North Dakota CPA Exam and License Requirements

Table Of Contents

North Dakota CPA Exam

North Dakota CPA (Certified Public Accountant) License allows an individual to practice public accountancy in the U.S. province of North Dakota. To earn the CPA license in North Dakota, you must meet the state-specific education, exam, and other requirements.

Note that North Dakota is a one-tier state. So, candidates may directly apply for the CPA license after passing the CPA Exam and fulfilling other prerequisites. The license is the official permit to practice the profession in the state. The North Dakota Board of Accountancy (NDBA) is the license-issuing authority.

Let’s brief the licensing requirements in North Dakota.

| Particulars | Requirements |

| Minimum age | Not required |

| U.S. citizenship | Not required |

| Residency | Not required |

| Social security | Not required |

| The international administration of the CPA Exam program | Participant |

| Good moral character | Required |

| Education Requirement for CPA Exam | 150 semester hours with

|

| Time period to meet the education requirement | Education requirements must be met at the time of application or within six months of it. |

| CPA Exam requirement | 75 points in each exam section |

| Education requirement for licensure | 150 hours |

| Experience requirement for licensure | 2000 hours within 4 years |

| Ethics exam | AICPA Professional Ethics Exam |

Here lies the North Dakota CPA Exam and license requirements in detail.

Contents

North Dakota CPA Exam Requirements

North Dakota CPA License Requirements

North Dakota CPA Exam Requirements

The Uniform CPA Exam is a computer-based series of tests with four sections. Each section is four-hour long. You must pass all the sections within 18 months. The 18-month period begins from the date you take your first passed CPA exam section.

It assesses the required competence and knowledge in newly licensed CPAs to practice public accountancy. Make sure to score at least 75 points on a scale of 0-99 in each section.

- Auditing & Attestation (AUD CPA Exam)

- Financial Accounting & Reporting (FAR CPA Exam)

- Regulation (REG CPA Exam)

- Business Environment & Concepts (BEC CPA Exam)

The CPA Exam comprises five testlets with multiple-choice questions (MCQs) and task-based simulations (TBSs) in each section. Only BEC has an additional question type, written communication tasks (WCTs).

Eligibility Requirements

CPA Exam applicants must earn at least 150 semester hours with an accounting concentration. It includes a bachelor’s degree or higher from a nationally or regionally accredited institution. Accounting concentration implies:

- 24-semester credits or the equivalent of accounting courses (in accounting, audit, or tax subjects), and

- 24-semester credits of other business courses (in business, management, finance, or marketing subjects)

Please note that you may include up to three economics credits in business courses. However, accounting principles or equivalent courses do not contribute to the overall credit calculation. Extra accounting classes also qualify for credits.

Candidates with foreign education credentials must obtain a course evaluation through NASBA International Evaluation Services (NIES) or Foreign Academic Credentials Service (FACS).

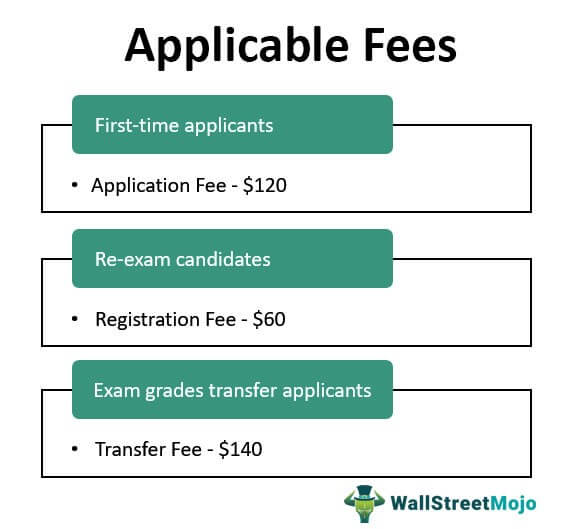

You must fulfill the educational requirements either at the time of application or within six months after the exam application date. Furthermore, submit your application through North Dakota (ND) State Board website with the required fees and academic documents.

Please note that your Notice-to-Schedule (NTS) is valid for only six months. Hence, you must sit for the applied section(s) within the specified period.

North Dakota CPA License Requirements

Candidates must fulfill the below-mentioned CPA license requirements.

- Good moral character

- Bachelor’s degree with 150 semester hours

- At least 75 points in each section of the Uniform CPA Exam

- 2000 hours of work experience (within four years)

- AICPA Professional Ethics course with a 90% or more score

Furthermore, North Dakota does not have citizenship, residency, social security, or minimum age requirements.

Education Requirements

You must earn at least a bachelor’s degree with 150 semester hours from an accredited academic institution. It includes 24 hours in accounting and 24 hours in business courses. For more details, see the Eligibility Requirements section.

Exam Requirements

North Dakota CPA licensure applicants must pass the Uniform CPA Exam within the rolling 18-month testing period. In addition, they should score at least 75 points in each of the four sections. Go through North Dakota CPA Exam Requirements for further details.

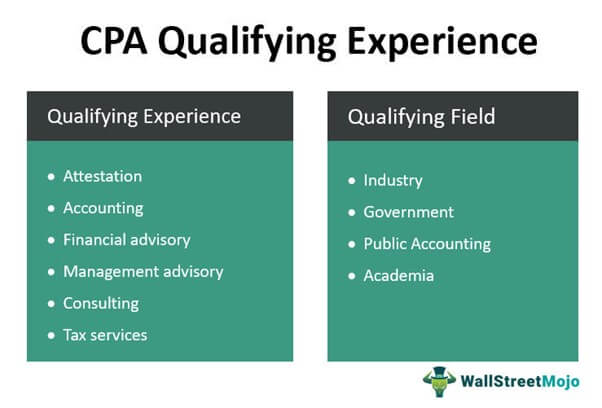

Experience Requirements

Once you pass the CPA Exam, ensure to complete one year of relevant full- or part-time work experience. This includes at least 2000 hours earned within four years. Moreover, an actively licensed CPA should verify your experience.

Ethics Requirements

You must complete the AICPA’s Professional Ethics course and take the exam to qualify for licensure. Ensure to pass the ethics exam with at least 90%.

Here are the details of the course.

| Particulars | Details |

| Study material | Professional Ethics: AICPA’s Comprehensive Course On-Demand (For Licensure) |

| Purchase from | North Dakota Society of CPAs |

| Course type | Self-study course |

| Course access | Online access for 1 year |

| Course content |

|

| How to study |

|

| Pricing (online) |

|

| Ethics exam | Online test conducted at the end of the course |

| Minimum passing score | 90% |

Continuing Professional Education (CPE)

North Dakota CPAs must complete 120 CPA CPE credit hours every three years to sustain their license. Moreover, they are required to earn at least 20 credit hours each year. Let’s look at the details.

| Particulars | Details |

| License renewal date | July 31 (annually) |

| CPE reporting period | July 1-June 30 (annually) |

| CPE requirements | 120 credit hours over a rolling three-year period with at least 20 hours annually |

| Ethics requirement | 6 credit hours over a rolling three-year period |

| Accepted programs |

|

| Exemption from CPE requirements | Non-resident licensee meeting requirements in their substantially equivalent state of residence (excluding Wisconsin, New York, & Virgin Islands residents) |

Credit Calculation

| Programs | CPE Hours | |

| Instruction | Credit hour = 2 times the credit hours available to take up the course | |

| Instruction at university/college | Prep & Instruction credit = 2 times the credit hours available for CPAs taking the course | |

| University/college credit | 1 Semester Hour = 15 CPE Hours | |

| 1 Quarter Hour = 10 CPE Hour | ||

| Self-Study | CE Credits = Amount granted by the sponsor (for NASBA-recognized sponsors) | |

| CE Credits = Half of the amount granted by the sponsor (for other sponsors) | ||

| Partial Credit | Group live, group internet-based, blended learning, or self-study | Accepted in 0.2 or 0.5 increments |

| Nano learning | Accepted in only 0.2 increments |

Once all the exam and license requirements mentioned above are fulfilled, you can call yourself a CPA in North Dakota! Try to prep up for the exam as soon as you graduate. Also, ensure to fill out your licensure application on time to avoid any last-minute hassle.

Please note that AICPA, NASBA, and the State Board keep changing the exam and licensure criteria. Hence, always keep yourself updated with the latest changes in the ND CPA licensing policies.

North Dakota Exam Information & Resources

1. North Dakota State Board of Accountancy (https://www.ndsba.nd.gov/)

215N 3rd Street, Ste 202C

Grand Forks, North Dakota - 58203

Phone: 701-775-7100

2. NASBA CPAES (https://nasba.org/)

800-CPA-EXAM (800-272-3926)

International: 615-880-4250

cpaexam@nasba.org

3. AICPA (https://www.aicpa.org/)

220 Leigh Farm Road

Durham, NC 27707-8110

Phone: 888-777-7077

Fax: 800-362-5066

4. North Dakota CPA Society (https://ndcpas.org/)

3100 South Columbia Road

Suite 500

Grand Forks, ND 58201

Contact: (701) 775-7111 or (877) 637-2727

E-mail: info@ndcpas.org

Recommended Articles

This article is a guide to North Dakota CPA Exam & License Requirements. We discuss North Dakota CPA requirements and license requirements in North Dakota. You may consider the following CPA Review providers to prepare for your exams -