Table Of Contents

What Is Mutual Fund Theorem?

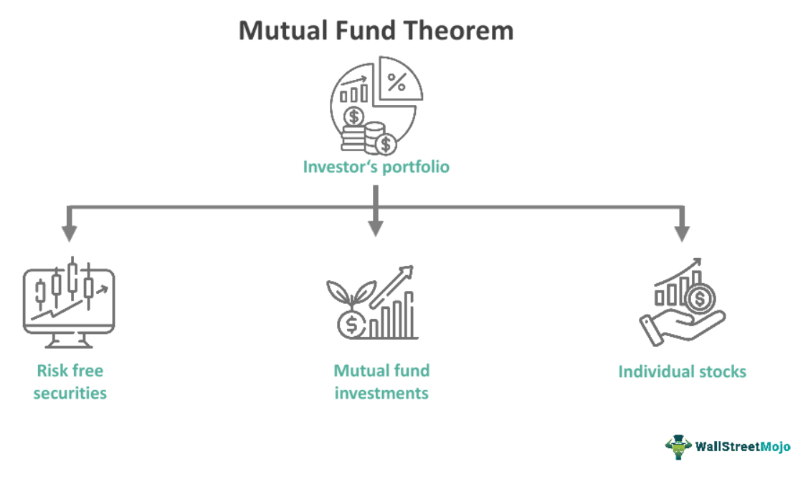

The Mutual Fund Theorem recommends a specific investment strategy where investors invest their risk capital in mutual funds comprising securities of the same type. It refers to mutual fund investments in a multi-layer portfolio that facilitates diversification and risk mitigation.

The theorem states that investors should place their entire risk capital in mutual funds for optimum diversification and returns. It also states they should have independent assets and risk-free securities in their portfolio in addition to mutual fund investment. Hence, the resultant portfolio composition can be referred to as the two mutual fund theorem. If the proportion of mutual funds to other assets is aligned with the recommended strategy, investors are likely to gain good returns.

Table of contents

- The mutual fund theorem is a useful investment technique that recommends investing in mutual funds along with individual securities for diversification and mean-variance optimization.

- Investors enjoy returns from multiple investments by including mutual funds in their portfolios. Based on a mutual fund’s quality and performance, investors optimize their risk capital to hedge risks and diversify their investments.

- The strategy subscribes to the modern portfolio theory. Investors can invest the funds left after placing their risk capital in mutual funds in risk-free securities.

- Constructing a portfolio using the principles laid out by the mutual fund theorem is considered wise because the likelihood of earning the highest possible returns in proportion to the risk borne is high.

Mutual Fund Theorem Explained

The mutual fund theorem is an investment strategy based on constructing an optimized portfolio that reduces an investor’s risk exposure by including mutual funds. To mitigate risk, an investor opts for portfolio diversification by putting their risk capital in mutual funds. These mutual funds offer the maximum possible returns at potentially high risks. The theorem further suggests that the number of mutual funds should be lower than the number of individual securities.

It encourages investors to locate suitable mutual funds and invest their risk capital in these assets, apart from investing in individual securities and assets. By doing so, an investor can diversify their portfolio using a mix of mutual funds, risk-free securities, and individual assets. This allows them to maximize their returns, explore new investment options, and protect the portfolio from market fluctuations and risks. Simply put, the mutual fund theorem promotes adding mutual funds to every investment portfolio.

The theory was established by James Tobin and Harry Markowitz between 1955 and 1956. James Tobin was an American economist and professor at Yale. He was also a member of the Board of Governors Federal Reserve System Academic Consultants. Tobin teamed up with Harry Markowitz, another American economist famous for the Markowitz theory. They worked together at the Cowles Foundation at Yale.

In 1990, Markowitz received a Nobel Prize in Economic Sciences for his work on the modern portfolio theory. The mutual fund theorem relies on the principles and notions promoted by the modern portfolio theory. It says that a portfolio offers maximum returns for the level of risk borne by investors against each asset in the portfolio.

Investors typically follow fixed criteria and study scores to identify the best mutual funds in the market. For instance, the Fund Investment Quality Scorecard (FIQS) gives investors the information needed to make decisions about mutual funds. It reviews key data and grades the quality of a mutual fund. FIQS takes account of the investment style and the manager’s ability to manage the assets.

Mutual Fund Portfolio Construction

The mutual fund theorem is based on the modern portfolio theory. Mutual funds are a pool of securities, treasury bills, and bonds selected in a portfolio per hedging risks associated with each asset. An investor who employs the mutual fund theorem constructs a portfolio with specific mutual funds, creating an efficient limit and separating them from other assets in the portfolio. Investors invest their risky capital in mutual funds and bear a reasonable risk level to secure maximum returns.

This limit is called frontier per the investment jargon. Diversification and mean variance are the most important facets of this theorem. The primary purpose is to allow investors to build an optimal portfolio using mutual funds. Using this approach, investors can efficiently allocate capital and construct an optimal portfolio. The concept is parallel to the risk aversion strategy.

Investors place their risk capital in mutual funds that offer diversification, while the rest is invested in risk-free securities. They can have multiple assets in different markets, but the mutual fund theorem primarily focuses on the stock portfolio.

Advantages

Here are the advantages of applying the mutual fund theorem while investing in the market.

- An investor can invest in various securities through a single mutual fund in their portfolio.

- From the portfolio management perspective, any investment based on this theorem helps mitigate risks and optimize a portfolio.

- It allows people to explore mutual funds, invest in the best, and gain good returns.

- The theorem allows investors to accomplish their portfolio diversification objectives.

- Investors who lack the relevant knowledge or cannot find the time to analyze the market (sectors and stocks) can invest their risk capital in mutual funds and build a robust portfolio.

- Buying individual stocks requires the availability of adequate funds and time. The process also demands consistent monitoring. Mutual funds address all these issues, making investments with limited resources (time and money) possible.

Frequently Asked Questions (FAQs)

The mutual fund theorem is also called the mutual fund separation theorem. It states that an investor can create an optimal portfolio by investing in certain mutual funds in a defined ratio. However, it should not equal or exceed the number of individual securities in the portfolio. In simple words, if a mutual fund has Stock A in its pool of securities, the investor should hold it in the form of a mutual fund instead of buying Stock A as an individual asset. This form of investment will allow the investor to benefit from its (Stock A) appreciation.

The criticisms of the mutual fund theorem are:

- Investors have no control over mutual fund securities and their performance.

- The fee/charge associated with investing in mutual funds is higher than investing individually, which reduces the return percentage.

- Most importantly, there is no guarantee of returns since fund performance cannot be controlled.

The mutual fund theorem promotes building optimal portfolios and mitigating risk through diversification. The covariance pricing theorem is used to determine the relationship between two asset prices to reduce portfolio risks. If the covariance value is positive, the underlying assets are directionally unified. The mutual fund theorem and covariance pricing theorem are based on the risk aversion principle.

Recommended Articles

This article has been a guide to What Is Mutual Fund Theorem. We explain its role in portfolio construction along with its advantages. You may also find some useful articles here -