Table of Contents

What Is A Futures Exchange?

A futures exchange is a market where futures contracts, options, and other futures trading take place. It enables market participants to transact with shares and commodities at a predetermined future price. Contracts have specified sizes, bids, pricing information, termination, and expiration dates.

In financial markets, it is critical for price discovery, risk management, liquidity availability, and standardization. Moreover, it allows market participants to hedge against price fluctuations, encourages efficient trading, and promotes capital formation. Additionally, it also promotes transparency and facilitates capital allocation by providing standardized contracts, which contribute to economic stability and progress.

Key Takeaways

- Futures exchanges are platforms that facilitate the trading of futures contracts, options,

- and other derivatives, providing a platform for transacting shares and commodities at predetermined future prices.

- They are crucial for price discovery, risk management, liquidity availability, and standardization in financial markets.

- They enable market participants to hedge against price fluctuations, encourage efficient trading, and promote capital formation.

- Regulatory oversight of futures trading in the U.S. began with self-regulation and legislative acts.

- The establishment of the Commodity Futures Trading Commission (CFTC) in 1974 was a major step toward it.

- Subsequent regulations have shaped the regulatory framework for futures trading.

How Does A Futures Exchange Work?

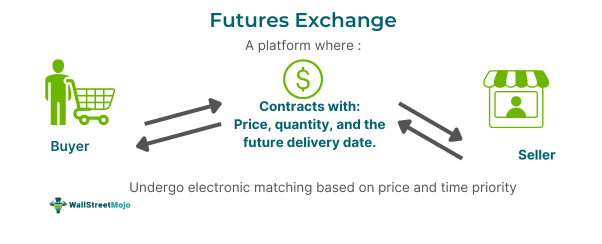

A futures exchange is a regulated market where standardized contracts for the delivery of futures and contracts, as well as other derivatives, are bought and sold at a later period. These futures contracts describe the quantity, price, and future delivery date of the underlying asset. Futures contracts are derivative agreements to buy or sell specific quantities of desired commodities or financial instruments at predetermined prices. Their delivery dates are set for the future.

Futures markets fulfill two main functions. Firstly, they facilitate price discovery by serving as a central marketplace where participants globally engage to establish prices. Secondly, they enable the transfer of price risk by allowing buyers and sellers to set prices for future delivery. This process is known as hedging.

The exchanges operate as organized marketplaces where buyers and sellers convene to trade standardized futures contracts. These contracts outline specific details about the underlying asset, encompassing aspects such as price, quantity, and the future delivery date. Participants submit buy or sell orders, which undergo electronic matching based on price and time priority. Acting as an intermediary, the exchange facilitates trade execution, clearing, and settlement. It enforces regulations, ensuring fair and transparent trading practices while also monitoring the financial integrity of the market.

Moreover, these exchanges provide platforms for physical or electronic trading of these assets and their standardized contract details, market data, and clearing services. They also provide regulations, margin requirements, settlement procedures, and delivery arrangements. These platforms help in establishing standardized contracts in specified assets for delivery, facilitate delivery arrangements, and provide pricing formulas, delivery period contract sizes, and price limits, ensuring orderly trading and risk management.

History

In the U.S., regulation of futures trading has evolved through key legislation. Before the creation of the Commodity Futures Trading Commission (CFTC), futures trading and regulation in the U.S. primarily occurred through self-regulation and legislative acts:

- 1848: The Chicago Board of Trade, or the CBOT, is established, initially trading in forward contracts for grain.

- 1859: Illinois legislature grants CBOT a corporate charter, enabling self-regulatory authority and standardization of grades.

- 1865: Introduction of standardized futures contracts.

- 1868: CBOT implements a rule against corners to deter manipulation, marking an early regulatory effort.

- 1870: The New York Cotton Exchange was founded, trading cotton futures contracts.

- 1883: Establishment of the first clearing organization for CBOT contracts.

- 1921: The Future Trading Act regulates futures trading in grain commodities.

- 1936: Enactment of the Commodity Exchange Act, laying the groundwork for future regulation.

These milestones represent the evolution of futures trading and early regulatory attempts in the U.S. before the establishment of the CFTC in 1974.

The Commodity Exchange Act of 1936 established oversight, while the creation of the CFTC in 1974 enhanced regulatory control. Subsequent acts, like the Futures Trading Practices Act of 1982, targeted abusive practices. The Commodity Futures Modernization Act (2000) provided regulatory clarity. It clarified the functions of the CFTC, the SEC (Securities Exchange Commission), etc. Subsequently, the Dodd-Frank Act of 2010 saw regulation of swap dealers, etc. Henceforth, regulations were passed as required.

The government actively participates in regulating exchanges, with federal oversight of futures trading dating back to 1923. The establishment of the CFTC in 1974 further solidified this role, creating an independent federal body responsible for supervising all aspects of futures trading. Additionally, the National Futures Association (NFA) was formed to regulate brokerage houses and their agents. These regulatory measures are essential for maintaining the integrity and fairness of the markets.

Examples

Let us look into a few examples to understand the concept better:

Example #1

Suppose Dan, a U.S. corn farmer, uses the futures market to protect his profits from potential price declines. He sells corn futures contracts on a futures exchange, hedging his position and securing a predetermined price for future corn delivery. If the futures exchange rate of corn decreases, Dan would face losses in the physical market.

However, the gains made in the futures market offset these losses, protecting his financial interests and mitigating the negative impact of price decline. Dan's strategy ensures stability and predictability in his farming operations. Furthermore, it allowed him to plan production, budget effectively, and safeguard profitability amidst potential market fluctuations.

Example #2

A study was conducted by Michael Gorham and Poulomi Kundu in collaboration with The Institute for Financial Markets and The IFM. It examined the 55 years of innovation and competition at U.S. futures exchanges. The research revealed that innovations generally performed better than imitations and product extensions.

In 1955, 61 futures contracts were listed on U.S. exchanges. By 2010, this number had grown to 916 contracts, indicating a significant increase in product innovation and the growing importance of futures in the financial and commercial sectors.

Moreover, the study reviewed 916 new futures contracts introduced by 39 exchanges between 1956 and 2010 and categorized them as 44% innovations, 35% product extensions, and 21% imitations. The findings showed that the average lifespan of a new future product was less than six years, and innovations tended to be more successful than extensions and imitations.

In addition, the study also observed a trend toward liquidity-driven monopolies in U.S. futures markets, with dominant contracts often holding a market share of over 95%. However, contrary to popular belief, the study found that being the first mover did not always guarantee success, as innovations outperformed competition about 50% of the time, while product extensions dominated in over 30% of cases.

List

Below are some of the U.S. future exchanges.

- Intercontinental Exchange - U.S. (ICE US)

- ICE US Commodities (ICEUS): Trades commodity futures contracts.

- ICE US Currencies (ICEUS): Focuses on currency futures contracts.

- ICE US Metals (ICEUS): Specializes in futures contracts for precious and base metals.

#1 - Other North American Exchanges

- CBOE Digital (CBOED): Focuses on digital asset trading, including cryptocurrencies and futures.

- CBOE Futures Exchange (CFE): Trades futures contracts on various assets, including equity index futures.

- Minneapolis Grain Exchange (MGEX): Trades agricultural futures contracts, particularly focusing on grain products.

- Montreal Exchange (MNTRL): Canadian derivatives exchange offering options, futures, and other derivatives.

#2 - South American Exchanges

- B3 S.A.- Brazil, Bolsa, and Balcao (formerly BM&F BOVESPA (BMF)): Brazilian financial exchange trading equities, derivatives, and commodities.

- Rosario Futures Exchange (ROFEX): Argentine futures exchange primarily dealing with agricultural commodities and financial instruments.

Exchanges are not limited to places or normal commodities. There are also gold futures exchanges, such as the Shanghai Gold Exchange and the U.S. Futures Exchange.

Above are a few examples of U.S. futures exchanges, and their futures exchange hours, rates, and delivery specifications are determined by institutional regulations. Hence, futures exchange hours, delivery specifics, and rates tend to vary.