Table Of Contents

What Is A Tax-Sheltered Annuity?

Tax-Sheltered Annuity (TSA) is a form of retirement savings plan in which the contributions made are from the income that has not been taxed. Therefore, the contributions and interest accrued on the same are not taxed during the savings period, while only the withdrawals are taxed.

Such annuity income plans are available for employees of public schools and non-profit organizations. This plan allows individuals to save their part using tax-deferred income. Th Internal Revenue Service (IRS), which wants taxpayers to be responsible enough, still collect their taxable part, but only when the money saved under TSA is withdrawn.

How Does A Tax-Sheltered Annuity Work?

A tax-sheltered annuity plan, also known as 403(b) plan, is a pre-tax retirement investment. It is an investment vehicle that allows an individual, especially employed in a public school or a non-profit organization, to save money from its tax-deferred income. As the name itself implies, it is an investment option that keeps one sheltered from paying taxes as long as individuals save in this scheme. So far as the tax-sheltered annuity taxation is concerned, IRS collects the taxes on these investments, but only when the individuals withdraw the money.

As per publication 571 (01/2019) of the Internal Revenue Service (IRS), the tax authority in the US, the Tax-Sheltered Annuity plan is for those employees who work for the specified tax-exempt organizations and falls under the terminology of 403(b) plans

The benefit is not given to those employees who are a part of the Roth IRA plan. In this case, the withdrawals are not taxable. The part of income contributed to this plan and the accumulated interest on the same are excluded from the taxable income, and only the remaining income is taxed. So basically, Roth IRA and TSA work diametrically opposite ways and are means of when the employee wants to pay the tax.

the TSA is a form of deferring taxes to a later point in time where the beneficiary has a greater ability to pay the same. Till the time the amount is not withdrawn, it is not taxed. Interest accrued during the account before retirement is not taxed either; however, the interest accrued post that is taxable.

Rules

The 403(b) plan is in the hands of the employer, and employees can’t set it up on their own. There are other aspects and rules too that need consideration while exploring the TSA plan. Some of the important guidelines have been segmented below:

Standard Rules

403(b) is a plan that offers numerous benefits to those who invest in the scheme. However, there are certain standard guidelines that an individual and entity both know of. These include the following:

- Eligible beneficiaries include government school or college employees, church employees, and the employees of charitable organizations covered under Section 501(c)(3) of the IRC.

- Both employees and employers can contribute to the account.

- Withdrawal before the allowable date attracts a 10% penalty.

- The annual contribution was limited to USD 19,000 in 2019 and increased to USD 19,500 in 2020.

- There is a provision to make additional contributions for the years in which the contribution was lower than the upper limit.

- The total contribution is limited to USD 57,000 for 2020, which was USD 56,000 in 2019; this includes employer and employee contributions.

- If an employee has more than one retirement savings plan, the combined annual total contribution should be per the prescribed limit of USD 19,500 for 2020.

Contribution Rules

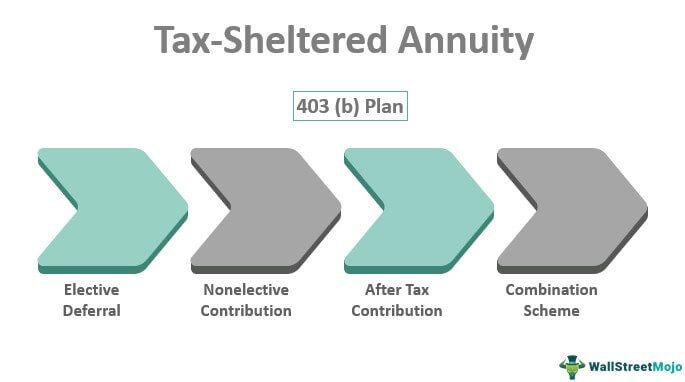

Under the tax-sheltered annuity 403(b) plan, there are various methods of making contributions, based on which the following terminology has been defined:

- Under Elective deferral, the employer deducts his contribution from the employee's salary and direct deposits into the savings account. Roth contributions are taxable while withdrawals are not, while it is the opposite for 403 (b) contributions.

- The non-elective contribution is the employer contribution, which matches that of the employee or is discretionary or might even be mandatory. These don’t reduce the salary and are not taxable until withdrawn.

- At times plans even allow after-tax contributions, and thus the withdrawal of these is not taxable.

- There can even be plans that combine features of all of the above and are sometimes known as a hybrid variant.

Withdrawal Rules

Distribution of the accumulated funds can be made at the occurrence of the following events:

- Once the employee reaches the age of 59 years and 6 months.

- Has been untimely severed from his employment;

- Death of the employee, in this case, his legal heirs, receives the payment.

- Physical or mental disability.

- The described financial hardship would allow distribution if the contribution were made under the effective deferral program.

These withdrawals are taxable entirely under the ordinary income head except if the payments were made to the Roth account.

- A minimum limit amount of interest, if not the entire amount accrued post-1986, should be withdrawn by April 1st of the year when the employee reaches the age of 70 years and six months or when he retires, whichever falls on a later date. The interest amount can be transferred to another employee under the contract exchange provision, and this transfer is tax-free. However, several conditions must be met for such a transfer post-September 24, 2007.

- Instead of withdrawing, accumulated funds can be rolled over to a Roth IRA at the end of the TSA as per the specified rules. Such rollovers get taxed in that year.

Examples

Let us consider the following instances to understand the tax-sheltered annuity definition and how it works:

Example 1

Charles, an NGO staff, opted for tax-sheltered annuity investment option to make sure he has a sufficient income available when he gets retired. For 20 years of his service, he kept the investment amount to the maximum, given the limits set by the authorities. However, in the midst of 2023, he had a personal emergency and hence, he had to opt for withdrawal of the amount in full. As the maturity period was yet to be reached, Charles had to pay the penalty and he received the invested amount after the required deductions.

This is how the withdrawal rules apply on this plan.

Example 2

A December 2023 report depicted the increase in the number of employees opting for 403(b) or TSA plan in 2022, and a considerable drop in the number of people choosing 401k plan, which comparatively offers wider range of investment options to people. According to this survey conducted by Plan Sponsor Council of America further elaborated the information and mentioned that around 83% active employees have trusted this program with one-third of the balances in the investment belonging to the vested employees who are no more associated with their workplaces for some reasons.

According to the report, individuals hardly opted for hardship withdrawals in 2022, despite it being allowed. The hardship withdrawal recorded was 1.6%, a considerable drop from 1.5% in 2021.

Advantages

Making this investment option free from taxes as long as the savings are being made is the feature that makes more and more individuals choose TSA as their retirement plan. After the individuals save for long and it is time to withdraw, they have funds to deal with the applicable taxes. Hence, this plan is convenient for most of the people. Besides this, there are other benefits of the process as well, which include the following:

- The contribution is not taxed in the early years of a person's career when he is building up his financial position, which helps him pay lower taxes and have higher disposable income

- An employer also contributes to the fund, which at times is mandatory for them; this leads to a greater accumulated corpus available at the time of retirement to support the retiree in his old age.

- If all conditions are met, then the interest transferred at the time of retirement is also tax-free, and therefore the tax is deferred to an even later time.

- When the employee faces financial hardships, which fall under the described category, the employee can withdraw the amount without paying a 10% penalty on premature withdrawal.

- Finally, as with all retirement plans, some income is saved for the future, securing retirement needs.

Disadvantages

Though these schemes have a number of advantages associated, there are limitations to it, which also require attention. Given below are some of the demerits of investing in the 403(b) plans. Let us have a look at them in brief:

- At times the tax slab revision might be detrimental, and uncertainty regarding the same becomes a problem because, at the time of withdrawal, the tax rates might be higher than when the contribution was made.

- Premature withdrawal attracts a penalty as per the described rules of the account. Therefore, gathering proof that such a penalty doesn't apply in certain cases becomes tedious and causes stress when there is an urgent need for funds.

- There are caps on the maximum amount that can be contributed to such an account, and the excess amount gets taxed.

- Further, calculating the maximum contribution based upon the given income, if it is below the maximum allowable limit, requires in-depth knowledge of tax law and therefore requires hiring a tax consultant, which can be time-consuming and costly.

Tax-Sheltered Annuity vs 401K

Both these plans are tax-deferred retirement plans made available to employees. However, they may have a similarity with respect to what they aim to achieve, there are multiple differences concerning this similarity they share. Let us have a look at the comparison between the two in brief:

Similarities

- As stated above, both are tax-advantaged options. This investment help individuals save on taxes as long as they do not withdraw the amount. When withdrawn, taxes apply.

- Both are pre-tax accounts that means the amount is deducted for savings before the taxes are deducted from them.

- For both these investments, employers may contribute to the account in addition to what the employees are making.

- Both have contribution limits. Per tax-sheltered annuity limit as well as 401k limit, employees are eligible to contribute up ti $22,500 of their income per the 2023 plan and $ 23,000 per 2024 plan.

- For both the options, there is a penalty applicable for early withdrawal.

Differences

- The TSA or 403(b) plan is the investment option for public sector employees and those employed in a non-profit organization, while 401(k) is the retirement savings plan that are offered to employees of private sector or for-profit firms.

- While the former comes with limited investment options, the latter has a wide range of options available for individual to choose the most fruitful and profitable one. The options available include mutual funds, exchange-traded funds, etc.

- There are less legal boundaries for TSA than the 401k plan. This means that the former does not require abiding by Employee Retirement Income Security Act (ERISA), while the latter must comply with the clauses.