Table Of Contents

What Is A Tax Residency Certificate (TRC)?

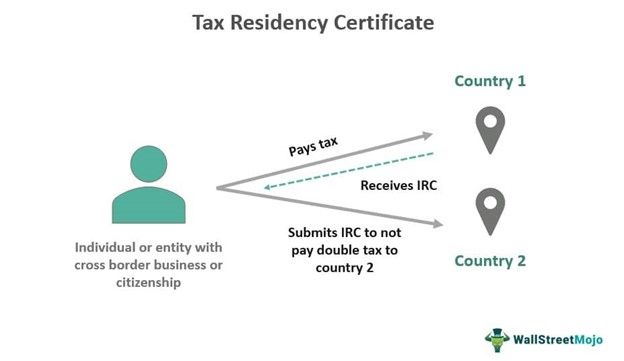

A Tax Residency Certificate is a legal document issued to an individual from its resident country's income tax authorities. It validates their residency in the nation for the given financial year. Several US treaty partners demand US residents provide this certificate to claim the treaty benefits.

The Internal Revenue Service (IRS) of the United States provides the TRC in the form of Form 6166, a letter of US residency certification. This document is a computer-generated letter bearing the name of the US Department of Treasury office. Using this letter, an individual can prove that they are legal American residents, especially for the income tax laws and regulations.

Key Takeaways

- A tax residency certificate (TRC) is an official document observed as legal proof that the individual is a tax-paying resident in another nation for the given financial year so that they are not double taxed.

- In the US, this certificate is offered by the IRS through Form 6166. It is a computer-printed letter with the stationery bearing to the office of the US Department of Treasury.

- Form 6166 is the certificate that an individual has to obtain to file Form 8802. Therefore, the former is the resulting certificate, and the latter is the application process.

- In the absence of established tax treaties, individuals must pay double taxes and follow the laws of the foreign country.

Tax Residency Certificate Explained

A tax residency certificate is official proof of an individual's residence and tax-paying activities in a different country. It enables them to demonstrate this status to their home country to avoid paying double taxes to the government. In the US, this certificate, known as Form 6166, is obtained by submitting a completed and signed Form 8802 to the IRS. Although issued by the IRS, the stationery on which it is printed bears the name of the US Department of Treasury. This process falls under the framework of tax treaty benefits.

A tax treaty is a bilateral agreement between two countries. It aims to eliminate double taxation problems arising from the passive and active income of their respective citizens. These treaties primarily describe the tax rates that a country's tax authority can impose based on their taxpayer's income, capital, wealth, and estate. The US has different tax treaties with around 70 nations, but some jurisdictions with low or no corporate taxes do not enter into tax treaties. In the absence of a treaty, individuals have to pay the income tax with the same rates following the other countries' laws.

There is a US residency eligibility requirement to obtain Form 6166. Those who haven't filed a US tax return but have filed as a nonresident are not eligible for the tax certificate. It is important to apply for a tax residency certificate in the USA to take advantage of the double tax avoidance agreement. The individual has to keep on applying for it every year, for which they are looking to claim benefits.

How To Get?

The steps to receive a US tax residency certificate are:

- The TRC is obtained with Form 8802.

- Form 8802 has complex instructions and requires a $85 fee.

- It must be submitted at least 45 days before the applicant needs the certificate.

- In case of any delays or issues, the IRS will contact the applicant within 30 days.

- Form 8802 will not get processed if it is not postmarked on or after December 1st of the year before the tax year requested.

- There is no option to submit Form 8802 online; an applicant may choose to pay any associated fees through secure government portals.

- The IRS mails the applicant Form 6166, the TRC. The applicant can then use it to claim tax treaty benefits.

- Some nations have different laws; they may impose their tax rates but will refund the applicant upon receiving proof of US residency.

Examples

Below are two examples to understand the concept better:

Example #1

Suppose Nick, based in New York, is a world-famous chef who travels to many countries working in Michelin-starred restaurants. Nick recently spent a year working in London, UK. He anticipated high tax rates, filed his tax return in the US, and requested a TRC.

Once he receives it by submitting Form 8802, he produces the same in front of UK tax authorities to avoid paying double taxes. It was possible because both America and England had tax treaties. It is a straightforward example, although actual eligibility criteria, conditions, and factors are more complex.

Example #2

In April 2022, the US IRS made some temporary revisions to its procedures regarding the application for residency certification. The new policy was officially published on the IRS's website. The rules apply to applicants who were asked to submit a signed copy of their most recent tax return, even if the return has been filed but yet not posted when they filed Form 8802.

The policy also clarifies that if the applicants are unsure about the recent IRS return posting, they may submit the current year's base return signed with Form 8802 to expedite their application. For applicants requesting a two-year certification, a pilot period extension is available. Typically, the IRS issues Letter 6166 to verify the applicant filed an appropriate tax return for the underlying year the certification is requested.

Benefits

The benefits of a TRC are listed below:

- It serves as proof of residence for individuals living in another country for a particular financial year.

- With TRC, a person with a dual country work setup tends to avoid double taxation and avail benefits under Double Tax Avoidance Agreement (DTAA) treaties.

- It assists in cross-border transactions for both individuals and entities as a legal document for administrative procedures.

- The TRC is based on the DTAA provision, which is a tax treaty agreement between two countries. It allows an individual or entity to take advantage of certain tax exemptions.

- Form 6166 assists individuals in receiving an exemption on the value-added tax imposed by foreign countries.