Table Of Contents

What Is Day Trading?

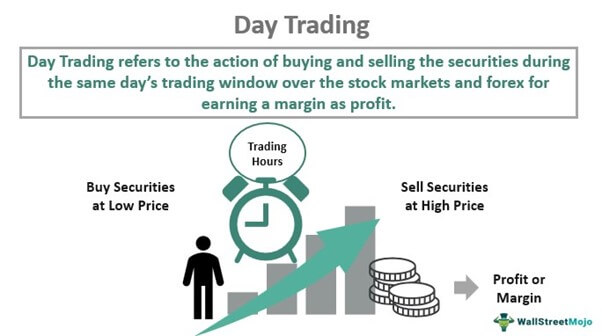

Day trading is the process of procuring and selling securities within the same trading day to book profits from their short-term price movements. Such an exchange usually takes place over the stock markets, foreign exchange markets (forex), and futures markets.

A day trader buys and sells stocks in a single day while watching and tracking their trend. Also, the idea here is to strategically manage the risk involved in such an exchange and ensure that the capital is not exhausted.

- Day trading refers to the system of buying and selling the securities during the same day’s trading window over the stock markets and forex for earning a margin as profit.

- A pattern day trader trades more than three times in a five-day trading period and adheres to the Financial Industry Regulatory Authority (FINRA) rules.

- The FINRA rule mandates a pattern day trader to uphold a minimum account balance of $25000 or the securities with an equivalent value at the end of a day to be eligible to trade on the next day.

How Does Day Trading Work?

Day Trading refers to a disciplined way of purchasing and selling shares and other financial instruments every day. It means that the stock bought today will be sold on the same day.

In the stock market, traders buy and sell the shares of the companies and exit their position before market closure at the end of the day. In the Forex market, the traders exchange global currencies and reap the benefit or make a loss due to relative change in that currency’s value. Lastly, in the Futures market, the traders profit from the increase or decrease in the price of futures contracts from the time of purchase to its sale at the end of the trading day.

By definition, day traders hold on to their stocks only for a day. By the end of every day, they exit or close their position in stocks, options, or futures and then restart the next day again. Closing a position means selling or buying back all stocks bought or sold during the day. The difference in the buying and selling price is the profit.

This type of trading is based on the theory of supply and demand. When a stock is bought in huge amounts, its supply diminishes. It drives its prices upwards. The same is true in reverse. Day traders who can spot the buying or selling pressures and act at the right time can make good profits. Note that the risks and rewards of such trading are immediate. If done correctly, it can help investors escape the periodic losses that come with the usual buy and hold strategy.

It seems like a very lucrative opportunity to earn a lot of money in a short span. But one should trade with the utmost care, discipline, and strategies. Day traders may lose a lot of money and sometimes even go bankrupt due to limited market knowledge and awareness.

Day Trading Strategies

There are different types of strategies that individual investors apply for this type of trading in the stock market. Some of them are as follows:

#1 - Scalping

Through this strategy, an investor reaps out the profit through small changes in the prices of the securities in a single trading day. Traders using this strategy buy and sell securities as fast and as often as they can.

#2 - Range Trading

This strategy is based on utilizing support (oversold) areas and resistance (overbought) areas. The investors purchase from support areas and sell from the resistance area. It is based on the logic that the securities whose prices are below or above their average as per the trend will go back to their average market price eventually.

#3 - News Based Trading

Here, the traders benefit from their market knowledge gained via news or any announcement that could impact the security prices. Thus, they buy and sell the securities accordingly on an intraday trade.

#4 - High-Frequency Trading (HFT)

It is a practice whereby the traders make decisions for the purchase or sale of stocks based on complex algorithms calculated by computer programs.

Day Trading Rules

Discussed below are the rules that the Financial Industry Regulatory Authority (FINRA) states for the pattern day traders. The pattern day traders are the ones who make at least four trades in five trading days:

- Minimum Equity Requirement: The pattern day traders have to keep a margin amount of $25000 in their trading account or the equivalent securities to carry out the trading activities. This condition has to be fulfilled on every previous day’s closure for trading on the next day.

- Day Trading Buying Power (DTBP): The pattern day traders can trade only four times the margin amount remaining in the trading account after excluding the minimum equity requirement ($25000) on the previous day’s closing.

DTBP = Margin Amount x 4

On purchasing beyond this limit, the trader receives a margin call from the broker or dealer to deposit the deficit margin money.

The buying and selling get confined to two times the excess margin amount until the trader deposits the remaining funds. The trader has five business days to fulfill this condition. After that, the broker limits the trading only up to the amount available in the trading account for 90 days or till the trader deposits the money.

How to Start Day Trading?

Day trading is a tricky profession. It involves plenty of challenges. Perfection in this field is all about market expertise and knowledge. For those interested in expanding their trading horizons into the crypto market, discovering the best crypto exchanges in Canada can be an excellent next step. These platforms offer competitive fees, reliable services, and a wide range of supported digital assets, making it easier for Canadian traders to diversify their portfolios.

The following steps will guide you through the path of becoming a day trader:

- First of all, pursue a financial trading course for better learning of the strategies and decision making.

- Next is to gather adequate funds for trading. Day traders in the U.S. have to keep at least $25000 in their trading accounts, excluding the capital employed to purchase securities.

- Perform a self-analysis to find out your skill gap. Try to improve on your weak points.

- Research the market trends and performance and study the different securities, price fluctuations, and returns.

- Determine your trading strategy and risk appetite. Simultaneously develop a plan to implement your trading strategy favorably.

- Be clear of the brokerage charges on the multiple trades in a single day and optimize the same.

- Before you try your luck with considerable capital, implement your strategy on a test account and see if it works the way you want.

- If your strategy is successful, first trade with a small amount to be safer and gradually raise your purchase capacity as you gain confidence.

Prompt decision-making is a crucial part of trading, and at the same time, you need to make sure that your capital is safe.

The process of Day Trading can be explained using a suitable chart from TradingView, as given below. In the chart, which is a 15 minute chart, shows the movement of prices and also helps to identify the points or levels at which the trader can enter the market. The entry levels are marked in green and since the financial instrument is overall in a n uptrend for quite some time, there are many opportunities for the trader to enter a long position.

Therefore, in day trading it is necessary for the trader to be able to identify these entry points during the trade. In this kind of trading, the trader has to continuously monitor the price movement and always keep a stop loss in place as per the risk appetite of the trader. This will protect from sudden adverse price movement and control or minimize the loss amount.

Day Trading Examples

In this trading scenario, an investor buys at a low price and sells at a high price. For example, an investor buys 500 shares in the share market at $10 per share at the opening of the stock market. After the half, an hour price starts increasing, and the investor decides to sell it at $11.5 per share and makes out a profit of $750.

| Particulars | Amount per share | No. of shares | Total Amount |

|---|---|---|---|

| Buying price | $10 | 500 | 5000 |

| Selling Price | $11.5 | 500 | 5750 |

| Profit (Buying price – Selling Price) | $1.5 | 500 | 750 |

In the below graphic representation of the above scenario, the x-axis shows the share price, and the y-axis shows the time at which the price is recorded.

Now, let’s move on to a recent dailyfx report on a downturn in U.S. stock markets. On November 18, 2021, the S&P 500 closed at $4688, i.e., 0.26% low as almost 67% of the companies in the index exhibited a decline. Also, the Dow Jones Industrial share tumbled by 0.58% due to a 4.7% fall in the Visa stocks, resulting from Amazon’s announcement of rejecting the UK-issued Visa cards. All these ups and downs impact the day traders who put their money in these shares.

Benefits

Day trading has been an exciting career option for the new generation since it has transformed the fortune of many traders by making them wealthy in a short period. Let us find out some of its significant advantages:

- Easy to Begin: No certification or license is required for trading. You can immediately start it if you have a laptop and internet connection.

- No Overnight Risk: The traders close their position before the end of the day. Thus, they are not insecure about overnight market fluctuations.

- Flexible Working Hours: The traders are free to trade at any point between the trading hours, i.e., between opening and closing times of the market.

- Source of Earning: They reap good profits daily, which serves as a daily income for the day traders.

- Tremendous Potential: It has the extreme possibility of generating a colossal margin when the market is at its best and if the luck turns in favor of the trader.

Disadvantages

Though fruitful, it is a highly challenging and risky field. To find out the reasons for the same, let us go through its following limitations:

- Nerve-racking: It requires a lot of discipline and may become very stressful since the markets are risky and unpredictable in the end.

- Loss to Individual Traders: Individual investors involved in this trading often make poor returns or lose money as they compete with firms that employ high-frequency trading techniques.

- Minimum Balance Requirement: Another significant drawback is that the day traders are often flagged as pattern traders and need to reserve a minimum amount ($25000) in their trading accounts.

- Involves High Risk: Investors with insufficient knowledge, resources, and assistance may lose a lot of money during market downturns.

- Needs Prompt Decision-Making: Since the market fluctuates rapidly, it can result in a loss if the trader fails to take the purchase or sale decision immediately.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Ask Questions (FAQs)

Though day trading doesn’t reap a constant return, traders can grab a sizeable fortune with an intense understanding of the market fluctuations and good strategic moves.

1. Begin with completing a financial trading course.

2. Accumulate the required capital for trading and maintain the trading account minimum balance.

3. Perform a self-analysis for grabbing your weaknesses.

4. Do proper market research to learn more about the market ups and downs and securities behavior.

5. Formulate a strategy and plan for its implementation.

6. Execute a trial through a test account.

7. If the trial is successful, employ a limited fund to buy stocks and later upraise your investment amount as you make a profit.

No, it is a legitimate practice unless the traders disobey the stock regulatory authorities' trading laws and regulations.

On Robinhood, without maintaining a sufficient trading account balance, a day trader can trade only three times in five days trading period. However, if a trader has stocks or a minimum balance of $25000 in the trading account on the previous day’s closing, there is no trading limit.

Recommended Articles

This article has been a guide to what is Day Trading and its meaning. Here we discuss how day trading strategies work, their rules, along with examples, benefits & disadvantages. You may learn more about Financing from the following articles –