Table Of Contents

What Is The Greater Fool Theory?

The greater fool theory states that there will always be a greater fool willing to pay a higher price for an already overvalued security due to his need or inflation. It implies that the price of any object is determined by the local and relative demand of a specific consumer and not by its intrinsic value.

Economics professor Burton Malkiel proposed this concept in his book, ‘A Random Walk Down Wall Street’ where a particular stock enters into a bubble owing to the excitement or chatter about it on the internet or the news. As a result, the price of the stock rises. Therefore, even buying an overvalued security will yield profits in the future by selling to another person (greater fool).

Key Takeaways

- The more excellent fool theory mentions that a greater fool will always strive to pay a higher price for an already overvalued security due to need or inflation.

- It suggests that the cost of any object is estimated by the local and relative demand of a specific consumer and not by its intrinsic value.

- One may use the theory to design an investing strategy based on the belief that an individual can always sell an asset or security at a higher price compared to the purchase price to a greater fool that pays a higher price

Greater Fool Theory Explained

Greater fool theory is an investment mechanism that makes an investor purchase overvalued security without regard to its quality, making it a greater fool that leads to speculative bubbles. One must follow due diligence to avoid becoming a greater fool. You must always evaluate an intrinsic value of an asset or security for investment considerations.

Greater fool theory is used to design an investing strategy that is based on the belief that an individual can always sell an asset or security at a higher price as compared to the purchase price to a greater fool who is willing to pay a higher price based on unjustified multiples of security instead of looking at its intrinsic value.

The whole idea is to make money by speculating on the increase in future prices irrespective of market conditions. This theory works based on the assumption that there is not a single fool in the market but many. This investing approach determines the likelihood that one can sell an investment of one individual to others at a higher price than what has been paid.

This investing mechanism focuses on forming speculative bubbles, which may burst someday and lead to a crisis. It does not always promise to give higher returns and may even prove fatal for the investors as it does not work on an asset's intrinsic value and its prospects to earn a higher yield in the future.

Examples

Let us understand the concept of greater fool theory economics with the help of a couple of examples as discussed below.

Example #1

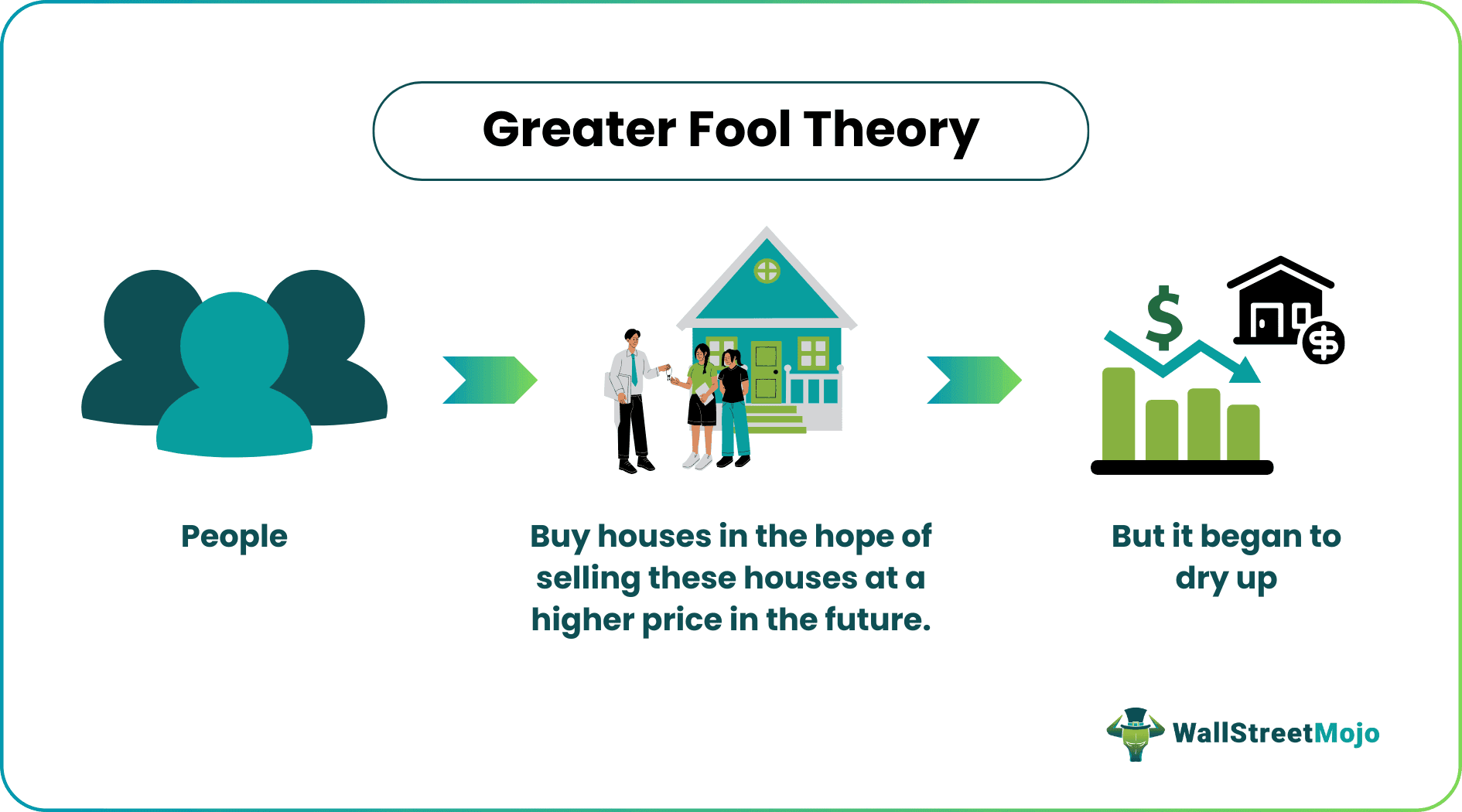

When formed by using irrational valuations instead of looking at the investment's intrinsic value, the speculative bubbles will burst and lead to a crisis. For example, the financial crisis of 2008, where people took loans from the banks to buy houses in the hope of selling these houses at a higher price in the future to make substantial gains. It worked for years until the supply of fools. That eventually, someday, began to dry up. As more people began to see the asset's intrinsic value and suddenly, the mortgage takers could not find buyers, banks wrote up a huge amount of credit granted to these buyers off their balance sheets. This event leads to the banking emergency and eventually to the financial crisis.

Example #2

In the stock market, this theory applies too, when many investors invest in a not-so-profitable company, assuming that it will be sold later at a higher profit to a greater fool. Investment in any stock is not made by looking at its intrinsic value and potential to provide higher returns. Rather, it is made on assumptions that someone is there to buy it at a higher price. It is called survivor investing.

Bitcoin and Greater Fool Theory

Bitcoin was an attractive and somewhat lucrative investment at one point. It is a pure example of a greater fool theory type of investment where one is not producing anything but only expecting it to increase depending on the investment made by others. It works on the same principle of the greater fool theory, which suggests the cycle will continue with hopes of getting a higher buy price. One can short Bitcoin by using future contracts on the world's leading derivatives marketplace. Bitcoin works on the Ethereum blockchain system. These cryptocurrencies are the gold standard. People who buy bitcoin expect other people to buy them at a relatively higher price. But the reality is that bitcoins are the deflationary coins or currencies that people hold for the long term. Bitcoin should not be looked at as a financial tool because it is blockchain technology. In a nutshell, bitcoins are non-productive assets that completely work at the mercy of others to buy and raise their price.

How To Avoid?

In financial markets filled with various securities, commodities, and other investment opportunities, it is important to understand the intricacies of each of them to ensure investors do not end up paying a price that is significantly higher than what it is actually worth.

Let us understand how to avoid paying a higher price and being the greater fool in this context through the discussion below.

- One should understand that there is nothing predictable with 100% accuracy in the securities market. The market works on the order of diverse trends, and nothing is certain in the market. For example, the price of an asset that is higher today may either inflate in the future or decrease drastically based on market conditions.

- One must diversify the portfolio. Also, one must include various securities and assets in the portfolio based on their past performance and credibility.

- Before investing, one should conduct thorough research, planning, and market analysis. Then, a proper strategy must be developed and implemented. Finally, one must adopt a long-term investment approach to avoid speculative bubbles.

- The common herd should not be followed by paying higher prices for something without a good reason because others are investing. The self-decision must be taken before investing, and one must eliminate greed and the temptation to make big money in a short period.