Table Of Contents

What is the Herfindahl-Hirschman Index?

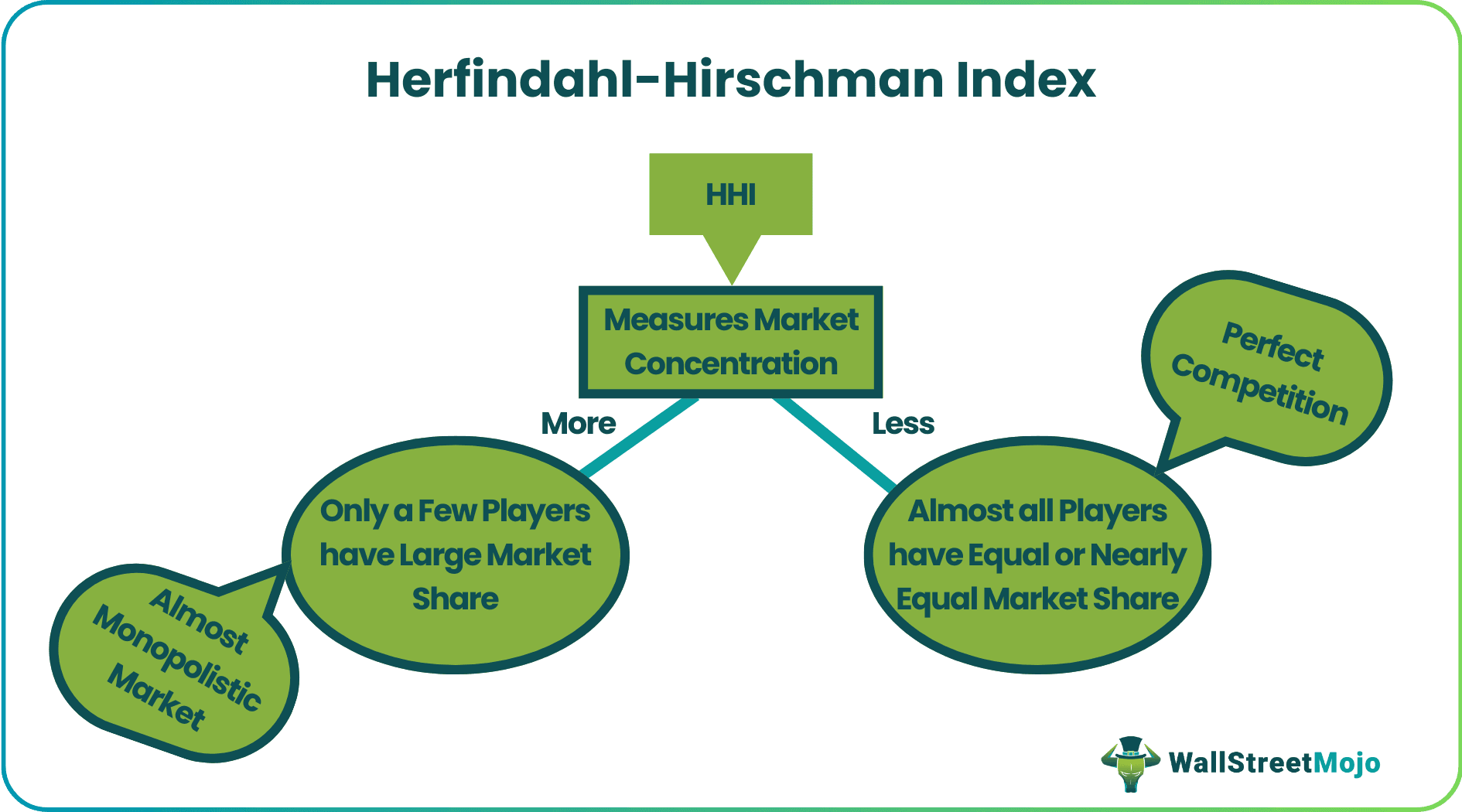

Herfindahl-Hirschman Index or HHI refers to an index reflecting a score that provides a measure of market concentration and indicates the amount of competition in a particular industry. It helps analyze and observe if a specific industry is highly concentrated or close to a monopoly or some competition around it. It is calculated by first squaring and then summing the individual market share of each firm in a particular industry or market.

HHI score can range from 0 to 10,000 if whole percentage numbers are used. Similarly, it can range from 0 to 1, where market shares are used as fractions. E.g., if there is only one firm operating in an industry holding 100% market share, its respective HHI would be exactly 10,000 or 1 and would indicate a monopoly.

Key Takeaways

- The Herfindahl-Hirschman Index (HHI) measures market concentration in a specific industry.

- The HHI provides insight into the level of competition in an industry by analyzing the market shares of firms within it.

- The HHI formula squares the market shares of all firms in the industry and then adds them up to provide a score indicating the concentration level.

- A higher HHI score means the industry is more concentrated, while a lower score means the industry is more competitive.

Herfindahl-Hirschman Index (HHI) Explained

Herfindahl-Hirschman Index score is directly proportional to the concentration in a particular market. That means a higher HHI value or score reflects a higher concentration in industry and thus reflects lesser competition. Similarly, a lower HHI score would entail a good match for firms in an industry. A value closer to 10,000 or 1 would indicate monopoly, and a weight more relative to 0 would mean healthy competition and almost null concentration among firms.

Every economy strives to make its general marketplace more effective and competitive so that anybody who wants to do business can access all the required resources. Sometimes, firms or companies try to impose their dominant position in an industry and harm the small players directly or indirectly, affecting the environment and discouraging healthy competition. Regulatory bodies and watchdogs continuously look for these scenarios that could increase concentration in any industry. The motive is not to prevent a large market share but to prune some practices that generally affect competition.

HHI considers the relative size of the firms in a market and approaches zero when many firms with relatively equal measures are present. On the contrary, when only one firm is present in a market, it reaches its maximum of 10,000 and indicates the presence of a monopoly. Therefore, HHI is a good tool for assessing the market structure and ascertaining concentration despite disadvantages.

The U.S. Department of Justice and many regulatory bodies worldwide utilize HHI to assess the concentration level in their respective markets, especially for M&A transactions. For simplicity, agencies generally consider following the HHI slab to determine the concentration: -

- HHI less than 1,500 = Competitive Market

- HHI between 1,500 and 2,500 = Moderately Concentrated Market

- HHI equal to or greater than 2,500 = Highly Concentrated Market

In addition, merger transactions that increase the HHI by more than 200 points in highly concentrated markets are likely to enhance market share under the horizontal merger guidelines issued by the U.S. Department of Justice and the Federal Trade Commission.

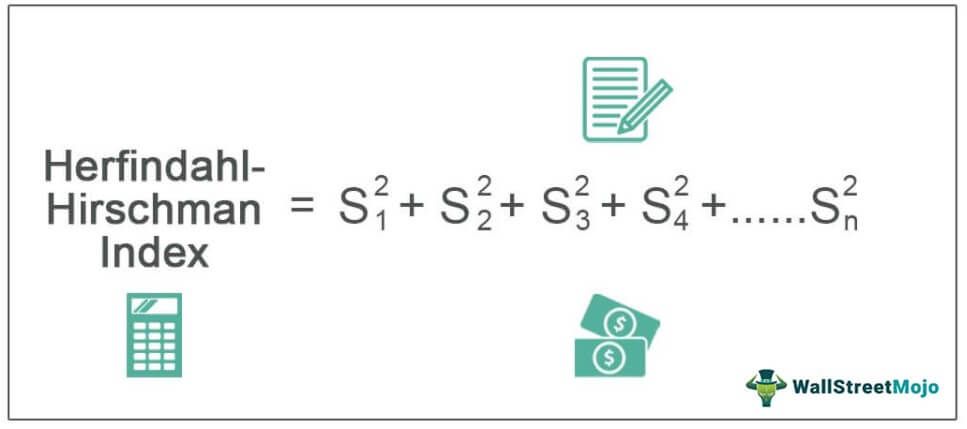

Formula

The Herfindahl-Hirschman Index formula is:

Herfindahl-Hirschman Index = s21 + s22 + s23 + s24 + ….s2n

Where,

sn is the market share of firm n.

Example

Let us consider the Herfindahl-Hirschman Index example to understand how it works:

Suppose we have only four firms in the toy-making industry and below are the respective market shares of these four firms: -

- Market Share of Firm A = 25%

- Market Share of Firm B = 35%

- Market Share of Firm C = 12%

- Market Share of Firm D = 28%

Solution:

Now let us check how to calculate Herfindahl-Hirschman Index:

Herfindahl-Hirschman Index (HHI) = (25)2 + (35)2 + (12)2 + (28)2

= 625 + 1,225 + 144 + 784

Herfindahl-Hirschman Index (HHI) = 2,778

Since the score is higher than 2,500, this would represent that our toy industry is highly concentrated, and healthy competition is not visible.

You can refer to the above given Excel template for the detailed calculation of the Herfindahl index.

Relevance

The primary advantage of Herfindahl-Hirschman Index data is its simple calculation and less dependency on huge data sources. Rather, HHI calculation only requires a handful of data to assess the viability and provides a good direction and starting point for further analysis.

A major disadvantage of HHI is also its simplistic nature. Since the formula is simple, it fails to undertake various market adversaries and complexities present in today's market structure, especially around M&A transactions.

Limitations

Generally speaking, in addition to the disadvantage of simplicity, HHI also suffers from various limitations, which would emphasize a careful consideration of all the persistent factors before its application. That means HHI cannot be implemented for all industries directly and can be effective only when all the relevant factors are considered.

For instance, firms may appear to have less market share in a particular industry, which could be competitive. Still, these firms could hold dominant positions in a specific geographic area or country, not indicating the HHI score. So, there is a limitation in defining the scope and market, making the analysis and observation less effective. E.g., the U.S. automaker industry might seem to be competitive with less concentration but a particular firm, let us say, Ford, might have a dominant position in a specific country, e.g., South Africa.

Also, the limitation of defining a market persists in a scenario where intra-industry competition is present in a specific market. E.g., a particular market might appear to be competitive with the analysis of a low HHI score. On the other hand, however, a specific firm might hold a dominant position within a particular segment of the market or product with which the firm deals with. E.g. in the tech industry, the HHI score might be low due to many players' availability and decent market shares.

But a particular firm like Google might hold a dominant position in a specific market segment, e.g., Search Engine. Alternatively, if we define our scope and focus on the search engine market only, instead of the generalized tech world, we would find that Google holds a significant market position and dominates the industry.