Table of Contents

Harrod-Domar Model Definition

The Harrod-Domar model is a Keynesian approach to economic growth. It is commonly used in development economics to describe an economy's growth rate with respect to its capital and saving rates. The model suggests that the rate of savings and the ratio of capital output determine an economy's growth rate.

The model states that balanced economic growth is not a natural occurrence. It indicates that governments must encourage saving and technological development to lower the economy's capital-output ratio, which would lead to developing nations experiencing economic growth.

Key Takeaways

- The Harrod-Domar model is a Keynesian method for growth in the economy.

- In development economics, it is often employed to describe an economy's growth rate in relation to its capital-output ratio and saving rates.

- In 1939, Sir Roy Harrod created the model alone. In 1946, Evsey Domar created it individually.

- One of the model's significant drawbacks is the difficulty of increasing the savings ratio in low-income countries.

- Many developing economies have inadequate marginal propensities to save. Instead of preserving money, individuals usually spend a more significant portion of their earnings.

Harrod-Domar Model Of Economic Growth Explained

The Harrod-Domar model is a growth model employed in development economics. It suggests that an economy's growth rate is determined by its savings rate and capital-output ratio. Sir Roy Harrod developed the model independently in 1939, and Evsey Domar designed it separately in 1946.

A nation with high savings levels has more significant funds available for companies to get loans and make investments. These investments may help improve an economy's capital stock and stimulate economic expansion by raising the generation of products and services. The capital-output ratio assesses the productivity of the investment made. Lower capital-output ratios indicate higher levels of output from fewer inputs. As a result, they increase economic productivity and lead to higher economic growth.

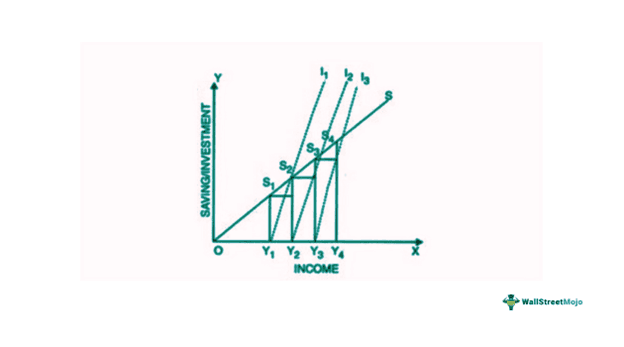

Diagram

The above diagram portrays the Harrod-domar model of economic growth. The X-axis shows income, while the Y-axis shows investments and savings. The saving line is SS. This figure demonstrates how varying income levels relate to varying degrees of savings. The scope of this line expresses the equality between the marginal propensity to save and the average propensity to save. The Y1I1 and Y2I2 slopes of the lines show the capital-output ratio.

Assumptions

The Harrod-domar model assumptions include the following:

- The economy will have income at the whole employment level.

- Both the capital-output ratio and the marginal propensity to save are fixed.

- The average propensity to save will be the same as the marginal propensity to save.

- Interest rates are never changed.

- The pricing level is always stable.

- Capital goods have an infinite use.

- Net terms take into account savings, investments, and income. This means that those factors do not include depreciation costs.

- Investments and savings will be the same.

- There is no delay in time between investment and the creation of productive capacity.

- The government does not intervene in business affairs.

- A closed economy will exist. It implies that there will be no net international trade or external assistance.

- The proposed and actual investments in the economy will be the same.

- The term 'capital' refers to both fixed and variable capital.

- Investments and savings are associated with the same year's income.

Equation

The Harrod-domar model equation is given below:

Rate of economic growth (g) = Level of savings (s) / Capital output ratio (k)

In this equation,

Level of savings (s) = Average propensity to save (APS). This is the ratio of national savings to national income.

Capital-output ratio = 1/marginal product of capital.

The ratio of capital to output measures how much capital is required to enhance output. A high capital-output ratio indicates ineffective investment.

Examples

Let us go through the following Harrod-domar model examples to understand the model:

Example #1

Suppose in an economy,

Savings ratio = 20%

Capital output ratio = 5

According to the model,

Rate of growth of GDP = Savings ratio / Capital-output ratio

Therefore,

Rate of growth of GDP = Savings ratio / Capital-output ratio = 20 / 5 = 4

This implies that a nation would expand at a rate of 4% annually if its savings rate is 20% and its capital-output ratio is 5. This is a Harrod-Domar model example.

Example #2

Mr. Harrod's creation of an economic growth model, which was released in March 1939, was his single most significant contribution. During World War II, this model was overlooked. However, Prof. Evsey Domar of the Massachusetts Institute of Technology made an independent discovery of it seven years later. The model gained popularity and gave rise to an extensive volume of post-war research on dynamic economics and growth. This is another Harrod-domar model example.

Advantages

Harrod-domar model of economic growth was developed following the Great Depression. It aimed to model economies in the near future during a time when unemployment was high enough for labor to utilize any new machinery fully. As a result, production was simply a function of capital in the model. The model was initially designed to assist in the analysis of the business cycle. However, it was later modified to take into account economic growth.

Moreover, the model has implications for nations where the economies are less developed. In these nations, labor is abundant, but physical capital is scarce, which slows down economic growth. Such countries do not have adequate high incomes to allow for adequate savings rates. As a result, building a physical capital stock through investment is constrained.

Limitations

Some crucial limitations of the Harrod-domar model are as follows:

- It is difficult to raise the savings ratio in nations with lower incomes. Marginal propensities to save are low in many developing nations. Individuals usually spend a larger amount of income instead of saving it. Several nations experience a recurring domestic savings shortage.

- Many developing nations are without a stable financial system. A higher level of household savings does not ensure that businesses will have more significant resources to borrow and invest.

- Inadequacies in human capital in developing nations result in inefficient capital use. Improving efficiency that lowers the capital/output ratio in these nations is challenging.

- Technological advancement is necessary to increase the capital/output ratio. A lack of funding for research and development (R&D) contributes to market failure in developing countries.

- In the long run, borrowing from other countries to compensate for the savings gap usually leads to difficulties with repaying external debt.