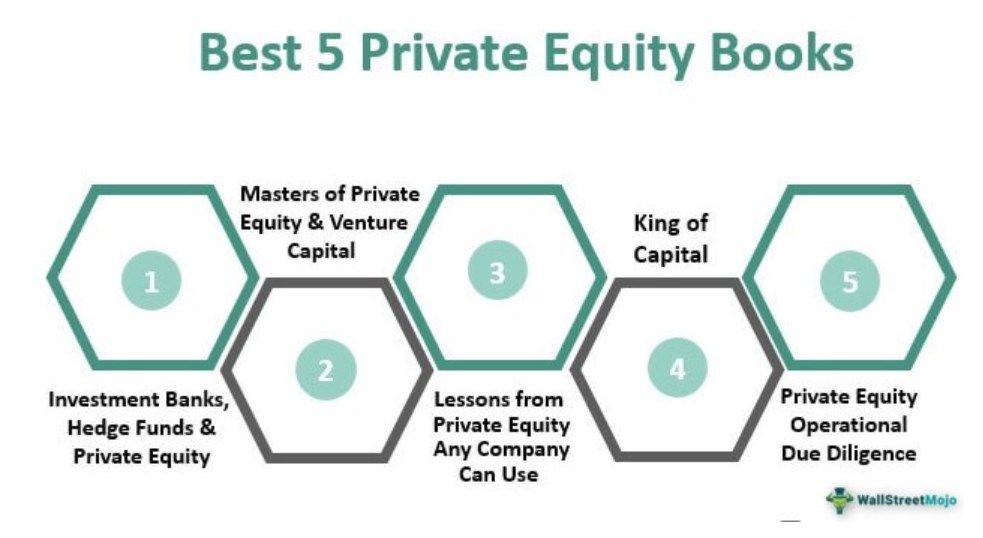

List of Top Best Private Equity Books [2025]

Below is the list of some interesting private equity books that can help you sort out all your concerns about private equity.

- Investment Banks, Hedge Funds, and Private Equity ( Get this book )

- The Masters of Private Equity and Venture Capital ( Get this book )

- Lessons from Private Equity Any Company Can Use ( Get this book )

- King of Capital: The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone ( Get this book )

- Private Equity Operational Due Diligence, + Website: Tools to Evaluate Liquidity, Valuation, and Documentation ( Get this book )

Let us discuss each of the private equity books in detail and its key takeaways and reviews.

#1 - Investment Banks, Hedge Funds, and Private Equity

by – David Stowell

Introduction

The writer has brought all the three parts of finance to life; these sectors challenge each other and sustain in the market along with each other, or you can say in each other's support. He has also captured the reshaping of these sectors after the global meltdown post-2009. The key function is compensation systems, unique roles in wealth creation, the battle between retail investor funds, and the influence of corporate along with risk management. It is a complete combination of rising from the academic background to looking at various industries and giving you insights elaborating on the changes in the reinvention of stabilizing and retriggering of the economic market after the year 2009.

He also gives you a macro look at these industries showing you how these financial institutions affect various organizations, corporations, governments, and individuals. He also gives you an idea as to why and how these sectors will show their power and influence us in the future.

Summary

This private equity book is a package that covers the top three parts of the finance industry. The author very carefully explains how investment banking, hedge funds, and private equity dominate the market, along with the investor’s investments and money-making. He also covers the strategies of coming back from these sectors after 2009. He continues by projecting the powers of these sectors and their overall influence on the market.

Best Takeaway

The private equity book is not talking about just one sector; it talks about three important parts of the financial sector. Finance is the mother of all industries, for if there is no money, no other industry will be able to function. And hence the book talks about the financial sector's influence on the market.

Rating

This private equity book has received a 5-star rating.

#2 - The Masters of Private Equity and Venture Capital

by -- Robert Finkel

Introduction

This private equity book is based on not just the authors' experience and research; it is based on the research of several equity experts and their experiences. When talking about equity, you have several kinds of research to understand the stock exchange, the market, the industries, and the companies to invest in. Private equity has very high returns; however, it has a huge risk. Venture capital is a very important part of private equity that needs to be learned and understood by the masters of private equity.

The author has conducted several interviews with experts in the private equity sector to write this book. The book covers stories that matter to high-level investors. However, private equity is about investing huge bulks into not registered stocks. The books also include a detailed study on applying private equity to non-profit organizations, selecting the management to work with them, looking for new markets, etc.

Summary

This book is overall a scholarly book to know about private equities. It is all about putting across the content appropriately. This book involves a lot of learning, which is a vital part of private equity. Besides the learning and knowledge, the author has researched a lot with the help of private equity experts and has filled this book with colorful stories of success and failures on subjects that interest high-value investors. We confirm this book is full of experiences as the author has penned down interviews with private equity experts.

Best Takeaway

Knowing about applications of private equity on non-profit institutions, working with management, and looking for new markets with the help of live examples in the form of interviews are very easy to understand The Masters of Private Equity and Venture Capital. Your best takeaway will be an exceptional understanding of the subject.

Rating

This private equity book has got four stars for its overall content and display of the subject.

#3 - Lessons from Private Equity Any Company Can Use

by-- Orit Gadiesh and Hugh Macarthur

Introduction

This book confirms that the investor's value for investments is more in private equity than in traditional public equity investments. The reason for high returns can be a good brand name or a big company name, adding up portfolios to create a global existence, etc.

He also shows how private equity firms become important leaders in the market. The five disciplines private equity firms use to attain an edge in investments and increase their portfolio are.

- Investment in these companies for their private equity needs to invest in them for 3 to 5 years, not less than that. Investing in private equity for a longer term gives the investor an average high return.

- A road map needs to be created to take investment initiatives that should generate more value for your investments within a certain period; it is also known as a blueprint of change.

- What matters only needs to be measured; other information is not relevant. For example, for private equity firms, what matters is critical operating data, cash, and key market intelligence, and hence the other unimportant aspects need not be measured.

- Private equity firms need to retain employees who are really good leaders and managers. Employees who think like the owners of the organization. They should have to make sure they hire such people, motivate them, and retain their hunger.

- The motive of PE is making money; they need to make their equity work hard by leaving cash scars and making managers reinvest capital that is underperforming into a more productive direction.

Summary

The author covers the private equity firms and the five disciplines they need to have and retain to make the equity perform better than traditional registered public equity. The reason why private equity firms perform better than others has been a mystery for people who are not a part of the deals and the industry. Reasons have been elaborated and justified. The author has justified the subject completely.

Best Takeaway

We like the five disciplines of the PE firms that help their equity outperform. Every discipline is explained in detail by the authors. The entire book is an overview of PE firms and their operations. It also confirms that high risk gives high returns, which is an absolute fact of this industry.

Rating

This private equity book has received a rating of 4.5.

#4 - King of Capital - The Remarkable Rise, Fall, and Rise Again of Steve Schwarzman and Blackstone

by-- David Carey and John E. Morris.

Introduction

Steve Schwarzman, the CEO of Blackstone, is termed the king of the capital market; the man himself and his powerhouse ensured that they avoided the tendency of self-destruction on Wall Street. This book is not just about Blackstone but also about other such firms that were termed as gamblers in the beginning, and they then turned into hostile artists and takeovers who are now a gate for disciplined risk-conscious investors. Many financial institutions and investment banks were involved in the same.

It is an untold story of the financial revolutions on Wall Street. And these investors have not only got their grip over Wall Street and across the globe as some of the best private equity firms. These companies have become major forces that have been challenging players like Morgan Stanley and Goldman Sachs, dominating the market.

It also involves more about Blackstone's growth of becoming a powerful institution on Wall Street, growing from a start-up of two men and a single secretary two a full-fledged institution and this success story. Its controversies, insider, and future planning are all mentioned in this book.

Summary

This book covers several untold stories of the small corporations that started as gamblers in the private equity market, converting themselves into big corporations that are a safety gate for investors who want to take a minimal risk with their investments. One such story is of the corporation called Blackstone, a big corporation having its existence globally challenging big market players to sustain and grow on Wall Street.

Best Takeaway

The authors have narrated the story of corporations that failed during the big global recession and have emerged as strong global institutions. The best takeaway here will be their comeback story. The logic, the strategies they put to use in making a comeback, and the story of how they managed and worked towards the growth of their organizations. The book involves examples of many such firms and organizations.

Rating

We rate this private equity book 4.5 stars.

#5 - Private Equity Operational Due Diligence, + Website: Tools to Evaluate Liquidity, Valuation, and Documentation

by -- Jason A. Scharfman

Introduction

The two industries are like competitors who want more and more investments to grow. This book points out that both the industries compare their unique aspects, challenges associated with the performances, and operations due diligence. It also guides and helps the readers with different tools to create a bendable narrative operational due diligence program for both private equity and real estate. The use of technical analyses is mentioned in this book, analyses of the fund's legal documents, financial statements, evaluating operational risk concerning valuation methodology, concerns of liquidity, and pricing of the documentation. Take a look at some important topics the book covers.

- The topics of this book include legal documents of funds, analyses technique of financial statements, and much more.

- The author has included a case study on fraudulent operations.

- This book also includes links to the laws and regulations, references, sample checklists, templates, and spreadsheets.

- As an investor, you are given tools to evaluate private equity and real estate liquidity, valuations, and documentation.

This book is full of case studies; if you are an investor in private equity and real estate, you must read it as a real guide. This book is also very helpful for fund managers, service providers, etc.

Summary

A rare book that covers not just the two industries competing for investments, it also covers and gives the investors technical tools to analyze documentation, operations expenses and risks involved, links to laws and regulations references, and living case study examples. It’s a combination of comparison, techniques, and case studies, which is rare and unique in its form.

Best Takeaway

This private equity book is not just for the investors but also the fund managers, service givers, operations, students, etc. The author productively explains and compares the industries and gives tools to help the readers understand before investing in risk-related industries. Both industries have very high-risk aspects involved; hence proper study is very important before investing. Some reading and researching before you invest will not save you from the risk. However, it will help you analyze the risk before you invest and help you make better decisions.

Rating

This book, private equity, has got a 5-star rating.

Amazon Associate Disclosure

WallStreetMojo is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to amazon.com