Table Of Contents

Full-Form of TAN

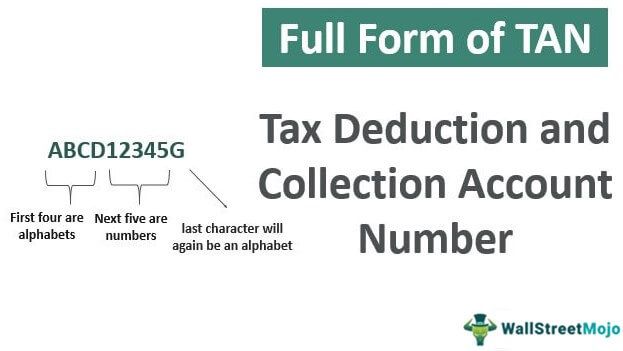

The full form of TAN is Tax Deduction and Collection Account Number. It is a ten-digit alphanumeric number allotted to any person under the Income-tax Act, 1961, required to deduct TDS, i.e., tax deducted at source while processing any payment as specified under the rent, commission, professional and technical payment, etc.

Who is Allowed to Apply for TAN?

Every person required to deduct and collect income tax on behalf of income tax authorities is compulsorily required to apply for TAN. Also, TAN is compulsorily required to quote in every TDS/TCS return, TDS/TCS payment challans, certificates to be issued, etc. Failure to apply for TAN may result in the application of the penalty. A person can be of any type like: –

- Individual

- Company

- Sole Proprietor

- Firms

- Association of Persons etc.

How to Apply for TAN?

- Every person is required to deduct and collect taxes on behalf of the government. Therefore, it is required to apply for a TAN, but now the question arises regarding how to apply. A person may apply for TAN either through online mode or offline mode. It is easy, and one can follow the following steps to get their TAN number.

- Income tax authorities allot TAN numbers. In the case of the online application, an applicant must fill 49B online and submit the same along with application nominal fees. In the case of offline application, an applicant for allotment of TAN needs to file form 49B and submit it at any of the TIN Facilitation Centres.

- One can also submit the application form online. Once after filing an application and submitting it the same at facilitation centers, an applicant will be allotted TAN subject to the condition that they must find no discrepancies in the application. It will generate an acknowledgment number after applying. One can track this number online at the income-tax website.

Structure

TAX Deduction and Collection Account Number is a unique number allotted to each assessee. The structure is as follows: –

ABCD12345G

As visible above, the series contains 10 alphanumeric characters.

- The first four are alphabets

- The next five are numbers

- The last character will again be an alphabet.

Example

As already mentioned in the structure, it is a 10-digit unique number.

DCBA98765G

Benefits

- TAN number, within itself, does not hold any benefits for the assessee except escaping from the file by complying with a legal requirement.

- It is also known as TDCAN, which sorts, identifies, and matches the number of TDS. TCS deducts, collects, and provides necessary credit to the person against whose income tax liability TDS/ TCS deducts.

- Overall, we can say that TAN provides benefits to income tax authorities for collecting tax at the point of time when income gets accrued.

Uses

The primary purpose is under the benefits. It serves the purpose of an early collection of tax when a taxpayer's income gets accrued or earned. However, as a part of legal compliance, a taxpayer can claim the following mentioned: –

- At the time of making any payments as specified under the Income-tax Act, where the service receiver has to deduct TDS like salary, commission, rent, winning from lotteries, etc. person deducts TDS on behalf of the government and deposits the same into the government account. One must report the amount under TAN to match amounts while undergoing assessments.

- While making any payment challan in respect of TDS deducted, or TCS collected, one needs to quote the TAN number in the payment challan; otherwise, one may treat it as invalid.

- While filing returns, one needs to quote the TAN number compulsorily.

- Also, the TCS certificate assessee needs to quote the TAN number while issuing TDS. Otherwise, one may treat the same as non-compliant and hence invalid.

- It records the address of the person who deducted TDS on the IT department's behalf. Also, it captures the PIN, recorded with the department.

Difference Between TAN and PAN

- To understand the difference between TAN and PAN, we must understand both terms. TAN is a unique 10-digit alphanumeric number allotted by the income-tax authority to a person who is required to deduct TDS or collect TCS. In contrast, PAN is a ten-digit alphanumeric 10-digit number allotted by the income-tax authority for uniquely identifying each assessee.

- One can designate PAN as a unique identification number allotted to each assessee who is required to or voluntarily opts for PAN. In brief, one can say that TAN is a further responsibility on the shoulders of an assessee. Every assessee with TAN will compulsorily hold PAN, but the same is not in the case of PAN. Every assessee having PAN may not necessarily hold TAN.

Conclusion

TAN is the ten-digit alphanumeric number allotted by the income tax authority to collect, deduct, and further deposit tax on behalf of another person to Income-tax authorities. In the case of applicability, a person needs to apply for TAN compulsorily and further comply with all the legal requirements as specified under the Income-tax Act.

If a person does not comply with the provisions, then the authority may apply a file for it. While making any filings related to TDS/ TCS, the person holding TAN needs to quote TAN in all correspondence; otherwise, one may treat it as invalid. PAN is not the same as TAN. A person holding TAN will compulsorily hold PAN, but vice versa is not always required by law and regulation.