Table Of Contents

What Is An Electronic communication network (ECN)?

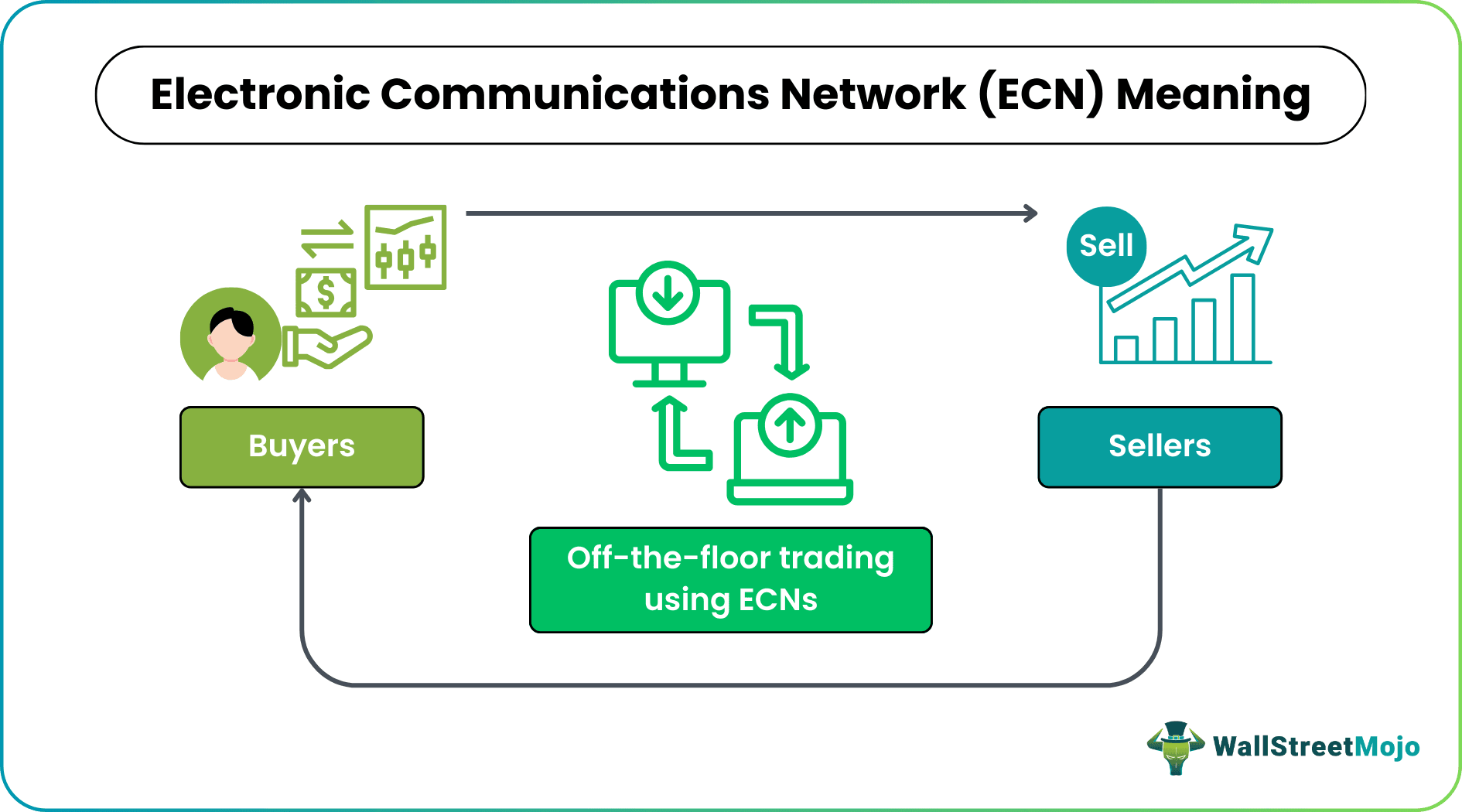

Electronic Communications Networks, or ECNs, are electronic trading systems that automatically connect buy and sell orders at predetermined prices. ECNs are Alternative Trading Systems (ATS) and are defined by Rule 600(b)(23) of the national market system Regulation. Regulation ATS governs ECNs, and they must register with the SEC as broker-dealers.

Alternative Trading Systems (ATS) are venues for trading stocks or securities off exchanges or when exchanges are not open. ECNs have emerged as a crucial component of the new-age market of securities, giving investors more flexibility and low trading costs while also giving competition to the major stock exchanges and the Nasdaq.

Key Takeaways

- Electronic communication networks, or ECNs, are stock exchanges for off-the-floor trading. In addition, they connect buyers and sellers for electronic trade execution.

- Individuals must be subscribers or have an account with a broker who offers direct access to trading to trade with an ECN. Those who have subscribed to ECN can enter orders into the ECN through customized computer terminals or network protocols. The ECN will then match and execute orders.

- The transaction execution reports identify the ECN as the party, enabling buyers and sellers to transact anonymously.

ECN Explained

Electronic communication network trading systems connect sellers and buyers to execute trades electronically. An ECN is an electronic system that largely caters to the orders of third parties made by an exchange market maker or over-the-counter market maker and permits the execution of such orders wholly or partly as per requirement. It omits internal broker-dealer order-routing systems and crossing systems. It also forbids participants from directly executing orders outside the predetermined hours.

A network of subscribers makes possible direct exchanges between buyers and sellers without the intermediary of a broker or exchange. A subscriber can place a limit order in the computerized book, which other subscribers can view and then indicate if they want to take it. When two orders match, the system immediately registers the transaction and prepares the necessary paperwork to complete it. People can automatically trade and quote securities, including those listed on exchanges, over an ECN.

Market makers, individual investors, institutional investors, and other broker-dealers are just a few of the many types of subscribers that ECNs have. These subscribers can access a variety of market services from ECNs. For instance, ECN subscribers can enter limit orders into the ECN, typically via a customized computer terminal or a direct dial-up. The ECN will then post these orders for viewing by other subscribers.

The ECN will later execute orders that are on the opposite side. For example, a sell order is opposite or contra-side for a buy option and vice versa. If the share price and share count match, they must be equal to execution. Most of the time, the buyer and seller don't know each other's identities, and the ECN is always the opposing party in transaction execution reports.

Trading In ECN

Trading outside of regular trading hours is possible for customers of ECNs. At the same time, there is the prohibition of price manipulation by the guarantees of equal trading rights and open price feeds. An ECN's price feed is based on prices obtained from liquidity sources, which include banks, brokers, and private ECN traders.

The market depth, which displays all offered prices and recommended volumes at each price level, accumulates all given liquidity. Trading orders are first sent at the best prices. However, if the projected liquidity is insufficient to fill the entire order, the next bid and offer (market depth levels) are used.

ECNs are possible through electronic negotiation, an agent-to-agent communication that enables cooperative and competitive information sharing to establish a fair price. Many also consider ECNs to be efficient at handling small orders. As a result, some ECN brokers may provide customers extra features, including negotiation, reserve size, and pegging.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples of Electronic Communication Networks

Check out these examples to get a better idea of ECN.

Example #1

Kevin Foley established Bloomberg Tradebook in 1996 as an online communications platform (ECN). Bloomberg Tradebook functions as a proprietary electronic communications network. Bloomberg serves the communication needs of its broker-dealer and institutional customers and facilitates their business transactions following Regulation ATS of the Securities Exchange Act of 1934. In addition, they provide various additional services, such as electronic messaging, equity order routing, and wanted bids, as well as linkages to specific exchanges within and outside of the United States.

Example #2

Instinet's decision to purchase Island in the early 2000s made headlines. The all-stock transaction was supposed to shine on the market's two biggest electronic communications trading networks. But it experienced a fall in retail day traders, and Island quickly displaced Instinet due to lower user fees and superior technology.

An agency-model broker, Instinet also acts as the independent stock trading division for its parent company, Nomura Group. ECN Island was established in 1996. It is one of the first electronic communication networks for trading stocks in the United States.

ECN vs STP vs Market maker

Straight-through processing (STP) is a system that automates end-to-end transactions involving financial instruments—using a single system to process or regulate all aspects of the workflow of a financial transaction, including the General Ledger and the Front, Middle and Back offices, as well as other areas. To put it another way, STP is the total of the electronic capture and processing of transactions in a single pass, from the point of the initial "deal" to the end settlement.

A company that is willing to buy or sell a stock at prices that are publicly stated is known as a "market maker." Some market makers will pay brokers to route traders' orders to them in exchange for their business, possibly on a per-share basis. They do this to entice brokers to place orders with them. The deal is known as Payment for Order Flow.

When it comes to electronic communication network brokers, one can observe that the orders match with the network's users, including major banks and brokers, traders, and private investors, to compete with one another for orders. In contrast, STP orders are merely forwarded to third-party liquidity providers. Even though all three deal primarily with the execution of trades, Compared to ECN/STP brokers, MM brokers bear more risk as they have to pay out of pocket to the traders. However, an ECN/STP broker covers their clients' positions with liquidity providers.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Electronic communication network trading systems are governed by the SEC and a national securities organization (with which the registered broker must require to be registered). On the other hand, exchanges have some regulatory bodies under which they operate.

Among other things, ECN brokers are good for forex trading and those who depend on the tightest spreads like them. STP brokers, however, offer quicker, smoother order execution with lower settlement risk, making them beneficial not only for forex trading but also for stock trading and other asset classes.

Orders are routed through liquidity providers by an electronic communication network broker (forex), which means that transactions are genuinely matched with other investors in the real market. On the other hand, traders take bets on an overlay that the market maker provides, which may result in price manipulation.