Table Of Contents

Round Tripping Meaning

Round Tripping is an unethical way to inflate revenues by swapping assets or shell transactions, usually on a no-profit basis through a mutual settlement or an agreement. In the process, one entity sells assets to another entity to show revenue generated, while promising the latter to buyback the same assets at a later stage.

Round tripping is the process that covers this whole cycle of selling and buying back the same assets only to increase the revenue figures of the company. For example, cloth dealers can enter into a round-tripping transaction with dealers of machinery to increase the revenue at a no-profit basis upon mutual consent or an agreement to reverse the transaction in the next period.

Key Takeaways

- Round tripping is an illegitimate way to boost earnings, by trading shell transactions or assets. It is mostly done on a no-profit basis or mutual agreement.

- Round tripping benefits the organization by inflating the revenue to demonstrate the organization's expansion,

- to demoAnstrate that the company is conducting more business than rivals, and to trick and entice investors.

- Round tripping is an induced fictitious growth that deceives investors into believing the company is a growth-generating enterprise.

Round Tripping Explained

Round tripping is an unethical process using which a company can derive sales and revenue figures that may not be genuine yet appear to be real. In this mechanism, a company sells all its assets to the other individual or entity. Doing this, the sales figures of the former increases to a significant level. However, the trick in this process is that the sale happens against a condition of buying back the same at a later stage from the one it is sold to.

This way, the company notes an increase in the sales and revenue figures for a specific period and once the figures are officially recorded, it buys the same assets from the buyers again. It is like keeping the assets of one party and returning the same to it once the purpose is served. So, the company does not lose the asset and at the same time, reflects better revenues.

In trading, round tripping is an illegal practice of showing off an increased volume of trades. This becomes the process in which the same shares are sold and purchased over and over again so that the players and participants in the market get a false idea of a security being in higher demand, though it’s not the real scenario. However, this ingenuine increase in the figures does not affect the companies behind the security in any manner. In short, it is a market manipulation technique that is used to reap benefits by reflecting falsely risen figures.

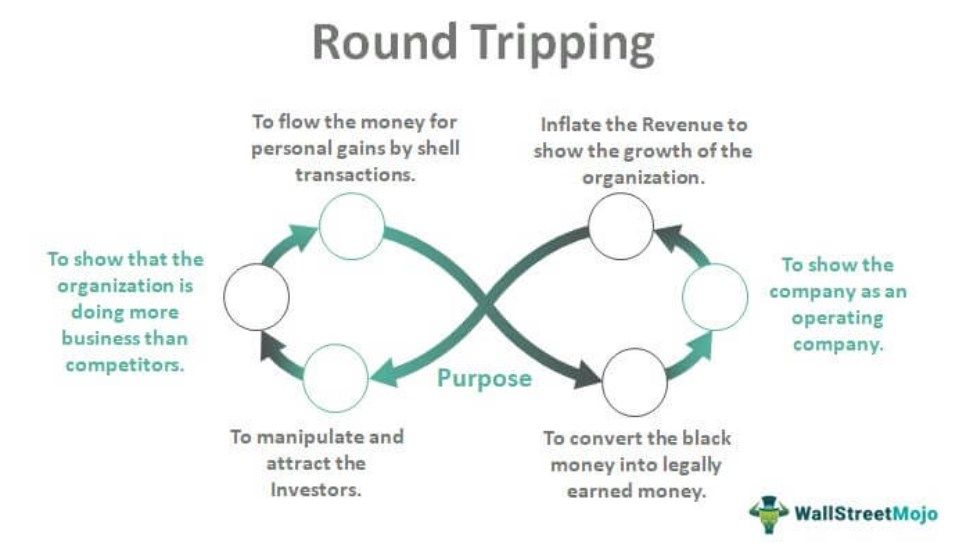

Purpose

When the companies opt for round tripping, it is mostly to ensure they could show better revenue generation. Though the process is misleading, it proves to be beneficial to those who use it. There are multiple purposes that this mechanism serves.

Let us have a look at few of the objectives of round tripping:

- Inflate the Revenue to show the growth of the organization.

- To show that the organization is doing more business than competitors.

- To manipulate and attract Investors.

- To flow the money for personal gains through shell transactions.

- To convert black money into legally earned money.

- To manipulate stock prices and perform insider trading to earn secret profits.

- To show the company as an operating company.

Examples

Let us consider the following examples to understand the concept better and also learn about how this works:

Example 1

Mr. A doing business with pipes comes to A Inc. is dealing in servicing of pipes, repairs, etc. with a proposal to buy the pipes from him 100 pieces of $ 10 each amounting to $ 1000, and in return, he will purchase the old pipes which need repairs from A Inc. for $ 5 each, 200 pieces. This transaction is called a round-tripping transaction. It looks like barter transactions, but it is done at cost and for the mutual benefit of the parties involved with no profit.

Example 2

In April 2023, Forbes raised doubt on Crypto firm Ripple’s sales volume as recorded and reflected in its account books. According to the publication ace, the company seemed to have adopted some misleading methods, possibly round tripping, to derive false revenue figures. On the contrary, the company claimed to have recorded a genuine increase in the sales volume and overall progress, identified by the introduction of new money transmitters in the Middle East and Asia.

Reasons

Round tripping might not be a justified way of increasing revenue, but it still makes organizations opt for it. Listed below are some of the reasons that make entities choose this mechanism to show off better revenue figures:

- To represent the organization as busy doing business and growing.

- To attract investors by showing the growth graph.

- To make the secret profits in the form of shell transactions through a round tripping business.

- To make the accounting statement attractive and impressive to the investors.

- To show the organisation as the operating one to prevent consequences and legal formalities to be performed in intraoperative organisations.

- To save from the various taxes by investing through foreign investors, as tax for foreign investors is less in some countries.

- To inflate the stock price of the company.

Benefits

In most cases, round-tripping is bad and used to make secret profits by various means. But on the other hand, the round-tripping business, if done in good faith, proves to be beneficial for the organization.

Let us have a quick look at the advantages below:

- The government uses round-tripping in times of recession to increase money flow in the market.

- Such transactions can be used as a tax planning tool by large organizations. Tax planning is considered legal, and it does not mean tax evasion.

- It is used to increase liquidity in the market when situations are adverse.

- The Government effectively uses it in policies to bring back the money routed outside the country.

Limitations

Round Tripping is used to flow the money and use it for personal gains. It is considered unlawful in most cases. The organization uses it to evade taxes and convert black money into white money.

Listed below are the disadvantages of the round tripping mechanism:

- Illusory growth due to round tripping manipulates the investors and presents the organization as a growth-making organization.

- It is used to inflate the market capitalization for a temporary period by the stock market players and insider traders, which is illegal.

- It violates the accounting norm of substance over form, i.e., the economic significance of the transaction is essential rather than just the legality of the transaction.

- From a global point of view, it is used for tax evasion and money laundering.

- It is used to meet the revenue benchmark even though transactions are done at no profit and mutual settlement with the suppliers or third parties.