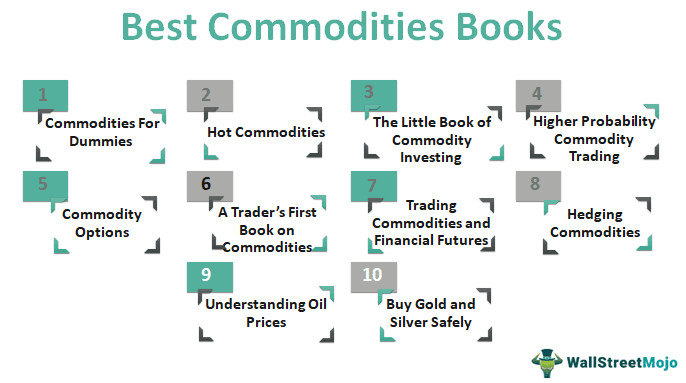

19 Best Commodities Trading Books [2025]

We have a list of commodities books that introduce beginners to the basics of this market, helpful trading strategies, and basics of commodity futures alongside detailed discussions on its future potential for growth and tools and techniques available for managing the element of risk. Below is the list of such commodities books:

- Commodities For Dummies ( Get this book )

- Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market ( Get this book )

- The Little Book of Commodity Investing ( Get this book )

- Higher Probability Commodity Trading ( Get this book )

- Commodity Options: Trading and Hedging Volatility in the World's Most Lucrative Market ( Get this book )

- A Trader's First Book on Commodities: An Introduction to the World's Fastest-Growing Market ( Get this book )

- Trading Commodities and Financial Futures ( Get this book )

- Hedging Commodities: A practical guide to hedging strategies with futures and options ( Get this book )

- Understanding Oil Prices: A Guide to What Drives the Price of Oil in Today's Markets ( Get this book )

- Buy Gold and Silver Safely: The Only Book You Need to Learn How to Buy or Sell Gold and Silver ( Get this book )

- A Trader's First Book on Commodities ( Get this book )

- Guide To Investing in Gold & Silver ( Get this book )

- Stack Silver Get Gold ( Get this book )

- The New Case for Gold ( Get this book )

- Crude Volatility ( Get this book )

- Trade Stocks and Commodities with the Insiders: Secrets of the COT Report ( Get this book )

- Energy Trading & Investing ( Get this book )

- The Colder War ( Get this book )

- Commodity Options ( Get this book )

While this discussion provides a solid overview, engaging with more in-depth material can significantly enhance this comprehension. Many find that this Commodity Trading Fundamentals Course complements this knowledge perfectly.

Let us discuss each commodity book in detail and its key takeaways and reviews.

#1 - Commodities For Dummies

by Amine Bouchentouf (Author)

Book Summary

This top commodities book is an excellent introductory work on trading and investing in commodities. It helps understand the risks involved in the commodities market and how to deal with them efficiently. Often, average investors ignore or avoid the commodities market for lack of know-how to identify and manage risks and develop a successful strategy. Still, this work offers a roadmap for these investors to succeed in this enigmatic financial market. Readers would also be able to learn ways to diversify their portfolio in commodities and how exactly this market differs from the others. The work also offers an insight into investing in energy and metals, two of the most sought-after classes of commodities, along with helping acquire the basics of commodity futures. It is a complete step-by-step approach for beginners to understand the breadth and scope of the market and start investing and trading in it with greater confidence.

Takeaways

An excellent introduction to commodities as a little-understood market that helps investors diversify their portfolio relatively easily. Readers would acquire an understanding of the risks associated with trading and investing in commodities, along with updated information on SEC guidelines. In addition, this work offers valuable insights into trading in energy and metals and the basics of trading in commodity futures. It is a perfect beginner’s guide to investing and commodity trading.

#2 - Hot Commodities:

How Anyone Can Invest Profitably in the World's Best Market

by Jim Rogers (Author)

Book Summary

This best book on commodities is an excellent work on the commodities market, usually ignored by investors for the lack of proper understanding of what is needed to succeed here. The author, an expert on commodities himself and who successfully managed nothing less than his commodities index fund, offers practical advice to investors who have yet to consider commodities a long-term investment option. This work would help create a fundamental understanding of commodities and how this market works, starting with the fundamental laws of supply and demand, which directly impact the prices of commodities, along with laying stress on the study of cyclical and historical trading patterns which reveal a great deal about their long-term market behavior. It is a perfect companion for those willing to take advantage of investment opportunities presented by this unique market while carefully weighing and managing the risks involved with the help of well-defined trading and investing strategies.

Takeaways from this Top Commodities Book

It is an ideal introduction to this market that adopts an uncomplicated approach to explaining the basics of commodities and how one can trade in them profitably in the long run. The author busts several myths along the way, including the common belief that commodities are unreliable by nature or that this market is not suited for long-term investment. It is an excellent read for anyone interested in acquiring a workable understanding of the commodity market and getting started without much ado.

#3 - The Little Book of Commodity Investing

by John Stephenson (Author), John Mauldin (Foreword)

Book Summary

This best book on commodities is a complete yet concise guide to investing and commodity trading as a viable alternative to preferred choices of stocks, bonds, and real estate as one of the fastest-growing markets. The author argues how commodities shape financial markets and how, in large developing economies, metals, energy, and agri-commodities acquire a whole new significance, which needs to be understood carefully. This work not only explains the basic concepts related to commonly traded commodities but also builds on some fundamental ideas while discussing the unexplored potential of this massive market. On top of it all, this serves as a pinpointed guide to help understand why commodities are the next big thing and how to invest in them correctly.

Takeaways

A quick introduction to commodities takes readers straight to the heart of the matter, explaining the fundamentals and the significance of commodities as a market in the modern financial industry. The author makes it amply clear how it is relatively easier to understand commodities than stocks and bonds. Still, the rewards could well outdo what any of the conventional investment choices might offer. A no-frills approach to investing and trading in commodities and how it can help one become a good investor in the long run.

#4 - Higher Probability Commodity Trading:

A Comprehensive Guide to Commodity Market Analysis, Strategy Development, and Risk Management Techniques Aimed at Favorably Shifting the Odds of Success

by Carley Garner (Author)

Book Summary

Commodity trading has become as sophisticated as other markets, and this elegant work explains some of the advanced strategies and investment approaches to commodities. Usually, investors think that options and futures have greater relevance while dealing with equity and debt instruments. Still, this author discusses practical tools and techniques for efficiently trading commodity options and futures. What sets apart this work is the rare synergistic approach of bringing together fundamental, technical, seasonal, and sentiment analysis to anticipate market price changes with greater accuracy—a path-breaking work on advanced mathematical techniques for trading in commodities.

Takeaways

A novel exposition on commodity trading discusses how to utilize several analytical techniques to minimize the risk associated with commodities. The author goes the extra mile to elucidate the principles of commodity futures and options and how one can develop an understanding of advanced techniques for commodity trading.

#5 - Commodity Options:

Trading and Hedging Volatility in the World’s Most Lucrative Market

by Carley Garner (Author), Paul Brittain (Author)

Book Summary

This book on commodities work demystifies commodity options trading for average investors to help them manage risk better. Despite a high level of market volatility, traders can learn how to set it off to an extent with precise options and strategies devised to change the odds in one’s favor. In addition, readers can discover how commodity options fundamentally differ from stock options, which is why conventional options strategies targeted at equities often fail when dealing with commodity options. Complete work on commodity options trading would help readers further evolve their understanding of this subject and its intricacies.

Takeaways

A commendable work on commodity options trading lays bare the differences between equity and commodity options apart from discussing practical strategies for commodities. This work also discusses how to hedge market volatility and identify the right kind of opportunities for trading. A highly recommended read for students and professionals alike.

#6 - A Trader's First Book on Commodities:

An Introduction to the World’s Fastest-Growing Market

by Carley Garner (Author)

Book Summary

An eye-opening revelation on the commodity market by an expert in the field explains how an average investor can trade in commodities without mistakes incumbent on a newcomer. This work introduces readers to a wide range of concepts, tools, and techniques that one can utilize to successfully trade in commodities depending on their exposure to dealing with specific types of commodities, level of experience, and risk capital, among other things. To help explain the risks involved with greater clarity, the author has discussed the failure of MF Global and PFGBest and what it means for investors. The work offers the latest information on technological changes and advanced techniques for commodity trading and how traders can become equipped with the right tools to manage risk efficiently and make the right trading decisions.

Takeaways

An ideal introductory book on commodity trading that takes the readers through every measured step, carefully weighing the pros and cons of commonly applied trading and investing strategies. The author also discusses the more considerable appeal and potential of the commodities market, along with a detailed analysis of well-known fund failures—a must-read for every entry-level trader and anyone interested in the commodity market.

#7 - Trading Commodities and Financial Futures:

A Step-by-Step Guide to Mastering the Markets (paperback) Paperback

by George Kleinman (Author)

Book Summary

A powerful introduction to commodity futures helps understand the rise of the commodities market in recent years, how it functions, and why you should invest in it. It is no longer the domain of those who specialize in commodities. An average investor and trader can acquire knowledge of the basics of commodities and trade profitably within a relatively short period. Usually, those who invest in equity or debt securities are wary of commodities as a somewhat risky and unpredictable market. Still, this work lays these fears to risk by systematically exploring every aspect of commodities and even goes ahead to acquaint the readers with the futures market in commodities which was commonly perceived to be off-limits for those new to commodities. For a beginner’s work, it offers several advanced trading strategies for traders and ways to personalize them successfully.

Takeaways

Exciting work on commodity futures aims at beginner to intermediate-level traders and investors in the commodities market. The author builds up the logic behind rather sophisticated trading strategies applied in the futures market for commodities from the very basics to help readers understand what is going on. However, what makes this work a perfect addition to everyone’s collection is the clarity with which these complex concepts are spelled out for an average investor to understand and apply to make good profits while managing risk efficiently.

#8 - Hedging Commodities:

A practical guide to hedging strategies with futures and options

by Slobodan Jovanovic (Author)

Book Summary

Challenging the common perception that hedging is a complex tool not fit for newcomers or average investors, this work outlines a successful approach to hedging in the commodities market. Hedging commonly utilizes for neutralizing risk, but when it comes to practice, only some traders and investors make it a point to manage risk efficiently by using hedging techniques. One of the most common reasons is a lack of awareness and proper knowledge of tools and techniques employed for the purpose. This work intends to fill that gap and help traders explore futures and options in the commodities market. To achieve this, the author presents critical concepts through illustrations, utilizing tables, diagrams, and visual patterns to convey ideas and techniques more efficiently—a valuable learning resource for amateur and professional traders.

Takeaways

Going beyond the rhetoric, this work intends to teach helpful hedging strategies for the commodities market utilizing powerful examples and illustrations. Readers would learn the value of hedging as a risk management strategy on a broader level and discover a wide range of successful strategies through tables, diagrams, and visual patterns designed to help understand and compare varied strategies without much effort—an essential work on commodity futures and hedging techniques for the novice as well as experienced traders.

#9 - Understanding Oil Prices:

A Guide to What Drives the Price of Oil in Today's Markets

by Salvatore Carollo (Author)

Book Summary

This top commodities book addresses the most fundamental questions concerning the oil industry and its functioning. First, the author questions the commonly accepted line of reasoning behind the rise and fall of oil prices and cites the 2008 crisis as a case in point when commonly accepted theories fell flat on their face, failing to explain how oil prices plummeted from $144 to $37 per barrel. He proposes that the oil industry is governed and shaped by a wide range of factors, usually not considered by investors. Finally, he discusses how the oil futures market became detached from the crude market in 2000, leading to unprecedented speculative investments in the industry. Overall, excellent work on how the oil industry works and how to study critical economic and geopolitical factors driving the industry for over four decades can help professional investors immensely.

Takeaways

It is a path-breaking approach to understanding the intricacies of the oil industry and the actual reasons behind global oil price changes. In a bold move, the author discards some of the most common reasons cited by industry and media for the sudden rise and fall in oil prices. Instead, it proposes how ill-conceived government policies, financial speculation, and massive disinvestment in refinery capacities have shaped the industry over the years. It is an eye-opening work on the oil industry for professional commodity traders, investors, policymakers, and the media.

#10 - Buy Gold and Silver Safely:

The Only Book You Need to Learn How to Buy or Sell Gold and Silver

by Doug Eberhardt (Author)

Book Summary

This best book on commodities trading introduces the average investor to the how and why of investing in gold and silver and discusses successful strategies. Usually, people need to learn more about gold and silver to manage their risk efficiently and, for fear of entering unknown territory, miss out on great opportunities to diversify their portfolios with the help of gold and silver. The author lays down some basic rules that would help investors navigate their way successfully through the maze of risk and opportunities ahead of them in precious metals investing. It also covers a basic understanding of the commodities market as a whole and how one is supposed to diversify their complex portfolios with the help of some reliable commodities. It is a must-read for every investor who wishes to make the most of long-term growth opportunities in this market.

Key Takeaways

It is a concise but reliable guide to understanding the principles behind investing in gold and silver: two of the most common precious metals that everyone knows without knowing how to profit from. The author has successfully presented these precious metals as valuable for diversifying any investor's portfolio. This work has all you need to know about the price changes for these precious commodities and how to manage the risk efficiently.

#11 - A Trader's First Book On Commodities

by Carley Garner

Book Review

One can make huge profits by trading commodities. However, significant practical knowledge of the associated risks and market characteristics before commencement. This commodities trading book is a simple, helpful, and valuable guide for new traders in the commodities market. The following aspects have been successfully highlighted, drawing on the vast experience of the author:

- Master the basics of trading commodities and avoiding mistakes for beginners

- Get what is needed and prevent losses for things that are not required

- Predicting prices, managing risks, and making trades reflecting the analysis

- Know what one is buying, its costs, and the risks and returns it can offer.

Key Takeaways

This commodities trading book offers specific guidance on calculating profit, loss, and risk in commodities and choosing the best brokerage firms. In addition, it will aid in decoding the industry's colorful language and walking through the entire trading process. Sufficient coverage is given to critical topics such as trading plans, handling of margin calls, and even maintenance of emotional stability as a commodities trader. It is a highly recommended commodities trading book for new traders.

#12 - Guide To Investing in Gold & Silver

by Michael Maloney

Book Review

This commodities trading book will focus on the importance of Gold and Silver as an investment in the overall portfolio. It will tell the readers about-

- The essential economic cycle of history that makes gold and silver the ultimate monetary standard.

- How are the governments driving inflation by diluting the money supply and weakening the money supply?

- The reason why precious metals are one the easiest, most profitable, and safest investments that one can make.

- Where, when, and how to invest money and realize maximum returns irrespective of the economy

- Essential advice on avoidance of intermediaries and taking control of financial investment and portfolios by making the investments directly into the market.

Key Takeaways

The author highlighted the historical background of paper currency, precious metals, and economics. The aspect that has gained a lot of attention is how the Western civilization could lead the entire financial world into a downward spiral and how in such a time, the accumulation of precious metals will offer non-parallel benefits. It is a highly recommended commodities trading book for any investor on protecting wealth under unforeseen circumstances.

#13 - Stack Silver Get Gold

by Hunter Rilley III

Commodities Trading Book Review

This book on commodities trading is appreciated for its simplicity and the experience of the author, who has an experience of over 15 years of trading gold and silver under its belt. It will reveal all the street-smart tactics an investor must know for investing in gold and silver. One will have answers to various aspects, such as:

- Seven types of gold and silver bullion to buy and liquidate quickly if required.

- Eleven types of gold and silver to avoid.

- Most secure places for securing precious metals.

- How to store precious metals in another country by installing an offshore storage system.

- The clear strategy towards investment in metals and bullion

- The various tax strategies, IRS reporting requirements, travel restrictions, and how to maximize benefits. Investors must know about financial rules and governing bodies such as FATCA, FBAR, and other gold and silver rules.

- It will also highlight the tackling of investments to be made online and to monitor the performance constantly.

- Extraction of benefits by including gold and silver bullion in 401 (k)

#14 - The New Case for Gold

by James Rickards

Book Review

In one of the boldest attempts to publicize the value of Gold around the globe, this book on commodities trading states how gold is an irreplaceable store of wealth and a standard of currency. As most the macroeconomic factors cannot be predictable, gold is one of the most prudent assets to own and the essential wealth preservation tool for banks and individuals. The author has specifically laid focus on historical case studies, monetary theory, and personal experience as an investor to state:

- The panic posts the Global Financial crisis of 2008 and how it can lead to another problem taking birth.

- The possible situation of how panic buy could set in and how only Central Banks, Hedge funds, and other big players will be able to buy and retain gold as a commodity.

- If Gold is monitored and controlled continuously, there will never be an artificial scarcity of the same, and one can define a stable non-deflationary price.

Key Takeaways

The book is concise, most factual and the arguments presented are based on sound economic principles. Various scenarios are presented of how they could unfold without making predictions. Suggestions have also been made to invest only 10% of investable assets in gold to minimize losses in uncertainty.

#15 - Crude Volatility

by Robert McNally

Book Review

Since OPEC has loosened its grip over the pricing of oil and its commodities, the oil market has been rocked by wild price swings, which have not been witnessed over multiple decades. The prices rose to $145 per barrel in 2015 and touched a trough of $25 in 2016-17 due to numerous macroeconomic situations. This book on commodities trading explains past periods of stability and volatility in the prices of oil aid in understanding the boom-bust era. Such levels of volatility have been considered a punishment that inflicts pain not only in the oil industry but also in the broader economy and geopolitical landscape. The author helps connect the dots on how oil has become central to the financial world and why it is subject to extreme fluctuations in price.

Key Takeaways

It offers an excellent overview of the market cycle in this industry in a journalistic style while addressing various controversial theories such as 'peak oil' or the role of OPEC and the US Shale industry in the most recent glut. Additionally, light has been cast on the logical analysis of demand and supply and how the lags in increasing and decreasing production within the oil industry lead to the inevitable booms and bust cycles witnessed around the globe.

#16 - Trade Stocks and Commodities with the Insiders: Secrets of the COT Report

by Larry R Williams

Book Review

One of the most successful traders, Larry R Williams, reveals industry secrets that offer guidance to investors and traders for successful investment and side-by-side trading with more considerable commercial interest worldwide. Readers get introduced to the COT (Commitment of Traders), one of the best resources for achieving trading success. It systematically walks the readers through the use of the information contained in the COT to set up trades. It even discloses a new indicator claimed to be more potent than any other index related to the prepared COT report.

Key Takeaways

The book circulates the intelligent people making money in this industry over the past decades and how one can profit from their actions – whether one is interested in agricultural commodities such as soya beans or the new breed of financial commodities such as currency and stock market indices. The investors can focus on the actual market conditions affecting price changes, which involve large buying and selling and demand/supply pressure.

#17 - Energy Trading & Investing

by Davis Edwards

Commodities Trading Book Review

Energy is one of the global market's most vibrant and essential sectors. Volatility in the prices of the energy sector and changes in the industry offers attractive investment opportunities for savvy investors and dangers for the uninformed ones. The author provides detailed information on every topic critical to energy investors, including -

- Natural gas, electricity, petroleum, coal, weather, and emission markets.

- Details on various financial products, including derivatives.

- Examples of deal structuring explaining spread options, spatial load forecasting, and tolling agreements.

- A practical introduction to market and credit risk and model risk management.

- A detailed explanation of natural gas, storage, logistics, and swing options contract.

- Coverage specialty electric markets, purchase power agreements, and other ancillary services.

Key Takeaways from this Top Commodities Trading Book

It covers a wide range of topics for established and professional traders, retail investors, MBA students, and other participants in the energy market. Several jargon used in the financial and energy markets have been explained smoothly, and the examples are easily understandable to the average reader. In addition, many topics have been mentioned, from traditional and emerging markets to need-to-know financial principles and proven investing strategies.

#18 - The Colder War

by Marin Katusa

Book Review

This commodities trading book looks at how the Western world is ceding its position in the energy market and what steps one can take to prevent it. Russia is now amidst a rapid economic and geopolitical revival under the rule of Vladimir Putin and studying his rise to power, thereby providing the key to understanding the shift in energy trade from Saudi Arabia to Russia. This upcoming rise to power threatens the control of the United States. The following aspects have been stressed throughout this book:

- The rise of Russia to the center of the world's energy market through political coups, assassinations, and Hostile takeover strategies.

- Following the rise of Putin and how it has disturbed the global balance of trade

- Understand how Russia has toppled the Mafia barons to position itself as the most potent force in the energy market.

- A detailed study on the long-range plans of Putin and its potential impact on the United States and the US dollar.

Key Takeaways

This book emphasizes that if Putin's plans materialize, Russia will starve other countries out of power, and the BRIC countries will also replace the G7 in terms of wealth and financial power.

#19 - Commodity Options

by Carley Garner

Book Review

Investors around the globe are discovering the enormous opportunities available through commodities options trading. However, since commodities have different underlying characteristics from equities, such options will also behave differently. This commodities trading book commences on how commodity options work, how they have evolved, and why conventional options strategies tend to fail in the commodity options market. Extensive examples have been used based on my research, and other factors emphasized are -

- The uniqueness of commodity options and what it means to the investors.

- Timing of trading short options and how to manage the commodities risk

- Master strategies designed for diverse market conditions.

- Exploiting short-lived trends through ‘synthetic’ swing trading

Key Takeaways

Certain warnings about specific futures options positions are beyond recognizing the importance to beginners in this area, which is smoothly explained in simplified language. The author carefully outlines the unique environment of the futures markets; lower liquidity tactics employed rather than equities, which can highlight problems in using various strategies. Hence, a beginner should make reference notes from this guide.

AMAZON ASSOCIATE DISCLOSURE

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com