Table Of Contents

What is Backdating?

Backdating is the practice of amending the date of a contract, a legal document, or a cheque to a previous date. Altering the date on any such document to misrepresent any information makes this practice illegal in some cases.

Explanation

Usually, backdating is considered an offense and is bound by legal consequences; however, it may be acceptable if both parties in the contract are on the same page. It is a practice in the insurance industry wherein the date on which the insurance policy was entered is amended to a previous date. It can be legitimate or illegal, depending on the scenario. The first impression seems improper, but the scope of backdating ranges from fraudulent activities to the legitimate practice of amending or executing a contract or a document after the date has passed.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Why Backdate Document?

Backdating a document can be done for many reasons, including misrepresentation – to fulfill personal greed and genuine cases – for legitimate reasons. At times it is done so that the information on the document is accurate. An example would be a verbal agreement between two parties made on 1 April that may be recorded on paper after a week. Still, since the verbal agreement was made on 1 April, the document can be backdated to the actual date rather than a week later.

When is it Appropriate?

Backdating in insurance is a legitimate practice and can be done when both parties agree to the terms while entering the contract. In insurance, the start date is altered to an earlier date than when the insurance policy was bought. The basic idea of backdating the start date of the insurance policy is to reduce the premium liability for the insured period pragmatically.

Examples of Backdating

- An employee of a manufacturing plant meets with a road accident. As per the company's health policy, in case of an accident, whether inside the manufacturing plant or outside, the company would bear all the treatment expenses until the employee recovers from work. To avert this liability under the health plan, the CEO on their own makes amendments to the health policy stating that the accident only inside the manufacturing plant will be covered and backdates the policy to a date before the accident had occurred. The backdating is illegitimate since the amendment was made to exclude the coverage of external accidents after an occurrence of such an accident.

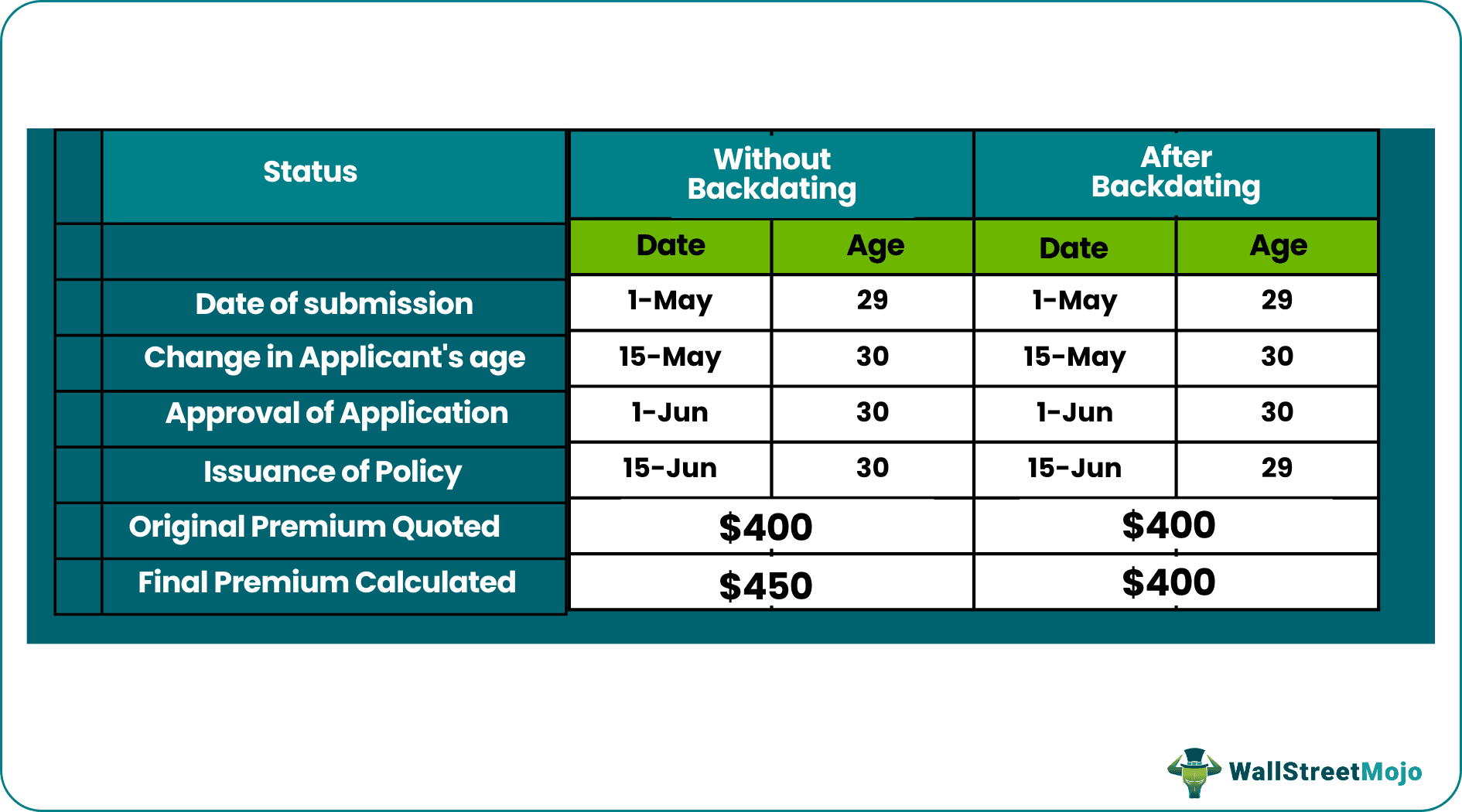

- The insurance of Andrew, who is about to turn 30 on 15 May 2020, can have the following outcomes if backdated and if not:

Andrew’s age changed to 30 on 15 May 2020, but since the policy was backdated to 14-May, he could be in the bracket of fewer than 30 years, which resulted in the premium being the same as the originally quoted premium of $400. As a result, the premium for the years to come will be less than $50 per year (say $1000 in total for 20 years). However, Andrew must pay the premium for the previous period where there was no coverage, i.e., from 15 May to 15 June, which would be around $33 plus taxes. By backdating the policy, Andrew's net savings is approximately $970.

This sort of backdating is legitimate, and both the insured and the insurer agree to the policy terms. The insured agrees to be an extra premium for the lapsed period when there was no coverage.

- Options are backdated, which alters the date on which the stock was granted to a previous date when the stock's price was low so that the option can be exercised at a future date, which would make the stock more valuable. It is practiced when the stocks are granted to the upper management and deemed illegitimate since it gives more money to the management than authorized.

Advantages

- The premium on an insurance policy will be lower by altering the start to a previous date where the insured's age is less.

- Early return on investment can be procured by backdating the investment's start date or execution date.

Disadvantages

- It can involve an additional cost in the present, which might weigh over the time value of money, which is net savings over the years.

- It can involve serious legal issues if it is done for misrepresentation or fraudulent activities. The person who makes such amendments should be clear about the intentions in making such an amendment and its direct impact.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.