Table Of Contents

Bond Rating Definition

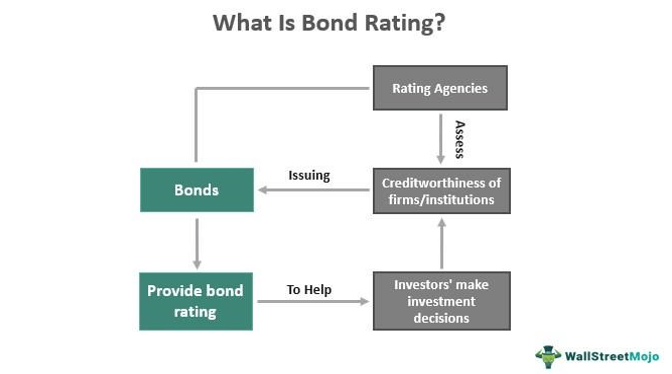

A bond rating evaluates a bond based on the issuers' financial health to ensure investors of timely payment and guaranteed repayment. There are agencies that provide ratings to the corporate or government bonds to indicate how fruitful it would be to invest in the bonds in question. Based on these ratings, the investors decide whether to make an investment.

The concerned agencies assess and thoroughly research the financial strength, stability, and performance, along with various other factors to check how worthy the firms issuing the bonds are of investors' trust. Finally, they assign the ratings to bonds in an alpha-numeric format.

Key Takeaways

- Bond rating refers to the rating system for the bonds offered by firms or government institutions, assessed for their creditworthiness.

- When found financially stable, the bonds issued by those entities acquire higher ratings and vice-versa.

- Standard & Poor's (S&P), Moody's, and Fitch are among the top Nationally Recognized Statistical Rating Organizations (NRSRO) accredited by the United States Securities and Exchange Commission (SEC).

- Though it helps investors and bond-issuing firms in various ways, a bond rating is not always free of flaws.

How does the Bond Rating System Work?

A bond rating system helps individuals and firms make smart and well-informed investment decisions. The professional financial analysts provide the alpha-numeric ratings based on which the investors identify the fruitful and junk bonds. As a result, they prefer investing in bonds of the issuers who can pay the interest timely and the complete amount when the bond matures.

The rating agencies explore every perspective of a firm or institution issuing bonds to check if they are in a sound financial position to pay the interest and principal on time. Then, based on their assessment of their creditworthiness, they provide ratings to the bonds, depending on which investors make an investment decision. While bonds with higher ratings are considered investment-grade bonds, the rest are categorized as high-yield bonds or junk bonds.

Bond Rating Agencies

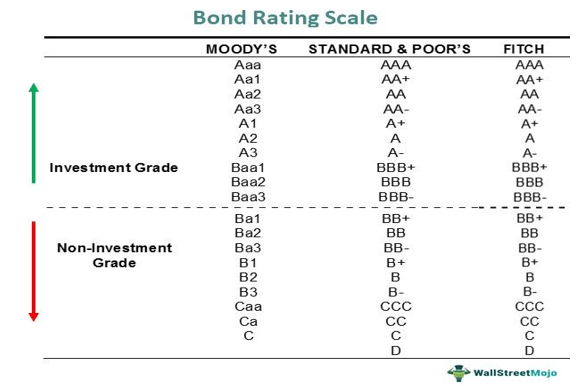

The rating agencies have professional analysts to analyze how fruitful or risky it would be for an investor to invest in a particular bond. These agencies apply different parameters to assess the quality of the bond through a bond rating chart. This chart helps investors to distinguish between the ratings that each agency provides. Based on their level of understanding and analysis, the investors decide if they should proceed with a bond investment or look for other alternatives.

Standard & Poor's (S&P), Moody's, and Fitch are the top Nationally Recognized Statistical Rating Organizations (NRSRO) that investors look up to for reliable ratings. These entities evaluate different factors to assess the financial health of every bond issuer, be it a corporation, an individual, or the government itself. Based on the creditworthiness of the entities that issue these bonds, the agencies provide valid ratings to them.

On the bond rating scale, it arranges the bonds to help investors identify and understand which deal would be fruitful or risky to spend in. First, the agencies prepare a bond rating chart displayed to investors. Based on their evaluation, they rate the bonds on the chart. As a result, investors can have a consolidated view of the ratings provided by different agencies for the same bond. This, in turn, helps them compare the credit quality of the corporate bonds or government bonds, whichever they want to opt for.

Rating Mechanism

Though all the three bond rating agencies consider different factors to assess the credit quality of the bonds, their mechanism and rating system are quite similar. For example, if an S&P and Fitch bond rating for a particular debt security is BBB- and a Moody's bond rating for the same is Baa3, the bond is an investment-grade bond involving lower risk. On the contrary, if rated lower on the respective scales, it becomes a non-investment grade bond.

- Bonds with a B-level rating or above are considered investment grade, whereas bonds with a lower rating are considered speculative or junk bonds.

- Triple-A rated bond offers more security and lower profit potential than B-rated bond. In addition, the coupon rates keep increasing as the rating move down, thereby intending to compensate for the risk offered.

- In the case of a corporate bond, rating agencies usually look at the cash flow of the company, its growth rate, and its existing debt ratios. Companies with ample free cash flow, profits, and few debt obligations will likely achieve higher ratings.

- The administrative authorities employ similar mechanisms for government entities. The specifications may differ, though. The US Treasury bond maintains a triple-A rating and likely always will because it is extremely reliable and unlikely to default.

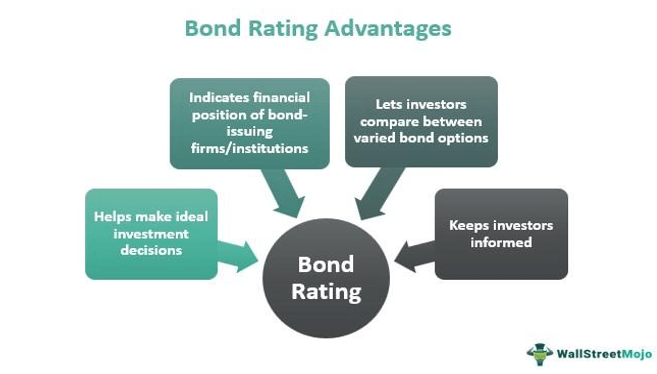

Benefits

Rating the bonds helps investors make informed decisions and enables bond issuers to build their market reputation. When a rating agency gives a better rating to a bond, the issuer is considered financially stable. As a result, the issuing entity becomes trustworthy so far as obtaining credits is concerned. In short, it becomes easier for them to borrow money for business growth and other requirements from different financial institutions.

In addition to the above, there are multiple other benefits of rating bonds:

- Bond rating helps investors stay informed about the latest standing and the strength of a company. As a result, they make well-informed investment decisions.

- It lets them select the right set of debt securities. Hence, the investors get an opportunity to have the right mix for their portfolios.

- Rating a bond helps firms approach the market players, indicating their financial standing. Through the ratings, they appeal to their prospects to investors, high-net-worth individuals (HNWIs), competitors, regulators, etc.

- Investors use the rating chart to compare the returns and credibility of two different companies and the bonds they issue.

Examples

Let us consider the following bond rating examples to understand the concept better:

Example 1

Company A issued a corporate bond to raise funds for its business after a major setback. S&P, Fitch, and Moody's rated the bond as AA+, AA, and Aa3, respectively, given the long-built market reputation of the firm. Investors witnessed the investment-grade ratings that the bond received, and hence, most of them decided to invest in it.

Example 2

In 2008, the debt securities with Triple-A rating in the prior year witnessed a huge downfall, with Moody's downgrading them to 83% of $869 billion mortgage-based securities. Thus, the ones with the highest ratings became the junk bonds of 2008.

In this scenario, the agencies couldn't predict what would happen in the future. As a result, investors who expected a fruitful return on the investment felt trapped.

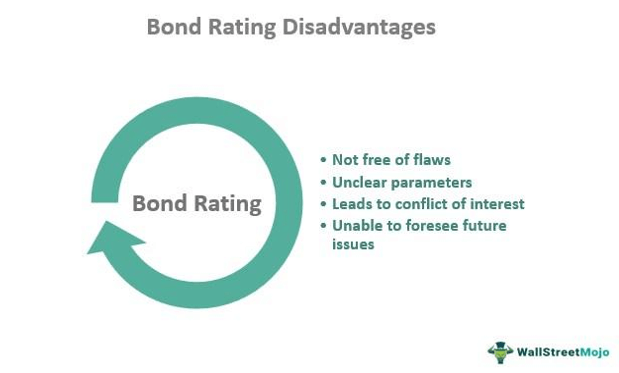

Limitations

A bond rating chart is not free of flaws. Different rating agencies evaluate different factors to rate the bonds. However, in the process, there are chances of missing out on points that might take a bond's rating either up or down.

The bond-issuing entities pay the rating agencies to feature their bonds and make them reachable to investors via different media. As a result, there might be a conflict of interest, which the investors must consider before blindly trusting the results.

Moreover, the rating system for bonds does not foresee the upcoming scenarios. This, in turn, might turn a deal negative for investors in the event of any unusual market turmoil.