Table Of Contents

Offtake Agreement Meaning

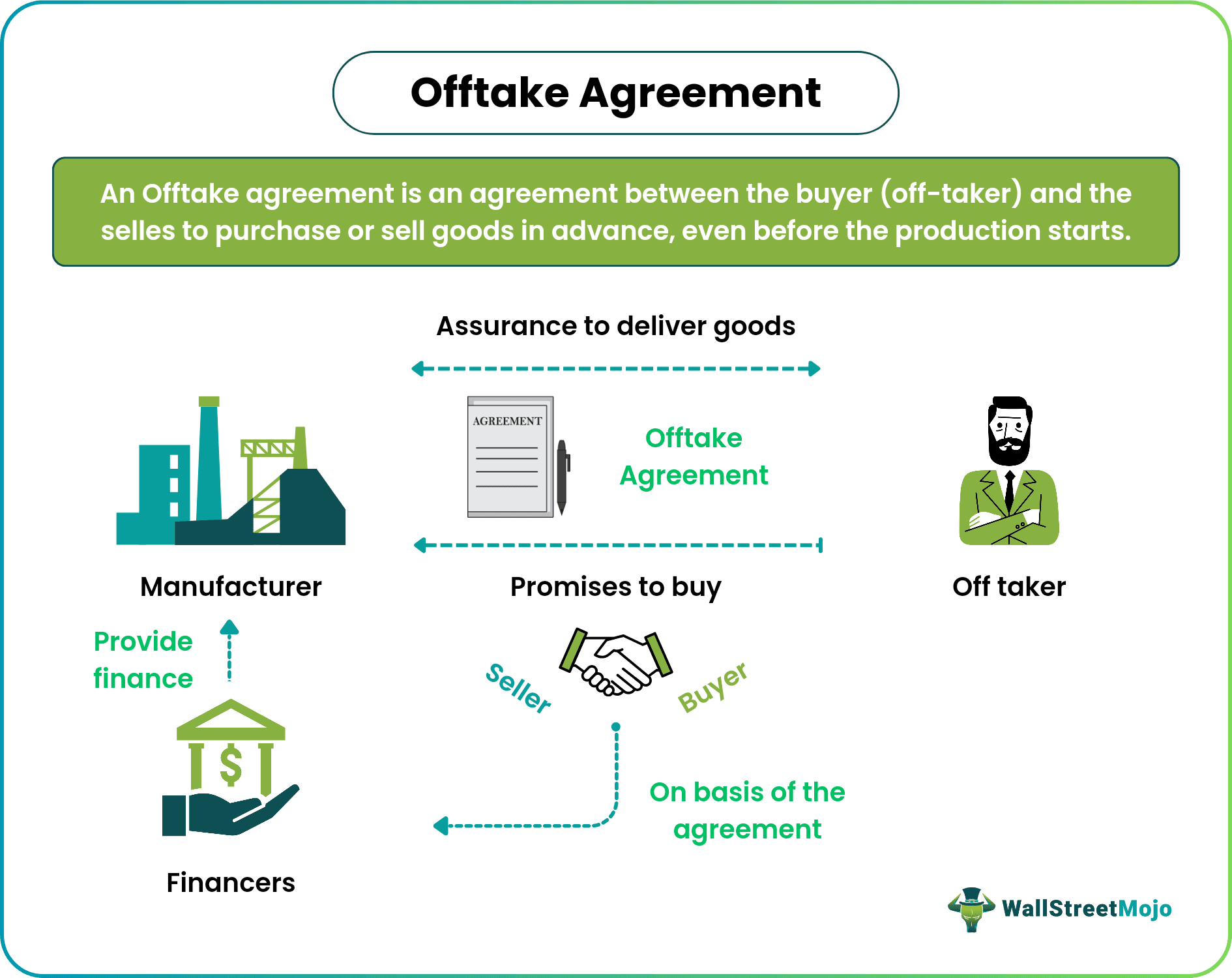

An offtake agreement (OT) is a long-term legal contract between two parties wherein the buyer undertakes to buy all or some portion of the manufacturer’s future production. It is usually entered upon before setting up the production unit so as to facilitate project financing. Such agreements are widely prevalent in mining, oil and gas exploration, and agriculture.

The main objective of the offtake agreement is to enable the producer to obtain easy finance and a guaranteed buyer for its future products. This type of agreement benefits both the buyer and the seller alike. While the seller has an assured market for its creation, at the same time the buyer enjoys protection against future price rises and supply shortages. There are different types of OT agreements based on the needs of the parties to contract.

Key Takeaways

- An offtake agreement is an agreement between the buyer (off-taker) and the seller to trade goods prior to their production.

- It is typically used for natural resources development projects requiring huge capital investment like mining, oil and gas extraction, power generation, etc.

- Offtake agreements enable contracting parties to manage future risks and obtain finance readily.

- Some important types of offtake agreements are Take or Pay, Take and Pay, Blended, Long Term Sales, Hedging, and Power Purchase Agreements.

Offtake Agreement Explained

An offtake agreement is a way to secure the parties to contract before the commencement of production. It ensures that the seller gets a fixed buyer and the buyer gets the desired product at a fixed price. This OT agreement is common in capital-intensive projects like infrastructure development, roadways, real estate, logistics, and agriculture-related manufacturing sectors.

Since such projects require a large capital investment, companies need a security buffer like an OT agreement. It ensures the supply of funds and buyers for their products. However, any company can enter into such a deal beforehand to secure its position in the future.

An OT agreement indicates the price and specifications of the future products, along with details related to their delivery. It also defines the rights and duties of the buyer and the seller. Once the deal finalizes, the manufacturer can show it to investors or lenders to obtain a loan easily.

With a credible buyer and a secured stream of future cash inflows, financers are also keen on funding such projects as they are certain of recovering their dues. Moreover, it also assures the buyer of receiving supplies in the future without fail at an agreed rate. So, it is a win-win situation for everyone.

However, OT agreements are not totally risk-proof as there is always a possibility of breach or termination of the contract. Usually, the contract contains a Force Majeure clause related to the termination of the contract in case of extreme circumstances like insolvency, natural disaster, etc. In case of breach of contract, the parties have the option to renegotiate and continue the contract.

How does the agreement relate to the offtake function?

Let us first understand the concept using a simple illustration. Suppose American Health Co. is a company working to develop a unique health monitoring app for Apple Inc. But the app development project requires a lot of financing to deploy app developers, testers, testing facilities, servers, and other requirements. However, American Health Co. does not have the funds to fulfill the app development.

Therefore, American Health Co. reaches out to Apple Inc. and tries to reach an agreement to fund the app development. Hence, Apple Inc. agrees to buy the app in the future and signs an offtake agreement with American Health Co. Thus, American Health Co. can use this agreement to secure bank loans and funding. Furthermore, Apple Inc. will receive the app at the agreed rate after its development.

Types of Offtake Agreement

In addition to these, there are seven major types of offtake agreements in practice within project finance. They are executed as per the requirements of the manufacturer or buyer. Let us discuss each one of them here:

- Take or Pay Contract: It is an agreement between seller and buyer that protects the seller's interests in case the buyer refuses to buy the products. This type of OT agreement requires the buyer to make the payment unconditionally. For example, during 1950-60, several promotional pipelines were funded through the take or pay contracts.

- Take and Pay Contract: This type of OT agreement is entered between buyer and seller on the condition that the buyer will pay the seller only if the product is delivered.

- Blended Contract: It is a hybrid of the Take or Pay Contract and the Take and Pay Contract. Under this contract, the payment by the buyer is in terms of advance loans to the seller. The seller repays by providing appropriate valued goods or services.

- Long-Term Sales Contract: Such contracts are used for products like oil, gas, mining, and petrochemical, which have readily available buyers. They are usually for 1 to 5 years. Under such a contract, the project company agrees with the off-taker to sell its product at prevailing market rates. However, the buyer will have to pay appropriate damages if it does not buy the product from the project company.

- Hedging Contract: This agreement is done to safeguard the project company from variations in product prices. The company keeps the price bracket of the product between the maximum and minimum of the market prices while getting into an agreement with the off-taker company.

- Throughput Agreement: It is specifically related to petroleum or oil refinery finance. Under this agreement, the project company must ensure the supply of a minimum amount of product at an agreed rate to the pipeline operator. This helps the operator to maintain the operational expenses and meet its debt burden.

- Power Purchase Agreements: This type of offset agreement is prevalent in electricity-generating projects. Here the government acts as an off-taker to buy the power.

Examples of Offtake Agreement

Example #1

Quezon Power Ltd Co., Philippines (ex-tutelage of America)

In the early 1990s, an ex-American governed island named the Philippines suffered from a power shortage. Hence, the Philippines government thought of creating the Quezon Power Project to solve the power crisis.

The government established Quezon Power Ltd Co. as a special purpose vehicle (SPV). Accordingly, it entered into a take-or-pay power purchase agreement (PPA) with Manila Electric Company (Meralco). Here, Quezon Power Ltd. was the project company, and Meralco was the off-taker. Hence, as per the agreement, Meralco had to unconditionally buy all the power generated by the Quezon power plant.

However, if the Quezon power plant failed to produce the agreed amount of electricity, it would have to pay the damages to Meralco. Moreover, in case the power generated was not fully bought by Meralco, then Quezon power could sell it to another buyer and deduct the payment from Meralco’s obligations.

Example #2

Offtake agreement in mining

Suppose there is a state in the US where huge uranium deposits have been found. Naturally, many companies want to mine Uranium and enjoy the profit. However, mining Uranium is a costly affair and requires huge funding from banks, buyers, and potential markets to get the project started.

So, the metal mining company Nevada Uranium Corporation conducts a Uranium mining feasibility study. As soon as it finishes the study, it starts scouting for buyers to initiate the metal exploration project. Finally, it finds a potential buyer French Nuclear Power Corporation in Europe. They enter into an OT agreement specifying the rate and the amount of uranium that will be delivered to the buyer at a stipulated date and time.

Nevada Uranium Corporation can use the offtake agreement to get the desired finance and buyer for its Uranium. At the same time, the OT agreement will ensure that the buyer, French Nuclear Power Corporation, receives an assured supply of Uranium for its nuclear power plant at a fixed price to meet its long-term fuel needs.