Table of Contents

Algorithmic Trading Meaning

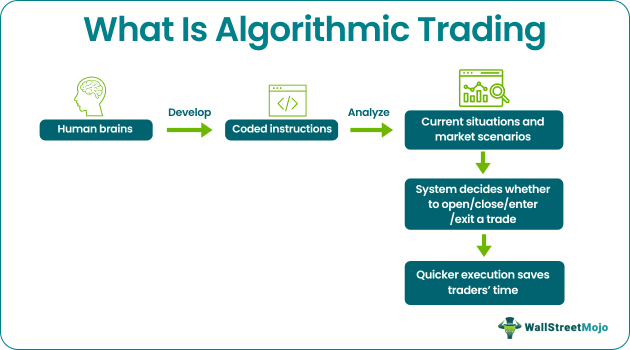

Algorithmic trading refers to automated trading wherein investors and traders enter and exit trades as and when the criteria match as per the computerized instructions. The systems are coded with instructions to undertake trades automatically without human intervention. It saves a lot of time for investors who can take more and more trades due to their quick execution time.

With algorithmic trading, there are no human emotions involved. The only thing that guides the overall trading process is the coded instructions, determining if the buyers’ and sellers’ requirements match. If so, the system opens and closes the deal accordingly.

- Algorithmic trading is automated trading that involves the usage of computerized platforms, advanced mathematics, and computer programming tools to drive trading transactions in the financial markets.

- The computer program dynamically assesses the market situation and implements a hedging strategy according to market sentiments.

- The regulatory authorities always install circuit breakers, limiting the functionality of algo-trades.

- The devising of the algorithm can be very complex and challenging, but when deployed well makes execution faster.

How Does Algorithmic Trading Work?

Algorithmic trading, also known as algo trading, is an advanced technique that works on advanced coding and formula and is based on a mathematical model. Unlike conventional trading methods, this process is fully automated.

The human brains develop codes to instruct systems to make situation-driven decisions. The mathematical models and algorithms are so created that computerized devices efficiently assess market situations. For example, as per the automated analysis, traders open-close or enter-exit trades.

Investors widely use algo trading in scalping as it involves rapid purchasing and selling of assets to earn quick profits out of small increments at the prices. As a result, traders can participate in multiple trades throughout the day and reap profits with the quick execution of the trades. A trading VPS ensures your algorithms execute trades around the clock, and enables faster trade execution, especially in volatile, fast moving markets.

Besides stock markets, algo trading dominates currency trading as forex algorithmic trading and crypto algorithmic trading.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Strategies

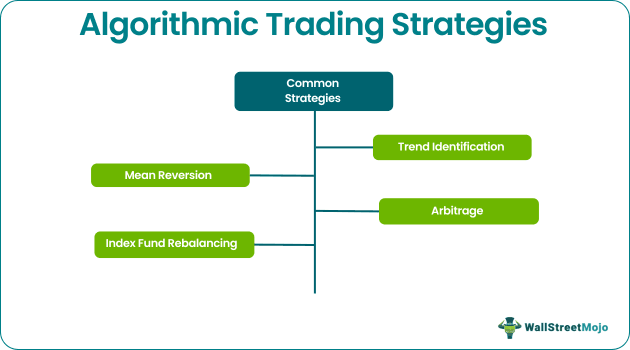

Algorithm trading includes various strategies based on which the developers develop coded instructions and make the algorithm work reliably. Some of the algorithmic trading strategies are as follows:

1. Trend Detection

The first strategy on the list that drives algo trading is trend identification. The codes help analyze market trends depending on the price, support, resistance, volume, and other factors influencing investment decisions. As the algorithms work on technology and formula, it is more likely for the automated systems to identify accurate trends.

2. Mean Reversion

It is the method that monitors the average highs and lows of a stock, helping investors decide whether to spend on a company’s stock or not. Based on the average fluctuations in the prices, the software determines the price that is most likely to drive the stocks at a particular trade. When the prices are expected to rise, the deal could be booked. On the other hand, if the market prices fluctuate beyond the average level, such stocks are considered less trustworthy.

3. Arbitrage

The automated trading facility gives investors arbitrage opportunities. Arbitrage involves purchasing dual-listed security. An investor can buy stock in one market at a lower price and sell the same at a higher rate in another market simultaneously with speedy execution of trades.

4. Index Fund Rebalancing

The index fund portfolios undergo frequent changes, given the price fluctuations of the underlying assets. This rebalancing helps traders operate via algo trading to book deals for better returns. In short, the changing portfolios help investors get stocks at the right time and the best prices with lower transaction costs.

Components

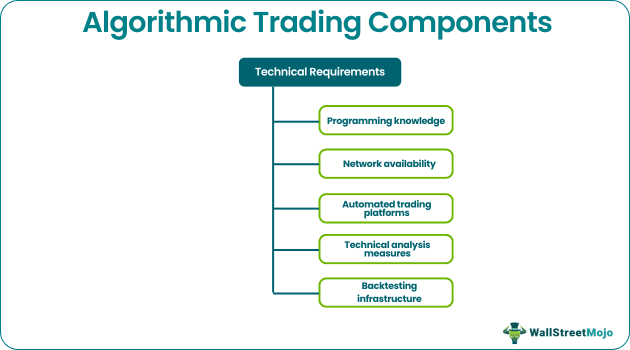

For algorithmic trading to work, there needs to be a human brain and proper hardware and software infrastructure. For algorithms to work as coded instructions, one needs to have complete knowledge of programming knowledge. The human brains with programming skills are the best source of developing such coded instructions for algo trading with if-else and other clauses.

Next, computer and network connectivity are essential to keep the systems connected and work in synchronization with each other. In addition, an automated trading platform provides a means to execute the algorithm. Finally, it manages the computer programs designed by the programmers and algo traders to deal with buying and selling orders in the financial markets.

Furthermore, the technical analysis measures constitute one of the algorithmic trading components. The analysis involves studying and analyzing the price movements of the listed securities in the market. Methods like moving averages, random oscillators, etc., help identify the price trends for a particular security.

Finally, backtesting is on the list. It is the process of testing the algorithm and verifying whether the strategy would deliver the anticipated results. It involves testing the programmer’s approach on the historical market data. In addition, the technique lets traders identify issues that might arise in case the traders use this strategy with the live market trades.

Examples

Let us consider the following algorithmic trading examples to understand the concept:

Example #1

Suppose a trader follows a trading criterion that always purchases 100 shares whenever the stock price moves beyond and above the double exponential moving average. Simultaneously, it places a sell order when the stock price goes below the double exponential moving average. The trader can hire a computer programmer who can understand the concept of the double exponential moving average.

The programmer develops a computer code to performs trading activities based on the above two instructions. The computer program is so dynamic that it can monitor the live prices of the financial markets and, in turn, trigger activities as per the above instructions. It saves the trader's time as they don't have to go to the trading platforms to monitor prices, and place the trading orders.

Examples #2

The flash crash of 2010 is an example of algorithm trading. There was an immediate placement of sell orders for securities in this crisis. There were also fast withdrawals of trade orders for deposits and high-frequency trades.

The regulatory authorities later placed circuit breakers to prevent a flash crash in the financial markets. They also prevented algo-trades from having direct access to the exchanges.

Advantages & Disadvantages

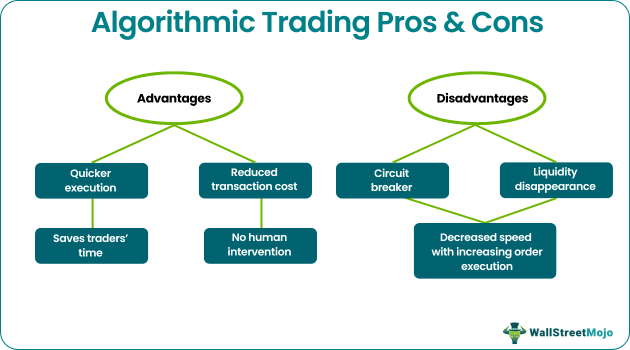

As there is no human intervention, the possibilities of errors are quite less, given the coded instructions are right. Based on the codes, the system identifies the trade signals of the financial market and accordingly decides whether to opt for it.

The algorithmic trading software helps systems feed the requirements of both buyers and sellers. The trade opens and closes instantly as soon as the algo identifies an ideal match. The execution process is fair and fast enough. As a result, traders have to complete the deals as soon as they are notified of a match. If the chance is missed, they have to wait for another match to be found. Investors widely use algorithmic trading for scalping, since it relies on rapid buying and selling of assets to capture quick profits from small price movements. This approach allows traders to execute multiple trades throughout the day, capitalizing on speed and precision. To maximize these opportunities, a trading VPS is essential, ensuring your algorithms run 24/7 with minimal downtime and delivering faster execution in volatile, fast-moving markets. With QuantVPS, you get the low-latency infrastructure built specifically for scalpers and algorithmic traders who can’t afford delays.

The regulatory authorities always install circuit breakers, limiting the functionality of algo-trades. In addition, the liquidity provided by algo-traders can almost disappear instantly or in seconds.

The execution speed of algo-trades without the intervention of humans can adversely impact live trades and settlements, which further limits the functionality of trading platforms and financial markets. Moreover, the algo-trades, if not monitored, can trigger unnecessary volatility in the financial markets.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.