Table of Contents

What Are Natural Gas Futures?

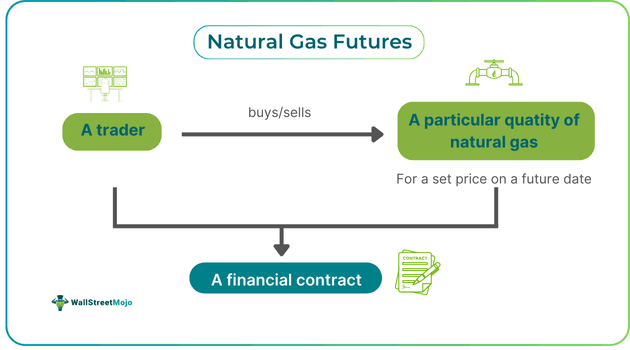

Natural gas futures refer to financial contracts that come with an obligation to purchase for buyers while giving sellers the obligation to sell specific natural gas quantities at a prespecified price on a particular day in the future. Individuals trade such contracts to hedge against price risks in the future.

These derivatives enable market participants to manage market volatility exposure by setting a price today for the sale or purchase of the underlying commodity on a future date. One can purchase and sell natural gas futures contracts on popular commodity exchanges, for example, the Chicago Board of Trade or CBOT and the Chicago Mercantile Exchange or CME.

Key Takeaways

- Natural gas futures refer to derivatives, which obligate buyers to buy and sellers to sell a predetermined quantity of the underlying commodity (natural gas) for a preset price on a certain future date.

- Individuals can trade them to reduce portfolio risk or purely to speculate on the price and make profits.

- It is essential to remain up-to-date regarding natural gas futures news as recent events, GDP growth, changes in demand, etc., can impact the price.

- For natural gas futures trading, Individuals can spread, intraday, and position trading strategies. They can also conduct fundamental and technical analyses to make well-informed decisions.

Natural Gas Futures Explained

Natural gas futures are financial agreements that involve individuals taking up the obligation to buy or sell a predetermined quantity of natural gas on a specific date in the future for a certain price. Traders utilize these contracts as a tool to manage the risk that arises from the price fluctuations concerning the commodity. A lot of traders also trade these derivatives purely for the purpose of speculation in an attempt to profit from favorable price movements in the market.

The pricing of such contracts is determined by the forces of demand and supply. Various factors may influence the prices of natural gas futures contracts. A noteworthy factor is weather conditions, particularly in North America, because the natural gas demand increases there in both summer (for powering air conditioners and winter (for heating).

Moreover, geopolitical events, gross domestic product or GDP growth rates, technological advancements concerning extraction techniques and any disruption in the production of natural gas can also impact the price. Hence, it is vital for one to stay updated with the latest natural gas futures news to make well-informed decisions in the market.

Specifications

Let us look at the specifications of a natural gas futures contract.

- Contract Size: It is the quantity of the commodity that is being purchased or sold. The standard contract size is 10,000 million British Thermal Units or BTUs.

- Ticker Symbol: It is a one-of-a-kind grouping of letters identifying the commodity on a particular exchange. For example, the symbol is NG on the NYMEX, which is short for the New York Mercantile Exchange.

- Deliverable Grades: The determination of the deliverable grade depends upon the specifications of the pipeline in effect when the delivery takes place.

- Price Quote: The measurement happens in cents for every million BTUs.

- Contract Month: Also known as the delivery month, it denoteswhen the futures contract expires.

- Last Trading Day: The last trading day is the financial contract’s expiry date.

- Trading Hours: It varies across exchanges. For example, on the NYMEX, trading takes place from 09:00:00 to 14:30 EST.

- Last Delivery Day: It refers to the contract month’s last business day.

- Tick Size: Tick refers to the minimum downward or upward movement of a financial instrument. In the case of these futures, the tick size is $0.01 for every million BTUs.

- Daily Price Limit: It refers to the highest range permissible for a contract in every trading session.

How To Trade?

To start trading these derivatives, one needs to open a trading account with any broker and transfer funds to your account. Note that Individuals can utilize different strategies for natural gas futures trading based on their market outlook and risk appetite. For example, one may consider carrying out spread trading. In this case, traders enter opposing positions in a couple of contracts, anticipating that the difference in price between them will go in a favorable direction.

Alternatively, position trading or day trading can also be effective strategies worth considering. Having said that, individuals must note that day trading can be highly risky. On the contrary, position or swing trading is typically less risky in comparison.

Also, one must remember that while technical analysis is extremely popular among traders, they should also consider conducting fundamental analysis to factor in any key geographical event or weather patterns that may significantly impact the price.

Examples

Let us look at a few natural gas futures examples to understand the concept better.

Example #1

Suppose Sam, a commodities trader, was tracking natural gas futures prices. He realized that winter was around the corner and that would mean that the natural gas demand would increase. This, in turn, would lead to a rise in natural gas prices. Hence, he decided to purchase 5 futures contracts on the NYMEX, with natural gas being the underlying commodity. He purchased the contracts at $2 per million BTUs. The size of each contract was 10,000 per million BTUs. As winter arrived, the price increased, and per the terms of the financial contract, he closed the position at $4. Thus, he made a significant amount of profit of ($2 x 5 x 10,000) = $100,000

Example #2

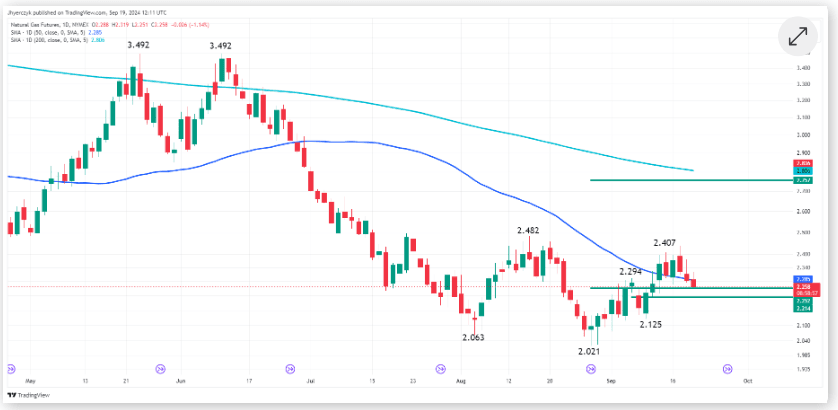

On September 19, 2024, United States natural gas futures were trending lower as traders awaited the weekly storage report of the Washington DC-based agency Energy Information Administration. After falling under the fifty-day moving average or MA of $2.285, the market hovered close to crucial support levels at $2.214 and $2.252, as shown in the chart below:

Source: FXEmpire

The pivots could possibly detect the direction of the market over the short term, especially as the traders digest the supply-demand balances and storage data.

The shift in the critical resistance level in the price chart added to the volatility in the market. The main top fell to $2.436 from $2.482, thus making it the new threshold for traders and analysts to watch. A breakout above this level could lead to a reversal in the trend, setting a target of $2.757.

Benefits

The advantages offered by natural gas futures contracts are as follows:

- These contracts provide individuals and organizations with direct exposure to carry out speculation on natural gas price movements.

- Futures contracts provide more flexibility when compared to trading natural gas exchange-traded funds or stocks.

- These financial agreements enable traders to diversify their investment portfolio and manage the risk exposure.

Risks

The most noteworthy risk associated with trading natural gas futures is market volatility. The prices may change dramatically because of the factors mentioned above, which, in turn, may result in significant financial losses for the trader. Moreover, since the investments in the futures contracts are leveraged, traders may end up losing more than their initial investment amount.