Table Of Contents

Arkansas CPA Exam

Arkansas Certified Public Accountant (CPA) License is an official permit issued by the Arkansas State Board of Public Accountancy to practice as a CPA. Arkansas has specific licensure protocols requiring you to satisfy the CPA Exam, experience, and other license requirements.

Please note that it is a one-tier state. Thus, candidates must pass the CPA Exam and gain relevant experience before applying for the license. In addition, Arkansas places no restrictions on age, citizenship, or residency for licensure. Moreover, the U.S. jurisdiction also participates in the International Examination Program.

Here is the Arkansas CPA exam and license requirements checklist.

| Particulars | Requirements |

| Age | Not required |

| U.S. Citizenship | Not required |

| Arkansas residency | Not required |

| Criminal background check | Required |

| Social Security number (SSN) | Required |

| Education requirement (for CPA Exam) | A bachelor’s degree with 120 semester hours, including

|

| Education requirement (for licensure) | 150 semester hours |

| Experience requirement (for licensure) | 1 year (2000 hours) |

| Ethics exam | Not required |

Contents

Arkansas CPA Exam Requirements

Arkansas CPA License Requirements

Arkansas CPA Exam Requirements

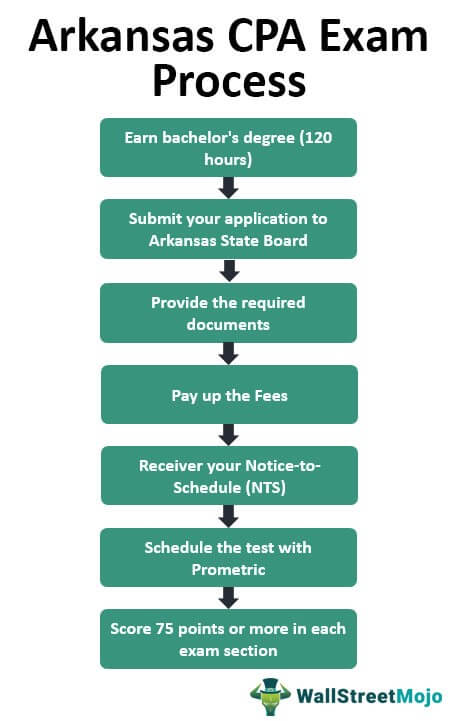

Arkansas applicants must pass the computer-aided sequence of tests within the rolling 18-month period. This duration begins from the testing date of your first passed section.

The American Institute of Certified Public Accountants (AICPA) associates with the National Association of State Boards of Public Accountancy (NASBA) and Prometric to deliver the licensure test.

The examination assesses an applicant’s cognition and professionalism to efficiently perform as an entry-level CPA. It consists of four sections. Each of them is four-hour long and requires a passing score of at least 75 points on a scale of 0-99.

- Auditing & Attestation (AUD Exam)

- Financial Accounting & Reporting (FAR Exam)

- Business Environment & Concepts (BEC Exam)

- Regulation (REG Exam)

All CPA exam sections include five tests with multiple-choice questions and task-based simulations. Apart from these, BEC also incorporates a different question type, namely, written communication tasks.

Eligibility Requirements

Arkansas requires applicants to hold a bachelor’s degree from a regionally accredited institution with

- 30 hours of upper-level accounting courses including,

- Management Accounting (Cost Accounting)

- Financial Accounting (Intermediate Accounting)

- Federal Taxation (Advanced income tax or fundamentals of taxation)

- Governmental & Not-for-Profit Accounting (Institutional Accounting)

- Accounting Information Systems

- Auditing & Attestation

- 30 hours of business courses (besides accounting)

Ensure to complete both accounting and business courses with at least a “C” grade. Then, submit your exam application to the Arkansas State Board of Public Accountancy (ASBPA) with the required fees and documents. The complete online application process is available on the ASBPA official portal.

| Particulars | Type of course | Semester credit hours |

| Internship Credit | Accounting or Business component (& not both) | Maximum 3 semester hours for accounting internship |

| Maximum 3 semester hours for business internship | ||

| Independent Study | Accounting or Business component (& not both) | Maximum 3 semester hours |

Note that you cannot use an accounting internship to fulfill a business course requirement.

Fees

Arkansas State Board charges a specific fee to each initial or re-exam applicant. Here lie the first-time application and examination fees. Please note that both are non-transferable and non-refundable.

| CPA Exam Sections | Initial Application Fees | Application Section Fees | Exam Provider Fees (per section) | Total Exam Provider Fees (all sections) | Total Fees |

|---|---|---|---|---|---|

| 4 exam sections | $50 | $120 | $226.15 | $904.6 | $1074.6 |

| 3 exam sections | $50 | $105 | $226.15 | $678.45 | $833.45 |

| 2 exam sections | $50 | $90 | $226.15 | $452.3 | $592.3 |

| 1 exam sections | $50 | $75 | $226.15 | $75 | $351.15 |

You have six months from the NTS issuance date to take the applied CPA exam section(s). Note that the board charges $10 per exam section to transfer credit from another jurisdiction. Submit this fee along with your application and the Authorization for Interstate Exchange of Examination and Licensure Information form.

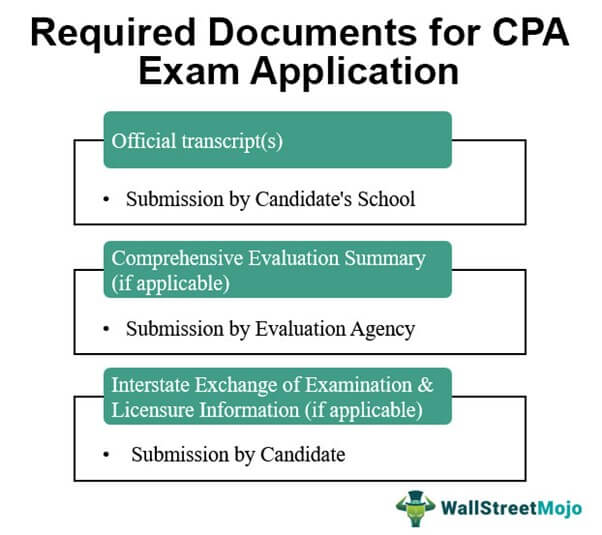

Required Documents

Here lies the list of required documents:

Candidates may use any evaluation service that is a member of the National Association of Credential Evaluators (NACES).

Arkansas CPA License Requirements

Arkansas is a relatively easy state to apply for a license with no minimum age, citizenship, residency, or ethics requirements. ASBPA shall grant the CPA license to individuals who,

- Complete 150 Semester hours

- Pass the Uniform CPA Exam

- Gain year of relevant work experience

- Provide a full criminal background check

Upon successful CPA exam completion, ASBPA Licensing Coordinator will send you an e-mail with the online licensure application link.

| Particulars | Fees |

|---|---|

| CPA License application | $50 |

| Annual registration | $110 |

| Background check fees | $35 |

Ensure to earn the CPA license within three years of passing the examination. Further details are mentioned on the State Board website.

Education Requirements

Arkansas CPA licensure applicants must obtain 150 semester hours of education with at least a Bachelor’s degree. Please note that it includes the semester hours required to sit for the CPA exam.

You must meet the qualification within three years of passing the last exam section. Applicants unable to do so due to extreme situations may request an extension to the Board.

Exam Requirements

Candidates must pass all four CPA exam sections with at least 75 points. In addition, ensure to complete the examination within the rolling 18-month testing period. For more information, please go through the Arkansas CPA Exam Requirements section.

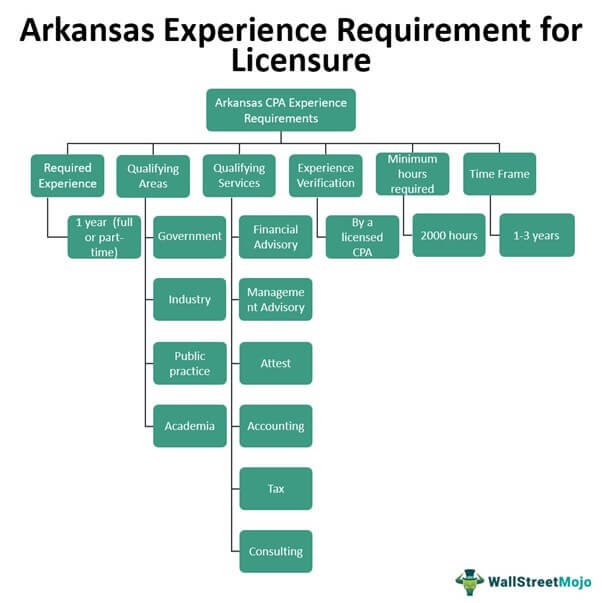

Experience Requirements

Let’s view the experience requirements in detail.

| Particulars | Details |

| Required experience | 1 year (full or part-time) |

| Qualifying areas | Government |

| Industry | |

| Public practice | |

| Academia | |

| Qualifying services | Financial advisory |

| Management advisory | |

| Accounting | |

| Attest | |

| Tax | |

| Consulting | |

| Experience verification | Required by a licensed CPA |

| Minimum hours required | 2000 hours |

| Time frame to gain the experience | 1-3 years |

Criminal Background Check

You must obtain national and state criminal background checks. The Federal Bureau of Investigation (FBI) and the Identification Bureau of the Division of Arkansas State Police (ASP) administer the checks. So, make sure to provide your fingerprints. Also, submit the necessary fee ($35) for the same.

Continuing Professional Education (CPE)

To sustain your CPA license, ensure to gain 40 CPE credit hours annually. Moreover, the program sponsors must be:

- members of NASBA’s or the Board’s Registry, or

- approved by other state boards

The programs sponsored by the following sponsors have automatic approval:

- AICPA and other CPA professional associations (national or state)

- Governmental entities

- Firms offering in-firm education programs (accounting and industrial firms)

- Accredited universities or colleges

Licensees with the initial license acquired during the current calendar year are exempt from the ethics requirement in their year of licensing.

| Particulars | Details | |

| License Renewal Date | January 1 (Annually) | |

| CPE Reporting Period | January 1-December 31 (Annually) | |

| Required CPE hours | For the current renewal year | 40 hours |

| If deficient in the current reporting year | This may include the past 3 years totaling 120 hours | |

| Ethics Requirement | Accounting Professional Conduct & Ethics | 4 hours (during 36 months immediately before the current license expiration date) |

| ASBPA-specific laws & rules | 1 hour through

| |

| Other Subject Area Requirements | Accounting/Attest, Accounting Ethics or Tax | Minimum 40% of hours (public accounting) |

| Minimum 20% of hours (non-public accounting) | ||

| Credit Limitations | Independent study (board-approved), self-study, & authorship credits | Maximum 80% of total CPE hours |

| Nano learning | Maximum 4 hours (per year of a reporting period) | |

| Instruction | Repetition in the same year is not allowed | |

| Upper-level college courses (use for credit once in 3 years) | ||

| Published material | Self-declared credit (if demonstrates competency & previously accepted for publication in writing) | |

| Fields of Study | Limitations on specific subject areas | |

| Full/partial exemption |

|

There is a reason why Arkansas is known as the “Land of Opportunity.” With an annual base pay of $55,472 for a CPA, the U.S. jurisdiction is undoubtedly among the best places to earn your CPA title. So, gear up for the CPA Exam and fulfill all requirements to be a proud owner of the Arkansas CPA license.

This highly esteemed credential opens up the door to endless career pathways. From tax accountant and chief financial officer to corporate controller, a CPA license offers plenty of senior-level positions. You can choose any field of specialization and enjoy a rewarding career!

Arkansas Exam Information & Resources

1. Arkansas State Board of Public Accountancy (https://www.asbpa.arkansas.gov/)

900 W. Capitol Ave, Suite 400

Little Rock, AR 72201-3108

Phone: (501) 682-1520

2. Arkansas Society of CPAs (https://www.arcpa.org/)

11300 Executive Center Drive

Little Rock AR 72211

501-664-8739

800-482-8739 in AR

arcpa@arcpa.org

3. Arkansas Department of Labor & Licensing (https://www.labor.arkansas.gov/)

900 West Capitol Avenue, Little Rock, AR 72201-3108

501-682-4500

501-682-4535 Fax

4. Arkansas Secretary of State (https://www.sos.arkansas.gov/)

State Capitol

500 Woodlane Avenue, Suite 256

Little Rock, AR 72201

501-682-1010

Recommended Articles

This article is a guide to Arkansas CPA Exam & License Requirements. Here, we discuss Arkansas CPA requirements and license requirements in Arkansas. You may consider the following CPA Review providers to prepare for your exams –