Mississippi CPA Exam and License Requirements

Table Of Contents

Mississippi CPA Exam

Mississippi CPA (Certified Public Accountant) License entitles a qualified individual to pursue public accountancy in Mississippi. There are specific education, exam, and other requirements for attaining a Mississippi CPA license.

The Mississippi State Board of Public Accountancy issues a CPA license. It follows the one-tier licensing system. This implies that you can directly apply for a CPA license by fulfilling all the requisites without applying for a CPA certificate first.

Please note that it doesn’t participate in the International CPA Examination Program. Here lies the detailed guide on Mississippi CPA Exam and license requirements.

| Particulars | Requirements |

|---|---|

| Minimum age | Not required |

| U.S. Citizenship | Not required |

| Mississippi residency | Required |

| Social security | Required |

| Good moral character | Required |

| Education requirement for CPA Exam | Bachelor’s degree with 120 semester hours |

| CPA Exam requirement | 75 points in each exam section |

| Education requirement for licensure | 150 hours |

| Experience requirement for licensure | 1-year general accounting experience |

| Ethics exam | Not required |

Contents

Mississippi CPA Exam Requirements

Mississippi CPA License Requirements

Mississippi CPA Exam Requirements

The Uniform CPA exam is a 16-hour-long automated assessment. It is designed to test your know-how and ability to perform as an entry-level CPA. Passing the CPA Exam is the key requirement in all states for acquiring a CPA license.

This includes four exam sections to be passed within the rolling 18-month period (beginning from the testing date of your first passed section). Let's take a look at some aspects of the CPA Exam.

| Particulars | Details | |

| Regulatory body | American Institute of Certified Public Accountants (AICPA) | |

| National Association of State Boards of Accountancy (NASBA) | ||

| Exam duration | 4-hour each section | |

| The time limit for passing the CPA Exam | 18 months (from the testing date of your first passed section) | |

| Exam sections | Auditing & Attestation (AUD) | |

| Business Environment & Concepts (BEC) | ||

| Financial Accounting & Reporting (FAR) | ||

| Regulation (REG) | ||

| No. of testlets | 5 in each section | |

| Passing score | 75 points on a scale of 0-99 in each exam section | |

| Question types | AUD, FAR, & REG | Multiple-choice questions & Task-based simulations |

| BEC | Multiple-choice questions, Task-based simulations, & Written communications tasks |

Best CPA Review

Eligibility Requirements

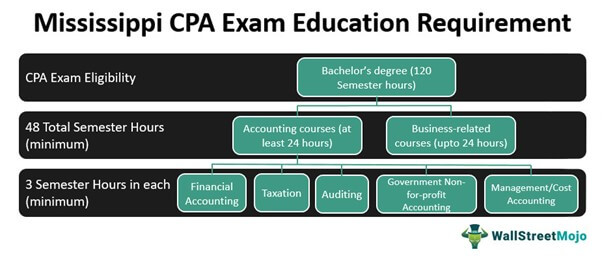

CPA exam applicants must hold a baccalaureate degree from an authorized institute with at least 120 semester hours. Ensure to complete the requirement before sitting for the examination.

Moreover, earn a total of at least 48 semester hours in:

- Accounting courses (no less than 24 hours) with at least 3 semester hours each in,

- Financial Accounting

- Taxation

- Auditing

- Government/Not-for-Profit Accounting

- Management/Cost accounting

- Business-related courses

Applicants with foreign academic documents must only request NASBA International Evaluation Services (NIES) for a course-by-course evaluation.

Submit your exam application, fees, and transcripts to the Mississippi State Board of Public Accountancy. Please visit the State Board website for more details.

Fee

First-time applicants:

| Particulars | Amount | Total Fees |

|---|---|---|

| Application fee | - | $150 |

| Examination fees | - | - |

| AUD | $238.15 | |

| BEC | $238.15 | |

| FAR | $238.15 | |

| REG | $238.15 | $952.6 |

| Total Fees | - | $1,102.6 |

Re-examination candidates:

| CPA Exam sections | Exam Fees (per section) | Total Exam Fees (all sections) | Registration Fees | Total Fees |

|---|---|---|---|---|

| 4 exam sections | $238.15 | $904.6 | $135 | $1039.6 |

| 3 exam sections | $238.15 | $678.45 | $115 | $793.45 |

| 2 exam sections | $238.15 | $452.3 | $95 | $547.3 |

| 1 exam section | $238.15 | $226.15 | $75 | $301.15 |

Know that both application and examination fees are non-refundable. So, Mississippi CPA exam applicants must sit for the applied section(s) within six months (Notice-to-Schedule expiry period).

Required Documents

Here is the list of essential documents:

- Official school transcripts

- International Evaluation Summary report (if applicable)

- Testing Accommodations Request form (if applicable),

- Proof of residency, i.e.,

- Place of voter registration

- Vehicle registration and tags

- Mississippi State Resident Income Tax Returns

- Qualifying for Homestead exemption in Mississippi and payment of real estate taxes to the jurisdiction

- Mississippi college or university graduate

Your school must submit the official transcripts to the state board directly, whereas you or NIES may send the evaluation summary. In addition, you must also submit the proof of residency and Testing Accommodations Request form to the state board.

Mississippi CPA License Requirements

Here is what you need to attain the Mississippi CPA License:

- Mississippi residency

- Good moral character (online background check)

- Social security number

- 150 semester hours of education

- At least 75 points in each section of the Uniform CPA Exam

- One year of work experience

After fulfilling all requirements, you must submit the CPA license application to the Mississippi State Board within three years of passing the CPA exam. Kindly check the online application on the Mississippi State Board’s website.

Education Requirements

Mississippi CPA licensure applicants must complete 150 semester hours with,

- A bachelor’s degree from an accredited college or university

- A total of at least 48 semester hours in accounting and business-related courses.

Further information is explained in the Eligibility Requirements section.

Exam Requirements

Candidates must score at least 75 points in all four CPA exam sections. Furthermore, ensure to pass the test in the rolling 18-month testing period. For more details, check the Mississippi Exam Requirements section.

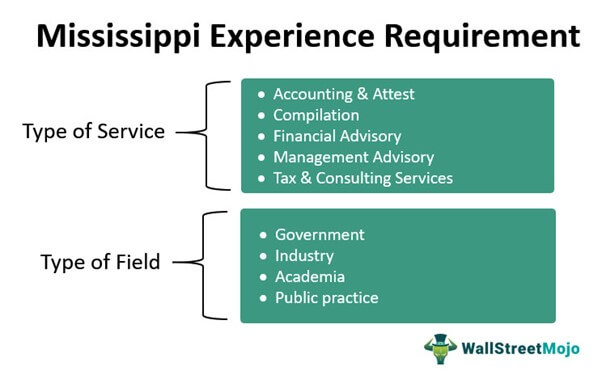

Experience Requirements

Once you pass the CPA exam, ensure to obtain at least one year of full-time work experience in the next three years. Moreover, you must gain experience under the supervision of a licensed CPA.

Here are the acceptable services and fields for gaining experience:

Licensing Fees

| Particulars | Fees | Amount | Total |

| Original Mississippi CPA License application | Registration Fee | $110 | |

| Board Processing Fee | $100 | $210 | |

| Reciprocal CPA License in Mississippi application | Registration Fee | $110 | |

| Board Processing Fee | $100 | $210 | |

| Reinstatement of CPA License application | Registration Fee | $110 | |

| Board Processing Fee | $200 | $310 | |

| Annual CPA License Registrations Fees | Registration Fee | $110 | $110 |

| Late fee | $150 | $260 |

Continuing Professional Education (CPE)

Mississippi CPAs must earn 40 CPE credit hours every year to sustain their accounting license. Also, they should enroll in the learning programs offered by board-approved sponsors to obtain the required credit hours. Let’s check out the details here.

| Particulars | Details | |

| License Renewal Date | January 1 | |

| CPE Reporting Period | July 1-June 30 (Annually) | |

| CPE hours Requirement | 40 hours every year | |

| Ethics Requirement | 4 hours with at least 1 hour exclusively in Mississippi Public Accountancy Law & Regulations | |

| Credit limitations | Personal Development | Maximum 20 hours |

| Published Materials | Based on published document submission & credits request | |

| Self-study | Courses approved by the NASBA Quality Assurance Service program | |

| Other State Policies | Carryover | Maximum 20 hours earned in excess of 40 CPE credit hours annually |

| Reporting | Report CPE hours (even 0) on the Board-prescribed reporting form by August 1 | |

| Exemption for non-resident licensees |

|

All the best to the aspirants, and congratulations to the newly licensed CPAs! Needlessly, passing the CPA Exam and gaining the Mississippi CPA License by meeting all requirements implies that you are the crème de la crème of the accountants. Moreover, it guarantees you a long and profitable career with an average annual salary of $74,718 in the state of Mississippi.

From Jackson or Laurel to Tupelo or Ridgeland, you can start your accounting career in any city. However, remember to keep yourself updated on the CPA exam and licensure policies through the Mississippi State Board.

Mississippi Exam Information & Resources

1. Mississippi State Board of Public Accountancy (https://www.msbpa.ms.gov/)

5 Old River Place, Suite 104

Jackson, Mississippi 39202-3449

Phone: (601) 354-7320

Fax: (601) 354-7290

2. Mississippi Society of CPAs (https://www.ms-cpa.org/)

306 Southampton Row

The Commons, Highland Colony Parkway

Ridgeland, Mississippi 39157

Phone: 601-856-4244

Fax: 601-856-8255

E-mail: mscpa@ms-cpa.org

3. Mississippi Attorney General (https://www.ago.state.ms.us/)

P.O. Box 220, Jackson MS 39205

550 High Street, Jackson MS 39201

Phone: 601-359-3680

Recommended Articles

This article is a guide to Mississippi CPA Exam & License Requirements. We discuss the Mississippi CPA requirements and license requirements in Mississippi. You may consider the following CPA Review providers to prepare for your exams: -