Table Of Contents

Top 4 Types of Joint Venture (JV)

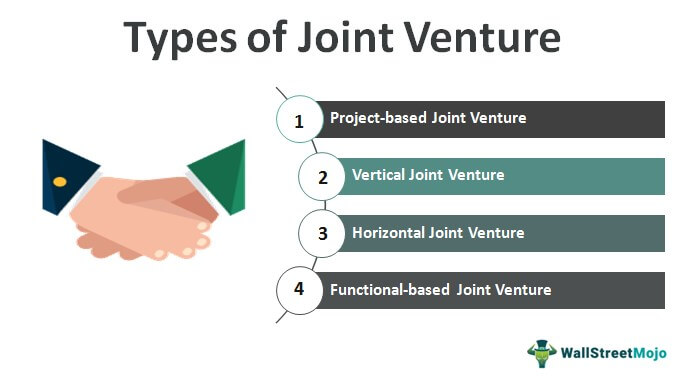

There are mainly four types of the joint venture which includes –

- Project-based joint venture - where the joint venture is done with the motive of completing some specific task.

- Vertical joint venture - where the joint venture takes place between the buyers and the suppliers

- Horizontal joint venture - where the joint venture takes place between companies having the same line of business

- Functional-based joint venture - where the joint venture is done with the motive of getting mutual benefit on account of synergy

Let us discuss each type of joint venture in detail –

Table of contents

- Joint Ventures are of four types, namely, Project-based joint ventures, vertical joint ventures, horizontal joint ventures, and functional-based joint ventures

- The type of joint venture to adopt depends upon each person's case situation and the synergy companies expect to achieve.

- Under a project bases venture, the companies enter into a combined venture to achieve a specific task. In contrast, companies into a functional venture to gain a mutual benefit, and under a vertical combined venture, the deal is between buyers and sellers.

#1 - Project-Based Joint Venture

Under this type of Joint Venture, companies enter into a Joint Venture to achieve a specific task, which can be an execution of any specific project or a particular service to be offered together, Assignment, etc. Such collaboration is usually undertaken between companies for an exclusive and specific purpose only and, as such, ceases to exist once the particular project is completed. In other words, these types of Joint Ventures are bound by time or a particular project.

For Instance, Axon Limited, an industry pioneer in the development of Residential projects, entered into an exclusive Joint Venture with Trump Industries, an industry pioneer in the Marketing and Sales of Residential projects, for their New Project, "Living Rise." Under the said Venture, Axon Limited will construct the Project "Living Rise," and Trump Industries will be the exclusive sales and marketing entity. Such types of Joint Ventures, which are undertaken for a whole project, are examples of Project-Based ventures.

Example

Another example to understand this type of Joint Venture is reproduced below:

Cipla is a traditional pharmaceutical manufacturer and wants to enter the booming biotech business. On the other hand, Biocon is a biotechnology firm. Cipla intends to utilize the research and development resources of Biocon to develop a particular drug for the treatment of some ailment. Now one way to achieve this objective is to buy Biocon. Still, in that case, Cipla indirectly buys many other areas in which Biocon caters, in which Cipla may not be interested. It will also result in an expensive way of gaining the research capability that it intends to gain from Biocon.

To make it a fruitful and synergized Joint Venture, the two companies, namely Biocon, which has research capabilities, and Cipla, which has in place a widespread marketing network, can come together and enter into a project-based joint venture in which the two businesses come together for this one activity and may not necessarily do anything else together in the future. By doing such a venture, both can gain from each other’s resources.

#2 - Functional Based Joint Venture

Under this type of Joint Venture agreement, companies come together to achieve a mutual benefit based on synergy in terms of functional expertise in certain areas, which enables them to perform more efficiently and effectively. The rationale companies focus on before entering such a Joint Venture is whether the likelihood of performing better is more together than doing it separately and more effectively.

Example

Company A specializes in the formulation business and has various patents trademarked under its name but due to lack of funding the company is unable to put such formulation to commercial usage. On the contrary, Company B is a cash-rich Pharma company that lacks in-house patents but holds commercial success experience and has adequate funding capacity. Together, these two companies can mutually benefit and complement each other by entering into a functional-based joint venture.

#3 - Vertical Joint Venture

Under this type of Joint Venture, transactions occur between buyers and suppliers. It is usually preferred when bilateral trading is not beneficial or economically viable. Normally in such Joint Ventures, maximum gain is captured by suppliers, while buyers achieve limited gains. Under these types of Ventures, different stages of an industry chain are integrated within to create more economies of scale. Usually, Vertical Joint Ventures enjoy a higher success rate and deepen the relationship between the Buyers and Suppliers, which ultimately helps benefit the businesses by offering quality products and services to customers at reasonable prices.

Example

Let's understand the same with the help of an example:

Lincoln Corp has invested in certain machinery and capital instruments required to produce Buyer specific products. Since Lincoln makes the investments exclusively to meet the buyer's needs (let's say, Prawn International). By entering into a Vertical Joint Venture with Prawn International, Lincoln Corp can avoid the uncertainty associated with contracts, usually for a specified period only, leading to discontinued business.

#4 - Horizontal Joint Venture

Under this type of Joint Venture, the transaction happens between companies in the same general line of business. They may use the products from the Joint venture to sell to their customers or create an output that can be sold to the same group of customers. Managing a horizontal joint Venture is usually cumbersome and often results in disputes as the alliance is between partners in the same line of business. Also, these types of Joint Ventures suffer from opportunistic behavior between the partners due to being in the same general line of business. Under such types of Joint Ventures, both parties equally share the gains.

Example

Let's understand the same with the help of an example:

Base International is an Indian company that specializes in the steel extrusion business and caters to various industrial units. Frank LLC is a US-based firm specializing in the molding of steel frames which has application in Industrial Units. The two companies decided to enter into a Horizontal Joint Venture under which Frank LLC, the foreign partner, will offer technical collaboration and foreign exchange components. At the same time, Base International, the Indian counterpart, will make available its site, local machinery, and product parts. Together with a new steel extrusion product, the two companies will offer to their existing clients. Thus by this type of Joint Venture, both firms were able to sell the product in multiple markets and gain from each other expertise, thereby putting resources to better usage.

Conclusion

The type of Joint Venture entered into depends upon the circumstances of each case, and the type of synergy companies intend to achieve. Still, no matter whichever type of Joint Venture is opted for, it acts as a stepping stone for companies to analyze and assess how well they work together and open getaways for future collaboration.

Frequently Asked Questions (FAQs)

A joint venture can be between individuals or entities like corporations, governments, and businesses. But, simultaneously, a partnership is often only for individuals.

The parties engaged in a joint venture can claim the tax deductions opposite to business partners, who are liable to pay tax on the partnership profit share at the tax rate.

The joint venture parties must know which employees must be appointed to the business. Suppose employees are not made to transfer to the combined venture entity; they must be removed from the company before the transfer or may be asked to object.

A joint venture is not a legal entity in and of itself. Instead, it is a business relationship between two or more parties who agree to work together on a specific project. Moreover, the parties involved will establish a separate legal entity.

Recommended Articles

This article has been a guide to Joint Venture Types. Here we discuss the top four Joint Ventures, including Project-Based, Functional Based, Vertical, and Horizontal Joint Venture. You may learn more about M&As from the following articles –