Table Of Contents

What Is A Pattern Day Trader (PDT)?

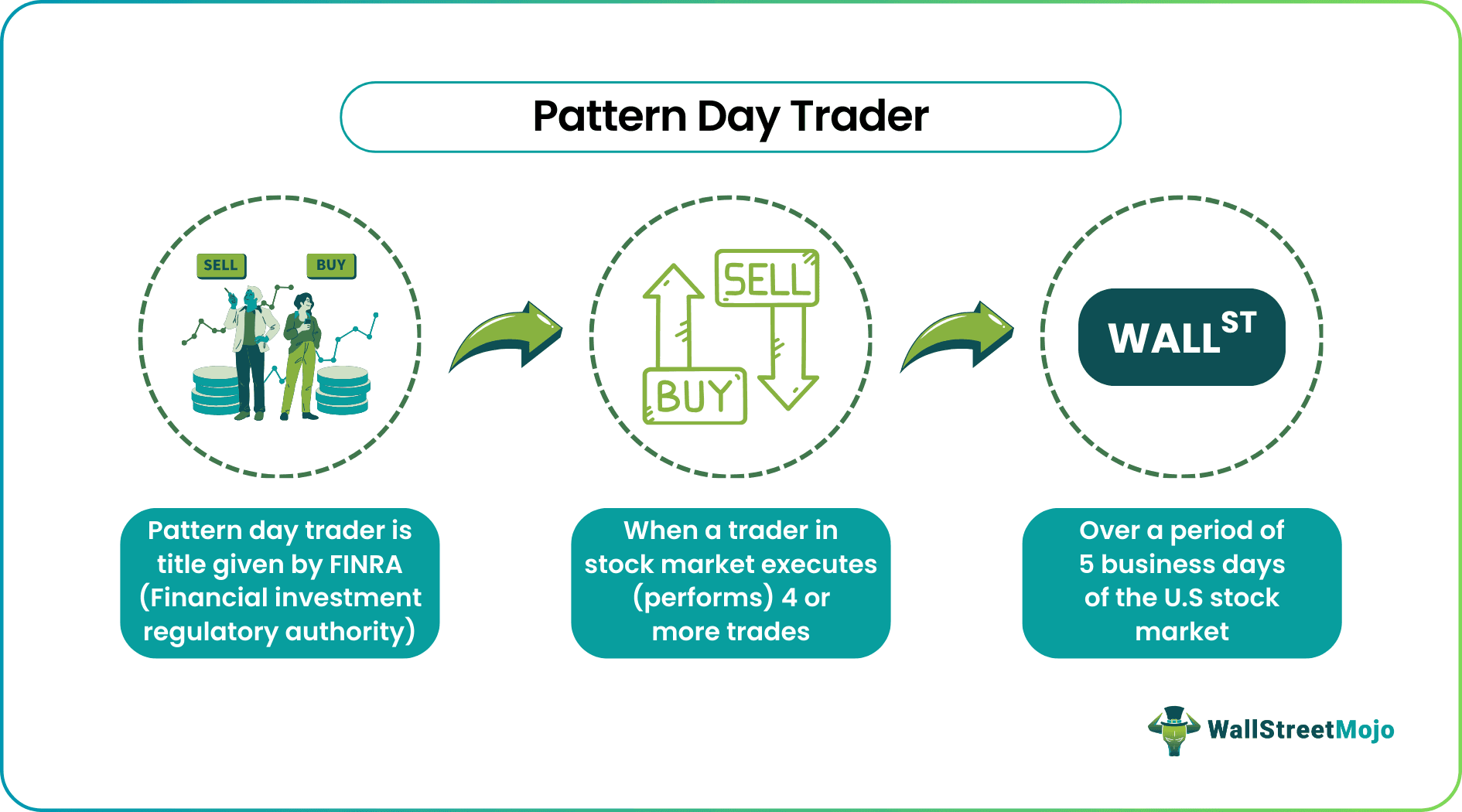

Pattern day traders execute four or more-day trades within five business days. This classification was introduced by the Securities and Exchange Commission (SEC). This rule was introduced to protect traders from excessive trading.

The pattern trading rule mandates investors to maintain $25000 in their margin account for four business days. On one side, PDT helps beginners in minimizing their losses. On the other hand, it limits their ability to perform trades. As a result, FINRA advises brokers and brokerage firms to monitor trading accounts.

Table of contents

- What is a Pattern Day Trader (PDT)?

- Pattern day traders (PDTs) execute four to five equity trades within 5 business days.

- PDT rules intend to balance market volatility.

- On February 27, 2001, the Financial Industry Regulatory Authority (FINRA) and Securities Exchange Commission (SEC) introduced pattern trading rules.

- PDTs are required to hold a minimum balance. If the balance goes below the margin, the broker sends them a pattern trader warning. It signals the trader that they cannot perform any further trades.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Pattern Day Trader Explained

Pattern day traders complete four or more-day trades within five business days. This classification was introduced by the Financial Industry Regulatory Authority (FINRA) and the Securities Exchange Commission (SEC). The intention behind the label is to help investors with losses—to prevent them from using their entire balance.

Once a trader is classified as PDT, they are subject to special rules—PDTS must hold a minimum balance of $25,000 (equity) in their margin account. An investor labeled as a pattern trader is a recent transaction account for more than 6 percent of total trades within five business days. The FINRA advises brokers and brokerage firms to monitor trading accounts.

If the balance goes below the margin, the broker sends them a pattern trader warning. It signals the day trader that they cannot perform any further trades. Regarding profits, the Federal government charges a short-term capital gains tax of 28% on pattern trades. It is important to note that long and short trades held overnight and sold the next day are not considered for PDT requirements.

The term's usage returns to the dot-com bubble (the early 21st century). The internet phase had just begun; people were confident about this new era. As a result, there was an active day trading market between1995-2000. Back then, there were very few day trading limits. As a result, traders executed frequent trades, leading to high volatility.

But, in a desperate attempt to recover losses, many traders piled up even more losses. Thus, on February 27, 2001, the American regulatory body FINRA announced a new rule called "Pattern trader.”

Pattern Day Trader Rule

Let us look at the pattern day trader rule.

#1 - Minimum Margin Requirements

FINRA requires PDTs to hold a minimum of $25000. This amount must either be in cash or the margin account. Traders can arrange funds from securities to maintain this amount. If the balance falls below $25000, the PDT must refill the margin until the next trading session. Likewise, if the trader fails to meet the margin—they receive a pattern trader warning.

#2 - Day Trading Buying Power

A pattern trader account allows investors to trade stocks 4-5 times in 5 days. If the trader crosses the limit, their broker will issue a day trading margin call. This call instructs the trader to deposit money—to meet the minimum PDT requirement.

The investor cannot execute trades unless they meet the PDT requirement—two consecutive trades get restricted. If the traders continue beyond restriction, they will be limited to cash account transactions for 90 days (until the margin fills up).

Pros And Cons

Now, let us look at pattern day trader pros and cons:

| Pros | Cons |

| Beneficial for new traders. | Takes time for transactions to settle. |

| Increased borrowing limit. | Risky in nature. |

| High profits in a short time. | Affects the liquidity of a trader. |

| Helps in minimizing losses. | Limits the ability to trade further. |

Examples

Let us look at the pattern day trader examples to comprehend the concept better.

Example #1

When it comes to the equity market, Hugh is an enthusiast. He is trying to enter the market. He is confident of his day trading ability.

Initially, Hugh executed three trades within a week. Soon, this number rose to 6 trades a week. The broker notifies Hugh that he is now a “PDT.”

Since the trades (buying and selling of shares) exceeded 4, he must maintain a minimum balance of $25000 in his margin account. In addition, Hugh has to hold the balance for four consecutive business days.

On the flip side, the restrictions did benefit Hugh. Before Hugh exceeded his allocated trading amount, his account balance plummeted to zero regularly. Later, PDT restrictions minimized his losses.

Example #2

Clarrisa undertakes intra-day trading. In the initial market hour, she buys five shares of Apple, 20 of Tesla, and three of Toyota.

The very next day, Clarrisa buys another lot of Amazon shares. Again, she sells previously bought shares at a 5% profit. She has now crossed the maximum limit of 4 (by PDT rules).

Now, she is required to maintain a margin of $25000. However, she fails to meet the margin requirements. As a result, Clarrisa is limited to cash account transactions for future trades for 90 days. In addition, she is required to pay a pattern trader tax of 28% (of profits).

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Following are the steps to remove the PDT status:

- Open a cash account—traders can execute unlimited cash account trades.

- Use multiple or different brokerage accounts.

- Deal in Forex and futures are not subject to PDT rules.

- Trade less (Not more than 2-3 per week).

No, the PDT rule does not apply to cash accounts. As a result, traders wanting to execute multiple trades can go for a cash account instead of a margin account. However, the borrowing limit in a margin account is 25% higher than in a cash account.

Yes, in addition to securities, PDT applies to options trading. However, traders can continue to trade futures and Forex without worrying about the PDT. We also discuss pattern trader warnings, pattern trader requirements, pattern trader accounts, and pattern trader taxes.

Recommended Articles

This article has been a guide to what is Pattern Day Trader. Here, we explain it in detail with its rules, example, and pros & cons. You can learn more about it from the following articles -