The differences are as follows:

Table of Contents

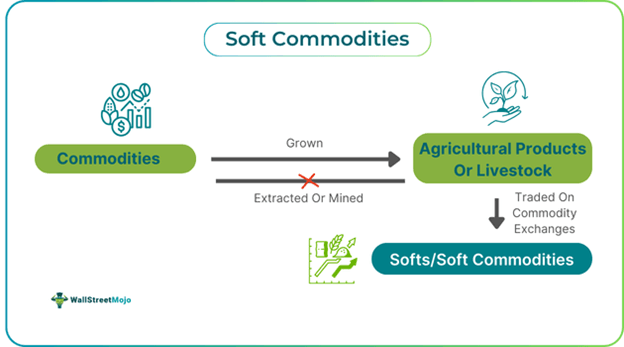

Soft commodities are products that are grown, such as agricultural goods or livestock. They are characterized by their reliance on natural elements for growth and production, and they are not obtained through mining or extraction.

Soft commodities, also known as softs, play a crucial role in the global economy. They are essential in manufacturing, energy generation, and food production. These commodities are traded on commodity exchanges or through over-the-counter (OTC) platforms. Due to their reliance on natural factors, soft commodities are often subject to price fluctuations, making them a key focus for both traders and investors.

Key Takeaways

Soft commodities are produced through cultivation. As essential goods, they are critical to the global food supply chain, feeding the world's population and serving as key raw materials in various industries. These commodities include agricultural products such as crops, livestock, and other primary goods that require careful management of natural elements for their growth.

The production of soft commodities largely depends on environmental factors specific to each country. Numerous elements impact the soft commodity market, and traders engage in this market to speculate on price trends and potential profits. Key factors influencing commodity prices include weather conditions, global policies, trade regulations, and crop diseases. Additionally, shifts in demand may occur due to changing consumer preferences, delivery challenges, or issues like soil degradation. These commodities' essential nature and limited availability create significant trading opportunities for traders and investors.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Soft commodities are traded on formal exchanges and through over-the-counter (OTC) platforms. Trading can be done using instruments such as stocks, ETFs (exchange-traded funds), and other financial products.

Trading in commodities is often more suited for those with a higher risk appetite. Investors are drawn to soft commodities due to their sustained global demand, their potential as an inflation hedge, and the opportunity to diversify portfolios. However, the perishable nature of these goods, combined with regulatory and seasonal risks and price volatility, can reduce their attractiveness as long-term investments.

Trading soft commodities generally involves the following steps:

Let us look at some of the examples to understand the concepts better.

Imagine Dan, a trader interested in soft commodities. Out of curiosity, he checks the list of available soft commodities traded in the market, including corn, sugar, cotton, and wheat. From this long list, he chooses wheat, reasoning that it is widely consumed by a significant portion of the world’s population. Dan decides to use CFDs (Contracts for Difference). The market price for 1 CFD of wheat is $200. His target price is $250, and he sets a stop-loss at $170. Suppose the price moves to $210, and he buys 100 CFDs; the profit he could make on each would be $10. He could choose to exit the position with minimal profits or wait for the price to reach his desired target.

The demand for economic growth in Africa is increasingly directing attention toward agriculture, particularly soft commodities like cocoa, cotton, and cashew nuts. While African nations are the largest producers of cocoa, exporting it primarily in its raw form limits potential profits and job creation. By focusing on value addition—processing these commodities beyond basic levels—Africa can enhance local consumption and improve producers' bargaining power, ultimately fostering a more robust manufacturing sector.

Investing in Africa's soft commodity sector offers local and international investors significant opportunities. The continent has higher potential returns compared to other regions, driven by its abundant natural resources and a growing middle class. Countries like Ghana are beginning to recognize the benefits of enhancing the value of their soft commodities and are adapting policies to attract investment, presenting a chance for businesses to capitalize on this high-reward environment.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

The differences are as follows:

| Particulars | Soft Commodities | Hard Commodities |

|---|---|---|

| 1. Concept | Agricultural products | Mined or extracted products |

| 2. Influencing Factors | These commodities are influenced by weather conditions, global demand, and crop yield. Additionally, they are affected by national and international politics and policies. | Hard commodities are affected by extraction costs, geopolitical events, and other issues. |

| 3. Investment Pathways | They can be invested in and traded through futures contracts, hedging short-term opportunities, and ETFs. | Hard commodities can be traded and invested in through assets, futures, ETFs, etc. |

| 4. Perishability | These commodities are perishable and, hence, have relatively short shelf lives. They require storage and maintenance facilities. | Hard commodities are not perishable and may require suitable storage facilities. |