Table Of Contents

Backup Withholding Meaning

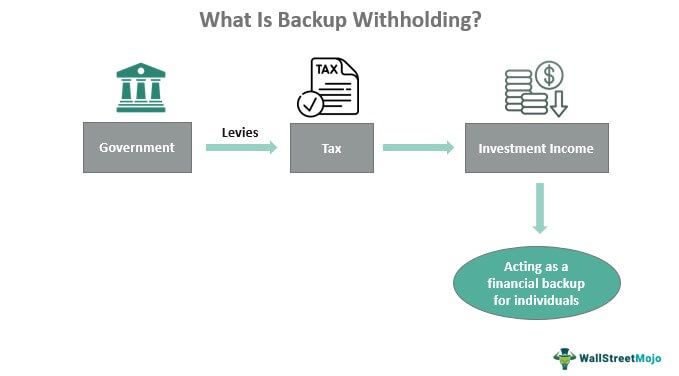

Backup withholding (BWH) is the tax levied on individuals to ensure they pay taxes on whatever income they make from investments. This tax is charged on the amount taxpayers withdraw as their returns on investment. The Internal Revenue Service (IRS) requires citizens to inform the authorities about the extra income they generate from investments.

The IRS backup withholding applies to specific types of 1099 income, which are non-employment earnings of individuals. These include interests, rents, royalties, dividends, gambling winnings, patronage dividends, payments from stock brokers on asset transactions, etc. Such tax implications let the government retrieve taxes from the population's income from different sources.

Key Takeaways

- Backup withholding is a tax that the government levies on the income generated from investments, which investors withdraw and the authorities get notified of.

- The tax applied is based on a specific rate, which is currently 24%.

- The IRS withholding applies to the 1099 income, which includes interests, dividends, gambling prizes, etc.

- When an investor fails to provide the correct tax identification number (TIN) to the authorities, it may lead to a withholding case.

How Does Backup Withholding Work?

The backup withholding tax is withheld by citizens for income that is not subject to payment otherwise. When the investor withdraws the income generated from the investments, the amount applicable for withholding per the current tax rate is paid to the government. This, in turn, lets the government extract the remaining tax funds. In the process, however, the investors are left with lesser cash.

Such withholding is due to investors when they fail to provide an accurate taxpayer identification number (TIN) and cannot indicate exemptions from the backup withholding. These taxes cannot be waived or reduced and do not apply to California real estate withholding. Though the returns on investments are withdrawn multiple times a year, the tax is levied on the amount only once in a calendar year.

When the tax authorities ask investors to pay these taxes, they are likely to have spent all their investment incomes, making it difficult for IRS and other tax authorities to collect the taxes. Hence, the IRS employs a cross-verification approach to ensure they receive the taxes without fail. Thus, an investor should be responsible for reporting and paying taxes accurately and in time while filing their annual tax returns.

The backup withholding exemptions apply to the payments, including unemployment compensations, state or local income tax refunds, canceled debts, long-term care benefits, foreclosures and abandonments, real estate transactions, fish purchases for cash, distributions from any retirement account, or an employee stock ownership plan, etc.

Purpose

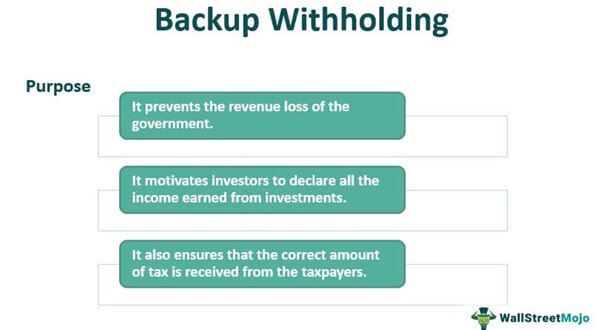

Two critical reasons lead to such withholding. Firstly, investors usually earn investment income in the form of interest income, dividends, rents, etc. Therefore, the authorities do not charge the tax on such income at the time of payment. Secondly, there are times when investors forget to declare that they have earned an investment income.

The primary purpose is to prevent revenue loss to the government. In addition, it motivates investors to declare all the income earned from investments accurately and in time. It also ensures that taxpayers pay the correct amount of tax, irrespective of the sources they earn from.

Rules

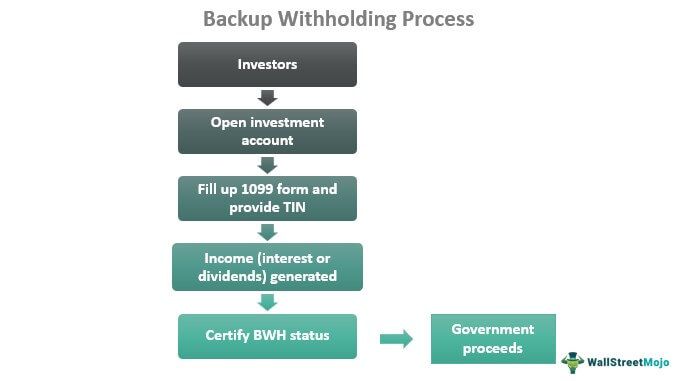

When investors open a new account to invest their money and receive the returns on the same, they have to fill up multiple details in Form 1099. Here, they have to provide their TIN to the bank, which could be their social security number (SSN), individual taxpayer identification number (ITIN), or employer identification number (EIN). In addition, as soon as the account earns interests or dividends, the investors have to certify that they are not subject to backup withholding.

The backup withholding is based on the pre-determined tax rate, which might vary depending on the taxpayer's income. Currently, the rate at which the withholding is applied is 24%. The IRS sends four notices to the payee within 120 days, and it proceeds with the withholding only if the recipients do not respond to the notices.

In such a scenario, employers or financial institutions deduct the tax from any future payments that it is due to make to the employee or investor. Once the deduction is made, the tax authorities, including the IRS, are notified about the same.

Example of Backup Withholding

George has a monthly salary of $200,000. The deductions made by his employer are as follows:

- Backup withholding tax

- Contributions to PF

- Other deductions

The sum of three is $15,000 every month. In addition, the employer remits $2000 every month to the state and federal government on his behalf. George and his employer declare the information about the salary, earnings, and deducted amount in the income tax form, which notifies the IRS about the same.

While cross-verifying, the IRS notices a mismatch and initiates a proceeding.

Prevention

The exemptions apply if a payee specifies that they are not subject to deductions for underreporting income in the current fiscal year. Providing IRS with the correct information, like the correct TIN, will prevent such an action. People can also avoid such events by paying the owed amount that they are likely to have underreported.