Table Of Contents

What Is Credit Rating Process?

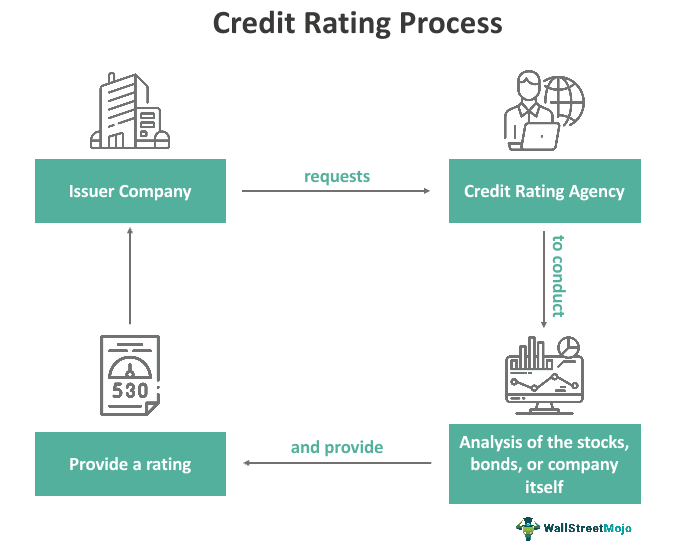

The credit rating process is when a credit rating agency (preferably a third party) takes details of a bond, stock, security, or company and analyses them to rate them so that everyone else can use those ratings to use them as investments.

In other words, it is an assessment of the borrower's ability to repay their financial obligations, and the creditworthiness of an individual, organization, etc., can be evaluated by taking various factors into due consideration that represents the willingness and capability of a borrower to timely discharge their financial commitment.

Key Takeaways

- The credit rating process is when a credit rating agency, ideally a third party, gathers information about a bond, stock, security, or company and evaluates it to give it a rating other investors may use as a benchmark.

- Corporations rely on stocks or debt to fund their operations. For equity, they can use investments from promoters, internal cash flows, or IPOs/FPOs to access financial markets.

- Credit rating agencies determine interest rates based on risk and must be impartial, vigilant, and unbiased in their evaluations

Credit Rating Process Explained

A credit rating process is a must for creditors to watch out for to ensure the borrowers they are trusting would not default on repayments. They rely heavily on credit rating agencies for lending at a special price for the risk-reward ratio. Hence, the rating agencies need to ensure fairness of opinion, a hawk-eyed approach for probable developments in the future, as well as unbiased credit ratings for a company they are evaluating.

In various cases of corporate lending, the banks themselves conduct credit analysis, as they may not want to rely on external credit agencies and rather form their view on the credit of a company. However, as seen in the recent cases of increasing NPAs (non-performing assets) coming to light in India, banks need to be cautious while lending to corporate.

There are only two ways in which any company would fund its business – equity or debt. The equity portion of the capital structure could be derived broadly from three sources: Promoters investing in the business, Company’s internal cash flows accruing over the years to equity, or IPO (Initial Public Offering)/FPO (Follow-on-public offering) for which a company taps different financial markets.

Out of the three, only the last step of the equity source, i.e., IPO/FPO, requires the attention of large banks and broker houses, who capture the company's equity valuation and drive the process. On the other hand, any form of debt issuance demands validation from a credit rating process. Of course, debt is cheaper than equity; companies, quite frequently and on an ongoing basis, issue debt (and repay the same eventually), which means the credit rating process of a company plays a major role in its debt-raising capacity.

Steps

The credit rating process involves a series of steps that agencies follow. Though these steps may differ from one agency to another, the basic series is similar. Let us have a quick at the steps that credit rating agencies follow to rate entities:

#1 - Receipt of Formal Request

The agency begins as soon as it receives the request from the rating companies. In short, the receipt of the formal request to issue a credit rating is the first step of the process. The companies do that to ensure each and every aspect of the process is thoroughly taken into consideration.

#2 - Signing an Agreement

The issuer company and the agency sign an agreement. According to this contract that they sign, the agencies are asked to keep the information of the issuer company as shared with them, confidential. The agreement gives the issuer company the liberty to accept or reject the ratings provided by the rating agencies.

#3 - Assigning to Analysts

As soon as the request is received and the agreement is signed between the parties, an analyst is assigned the task to look after the rating. Before this task is assigned, the expertise of the analysts in the agencies is checked. Based on the area they possess maximum knowledge and skills in, the credit agencies assign a particular credit rating task to respective analyst teams.

#4 - Scheduling Visits & Meetings

The next step is to schedule visits and meetings with the company management. Through the visits, the analysts and team try to explore the operational aspects of the clients. They figure out the business activities, production process and cost of production, and other aspects. The meeting with the management helps analysts assess the overall position, strategies, risks, and policies of the client.

#5 - Forming an Opinion

The next steps are to present a report based on the observation and also mention the ratings as felt suitable. In short, this is the step where the rating opinion is formed and then the same is presented to the rating committee.

#6 - Communicating the Rating

Then, the rating is communicated to the issuer company with reasons. It is, however, the issuer company that would further decide whether to accept or reject the rating assigned by the agency. If they are convinced by the ratings against the reasons, they accept the decisions, else, they reject it. The final step is to communicate the rating to the public.

However, even after the ratings are finally assigned by the agency, they keep monitoring the issuer company to check if they have provided them with an accurate rating. It becomes a kind of case study for them as they understand where they were right and where they had room for more effective decision-making while assigning ratings.

Reasons

Let us assume that Teva Pharmaceuticals Industries Ltd (or “Teva”), an Israel-based world's leading generics pharma company plans to set up a manufacturing unit in the US to manufacture its drugs for the US market. To fund this capital expenditure, suppose Teva plans to issue a bond in the US market or a bank loan from Morgan Stanley. Of course, the creditors would like to evaluate Teva’s ability to repay its debt (also called the company's creditworthiness). A company's credit rating helps the creditors price the debt instrument for the company with reference to the amount of credit risk that the creditors would be taking. In such a scenario, Teva may ask a credit rating agency, say Moody's, to assign them a credit rating to enable them to raise debt. On the other hand, a non-rated company (bringing in fear of the unknown for the creditors) would face issues in raising debt compared to a company rated by an external credit rating agency.

Below is one of the samples of Moody's rating assigned to Teva

source: Moody's

Significance

Now let us understand what credit rating signifies.

A credit rating determines the probability of the company paying back its financial indebtedness within the stipulated time. The ratings could be assigned to a particular company or could also be issue specific.

Below is the chart illustrating the credit rating scale from the global credit rating agencies – S&P, Moody’s, and Fitch. The long-term ratings are usually assigned to a company, while the short-term ratings are essentially for specific loans or debt instruments. It is to be noted that Indian rating agencies ICRA, Crisil, and India rating and research are Indian subsidiaries of Moody's, S&P, and Fitch, respectively.

- The top ratings in the above chart signify the strongest companies financially.

- The long-term ratings from Aaa to Baa3 in the case of Moody’s and likewise in S&P and Fitch qualify as investment grade, while the companies rated below Baa3 fall under the non-investment grade category (which have a higher probability of default).

- An investment-grade company is typically characterized by low levels of leverage (Debt/EBITDA) and capitalization (Debt/Total Capital), strong liquidity (i.e., ability to service its financial obligations), strong business profile (with leading positions in their respective markets), strong cash flow generation, and low cyclicality.

- Of course, given the lower risk involved in lending to an investment-grade company, the cost of debt for such companies would be low compared to a non-investment grade.

- Likewise, the cost of debt is higher for a company rated at Ba3 than a Baa3 rated company. No point in guessing that companies aim for an investment-grade rating to reduce the pricing in which they can raise loans from the bank or bonds from financial markets.

Example

Moody would assess the credit rating process, its profile, and, subsequently, the ratings of Teva concerning different weights assigned to different parameters, as described above (both financial and business). For issue-specific ratings, Moody's would also analyze the quality of collateral provided by the Company for a particular instrument. Of course, if the need arises, Moody's could also visit Teva’s manufacturing facilities and meet with the management to perform its due diligence (to evaluate Teva’s actual commercial potential).

We note that the rating that Moody’s came up with for Teva's inherent profile was A3 as of Apr 2015.

However, we note that Moody’s downgraded Teva by one notch to Baa1 in Jul 2015 and another notch to Baa2 in Jul 2016.

Let us see what drove Moody’s to downgrade Teva by two notches within a year.

- The first downgrade was based on Teva’s announcement in Jul 2015 to acquire the generics business of Allergan for USD40 billion.

- While a portion of this acquisition was to be funded by equity, this acquisition required Teva to raise a lot of debt on its balance sheet, leading to a leverage ratio of 4.3x on a proforma basis (i.e., including the EBITDA and debt of the acquired entity).

- Hence, the one-notch downgrade was driven by the increase in financial and integration risks due to significantly higher indebtedness, considering the company's improved scale with the acquisition.

- The second downgrade was driven by the completion of the acquisition and the higher pro forma leverage ratio of 4.7x, as well as sales erosion owing to the patent and expiration of Copaxone.

Factors

It is returning to Teva, who approached Moody’s to assess its credit rating. With the receipt of this request, Moody assigns a credit rating (typically through a couple of weeks-long processes) to Teva. Let us think about some of the factors that Moody’s would look at for assigning a credit rating to Teva.

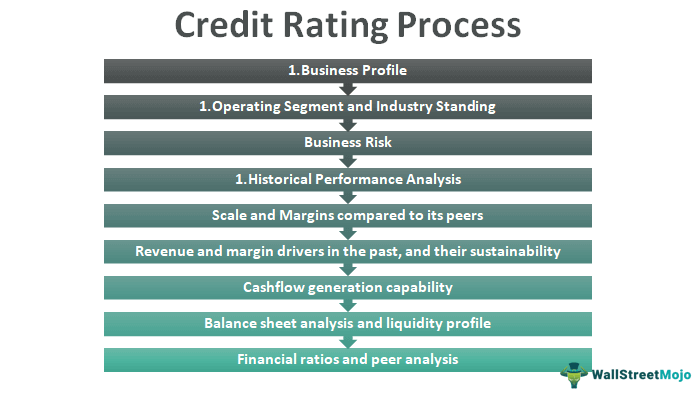

Moody’s industry expert analysts would perform the credit rating process, a detailed analysis of Teva broadly based on the following factors:

- Business Profile

- Operating Segment and Industry Standing

- Business Risk

- Historical Performance Analysis

- Scale and margins compared to its peers:

- Revenue and margin drivers in the past and their sustainability:

- Cash flow generation capability:

- Balance sheet analysis and liquidity profile:

- Financial ratios and peer analysis:

#1 - Business profile

The analyst would first understand Teva’s business profile, its competition, core products, number of employees, facilities, clients, etc.

#2 - Operating segments and industry standing

- Teva operates in two broad segments comprising: 1) a portfolio of generic drugs (i.e., copycats of drugs of which patents have already expired), as well as a 2) modest product pipeline of originator drugs (which have live patents).

- Moody’s would analyze its operating segments and their respective market positions. Teva has a strong generics product pipeline, which derives most of its revenues from the US and Europe, and has leading positions in these developed markets, which are already encouraging the growth of generics.

- The Obamacare act in the US, which increases the insurance coverage of US citizens, would like to focus on reducing their healthcare costs. At the same time, the European markets would aim to reduce healthcare costs too (owing to the ongoing difficult macroeconomic conditions) by increasing the usage of generics.

- Hence, we believe that, overall, Moody would view Teva’s generics segment quite favorably.

- On the other hand, the branded segment is subject to competition from generics (post the patent expiries of its drugs). Teva’s sclerosis (a disease about the hardening of tissues) therapy drug Copaxone, which represents ~20% of its revenues, is facing the same risk!

- Copaxone’s one version of the drug has already expired, which means that cheaper generic drugs of the same brand could be launched in the markets, thus impacting Copaxone’s market position significantly.

#3 - Business risks

- Moody’s would look at each of its product segments and also see the kind of future portfolio (characterized by the type of their R&D expenses) that Teva plans to launch to cover the loss in sales from the expiring drugs in the branded portfolio.

- Further, Moody’s pharma industry expert would analyze all the industry-specific factors such as litigations in which Teva is involved and their materiality in terms of probable financial impact and regulatory risks in terms of US FDA inspections of its facilities (to be noted that US FDA demands the highest quality of manufacturing practices for the pharma companies selling their products in the US).

- Additionally, concentration risks related to a particular product (where difficulties in one product could impact the company financially), a particular supplier (where a supply issue could impact its sales), and particular geography (where geopolitical issues could arise) would need to be analyzed separately on a company and industry-specific basis.

#4 - Historical financial performance

In this, an analyst would go about analyzing the historical performance of the company—calculating Margins, Cash Cycles, growth rates of revenue, Balance Sheet Strength, etc.

#5 - Scale and margins compared to its peers:

- Teva is the largest generics company and one of the top 15 pharmaceutical firms in the world. Teva generated annual revenues worth ~USD20 billion in the financial year ending 31 Dec 2015 or "FY15", indicating the company's high economies of scale.

- Teva’s EBITDA margin (~24% in 2015 on an EBITDA of ~USD4.7 billion) is among the highest in the world. It is another topic of discussion that different rating agencies could come up with different EBITDA calculations depending on whether they include or exclude litigation charges (which could be considered operating in nature in the case of pharma companies) or restructuring charges (which could be ongoing and may not make sense to exclude from EBITDA).

- Anyways, coming back to Teva, the company's leading margins and scale could help derive great brownie points from Moody's.

#6 - Revenue and margin drivers in the past, and their sustainability:

- As mentioned earlier, Copaxone’s patent expiry would significantly drive the revenues and margins down for the company in the coming years, and Moody’s would need to analyze how the company’s future product pipeline would cover the loss.

- However, we note that Moody’s would nevertheless derive comfort from its leading position in the generics segment.

#7 - Cash flow generation capability:

- A company's cash flow generation and stability are important parameters.

- Teva’s cash flows must be enough to service its debt (i.e., principal and interest payments), CAPEX, and dividends.

- We note that a company with shareholder-friendly policies like a high dividend payout ratio (i.e., dividends/net income) would be less liked by the credit rating agencies, as the creditors would rather like the free cash flow to be utilized for debt repayments than dividends/share buyback

#8 - Balance sheet analysis and liquidity profile:

- Moody’s would be keen to see the amount of dispensable cash that Teva has, which is required to fund its working capital requirements (related to product inventories ahead of the new launch and receivables from the pharmacies).

- Further, Moody’s would analyze Teva’s debt structure and its maturity profile.

- Debt maturing in the shorter term would require more caution, as the debt amortization payments could impact its ability to undertake day-to-day operations and could hurt its expansion plans.

- Teva had total debt of ~USD10 billion as of FYE15, which may sound huge; however, on an EBITDA of USD4.7 billion, the gross leverage ratio (Gross debt/EBITDA) came to 2.1x, while the net leverage (Gross debt-Cash/EBITDA) came to a low 0.7x, which indicates a relatively strong financial profile.

#9 - Financial ratios and peer analysis:

- Ratio analysis is a basic and effective way of comparing companies within the same industry.

- Rating agencies would typically compare the pharma companies of similar scale with comparable business profiles with the company it is expected to rate.

- Consequently, Moody’s would compare Teva’s margins, leverage, debt service coverage ratio, interest coverage (EBITDA/ interest expense), and gearing (Debt/(Debt+Equity)) with that of its competitors (which also could be rated by them) and arrive at an estimation of the strength of Teva’s financial profile.

Conflict of Interest

You may wonder if there exists a conflict of interest between rating agencies and the companies paying them for the ratings.

It may seem so, given that Teva is a source of revenue from Moody’s. After all, rating agencies earn only from companies they so closely and critically evaluate!

However, for a rating agency, its credibility is of utmost importance.

If Moody's did not downgrade Teva based on the significant increase in debt post the acquisition of the generics business of Allergan, it would have lost the creditors' trust. It would not have valued Moody's opinion as we advanced.

Once the companies subscribe to the credit rating agencies, they need to periodically monitor the company's ratings based on new developments in the company (like seen in the above case with Teva’s announcement of acquisition), as well as any updates related to the industry (in Teva’s case pharma), regulatory changes, and peers.