Table Of Contents

Inverse Head And Shoulders Pattern Meaning

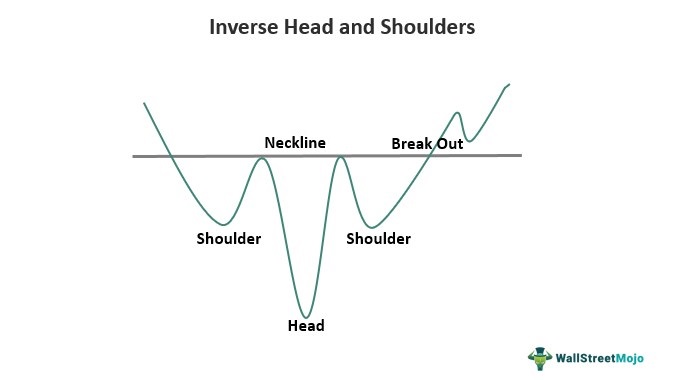

The inverse head and shoulders is a technical chart pattern that signals a potential trend reversal from a downward trend to an upward trend in the price of a security or asset. The pattern resembles the shape of a person's head and two shoulders in an inverted position, with three consistent lows and peaks. The chart aims to identify a potential reversal in a downtrend, indicating a possible bullish trend.

The pattern indicates a potential change in the asset or security direction, indicating a positive outlook for future price movements. Traders and investors use this as a bullish reversal signal and look to enter long positions when the price breaks above a resistance level known as the neckline. However, the strategy can be complex because it requires a good understanding of chart analysis and technical indicators to identify the pattern properly.

Table of contents

- Inverse head and shoulders meaning

- Inverse head and shoulders is a price pattern in technical analysis that signals a potential reversal from a downtrend to an uptrend.

- The pattern resembles the shape of a person's head and two shoulders in an inverted position, with three consistent lows and peaks.

- The pattern is significant because it suggests that the selling pressure driving prices is slowing, and buying pressure is starting to emerge.

- The neckline is a crucial component of the pattern, as it represents the line in which a break above signals a confirmed reversal.

Inverse Head And Shoulders Pattern Explained

The inverse head and shoulders pattern is widely recognized and used in technical analysis to predict price trends in the financial markets. The pattern is believed to have originated from chartists and traders who used it to identify potential reversals in downtrends and determine market entry and exit points. As a result, it is one of the most well-known and widely used technical analysis patterns and is a popular tool among traders and investors for making investment decisions.

The components of an inverse head and shoulders pattern in technical analysis are three troughs and peaks. The first and third troughs are smaller, forming the shoulders, while the second trough is the deepest, forming the head of the pattern. The troughs are connected by downward-sloping trend lines, forming the neckline, which is an important part of the pattern. When the security price rises and breaks above the neckline, it is considered a bullish signal and can indicate a potential reversal of the prior downtrend. The pattern can provide valuable information to traders and investors in making investment decisions.

Chart

Let us look at the G R Infraprojects Limited stock price chart below to understand this pattern better.

In the above chart, we can find the specific features of an inverse head and shoulders pattern. One of the features is the three distinct troughs Among the troughs, the middle one or the head, is the lowest. Another key feature is the neckline, which is the trend line (dotted line) connecting the highs of the right and left shoulders. It indicates the level of resistance before the confirmation of the pattern. As individuals can observe, a downward price movement forms the left shoulder, while an upward price movement leads to the formation of the right shoulder.,

The breakout above the trend line serves as a confirmation, signaling a potential upward trend. Note that this may also be a false breakout. Hence, one may consider using additional indicators, for example, increased trading volume to increase the chances of success when trading with this pattern. If individuals wish to develop a better understanding of this pattern, they may consider looking at various other charts related to this topic on TradingView.

How To Trade Inverse Head And Shoulders Patterns?

To trade an inverse head and shoulders pattern, one can follow these steps:

- Identify The Pattern: In this pattern, two troughs (shoulders) are on both sides of a lower trough (head), with a neckline connecting the two shoulders.

- Draw The Neckline: Once the pattern is identified, draw a neckline by connecting the two highs between the shoulders and the head.

- Wait For A Breakout: Wait for the price to break above the neckline, which indicates a potential trend reversal.

- Determine Entry Point: One can enter a long position when the price breaks above the neckline and reaches a certain level of confirmation.

- Set Stop-Loss: To manage risk, it's advisable to set a stop-loss below the neckline or the pattern's low.

- Take Profits: One can set profit targets by measuring the distance from the head to the neckline and projecting it from the neckline after the breakout.

Examples

Example #1

A good example of an inverse head and shoulder target is the WTI stock. Lately, oil has been exhibiting a bullish run and is encouraged by the bullish technical chart situation. As a result, the company's stock price went off to 86 USD/bbl, a good high to arrive.

The price fluctuation was not random and has designed an inverse head and shoulder pattern, a very significant price chart formation. The price also broke the neckline and pointed towards a buying signal per the pattern rules. The stock also broke the downtrend, a good signal for investors to take a long position.

Example #2

Another good example of an inverse pattern is the TATA consumer products reaching the 52-week high after forming an inverse head and shoulder pattern. The stock grew nearly 4% in a week and strongly indicated a bullish run. The single-week growth helped the stock break the neckline, and the company is majorly in the tea and coffee-making business. The company has a good market capitalization of seventy-six thousand crores.

Inverse Head and Shoulders vs Head and Shoulders Pattern

The head and shoulders and inverse head and shoulders patterns are chart formations in technical analysis. For example, they are used to identify potential reversal points in the price of a security.

- A head and shoulders pattern occurs when the price of a security rises to a new high, pulls back, rises again to a similar or slightly higher high, pulls back again, and then rises for a third time, but only to a lower high. It creates the appearance of a "head" and two "shoulders" on the price chart. A downward reversal is indicated when the price breaks below the "neckline" connecting the two lows.

- An inverse head and shoulders pattern is the opposite of a head and shoulders pattern. It occurs when the price of a security falls to a new low, rises, falls again to a similar or slightly lower low, rises again, and then falls for a third time, but only to a higher low. It creates the appearance of a "head" and two "shoulders" on the price chart, but in reverse. An upward reversal is indicated when the price breaks above the "neckline" connecting the two highs.

In summary, the head and shoulders pattern is a bearish reversal pattern, while the inverse head and shoulders are bullish.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The reliability of the inverse head and shoulders pattern as a stock market indicator varies and depends on factors such as market conditions, historical trend analysis, and other technical indicators. However, it is generally considered a reliable pattern when it appears in conjunction with other bullish signals.

The target of an inverse head and shoulders pattern is calculated by measuring the distance between the head and the neckline and then adding it to the neckline breakout point. This measurement provides an estimate of the potential upward price movement following the formation of the pattern. However, it is important to remember that the target is only an estimate, and the actual price movement may differ.

The success rate of the inverse head and shoulders pattern as a trading strategy cannot be accurately determined as it depends on various factors, such as market conditions. However, many traders and technical analysts consider it a reliable reversal pattern when used with other analysis tools and strategies. Nevertheless, like any other trading strategy, inverse head, and shoulders also involve a certain level of risk, and its success rate may vary.

Recommended Articles

This has been a guide to Inverse Head And Shoulders and its meaning. We explain how to trade it, its examples, and comparison with head & shoulders pattern. You can learn more about it from the following articles –