Table Of Contents

Forward Rate Agreement Meaning

Forward Rate Agreement, popularly known as FRA, refers to customized financial contracts that are traded Over the Counter (OTC) and allow the counterparties, primarily large banks, corporate to predefine interest rates for contracts that are going to start at a future date.

Two parties are involved in a Forward Rate Agreement: the Buyer and Seller. The Buyer of such a contract fixes the borrowing rate at the contract's inception, and the seller fixes the lending rate. At the inception of an FRA, both parties have no profit/loss.

However, as time passes, the Buyer of the FRA benefits if Interest Rates increase than the rate fixed at the inception, and the Seller Benefits if the interest rates fall at the rate fixed at the inception. In short, the Forward Rate Agreement is Zero-sum games where the gain of one is a loss for the other.

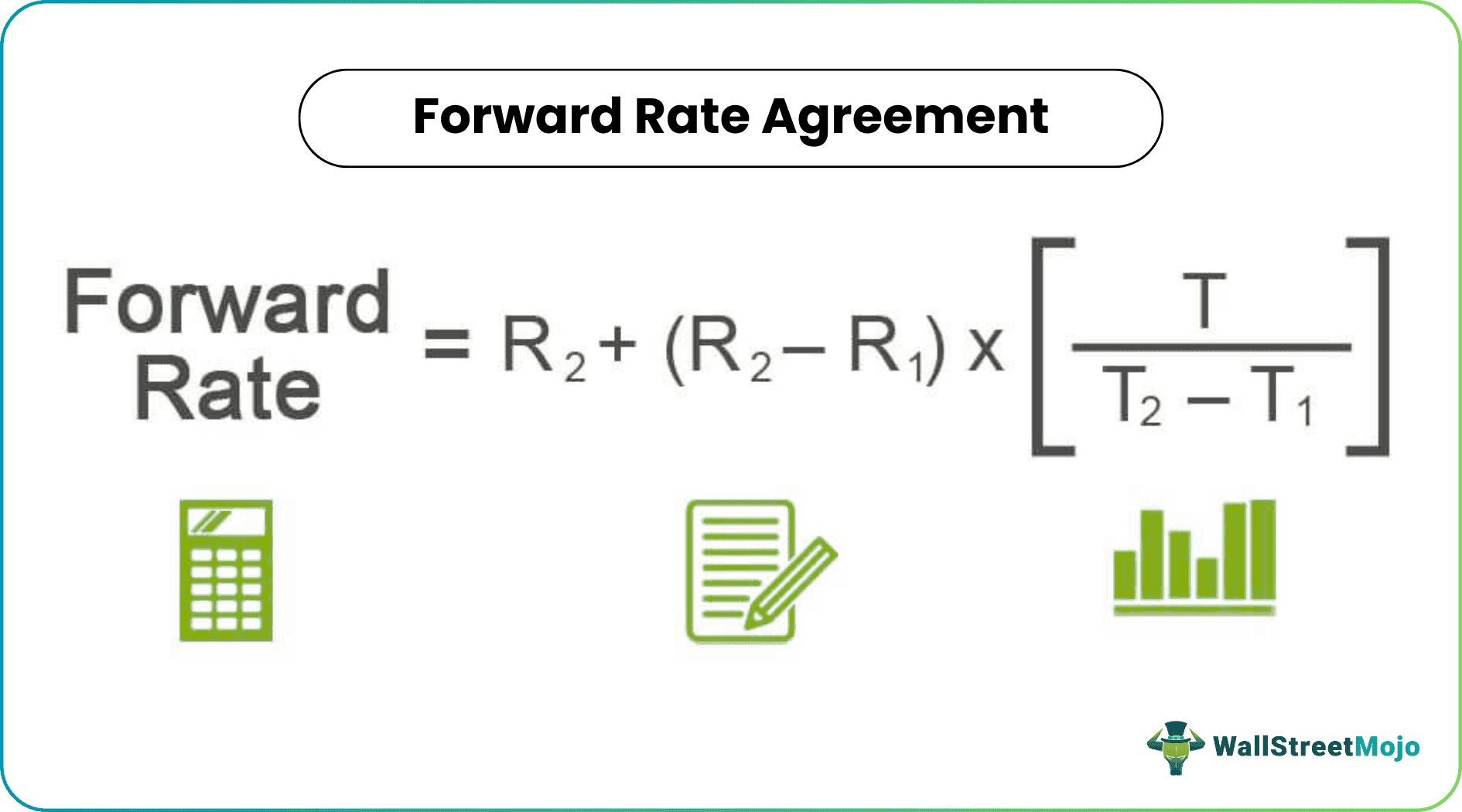

Forward Rate Agreement Formula

The formula for calculating Forward Rate is as follows:

Forward Rate Agreement Formula = R2 + (R2 – R1) x

Forward Rate Agreements (FRA) Examples

However, there are multiple ways to calculate the same, which are discussed through the examples below.

Example #1

Let’s understand the Concept of FRA with the help of a few examples:

- Forward Rate Agreements are usually denoted, such as 2×3 FRA, which means a 30-day loan, sixty days from now. The first number corresponds to the first settlement date, and the second to the time to final maturity of the contract.

- One should understand this terminology to understand the nuances of a Forward Rate Agreement. Now lets Raven Bank want to value a 1X4 FRA (which means a 90-day loan, 30 days from now)

Current 30 day LIBOR rate: 4%

Current 120 day LIBOR rate: 5%

Let’s calculate the 30-day loan rate and 120-day loan rate to derive the equivalent 1/(n1-n2) – 1" url="https://www.wallstreetmojo.com/forward-rate-formula/"]forward rate, which will make the value of FRA equivalent to zero at inception:

Example #2

- Axon International entered into a Forward Rate Agreement to receive a rate of 3.75% with continuous compounding on the principal of USD 1 Mio between the end of the first year and the end of the Second year.

- The current Zero rates for one year are 3.25%, and for two years, it is 3.50%.

This is a 1X2 FRA Contract.

Let’s calculate the value of the Forward Rate Agreement in two scenarios:

- At the beginning of the contract

Thus we can see at the beginning of the Forward Rate Agreement that there is no profit loss to any of the two parties.

Now let’s assume the rate falls to 3.5%, and let's compute the value of FRA again:

(Excel file attached)

Thus we can see that as interest rates move, the value of FRA changes again for one counterparty and equivalent loss to the other counterparty.

Example #3

- Rand Bank entered into a Forward Rate Agreement on 20th Oct 2018 with Flexi Industries, whereby the Bank will pay a fixed interest of 10% and, in return, will receive a floating rate of interest based on the Commercial Paper rate existing at the time of payment.

- Payment is settled every quarter, with the first payment due on 20th Jan 2019.

Below are the details:

(excel file attached)

Thus Rand Bank will receive USD 2.32 Mio from Flexi Industries.

Advantages of Forwarding Rate Agreement (FRA)

- It enables the parties to such an Agreement to reduce their risk of future borrowing and lending against any adverse movement by entering into such contracts. For instance, a market participant who is scheduled to receive payment in Foreign currency at the end of one year can avoid the currency fluctuation risk by entering into a Forward Rate Agreement. Similarly, a Bank which has borrowed funds at a fixed rate and expects the rates to decline in the future can benefit from such a decline by entering into a Forward rate Agreement as a Floating ratepayer.

- It is frequently used for Trading based on interest rate expectations of Market participants.

- Forward Rate Agreements are derivative contracts that form part of the Off-Balance Sheet and, as such, doesn't impact the Balance Sheet Ratios.

Disadvantages of Forwarding Rate Agreement (FRA)

- FRA is customized and traded Over-the-counter and, as such, carries a higher amount of Counterparty Risk compared to a standardized Futures contract, which is settled through a Qualified Centralized Counterparty (QCCP)

- It isn't easy to find a third counterparty to close the contract before maturity if the original contract is to be closed and the initial counterparty is not ready to reverse the position.

Important Points

- The long position is effectively long the rates and benefits when rates increase. Similarly, the short position in a Forward Rate Agreement effectively shortens the rates and benefits when rates decrease.

- FRA is a Notional Contract, and as such, there is no exchange of principal at the expiry date.

- FRA is similar to Futures contracts, except they are known as centrally cleared over-the-counter instruments, which the parties can customize for any maturity.

- FRA is a Linear Derivative Instruments and derives its value directly from the underlying instrument.

Conclusion

Forward Rate Agreement has customized Interest Rate contracts that are Bilateral, don't involve any Centralized Counterparty, and are frequently used by Banks and Corporate.