Table Of Contents

Spot Rate Definition

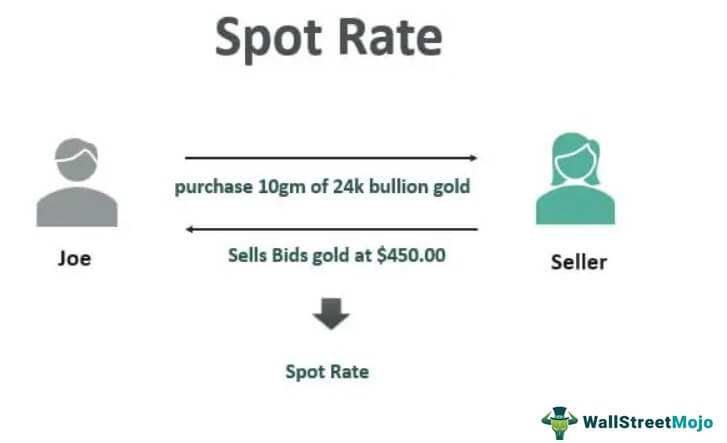

Spot Rate is the cash rate at which immediate transactions and settlements occur between the buyer and seller parties. It gives the immediate value of the product being transacted. This rate can be considered for any products prevalent in the market, from consumer products to real estate to capital markets.

A spot rate is determined based on what the parties involved are convenient with. It is the price set depending on the price that a buyer is willing to pay and the price that the seller is willing to accept from customers. It may vary with time and place.

Key Takeaways

- The spot rate is the cash rate for quick transactions and payments between the buyer and seller parties. It applies to widely used products, including capital markets, real estate, and consumer goods.

- The current spot rate is the reference rate for forward rates and other futures and swap contracts. For investors, fluctuations in the spot rate define a market's outlook. It establishes the price for numerous derivative goods.

- Investors rely on the spot rate to determine other factors impacting a product's cost. The product sellers must examine each component it depends on to get significant spot rate contracts.

Spot Rate Explained

A spot rate is one of the most important components denoting the market movement. Even forward rates and other futures/swap contracts work at the reference of spot rates. Movement in spot rate defines a market view for investors. It also defines rates for other derivative products. Investors rely on the spot rate for other parameters defining the price components of products. However, to make the best from spot rate contracts, sellers of that particular product must properly analyze all components on which it depends. On the other hand, buyers need to be completely aware of existing market trends, and there should be a mutually agreed rate for the transaction.

An increase in the spot rate reflects the acceptance of the product in markets and vice-versa. The volatile spot rate signifies the instability of the product’s performance in the market. It increases the portfolio’s overall risk and may also affect the performance of other assets in the portfolio.

Increases in the spot rate denote a bullish market and vice-versa. However, it is important to understand the dynamics of such securities prevalent in that instance. Delta, the first-order derivative, depends upon changes in the price of the product and is one of the key indicators of market movement for most securities.

These rates are applicable to a number of assets and interest rates. Starting from commodities to bond interest rates and spot rate for foreign exchange market, these rates find relevance in all cases. They play different role for different asset type deals. While the sport price or rate is the price that one pays for a security, commodity, and currency immediately, it becomes the rate of interest at which one pays at a specific point in time in case of buying a bond.

How To Calculate?

The spot rate or spot price is the one which an investor would pay if they wish to buy an asset immediately. However, these rates keep changing with time and they are impacted by the currency exchange market fluctuations as well.

Hence, it is important to understand how these rates are calculated. Though there is no standard formula specified in this case, but there is a common standard way that is adopted to make the calculations related to it. A spot price is determined by identifying a discount rate, which when applied to the zero-coupon bond value would yield the figure, which equals the present value of that bond.

Examples

Let us see some simple to advanced examples to understand what is a spot rate:

Example #1

Joe goes to the market to purchase 10gm of 24k bullion gold. The seller bids the same at $450.00. This rate is the spot rate. If Joe buys the bullion at this rate, the transaction gets settled.

We can also say that this rate is the real market rate, which shows the actual market movement.

Example #2

The above example considers that the seller offers Joe a deal. He believes the market will be bullish in the future, and gold rates will rise. He suggests Joe book the bullion today at $455.00 and collect the same after one month. Rates after one month would be around $475.00.

This type of agreement is a forward contract whereby the buyer can book the product at a rate that is a little higher than the spot rate (including the seller's premium), also called the forward rate, and take the delivery later, thus making profits from the then spot rate.

Example #3

It can be measured for Currency exchanges as well. Below is a table demonstrating the conversion rates of various currencies against the USD.

Spot Rates as on Closing of 18th April 2019

Source: www.yahoofinance.com

The above table reflects the rate paid by each currency to purchase U.S. Dollars. These are spot rates because at that specific instance, or at that spot, this is the exchange rate. It continuously changes in bps every second. It may vary at different times of the day and on other days as well.

Advantages

These rates are the figures that allows the market to remain stable by making assets available at a reasonable price to the buyers based on what the buyers and sellers both are comfortable to pay and receive. There are many benefits of calculating these spot prices. Some of them have been listed below:

- The parties are confirmed with the rate and value of the product for which the transaction is to be made.

- Spot rate gives the actual movement of markets.

- There is no speculation involved in the calculation of this rate.

- There is no effect from market dynamics like volatility, time value, interest rate changes, etc., since buyers and sellers are sure about the current scenario in the market with no reason for any doubts about future market movement.

- The study of spot rates for a particular period may help in market price trend analysis for the particular product.

Disadvantages

Undoubtedly, the advantages of these prices are many, but the number of limitations are equally important to consider and know about. Let us have a look at the demerits associated with such rates:

- Spot rate may bring lesser profit to a product buyer inbearish markets. The current spot rate may be higher, so the buyer will pay more today than tomorrow.

- Financing also requires other products, which deal with future rates and speculation.

- Spot rate brings exchange risks to the individual, corporate and other finances since the current rate may not be equivalent to the rate at the time of settlement.

- Floating rates may create a difference in the actual calculation as they fluctuate and may differ at the settlement time.

- It also depends upon market situations, which include political scenarios, war conditions, an act of God situations, and other environmental activities. Although this may not be directly related to product performance, it affects its price in the market. However, in such scenarios, almost the entire market gets affected.

Significance

These rates are used in various ways and hence they are significant. Let us have a look at the importance of calculating them below:

- It can be beneficial in a particular instance but cannot forecast futuristic rates and market movement.

- It depends upon the demand for that particular product in the market. The higher the demand -the higher the price. However, if demands vary in the future, price changes; hence, a buyer who has a bullish view may face losses based on spot rate purchases. However, this can be hedged by any derivative product with a future rate of interest as one of its components.

- It is very dynamic. For liquid products in the market, it changes every second (sometimes even a millisecond). Hence, the buyer has to be extremely focused on the purchase and settlement of their desired deal, as small changes in basis points can also have big impacts on some deals depending upon other factors.

- It is the basic rate. Investors can deal with spot rate contracts based on a specific rate and give a conservative income upon a sale. This limitation can be overcome by investing in more dynamic products with futuristic rates.

Spot Rate vs Forward Rate

Spot rate and forward rate are terms that are widely used in the financial market and have relevance with respect to different financial instruments. Let us have a look at how these rates differ in their nature and objective:

- While a spot rate helps obtain the spot price for an asset in the spot market, forward rates apply on forwards contracts to be executed in the future.

- Spot rate applies to investors who want to crack a deal immediately. On the other hand, forward rates are applicable to assets that have been booked for future at a predetermined date and price.