Table Of Contents

Tax Avoidance Meaning

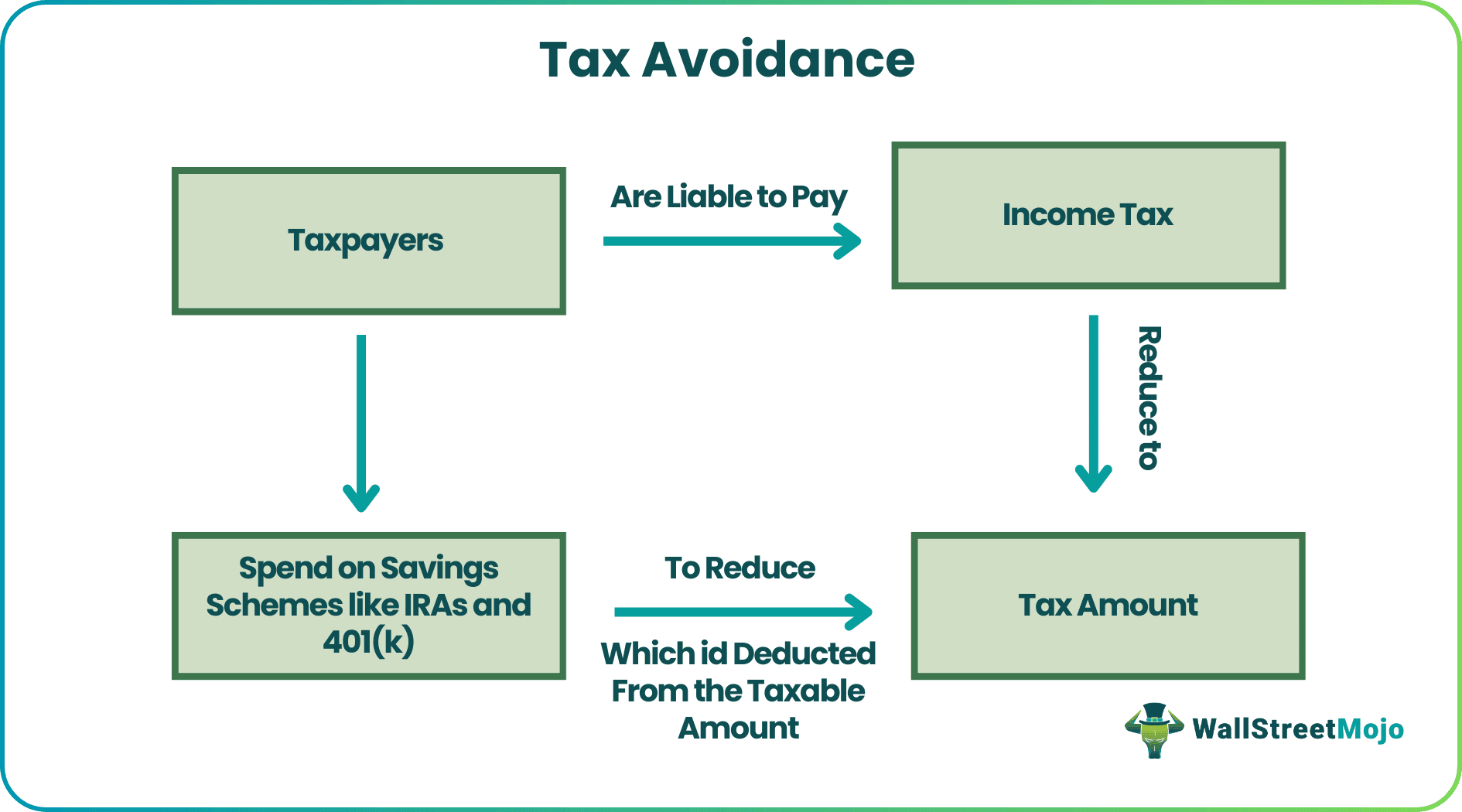

Tax avoidance is the process of reducing the tax payable, given the deductions applicable to taxpayers. It helps reduce the tax burden of individuals and businesses, including major corporates. Avoiding taxes is a legal way of decreasing the tax liabilities of a citizen or business unit in an economy.

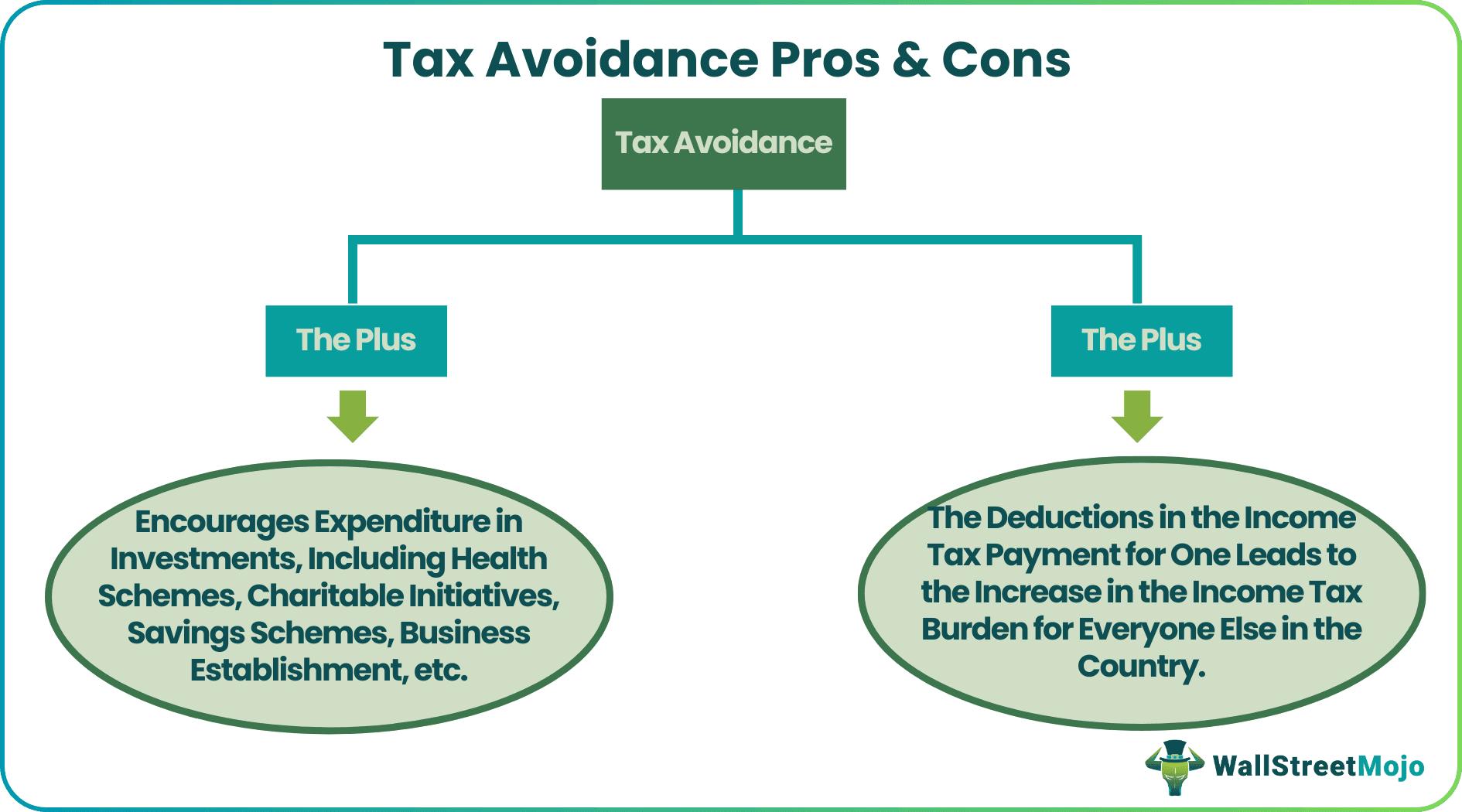

Tax avoidance is different from tax evasion, which involves illegal ways of getting rid of the tax responsibilities or conducting tax frauds. Though it is completely ethical to keep the taxes as minimum as possible using this avoidance process, it is still not recommended as it increases the tax burden for everyone else in the nation.

Key Takeaways

- Tax avoidance reduces the tax amount through deductions and tax credits as applicable to individual taxpayers.

- Some avoidance methods include spending on investments, claiming deductions and tax credits, starting a business, etc.

- When one person avoids tax, it automatically increases the tax burden for the rest of the population.

- It is an ethical and legal way of minimizing the tax burden, unlike tax evasion, involving the false representation of data for evading taxes.

How does Tax Avoidance Work?

Tax avoidance helps individuals and entities adopt legal ways of avoiding their tax liabilities. This is achieved through deductions and credits that an economy allows to the taxpayers. In addition, individuals can prevent tax loads by making tax-advantaged investments, including 401(k)s and Individual Retirement Accounts (IRAs).

Every country has a specific tax law to determine the legal ways of tax avoidance. Depending on those provisions, the individuals and businesses decide how to lower their tax liabilities. The motive behind introducing the tax avoidance schemes is to encourage people’s expenditure on different savings and other charitable initiatives, which people ignore most of the time.

In the attempt to pay less income tax, the individuals and entities try spending more amount into the savings schemes, deducting a portion of their taxable amount to a significant limit. The process is a legitimate way of reducing the tax burden, but it leads to reduced revenue collection for the governments of respective nations. As a result, the tax authorities have to impose extra tax liabilities on the rest of the population to compensate for the losses.

Though it is necessary for taxpaying individuals and businesses to adopt these legal means of avoiding taxes, some might take unfair advantage of it by implementing new ways of avoiding tax liabilities with respect to the legal limits.

Methods

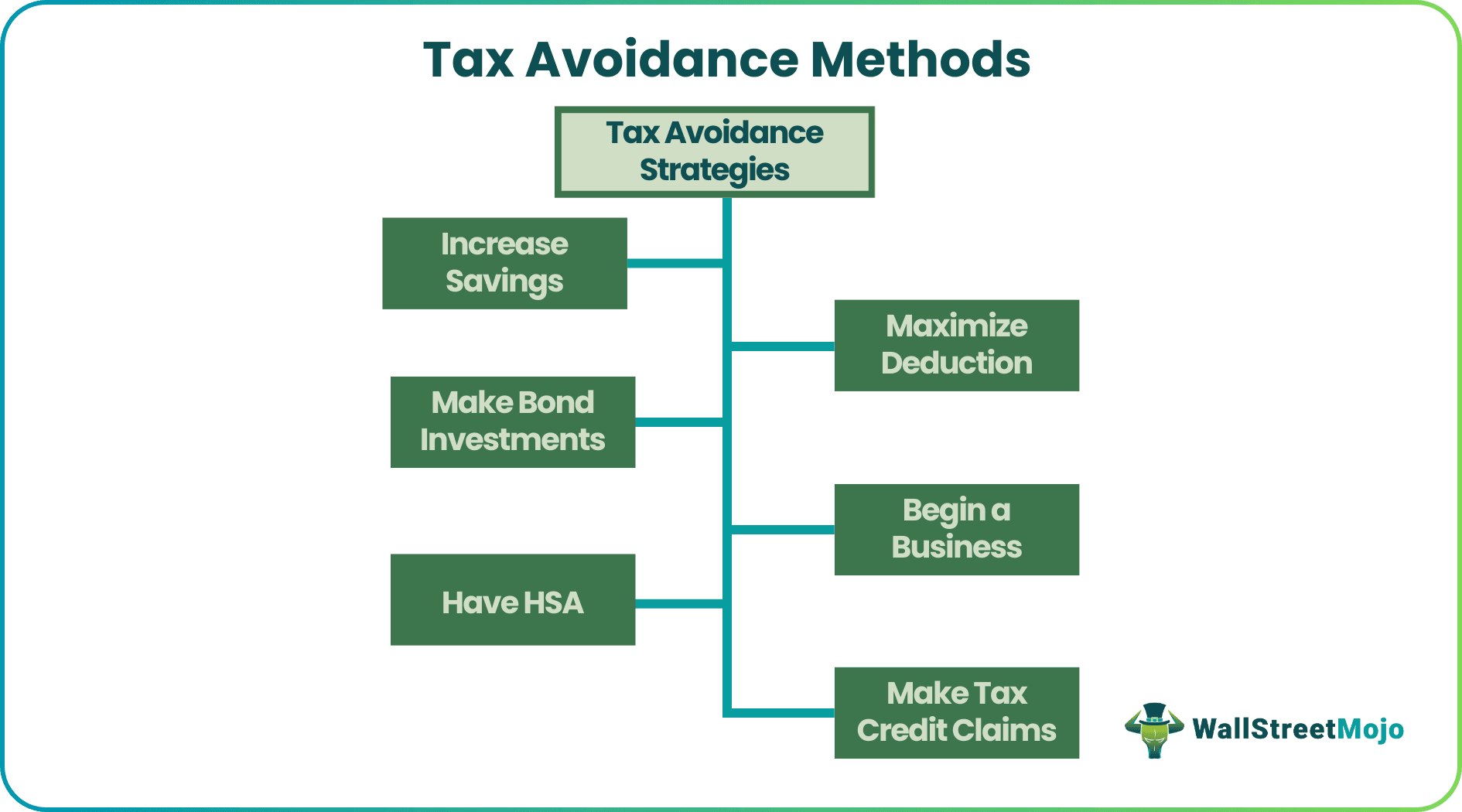

There are various tax avoidance strategies to ensure taxpayers save on their income taxes and make their tax planning accordingly. Some of them have been listed below:

#1 - Savings

Spending on employer-sponsored savings schemes keeps individuals open to tax deductions. For example, IRAs help employees save a portion of their gross income to ensure a happy retirement life and let them enjoy significant tax benefits. For example, US citizens can contribute up to $ 19,000 to a 401(k) scheme if they are below 50 and up to $25,000 if they are 50 and above.

#2 - Deductions

The expenses that remain non-reimbursed could be filed and claimed under the annual tax return. However, this applies to only a specific set of workplace expenses, which are a must for employees to keep performing. Some such expenses include union dues, tools, personal conveyances, etc.

#3 - Investments

The governments allow deductions for investment in certain funds. For example, the mortgage payments are subject to offering tax benefits to the concerned investors. So, taxpayers must ensure making an investment that helps them enjoy some tax deductions. Home equity comes with tax-deductible interest. Individuals are allowed an amount to a limit, depending on their income, which could be used for annual deduction.

#4 - Startup

One of the most efficient tax avoidance methods is to have a startup, as business expenses tend to offer huge tax benefits to individuals. This is because the tax authorities allow all the business-related expenses for tax deductions. However, no personal expenses are included.

#5 - Health Scheme

Expenditures made for paying health, medical, and dental premiums offer tax-deductible advantages to the insurance holders and their dependents. The Health Savings Account (HSA) is a plan that allows individuals to enjoy major tax benefits. One can make payments for health and medical expenses using the insurance coverage and add it to the tax deduction list.

#6 - Tax Credit

The tax authorities let taxpayers claim for tax credits, which sometimes equate to a zero tax liability. This makes tax credit one of the best tax avoidance types for individuals and businesses. The Internal Revenue Service (IRS) has introduced multiple tax credits for taxpayers to claim. Some of these include the Earned Income Tax Credit, Advance Child Tax Credit, Energy Tax Incentives, Tax Relief in Disaster Situations, Federal Tax Deductions for Charitable Donations, etc.

Examples

Let us consider the following tax avoidance examples to understand the concept and the process better:

Example #1

Sarah had an average gross income and is left with a service tenure of 10 years. Hence, she decides to save for her retirement in the Saver’s Credit account. Thus, she starts saving $1000 in the account for a financially stable retirement phase. This makes her eligible for a tax credit of up to half the contribution she made for the plan.

Example #2

Mr. X, Y & Z have the same gross income, but they pay different amounts of tax, and their take-home salaries also differ. The reason is the difference between their contributions to various accounts.

The table above shows that Mr. Y’s take-home salary is reduced by $(40700-36020) = $4680 as he increases his contribution to the retirement funds by $6000. On the other hand, the take-home salary of Mr. X is more, but his retirement fund contribution is less, which would mean a lesser income during retirement.

The comparison, however, is similar for Mr. Y and Mr. Z too. Again, this shows how a healthy contribution to retirement funds will mean a healthy amount after retirement while offering heavy tax deduction opportunities in the present.

Advantages

The benefits of the process are as follows:

- Increases income and savings for individuals and business entities both for present and future

- Betters working capital

- Enhances savings tendency

- Offers tax shelter opportunities

- Ethical way of fulfilling obligations

Disadvantages

The limitations that the process puts on tax authorities include the following:

- Decreases government revenue

- Reduces nation’s growth rate on the nation

- Increases government intervention

- Stricter tax policies

- More government-friendly than citizen-friendly.

Tax Avoidance vs Tax Exemption

Tax avoidance and tax exemption might sound similar, but they are different in many aspects. Though both the processes reduce the tax amount, they differ in legal terms. While tax avoidance is a legal way of reducing the tax to be deducted from the gross income, tax evasion is an unethical and illegal way of skipping tax payments.

Individuals and businesses get an opportunity to avoid taxes by utilizing tax shelters. It means they are free to invest in tax-advantaged schemes and initiatives. On the contrary, evading taxes involves sandbagging techniques where individuals and institutions falsify deductions by underreporting the gross income.