Table Of Contents

Virginia CPA Exam

Virginia CPA (Certified Public Accountant) License proffers the privilege of using the CPA designation to qualified professionals in the Old Dominion. The license is an assurance that practicing accountants meet professional standards set forth by the state laws and statutes. To secure the esteemed license, Virginia applicants must qualify the Uniform CPA Exam and complete other predefined requirements.

The Virginia Board of Accountancy (VBOA) promulgates the rules and regulations for licensing in the state. The U.S. jurisdiction also participates in the International CPA Examination Program, permitting candidates to take the test internationally.

Note that Virginia is a one-tier state. Accordingly, candidates are not required to gain a CPA certificate. Instead, once the prescribed conditions are met, they can straight away apply for the CPA license.

Virginia is long-known for its robust economy, excellent education system, and high quality of life. As a result, it has recently bagged the best U.S. state for business in the 2021 CNBC survey, the fifth time in a row.

The strong socio-economic outlook contributes to enhancing the state's employment possibilities. Besides, finance is touted as a rapidly growing sector. Thus, finance professionals will be increasingly in demand. Given the scenario, Virginia is undoubtedly a much sought-after destination for aspiring CPAs.

To seek the Virginia CPA License, candidates must understand the state-specific CPA exam and license requirements. Here is an outline of the requisites.

| Particulars | Requirements |

|---|---|

| Minimum age | None |

| U.S. citizenship | Not required |

| Virginia residency | Not required |

| Social Security Number (SSN) | Required |

| Education (for CPA Exam) | 120 semester hours |

| Exam | Pass all four exam sections within 18 months |

| Education (for licensure) | 150 semester hours |

| Experience | 1 year of full-time employment |

| Ethics exam | Pass AICPA Professional Ethics Exam |

Contents

Virginia CPA Exam Requirements

Virginia CPA License Requirements

Virginia CPA Exam Requirements

The Uniform CPA Exam is a computer-based professional licensing exam that scrutinizes the comprehension level of aspiring CPAs. It verifies their potential to pursue the CPA profession. The CPA exam includes four sections covering a wide range of accounting, finance, and business concepts.

The exam is believed to be one of the most demanding professional examinations due to its format and extensive syllabus. It is developed by the American Institute of Certified Public Accountants (AICPA) in association with the National Association of State Boards of Accountancy (NASBA) and conducted worldwide through the Prometric test centers.

Here is a brief of other details of the exam.

| Exam particulars | Details |

|---|---|

| Exam mode | Computerized |

| Exam sections | Auditing & Attestation (AUD) |

| Business Environment & Concepts (BEC) | |

| Financial Accounting & Reporting (FAR) | |

| Regulation (REG) | |

| Number of testlets | Five |

| Total duration of the exam | 16 hours (4 hours for each section) |

| Type of questions | Multiple Choice Questions (MCQs) |

| Task-based Simulations (TBSs) | |

| Written Communication Tasks (WCTs) | |

| Passing marks | 75 out of 99 in each section |

| Time limit for passing all sections | 18 months |

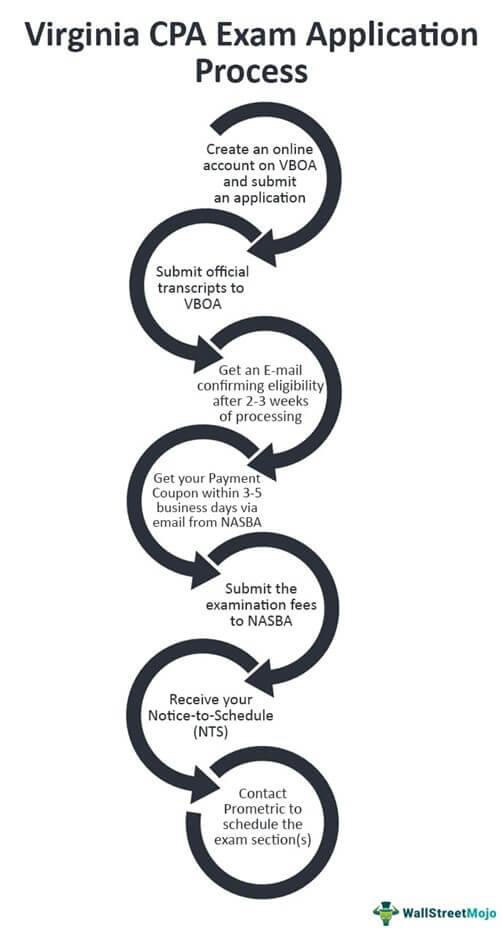

Apply for the exam through VBOA. To know the complete process, please check its official portal. The following image outlines the CPA application process in brief.

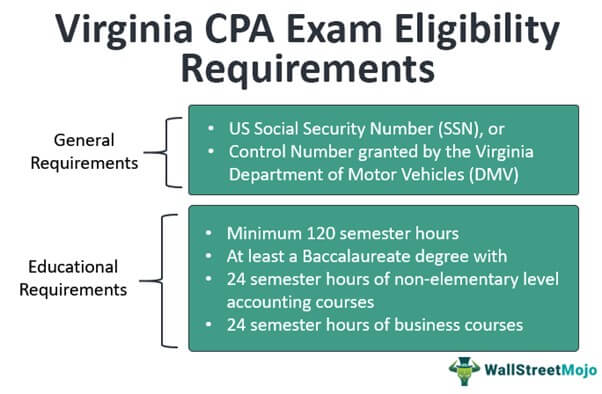

Eligibility Requirements

General prerequisites

Gain a U.S. Social Security Number (SSN) or control number granted by the Virginia Department of Motor Vehicles (DMV). Note that NASBA will charge an additional $67.50 for using the control number.

Educational prerequisites

Earn at least:

- 120 semester hours

- A baccalaureate degree with an accounting major or equivalent from one or more accredited institutes, including

- 24 semester hours of non-elementary level accounting courses with:

- 3 semester hours of financial accounting

- 3 semester hours of auditing

- 3 semester hours of taxation

- 3 semester hours of managerial or cost accounting

- 24 semester hours of business courses with a maximum of 6 hours of upper-level accounting courses

- 24 semester hours of non-elementary level accounting courses with:

Fees

The application and registration fees are payable to the Virginia state board. At the same time, you must pay up the examination fees to NASBA via the NASBA payment coupon within the six-month validity period.

| Particulars | Examination Fees | First-time Applicant Fees | Re-exam Applicant Fees |

|---|---|---|---|

| Application Fee | - | $120 | - |

| Registration Fee | - | - | $20 |

| Exam sections | - | - | - |

| AUD | $238.15 | - | - |

| BEC | $238.15 | - | - |

| FAR | $238.15 | - | - |

| REG | $238.15 | $952.6 | $952.6 |

| Total Fees | $952.6 | $1072.6 | $972.6 |

After paying the examination fees, NASBA sends you a Notice-to-Schedule (NTS) notification. You must apply and pay for the section(s) possible to take up within 12 months from the NTS issuance date.

All fees are non-refundable. However, you may receive a partial waiver in drastic situations or military deployment. Moreover, submit the written documentation to VBOA within five days of the examination date.

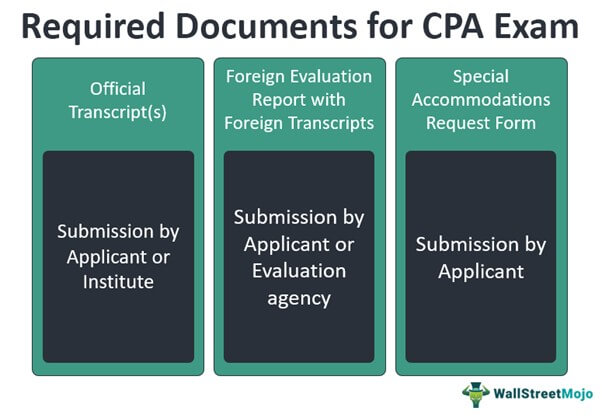

Required Documents

Submit the below-mentioned documents to VBOA.

Here are the VBOA-approved credential evaluation agencies:

- Academic Credentials Evaluation Institute, Inc.

- International Education Research Foundation, Inc.

- Educational Credential Evaluators, Inc.

- Josef Silny & Associates, Inc.

- Foreign Academic Credentials Service, Inc., or

- NASBA International Evaluation Services (NIES)

Ensure to send the transcript(s) or evaluations in a sealed envelope. Your transcripts must include the institute’s official signature or seal covered with the envelope’s flap.

Virginia CPA License Requirements

Let’s view the Virginia CPA licensure requirements.

| Particulars | Requirements |

|---|---|

| Education | 150 semester hours |

| Examination | Score a minimum of 75 points in each of the four exam sections |

| Experience | 1 year of relevant work experience |

| Social Security Number/Control Number issued by Virginia Department of Motor Vehicles | Required |

| Ethics Exam | Pass the Ethics Exam with at least 90% |

Apply for the CPA license through VBOA. Ensure to attach the associated fees ($75) and documents. Further details are mentioned on the Virginia state board website.

Education Requirements

CPA aspirants must attain:

- at least a baccalaureate degree with an accounting major or equivalent from an accredited institution

- a minimum of 150 semester hours of college education

Ensure to include graduate-level accounting coursework in meeting the educational requirement. For more information, kindly visit the Eligibility Criteria section.

Exam Requirements

Candidates must successfully conclude the CPA Exam within the rolling 18-month timeline. In addition, they must secure at least 75 points in each of the four sections for passing. Please refer to the Virginia Exam Requirements section for more details.

Experience Requirements

Applicants must complete at least 2080 hours or 1 year of full-time work experience verified by an active CPA. They may gain the required employment in a firm, academia, industry, or government.

It must entail the usage of financial, accounting, tax, or other board-recognized relevant skills. Ensure to complete and submit the Experience Verification Form along with the licensure application.

Ethics Requirements

Virginia CPA licensure applicants must take up and pass the AICPA self-study ethics course and exam. Ensure to get a minimum score of 90%.

Here lie all the details.

| Particulars | Requirements | |

|---|---|---|

| Course Title | Professional Ethics: The AICPA’s Comprehensive Course | |

| Course Provider | AICPA | |

| Format | Self-study course | |

| Open-book Exam | ||

| Passing Score | 90% | |

| Exam Mode | Online | |

| Exam Availability | 1 year from the date of purchase | |

| Fees | AICPA Members | $189 |

| Non-AICPA Members | $245 | |

| Course Level | Basic | |

| Steps to Follow | Sign-up for the course from AICPA | |

| Read the study material | ||

| Attempt the Exam | ||

| Get the result | ||

| Mail, fax, or email a copy of the course certificate with the score to the VBOA | ||

| Course Content | Conceptual framework | |

| Ethics interpretations | ||

| Independence requirements | ||

| Integrity, objectivity, & professional conduct | ||

| AICPA Code of Professional Conduct | ||

| Activities defaming the CPA profession |

Continuing Professional Education (CPE)

Virginia CPA licensees must obtain the necessary CPE credits and renew their licenses annually. For meeting the CPE requirement, they must earn 120 CPE credit hours over the three-year reporting cycle.

CPE helps them to retain their professional competence and continue rendering quality services. Note that the state accepts CPE credits for programs recommended by the National Registry of CPE Sponsors.

Let’s view all the information.

| Particulars | Details | |

|---|---|---|

| License Renewal Date | June 30 (annually) | |

| Renewal Fee | $60 | |

| Additional $25 fee for renewal via check | ||

| CPE Reporting Period | Jan 1-December 31 (over a 3-year rolling period) | |

| Required CPE hours | 120 hours | |

| Minimum 20 hours annually | ||

| Ethics Requirement | 2 hours annually in Virginia-specific ethics | |

| Other Requirements | Attest or Compilation Services | 8 hours |

| Credit Calculation | Instruction | Credit = Presentation + Preparation |

| Partial Credit | Acceptable in any amount | |

| University/College | 1 semester hour = 15 CPE hours | |

| 1 quarter hour = 10 CPE hours | ||

| Credit Limitations | Exams | Maximum 60 hours over the 3-year reporting period |

| Instruction | Maximum 30 hours over the 3-year reporting period | |

| Other State Policies | Exemption | Non-resident licensee must meet their state CPE (with ethics) requirements |

| Grace Period | January 31 is the deadline to obtain CPE for the previous calendar year |

Virginia, being a pro-enterprise state with numerous small, mid-level, and well-established firms, has a steady demand for CPAs. Additionally, the Big 4 accounting firms in the state are at the forefront to hire certified accountants. They offer handsome packages and sustainable career growth.

On average, Virginia accountants earn around $83,000 annually. While Virginia CPAs have an average median base pay of $100,000. Needlessly, the higher remuneration enunciates the relevance of licensure.

Note that the Virginia CPA’s earnings differ substantially by region and firm size. So, choose your employer and location wisely to get the most out of this fancy title.

To start your licensure journey in Virginia, check out the VBOA, AICPA, and NASBA websites for the CPA exam and license requirements. Furthermore, subscribe to the VBOA newsletter to stay updated with all relevant news. Learn more about CPE Credits for CPAs

Virginia Exam Information & Resources

1. Virginia Board of Accountancy (https://boa.virginia.gov/)

Mailing address:

9960 Mayland Drive, Suite 402

Henrico, Virginia 23233

Email: boa@boa.virginia.gov

Phone: (804) 367-8505

CPA examination services: (804) 367-1111

Fax: (804) 527-4409

2. Virginia Society of CPAs (https://www.vscpa.com/)

4309 Cox Road

Glen Allen, VA 23060

Local: (804) 270-5344

Toll-Free: (800) 733-8272

Email: vscpa@vscpa.com

3. NASBA (https://nasba.org/)

150 Fourth Ave. North

Suite 700

Nashville, TN 37219-2417

Phone: 615-880-4200

Fax: 615-880-4290

4. AICPA (https://www.aicpa.org/)

220 Leigh Farm Road

Durham, NC 27707-8110

Phone: 888.777.7077

Fax server: 800.362.5066

5. Virginia Department of Labor & Industry (https://www.doli.virginia.gov/)

Main Street Centre

600 East Main Street, Suite 207

Richmond, Virginia 23219

Phone: 804-371-2327

Fax: 804-371-6524

Email: webmaster@doli.virginia.gov

Recommended Articles

This article is a guide to Virginia CPA Exam & License Requirements. We discuss the Virginia CPA exam, license, and Virginia CPA requirements. You may also have a look at the below articles to compare CPA with other examinations –