for a permanent account number verification through the explanation below.

- Individuals: In the case of individuals applying for PAN numbers, they should be a citizen of India and have valid addresses, date of birth, and ID proof. The proof to substantiate the ID could be a driver's license, passport, Aadhar card or voter's card, etc.

- Hindu Undivided Families: The head of the family, also known as Karta. In the case of a Hindu Undivided Family, one could apply for a PAN number on behalf of other family members by providing ID proof such as the address proof and date of birth of the members of the HUF.

- Minors: In the minors' cases, the guardians could apply for the PAN number on their behalf by providing their ID proofs.

- NRI: In this case, citizens outside India can apply for the PAN number by providing a bank statement of the country where they currently reside as the address proof.

- Corporate: Companies applying for PAN numbers should be registered with the ROC and provide the registration certificate as ID proof.

- Partnerships/Firms: Limited liability firms or partnerships should be registered with the relevant authority to get the PAN number and provide a copy of registration as ID proof.

- AOP: Association of a person registered with the appropriate authority can get the PAN number by providing their registration certificate.

- Artificial Judicial Person: Artificial judicial persons can apply for PAN numbers by providing the relevant registered certificate or documents.

- Trust: Trust can apply for the PAN number by providing the certificate of deed or registered certificate.

Types

Let us understand the permanent account number details through discussing the different types of PAN as discussed below.

- Individual

- Hindu Undivided Family (HUF)

- Corporation / Company

- Trust

- Artificial Judicial Person

- Limited Liability Partnerships/ Firm

- Minor

- Society

- Association of person

Documents Required

Primarily, a permanent account number verification requires these documents for two major reasons: proof of identity and address proof. The following are the primary documents required based on the type of PAN for which they are applying for the PAN numbers.

| Applicant | Documents Required |

|---|---|

| Individual | Aadhar card, Voter ID, Driver's License, Passport |

| Hindi Undivided Family | An affidavit of the HUF on behalf of the members with address proof and DOB identity of the members. |

| Corporations | Registration certificate of the companies issued by register. |

| Partnership Firms | Registration certificate of the partnership firms issued by the register of the partnership firms deed. |

| Trust | Trust deed and certificate number of registration issued by the commissioner of charity and trust |

| Society | registration certificate issued by commissioner of charity and co-operative society |

| Foreigners | Passport, Bank Statement of the residing country, Bank statement of NRE account in India |

Why do we need a PAN Number?

The requirement of the PAN card number is for various reasons. The following are the major reasons which make the PAN numbers necessary:

- PAN number is required to file an Income Tax return.

- PAN number is required as proof of identity.

- PAN number is required to open any bank account or depository account.

- A PAN number is essential to apply for a bank loan or credit card.

- A PAN number is necessary to purchase or sell property having a valuation above ₹5 lakhs.

- To shell out a bill above ₹25,000 PAN number is required.

- A PAN number is required if someone deposits ₹50,000 or above in the bank account.

- PAN number is also called for to purchase and sell a car or any other vehicle.

- PAN number is required in case of an investment of ₹50,000 and above.

- PAN number is required in the purchase transaction of jewelry above the prescribed limit.

How to Apply for PAN Card?

PAN can be applied through online or offline.

Online Application

Follow below given steps for applying for pan card online.

- Visit the NSDL (National Securities Depository Limited) or UTIITSL website

- Fill the required form, submit the same by shelling out the required fee amount.

- PAN number will be sent to the applicant at the address provided by him in the application.

Offline Application

- Step 1: Visit the authorized PAN card center to get the required application form.

- Step 2: Fill out the required application form, attach the required documents with the form, and pay the application fee.

- Step 3: It will send the PAN number to the applicant at the address provided in the application.